- Page 2:

Visit the department’s website at

- Page 8 and 9:

Chief Executive ForewordChief Execu

- Page 10 and 11:

10Department Health and Families

- Page 12 and 13:

Dr Barbara PatersonCorporate Plan P

- Page 14 and 15:

Peter BeirneCorporate Plan Priority

- Page 16:

In comparing data between 1994-98 a

- Page 19 and 20:

Aboriginal Health and FamiliesProf.

- Page 21:

Corporate Plan 2009 - 2012Vision, M

- Page 25 and 26:

to detect, monitor, report and eval

- Page 27 and 28:

PRIORITY ACTION AREA 2Healthy Child

- Page 29 and 30:

to parents at key ages i.e. exclusi

- Page 31 and 32:

PRIORITY ACTION AREA 3Targeting Smo

- Page 33 and 34:

the health effects of smoking from

- Page 35 and 36:

PRIORITY ACTION AREA 4Connecting Ca

- Page 37 and 38:

The Chief Minister’s Youth Round

- Page 39 and 40:

Created four additional positions i

- Page 41 and 42:

PRIORITY ACTION AREA 5Safety, Quali

- Page 43 and 44:

essential to make sure that, wherev

- Page 45 and 46:

PRIORITY ACTION AREA 6Attract, Deve

- Page 47 and 48:

Established an Indigenous Nursing a

- Page 49 and 50:

Implement the Professional Practice

- Page 51 and 52:

The Integrated Maternity Services C

- Page 53 and 54:

Radiation Oncology Services

- Page 55 and 56:

Service Map DetailsDepartment Healt

- Page 57 and 58:

NT HEALTH FACILITIESDEPARTMENT OF H

- Page 59 and 60:

Through the East Arnhem Regionalisa

- Page 61 and 62:

very effective with the Alice Sprin

- Page 63 and 64:

Across the TerritoryDigital Regions

- Page 65 and 66:

Our PeopleDepartment Health and Fam

- Page 67 and 68:

Snapshot of our peopleFigure 1 show

- Page 69 and 70:

National Indigenous Cadetship Progr

- Page 71 and 72:

Supporting our PeopleHuman Resource

- Page 73 and 74:

Managing AggressionAggression Manag

- Page 75 and 76:

Eliminating bullying and harassment

- Page 77 and 78:

Graduate ProgramThe Department has

- Page 79 and 80:

GovernanceDepartment Health and Fam

- Page 81 and 82:

NT Family & ChildrenAdvisory Counci

- Page 83 and 84:

Royal Darwin Hospital Medical Evacu

- Page 85 and 86:

Coronial FindingsThe Coroners Act e

- Page 87 and 88:

NTFC options for a complaint outcom

- Page 89 and 90:

Sentinel Eventsdeath or serious har

- Page 91 and 92:

Human Research Ethics CommitteeThe

- Page 93 and 94:

Department Health and Families 93

- Page 95 and 96:

Table 16: Budget by Output groups20

- Page 97 and 98:

NT Families and ChildrenDepartment

- Page 99 and 100:

Key Achievementsfurther increases i

- Page 101 and 102:

Key AchievementsAdditional funds of

- Page 103 and 104:

The Youth Triage Team was formed in

- Page 105 and 106:

Youth ServicesThe Northern Territor

- Page 107 and 108:

Performance Measure2008-09Actual200

- Page 109 and 110:

Acute CareDepartment Health and Fam

- Page 111 and 112:

1. “Due to remoteness, the disper

- Page 113 and 114:

Figure 5 - Weighted Separations by

- Page 115 and 116:

There are three types of treatment

- Page 117 and 118:

1.2.3.4.Due to remoteness, the disp

- Page 119 and 120:

HospitalsAlice Springs HospitalTota

- Page 121 and 122:

Audiologist (visits from Darwin) Ce

- Page 123 and 124:

Patients requiring services that ar

- Page 125 and 126:

Health and Wellbeing ServicesDepart

- Page 127 and 128:

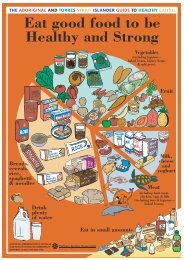

in remote communities. Children are

- Page 129 and 130: Key AchievementsMore than 70 facili

- Page 131 and 132: Healthy Pregnancy Healthy Baby info

- Page 133 and 134: The core clinical and health promot

- Page 136 and 137: School Screening Services (SSS)The

- Page 138 and 139: increased access to after-hours med

- Page 140 and 141: Key AchievementsImplemented the NT

- Page 142 and 143: Community Support Services for Frai

- Page 144 and 145: Commenced development and implement

- Page 146 and 147: 146Department Health and Families

- Page 148 and 149: Public Health ServicesEnvironmental

- Page 150 and 151: Key AchievementsNo Germs on MeThe

- Page 152 and 153: Figure 13: NT Schedule 8 drug presc

- Page 154 and 155: 1. SHBBV 2009-10 data may not be co

- Page 156 and 157: of on-shore detections of exotic Ae

- Page 158 and 159: In July 2009 a National Coordinatio

- Page 160 and 161: Tuberculosis and Leprosy Unitwith a

- Page 162 and 163: 1 The Alcohol and Other Drugs Progr

- Page 164 and 165: other drugs nursing position is bas

- Page 166 and 167: Father Flynn FellowshipThe Father F

- Page 168 and 169: Sales of Goods &Services4%Other Rev

- Page 170 and 171: Grants and Subsidies

- Page 172 and 173: CERTIFICATION OF THE FINANCIAL STAT

- Page 174 and 175: Balance SheetNOTE 2010$'0002009$'00

- Page 176 and 177: Cash Flow StatementNOTE2010$’0002

- Page 178 and 179: 1. Objectives and fundingThe Depart

- Page 182 and 183: Revenue in respect of Appropriation

- Page 184 and 185: o) ReceivablesReceivables include a

- Page 186 and 187: t) Employee Benefitsmeasured at pre

- Page 188 and 189: 3. Comrehensive operating statement

- Page 190 and 191: 2010$'0002009$'000Note 6 (cont)Unal

- Page 192 and 193: 10 PROPERTY, PLANT AND EQUIPMENT (C

- Page 194 and 195: 11c HERITAGE AND CULTURAL ASSETS201

- Page 196 and 197: 2010$’0002009$’00017. NOTES TO

- Page 198 and 199: 18. FINANCIAL INSTRUMENTS (continue

- Page 200 and 201: 18. FINANCIAL INSTRUMENTS (continue

- Page 202 and 203: 20. CONTINGENT LIABILITIES AND CONT

- Page 204 and 205: 24. SCHEDULE OF TERRITORY ITEMSThe

- Page 206 and 207: Appendix IFunding to External Provi

- Page 208 and 209: Appendix II2009-10 Capital and Mino

- Page 210 and 211: New Works 2009-10Alice Springs Hosp

- Page 212 and 213: Appendix IIILegislation Responsibil

- Page 214 and 215: Appendix IVCouncils, Committees and

- Page 216 and 217: 7. Raise community awareness of the

- Page 218 and 219: Northern Territory Family and Child

- Page 220 and 221: Key areas from terms of reference:T

- Page 222 and 223: Australian Manufacturing Workers’

- Page 224 and 225: Members of the Council who left in2

- Page 226 and 227: Meetings:The Committee met in July

- Page 228 and 229: Appendix VEmployment InstructionsDe

- Page 230 and 231:

Employment Instruction No.5Medical

- Page 232 and 233:

Appendix VIAcronymsAASAustralian Ac

- Page 234 and 235:

DHFDepartment of Health andFamilies

- Page 236 and 237:

MHSMental Health ServicesMJDMachado

- Page 238 and 239:

TBCTBCHTuberculosis CommunityHealth