- Page 1 and 2:

Page 1 of 1

- Page 3 and 4:

Chapter 42 Drafting of Communicatio

- Page 5 and 6:

other Central Acts. A growing need

- Page 7 and 8:

y the Ministry of Home Affairs. Sub

- Page 9 and 10:

1.14 Directorate of ProsecutionThe

- Page 11 and 12:

absconders and fugitives as well as

- Page 13 and 14:

direct recruitment unless the Emplo

- Page 15 and 16:

2.3.10 An employee appointed on dep

- Page 17 and 18:

2.3.13 Premature Reversion of Deput

- Page 19 and 20:

2.6 Casual Appointments 4[4]2.6.1 C

- Page 21 and 22:

Employment Exchange. They should no

- Page 23 and 24:

2.7.3 Authority Competent to make C

- Page 25 and 26:

3.4 Supply of Blank Identity CardsB

- Page 27 and 28:

3.12 Destruction of Identity CardsA

- Page 29 and 30:

Tour)TOTAL 1 year &14weeks1 year &

- Page 31 and 32:

(i)To acquaint the recruits with th

- Page 33 and 34:

Officers by the JD(Admn.) and of th

- Page 35 and 36:

5. SERVICE RECORDS5.1 Service book

- Page 37 and 38:

(vii)Professional and technical qua

- Page 39 and 40:

his signature there in token of the

- Page 41 and 42:

6. CONFIRMATION6.1 As per the prese

- Page 43 and 44:

7. SENIORITY7.1 Fixation of Seniori

- Page 45 and 46:

ecruits or promotees, as the case m

- Page 47 and 48:

deployment in the latter office, wo

- Page 49 and 50:

8. ANNUAL CONFIDENTIAL REPORTS8.1 T

- Page 51 and 52:

non-initiation certificate in this

- Page 53 and 54:

should be rewarded by excessively f

- Page 55 and 56:

In the circumstances, where on cons

- Page 57 and 58:

9. PROMOTION9.1 The regular promoti

- Page 59 and 60:

seniority) is dispensed with and th

- Page 61 and 62:

9.9.2 In cases where the reasons ad

- Page 63 and 64:

10. FIXATION OF PAY10.1 Various pro

- Page 65 and 66:

10.4.2 Thus on comparing the positi

- Page 67 and 68:

(b) In the above case, if he opts t

- Page 69 and 70:

(ii)In the case where pay scales ar

- Page 71 and 72:

deputation/foreign service, even if

- Page 73 and 74:

selection, he/she is required to re

- Page 75 and 76:

13. LEAVE13.1 Provisions relating t

- Page 77 and 78:

certificate of fitness in accordanc

- Page 79 and 80:

(v)E.L. can be availed upto:(a) 180

- Page 81 and 82:

13.4 Commuted Leave(i) Commuted lea

- Page 83 and 84:

(iv)LND should not be granted as le

- Page 85 and 86:

(h)No Leave salary is admissible fo

- Page 87 and 88:

to leave salary during half pay lea

- Page 89 and 90:

sporting events subject to the over

- Page 91 and 92: 13.16 Encashment of Half Pay Leave:

- Page 93 and 94: Request for leave will be considere

- Page 95 and 96: (ii)(iii)(iv)(v)(vi)(vii)(viii)The

- Page 97 and 98: accordance with the provisions of R

- Page 99 and 100: Government servant who opts to reti

- Page 101 and 102: ten years. It is calculated at the

- Page 103 and 104: 15.15.2 No gratuity shall be paid u

- Page 105 and 106: three months pay or Rs.8000/- which

- Page 107 and 108: dies before the date of retirement

- Page 109 and 110: date of retirement in which case au

- Page 111 and 112: 16. DECENTRALIZATION OF ACCOUNTS16.

- Page 113 and 114: PAO/CBI after checking of bills, in

- Page 115 and 116: (c) re-appropriation of funds excee

- Page 117 and 118: 17.4.2 Motor vehicles owned by the

- Page 119 and 120: 18.4.3 A monthly expenditure statem

- Page 121 and 122: 19. ALLOWANCES AND REWARDS/HONORARI

- Page 123 and 124: qualifying limits of the city/urban

- Page 125 and 126: including civilian employees paid o

- Page 127 and 128: (i)(ii)(iii)the normal one hour of

- Page 129 and 130: promotion/reversion or revision of

- Page 131 and 132: The Toll tax charged at any station

- Page 133 and 134: ut the daily allowance drawn for th

- Page 135 and 136: duty/leave/suspension depending on

- Page 137 and 138: 19.16 Railway WarrantsRailway Warra

- Page 139 and 140: Officer should be kept in the servi

- Page 141: can be sanctioned by Addl.Director,

- Page 145 and 146: (flood/drought/cyclone) and granted

- Page 147 and 148: An advance not exceeding the travel

- Page 149 and 150: When an advance is granted to an em

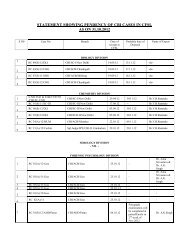

- Page 151 and 152: 2001-02 13 9.5 7.02002-03 12.5 9.0

- Page 153 and 154: h) Advance can be granted only if t

- Page 155 and 156: e) The advance can also be given on

- Page 157 and 158: ) Constructing a new house on a plo

- Page 159 and 160: 5 For constructionThe advance shoul

- Page 161 and 162: ii)iii)iv)The second charge can be

- Page 163 and 164: (iii)City Compensatory Allowance(iv

- Page 165 and 166: (iii)Cycle Advance(iv)Motor Cycle A

- Page 167 and 168: 22. CONTINGENCIES22.1 Contingencies

- Page 169 and 170: nomination that the nomination will

- Page 171 and 172: advance and the total consolidated

- Page 173 and 174: (viii)Pass Books are to be issued t

- Page 175 and 176: 24.3 The balance for March every ye

- Page 177 and 178: drought etc. and his financial posi

- Page 179 and 180: advance should be adjusted within s

- Page 181 and 182: now eligible to retain the governme

- Page 183 and 184: 26. DEPARTMENTAL CANTEEN26.1 Meetin

- Page 185 and 186: Register/Sanitary Diary. A suggesti

- Page 187 and 188: 27. MEDICAL FACILITES TO THE CENTRA

- Page 189 and 190: 4. Cantonment hospitals in cantonme

- Page 191 and 192: and their family members residing i

- Page 193 and 194:

ii) X-Ray, Laboratory and other dia

- Page 195 and 196:

office concerned will correspond wi

- Page 197 and 198:

Group ofEmployeesSubscription per m

- Page 199 and 200:

(b)(c)(d)if there is no valid nomin

- Page 201 and 202:

) While selecting the site, it shou

- Page 203 and 204:

safaiwala, cleaning work can be got

- Page 205 and 206:

contract awarded to another firm of

- Page 207 and 208:

vi)Responsibility and accountabilit

- Page 209 and 210:

(x)(xi)(xii)(xiii)(xiv)(xv)(xvi)Whe

- Page 211 and 212:

i) Verification shall always be mad

- Page 213 and 214:

31. FURNITURE31.1 The furniture wil

- Page 215 and 216:

Sl.NomenclatureScaleNo.1 Officer’

- Page 217 and 218:

i) For rooms having area upto 30 sq

- Page 219 and 220:

charges are to be deposited by the

- Page 221 and 222:

33.6 Officers of the rank of Joint

- Page 223 and 224:

All 4-wheelers should be got servic

- Page 225 and 226:

33.19 All requisitions for the vehi

- Page 227 and 228:

34.5 No dues certificate from Libra

- Page 229 and 230:

35. SECURITY PLAN35.1 In view of th

- Page 231 and 232:

inner entry point. Similarly, all v

- Page 233 and 234:

35.6.3 The local fire service can b

- Page 235 and 236:

35.7.3 Transit of documents and des

- Page 237 and 238:

a later stage.that Server and nodes

- Page 239 and 240:

35.9.9 The attack or crisis control

- Page 241 and 242:

35.10.10 Blood groups of all the st

- Page 243 and 244:

36.7 'Central receipt and issue sec

- Page 245 and 246:

36.31 'Note' means the remarks reco

- Page 247 and 248:

37. MACHINERY OF GOVERNMENT37.1 The

- Page 249 and 250:

consists of assistants and clerks s

- Page 251 and 252:

CR No..............................

- Page 253 and 254:

39. RECEIPT-SUBMISSION AND DIARISAT

- Page 255 and 256:

(ii)The Section Officer/OS/Head Cle

- Page 257 and 258:

(xiv)put up the case to the appropr

- Page 259 and 260:

notes.If he agrees to the line of a

- Page 261 and 262:

40.11 Oral discussions(i)All points

- Page 263 and 264:

ing to the notice of the branch off

- Page 265 and 266:

one FRs, they should be flagged sep

- Page 267 and 268:

41. FORMS AND PROCEDURE OFCOMMUNICA

- Page 269 and 270:

(x) Endorsement :This form is used

- Page 271 and 272:

(i) the originating Ministry should

- Page 273 and 274:

should ordinarily be preceded by in

- Page 275 and 276:

eplies have not been received, may

- Page 277 and 278:

(vi)All drafts put up on a file sho

- Page 279 and 280:

43. ISSUE OF DRAFTS43.1 Marking of

- Page 281 and 282:

(iii)At the end of the day, the cle

- Page 283 and 284:

(iv)Separate the communications to

- Page 285 and 286:

maintenance of service postage stam

- Page 287 and 288:

(iii)The Branch officer in charge o

- Page 289 and 290:

44. FILING SYSTEM44.1 Filing system

- Page 291 and 292:

(d)the factors to be taken into con

- Page 293 and 294:

(ii) Movement of files received fro

- Page 295 and 296:

(e) arrange the index slips in two

- Page 297 and 298:

(d) in respect of records connected

- Page 299 and 300:

(a) complete columns 4 & 5 of the f

- Page 301 and 302:

eview in the preceding year togethe

- Page 303 and 304:

46. SECURITY OF OFFICIAL INFORMATIO

- Page 305 and 306:

47. CHECKS ON DELAYS47.1 Weekly arr

- Page 307 and 308:

(a) scrutinise the case sheets and

- Page 309 and 310:

(b) prepare the consolidated statem

- Page 311 and 312:

47.9 Responsibility of expeditious

- Page 313 and 314:

(iv) A register of Identification C

- Page 315 and 316:

Pension Payment order (PPO) was not

- Page 317 and 318:

49. INSPECTIONS49.1 Meaning & Purpo

- Page 319 and 320:

49.7.1 Attendance Register - Whethe

- Page 321 and 322:

(b) items pending for actual payee

- Page 323 and 324:

49.10.6 Diaries and Progress Report

- Page 325 and 326:

xv)xvi)xvii)xviii)xix)xx)xxi)xxii)x

- Page 327 and 328:

(xiii) Stock Registers :a) Consumab

- Page 329 and 330:

(a) he has passed the Matriculation

- Page 331 and 332:

APPENDIX-IPOSTS SANCTIONED IN CBI A

- Page 333 and 334:

DPA Gr.B 1 Rs.6500-200-10500/-DPA G

- Page 335 and 336:

x. To liaise with all officers/Sect

- Page 337 and 338:

iii. Supervision, caretaking etc.,

- Page 339 and 340:

APPENDIX-IIIRECRUITMENT RULES1. Int

- Page 341 and 342:

(ix) Fifty percent posts of ASIs ar

- Page 343 and 344:

appointmentCentral Government Offic

- Page 345 and 346:

APPENDIX-IVAPPOINTMENT THROUGH STAF

- Page 347 and 348:

APPENDIX-VTHE DELHI SPECIAL POLICE

- Page 349 and 350:

shall be deemed to have been suspen

- Page 351 and 352:

7. DISCIPLINARY AUTHORITIES:(1) The

- Page 353 and 354:

(9) The Disciplinary Authority shal

- Page 355 and 356:

11. SPECIAL PROCEDURE IN CERTAIN CA

- Page 357 and 358:

without holding an inquiry at all a

- Page 359 and 360:

the appellant relies; shall not con

- Page 361 and 362:

PROVIDED THAT-(i) the appellate aut

- Page 363 and 364:

PART-VI- MISCELLANEOUS27. THE CENTR

- Page 365 and 366:

SCHEDULEDescriptionof rank orpost1A

- Page 367 and 368:

SCHEDULEDescription ofpost1Part-I -

- Page 369 and 370:

SCHEDULEPart-III- General Central S

- Page 371 and 372:

It will aid the recruitment/promoti

- Page 373 and 374:

Annexure - INo.4/31/61-TGOVERNMENT

- Page 375 and 376:

Encl. To Annexure-IIINVESTIGATION A

- Page 377 and 378:

IV.RESEARCH DIVISION.(1) Analysis a

- Page 379 and 380:

Annexure - IIINo.21/43/2002-PD-0130

- Page 381 and 382:

WEST ZONE10 Anti-CorruptionRegion-I

- Page 383 and 384:

SP/ACB/Guwahati27 Anti-Corruption B

- Page 385 and 386:

Union Territoriesof Pondicherry and

- Page 387 and 388:

SP EOU-II, EO-I(Existing SP-II/SIG/

- Page 389 and 390:

77 Special Unit KolkataSP SU Kolkat

- Page 391 and 392:

(b) Horizontal Reservation :(i) Whe

- Page 393 and 394:

(f) (i) The post for which this req

- Page 395 and 396:

Investigation includingappreciation

- Page 397 and 398:

Annexure - VICHECKLIST OF POINTS FO

- Page 399 and 400:

Annexure - VIIMOST IMMEDIATENo.DP A

- Page 401 and 402:

STATEMENT SHOWING THE FINANCIAL AND

- Page 403 and 404:

the Central Civil Services(Pension)

- Page 405 and 406:

MODEL CALCULATION - 2PENSION, COMMU

- Page 407 and 408:

Annexure - X(A)No.240/1/96-AVD.IIGO

- Page 409 and 410:

4 Electric Gas and WaterCharges.5 F

- Page 411 and 412:

9 Engagement of Spl.Counsel on beha

- Page 413 and 414:

(ii) For residential andother purpo

- Page 415 and 416:

28 CONTINGENTEXPENDITURE (Table inS

- Page 417 and 418:

ToThe Director,Central Bureau of in

- Page 419 and 420:

Annexure - XI(A)No. 29/1/96-AD.IIIC

- Page 421 and 422:

The delegation of financial powers

- Page 423 and 424:

(b)i) APP, Gr-B (Non-Gazetted) Rs.

- Page 425 and 426:

Other Govt. Servants - As considere

- Page 427 and 428:

To,1. PS to Director, CBI.2. Ps to

- Page 429 and 430:

7Legal Charges/ otherlegal charges(

- Page 431 and 432:

paymentof localand trunkcalls andre

- Page 433 and 434:

24 Incurring of--- RecurringMiscell

- Page 435 and 436:

irthvest only with-Director /CBIbei

- Page 437 and 438:

pay and allowancestherefore(Ministr

- Page 439 and 440:

than those mentionedin SRs. 130 and

- Page 441 and 442:

RPS dated 30.11.5671 Appointment of

- Page 443 and 444:

to which Govt. is a-party ( Rule 25

- Page 445 and 446:

joining time inrelaxation of provis

- Page 447 and 448:

115 House buildingadvance to office

- Page 449 and 450:

Authorised MedicalAttendant would n

- Page 451 and 452:

Annexure - XIVG.I, Dte. of Estates

- Page 453 and 454:

(II)NON-CONVENTIONAL SPACESl. No. P

- Page 455 and 456:

(M.K. Nair)Deputy Financial Adviser

- Page 457 and 458:

(ii)(iii)(iv)The officer using the

- Page 459 and 460:

to the wall or partition. The top o

- Page 461 and 462:

(c) All occupants of the building s

- Page 463 and 464:

Annexure - XIXASSISTANT’S DIARYSl

- Page 465 and 466:

4. The correctness of the entries o

- Page 467 and 468:

Annexure - XXIIPRECEDENT BOOKHeadin

- Page 469 and 470:

Annexure - XXIII(B)No.84/5/62-Estt.

- Page 471 and 472:

SPECIAL POLICE ESTABLISHMENTSTATEME

- Page 473 and 474:

36 Property returns andcorresponden

- Page 475 and 476:

88 TA Bill Register. 10 years.89 Ma

- Page 477 and 478:

21 Supply of stationery and forms 3

- Page 479 and 480:

STATEMENT SHOWING THE PERIODS FOR W

- Page 481 and 482:

Annexure - XXIII(E)No.40/86/69-AD.I

- Page 483 and 484:

17 Correspondence regarding HouseBu

- Page 485 and 486:

Annexure - XXIVREGISTER FOR WATCHIN

- Page 487 and 488:

Annexure - XXVILIST OF FILES DUE FO

- Page 489 and 490:

5. 4. The same form will be used to

- Page 491 and 492:

Annexure - XXIXCASE SHEETFile/Diary

- Page 493 and 494:

Annexure - XXXINUMERICAL ABSTRACT O

- Page 495 and 496:

Annexure - XXXIIMONTHLY PROGRESS RE

- Page 497 and 498:

Annexure - XXXIVCHECK LIST FOR WATC