DHF Annual Report 2009 - NT Health Digital Library - Northern ...

DHF Annual Report 2009 - NT Health Digital Library - Northern ...

DHF Annual Report 2009 - NT Health Digital Library - Northern ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

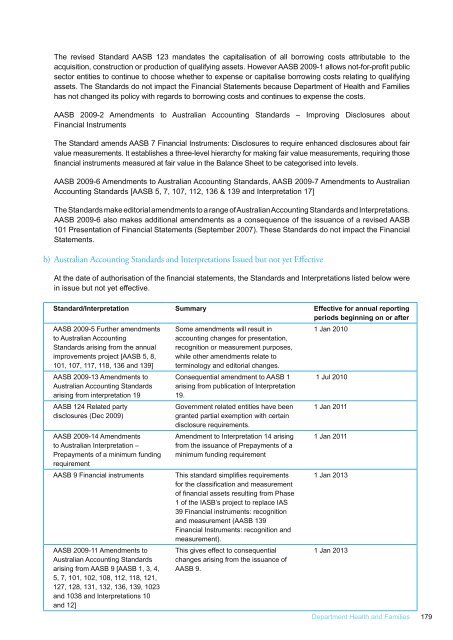

The revised Standard AASB 123 mandates the capitalisation of all borrowing costs attributable to thesector entities to continue to choose whether to expense or capitalise borrowing costs relating to qualifyingassets. The Standards do not impact the Financial Statements because Department of <strong>Health</strong> and Familieshas not changed its policy with regards to borrowing costs and continues to expense the costs.AASB <strong>2009</strong>-2 Amendments to Australian Accounting Standards – Improving Disclosures aboutFinancial InstrumentsThe Standard amends AASB 7 Financial Instruments: Disclosures to require enhanced disclosures about fairvalue measurements. It establishes a three-level hierarchy for making fair value measurements, requiring thoseAASB <strong>2009</strong>-6 Amendments to Australian Accounting Standards, AASB <strong>2009</strong>-7 Amendments to AustralianAccounting Standards [AASB 5, 7, 107, 112, 136 & 139 and Interpretation 17]The Standards make editorial amendments to a range of Australian Accounting Standards and Interpretations.AASB <strong>2009</strong>-6 also makes additional amendments as a consequence of the issuance of a revised AASB101 Presentation of Financial Statements (September 2007). These Standards do not impact the FinancialStatements.b) Australian Accounting Standards and Interpretations Issued but not yet Effectivein issue but not yet effective.Standard/Interpretation Summary Effective for annual reportingperiods beginning on or afterAASB <strong>2009</strong>-5 Further amendmentsto Australian AccountingStandards arising from the annualimprovements project [AASB 5, 8,101, 107, 117, 118, 136 and 139]AASB <strong>2009</strong>-13 Amendments toAustralian Accounting Standardsarising from interpretation 19AASB 124 Related partydisclosures (Dec <strong>2009</strong>)AASB <strong>2009</strong>-14 Amendmentsto Australian Interpretation –Prepayments of a minimum fundingrequirementAASB 9 Financial instrumentsAASB <strong>2009</strong>-11 Amendments toAustralian Accounting Standardsarising from AASB 9 [AASB 1, 3, 4,5, 7, 101, 102, 108, 112, 118, 121,127, 128, 131, 132, 136, 139, 1023and 1038 and Interpretations 10and 12]Some amendments will result inaccounting changes for presentation,recognition or measurement purposes,while other amendments relate toterminology and editorial changes.Consequential amendment to AASB 1arising from publication of Interpretation19.Government related entities have beengranted partial exemption with certaindisclosure requirements.Amendment to Interpretation 14 arisingfrom the issuance of Prepayments of aminimum funding requirement1 of the IASB’s project to replace IAS39 Financial instruments: recognitionand measurement (AASB 139Financial Instruments: recognition andmeasurement).This gives effect to consequentialchanges arising from the issuance ofAASB 9.1 Jan 20101 Jul 20101 Jan 20111 Jan 20111 Jan 20131 Jan 2013Department <strong>Health</strong> and Families 179