Download the Time to Take Stock Brochure - Franklin Templeton ...

Download the Time to Take Stock Brochure - Franklin Templeton ...

Download the Time to Take Stock Brochure - Franklin Templeton ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

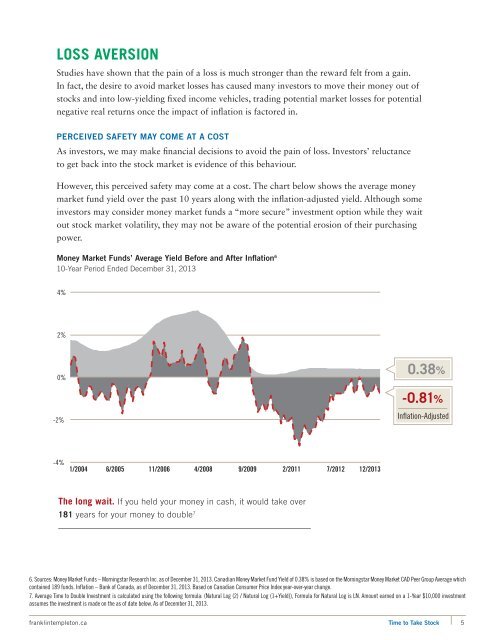

Loss AversionStudies have shown that <strong>the</strong> pain of a loss is much stronger than <strong>the</strong> reward felt from a gain.In fact, <strong>the</strong> desire <strong>to</strong> avoid market losses has caused many inves<strong>to</strong>rs <strong>to</strong> move <strong>the</strong>ir money out ofs<strong>to</strong>cks and in<strong>to</strong> low-yielding fixed income vehicles, trading potential market losses for potentialnegative real returns once <strong>the</strong> impact of inflation is fac<strong>to</strong>red in.PERCEIVED SAFETY MAY COME AT A COSTAs inves<strong>to</strong>rs, we may make financial decisions <strong>to</strong> avoid <strong>the</strong> pain of loss. Inves<strong>to</strong>rs’ reluctance<strong>to</strong> get back in<strong>to</strong> <strong>the</strong> s<strong>to</strong>ck market is evidence of this behaviour.However, this perceived safety may come at a cost. The chart below shows <strong>the</strong> average moneymarket fund yield over <strong>the</strong> past 10 years along with <strong>the</strong> inflation-adjusted yield. Although someinves<strong>to</strong>rs may consider money market funds a “more secure” investment option while <strong>the</strong>y wai<strong>to</strong>ut s<strong>to</strong>ck market volatility, <strong>the</strong>y may not be aware of <strong>the</strong> potential erosion of <strong>the</strong>ir purchasingpower.Money Market Funds’ Average Yield Before and After Inflation 610-Year Period Ended December 31, 20134%2%0%0.38%-0.81%-2%Inflation-Adjusted-4%1/2004 6/2005 11/2006 4/2008 9/2009 2/2011 7/2012 12/2013The long wait. If you held your money in cash, it would take over181 years for your money <strong>to</strong> double 76. Sources: Money Market Funds – Morningstar Research Inc. as of December 31, 2013. Canadian Money Market Fund Yield of 0.38% is based on <strong>the</strong> Morningstar Money Market CAD Peer Group Average whichcontained 189 funds. Inflation – Bank of Canada, as of December 31, 2013. Based on Canadian Consumer Price Index year-over-year change.7. Average <strong>Time</strong> <strong>to</strong> Double Investment is calculated using <strong>the</strong> following formula: (Natural Log (2) / Natural Log (1+Yield)), Formula for Natural Log is LN. Amount earned on a 1-Year $10,000 investmentassumes <strong>the</strong> investment is made on <strong>the</strong> as of date below. As of December 31, 2013.franklintemple<strong>to</strong>n.ca <strong>Time</strong> <strong>to</strong> <strong>Take</strong> S<strong>to</strong>ck 5