Pareto World Wide Offshore AS - Pareto Project Finance

Pareto World Wide Offshore AS - Pareto Project Finance

Pareto World Wide Offshore AS - Pareto Project Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

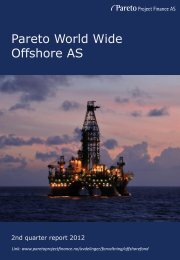

The offshore oil services marketDayrate development for Seismic, Drilling and OSVsAvg. Spot dayrates '10 '11 '12 '13e ∆ 11 ∆ 12 ∆ 13High end seismic vsl USD 205k 215k 245k 300k 5% 14% 22%Premium JU (< 20Y) " 120k 135k 145k 170k 13% 7% 17%6G UDW rig " 430k 450k 585k 600k 5% 30% 3%PSV > 3,500 dw t " 23k 24k 25k 26k 8% 3% 3%AHTS > 15,000 bhp " 23k 30k 31k 45k 30% 3% 45%Subsea vsls > 120m " 75k 77k 85k 95k 3% 10% 12%Source: <strong>Pareto</strong> ResearchAvgdemandgrow th2000-12Avg. Fleetgrow th2012-14Utilisationsw ingPSV > 3,000 dw t 16% 12% 4%AHTS > 15,000 BHP 13% 4% 9%UDW rigs 17% 16% 1%JU > 300 ft, modern 18% 16% 2%Subsea, high end vsls 13% 8% 5%3D seismic vsls 9% 6% 3%Average 14% 10% 4%Source: <strong>Pareto</strong> Research, ODS-Petrodata, PGS, ABG Sundal CollierA favourable outlook for high end oil servicesThe current market for offshore oil services assets iswell balanced, with utilisation levels having generallyclimbed above the 90% threshold, which traditionallyimplies rate increases. This is exactly what we haveseen. While things stabilised and started to improvelast year, the market tightness has accelerated thisyear, with a stronger impact on dayrates.Going forward, we expect the trend towards greatercomplexity and increased oil service intensity tocontinue. This means more demand for modern highspecification assets, which is what we have witnessedover the past decade or so. Since 2000, demand forsuch assets has grown by an average of 14% per year.If we look at the supply side and the order book fornew capacity, it will only grow by 9% p.a. in the nextthree years. Hence, if demand growth continues alongits historical trend, there will be a significantstrengthening in the utilisation levels, with acorresponding impact on dayrates and earnings.We think there is upside to the historical growth rates.Therefore, owners of modern, high quality oil serviceassets are well placed to reap solid returns in the nextcouple of years. Does this mean that only leading edgeassets will benefit? We think no. There is a significantreplacement need for older equipment, which is likelyto turn any owner of a modern oil service asset into awinner in the next couple of years.At the same time, the weak financial markets arerestricting available financing and is depressing assetvalues. This means that there is a buyer’s market outthere for investors with available capital. Moreover,the difficulty in accessing financing is also likely tolimit the level of speculative newbuilding, whichultimately will have a positive impact on the futuremarket balance in the oil service markets.