2010 Annual Report - S&B

2010 Annual Report - S&B

2010 Annual Report - S&B

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Recapturingvalue<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

Recapturingvalue<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>

Raw materialsshipped to our plantat Neuss harbour

contents4 Our Purpose8 Financial Highlights10 S&B at a Glance12 Global Presence17 Management <strong>Report</strong>20 Market-to-mine22 Product Divisions24 From nature……to everyday living26 Bauxite28 Bentonite30 ContinuousCasting Fluxes32 Minerals Trading34 Perlite38 CorporateSocial Responsibility40 Corporate Governance49 Remuneration50 Shareholder’sNotebook52 Glossary53 IFRS FinancialStatements<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>3

Our PurposeWe provide innovative industrial solutionsby developing and transforming naturalresources into value creating products.Our ValuesIntegrityWe keep our promise.Customer IntimacyWe strive to understand and satisfy our customers’ needsand to share their aspirations for the future.Respect for PeopleWe value our people and we foster their development withina safe working environment of mutual trust and respect.Social ResponsibilityWe gain the respect of our stakeholders with our professionaland responsible conduct.S&B utilizes the multiple properties ofindustrial minerals to offer a portfolioof customized solutions across abroad range of industry applications.Our product range, our geographicdispersion in reserves and operationsand our relentless efforts to understandand satisfy our customers’needs, underpin S&B’s focus in pursuingsustainable, profitable growth.Industrial Minerals have always beenat the center of our 76 year history,which has seen S&B grow into an internationalgroup of more than 40companies with sales in 76 countriesacross the globe.Our market-to-mine approach coupledwith our professional and responsibleconduct towards societyand the environment, provide thebasis for continued sustainable development.4 S&B Industrial Minerals S.A.

Free-flowing propertiesas well as grain stabilityof the freshly producedgranules convince ourcustomers of the qualityof our casting fluxes

Recapturing valueFor our Group, <strong>2010</strong> has been a year of recovery. Our international profileand global market exposure enabled us to capitalize on the returninggrowth prospects in economies and industries that had deteriorated duringthe crisis. Owing to the strengthened demand from key market segmentsand the efficiency initiatives implemented in 2009, we have realizeda significant return to growth, solid expansion of our margins and increasedprofitability. The value recaptured in our business brought us closeto pre-crisis levels. We remain focused on maintaining this positive momentumas we anticipate steady and continued progress during 2011.

Financial HighlightsContinuing operationsEvolution of Key FiguresSalesEBITDAEarnings Per ShareNet Debt355423456336420616765600.470.56154191203390.351221130.260.05in € million‘06 ‘07 ‘08 ‘09 ‘10in € million‘06 ‘07 ‘08 ‘09 ‘10in €‘06 ‘07 ‘08 ‘09 ‘10in € million‘06 ‘07 ‘08 ‘09 ‘10Net Debt / EBITDANet Debt / EquityTrade Working Capital / SalesNet Capex / Sales2.52.83.1 3.11.90.901.031.0527.2% 27.0%26.0%23.4%20.0%5.8%6.1%6.6%9.0%5.8%0.530.46‘06 ‘07 ‘08 ‘09 ‘10‘06 ‘07 ‘08 ‘09 ‘10‘06 ‘07 ‘08 ‘09 ‘10‘06 ‘07 ‘08 ‘09 ‘108 S&B Industrial Minerals S.A.

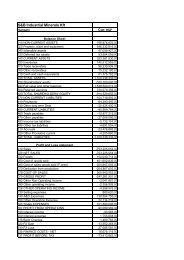

<strong>2010</strong> 2009 2008 2007SUMMARY P&L (€ ’000s)Sales 420,134 335,835 456,393 423,298EBITDA 1 59,817 38,958 65,290 67,036Operating Profit 27,611 14,365 37,878 39,838Profit before Taxes 21,758 7,325 19,846 31,400Net Profit 12,875 1,900 14,258 22,374Net Profit (after Tax & Minorities) 13,133 2,085 13,988 22,505EBITDA margin 14.2% 11.6% 14.3% 15.8%Operating profit margin 6.6% 4.3% 8.3% 9.4%Outstanding No of Shares 51,782,200 41,425,760 31,010,717 30,876,660Basic Weighted Average No of Shares 2 51,233,839 43,543,176 40,541,119 40,262,012DATA PER SHARE (€)Basic Earnings per Share 2 0.26 0.05 0.35 0.56Cash Earnings per Share (CEPS) 2,3 0.87 0.61 0.98 1.19Dividend per Share - nominal 0.25 * 0.12 0.16 0.31Dividend per Share - adjusted 2 0.25 * 0.10 0.10 0.19* proposed capital return instead of a dividendSUMMARY FINANCIAL POSITION (€ ’000s)AssetsNon-current assets 333,000 335,923 330,280 322,935Current assets 190,671 174,933 180,625 175,105Total assets 523,671 510,856 510,905 498,040LiabilitiesNon-current liabilities 172,641 207,147 172,048 223,714Current liabilities 108,072 72,682 145,078 88,875Total liabilities 280,713 279,829 317,126 312,589EquityOwners of the Company 242,397 229,932 192,445 183,829Non-controlling interests 561 1,095 1,334 1,622Total equity 242,958 231,027 193,779 185,451ROE 4 5.3% 0.8% 7.4% 12.1%Net Debt 112,913 121,920 203,149 190,900Free Cash Flow from Operations 43,540 87,033 34,606 35,481Notes:1. EBITDA: Profit before income tax, depreciation, financial and investment results2. In line with IFRS requirements, the weighted average number of shares in all years prior to 2009 has been adjusted to reflect the rights issue completedon September 21, 2009 using a 1.049 factor on the average number of shares prior to that date. In addition, for all years prior to <strong>2010</strong> it hasbeen adjusted to reflect the 1-for-4 bonus share issue completed on August 9, <strong>2010</strong> using a 1.25 factor on the average number of shares prior tothat date. As a result, all per share indicators in all years prior to <strong>2010</strong> (except for nominal dividends ) are equally adjusted for both of these corporateactions.3. Cash Earnings per Share (CEPS) = [Net Group Profit (after Tax & Minorities) + Depreciation&Amortisation] / Basic Weighted Average No of Shares4. Return on Equity (ROE) = Net Profit / Total Equity<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>9

S&B at a glance<strong>2010</strong> Industrial Minerals Salesby Segment<strong>2010</strong> Industrial Minerals Salesby DivisionMetallurgy& Mineral Processing 63%Foundry 24%Continuous Steel Casting 23%Iron Ore Pelletising 6%Alumina 5%Refractories 4%Iron smelting 1%Bentonite 45%ContinuousCasting Fluxes 22%Construction 17%Construction& Building materials 10%Civil Engineering 5%Cement Industry 2%Perlite 16%Horticulture 5%Glass & Ceramics 4%Other 4%Drilling 4%Pet Litter Absorbents 3%Various 20%Bauxite 8%Minerals Trading 9%<strong>2010</strong> Ebitdaby Divisionexcluding corporate costs<strong>2010</strong> Capexby DivisionBentonite 58%ContinuousCasting Fluxes 23% Bauxite 43% Bentonite 34%Bauxite 1%Perlite 12%Minerals Trading 5%Minerals Trading 1%Perlite 10%ContinuousCasting Fluxes 13%10 S&B Industrial Minerals S.A.

Sampling inthe Formsandlaboratory in Marl

sales in 76countries1,983employeesGlobal Presence<strong>2010</strong> Industrial Minerals Salesby Geographical Area<strong>2010</strong> Industrial Minerals Salesby Type of Operation<strong>2010</strong> Headcountby Geographical AreaEurope 68%Downstream operations 65%Europe 72%Other 1%Asia 6%NorthAmerica 21%Upstream operations 35%Other 1%Americas 10%Asia 17%SouthAmerica 2%Middle East& Africa 2%Countries of salesJapanLuxembourgSerbiaFinlandBurkina-FasoIcelandNepalIndonesiaFranceSwitzerlandGreeceSouth AfricaAlgeriaIsraelAustraliaRussiaKoreaPanamaHungaryLithuaniaSingaporeBulgaria LatviaBelarusNorwayTurkeyArgentinaEgyptSpainGeorgiaPakistanDenmarkEstonia MexicoIreland Libya KazakhstanBelgiumUnited Kingdom AustriaJordanBangladeshCzech Republic New ZealandRomaniaChile ChinaIran Malaysia VenezuelaFYROM BrazilCanadaGermanySurinameSlovakiaPoland12 S&B Industrial Minerals S.A.PortugalSwedenSaudi ArabiaUSAUkraineCroatiaUnited Arab EmiratesMoroccoKuwaitQatarNetherlandsTaiwanThailandTunisiaIndiaCyprusSloveniaItaly

26mines46plants & processingunits26distributioncentersin 20 countries& 5 continentsMines2114 11Processing plants4 3 117 1 1112 11Warehouses& Distribution CentersCanada2USA3UK11 1Belgium1Netherlands4 2GermanyPolandHungaryBulgariaGeorgiaCountries of operationsBrazilMoroccoSpainFranceItalyGreeceTurkeyIndiaChinaSouth KoreaMines11 17 3 11 1Processing plants11 2 1 1 1 1 2 3 1 113 1 11Warehouses& Distribution Centers111 12 14• • • • Bentonite Perlite Bauxite Continuous Casting Fluxes Minerals Trading•<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>13

Coal samplingafter drying in Marl

Management <strong>Report</strong>Salesin € millionEBITDAin € millionin €456‘08 ‘09 ‘10650.3533639‘08 ‘09 ‘100.05‘08 ‘09 ‘1042060Earnings Per Share0.26€0.25per shareproposed capitalreturnDuring <strong>2010</strong> our Group’s businessperformance recovered in virtually allsegments and maintained the positivetrend that emerged towards theend of 2009. In northern Europe andNorth America, where we generatethe larger part of our revenues andwhere a significant part of our assetbase is installed, industrial productionrebounded strongly, supporting,in turn, higher demand for our products.Steel production in Europe andNorth America did not reach pre-crisislevels. However, demand fromthe metallurgical industry was strongand improved progressively duringthe course of the year as the initialsignificant restocking effect drivenby extremely low inventory levels,was gradually being replaced bystronger demand in the marketplace.The construction related sectorwas generally subdued in bothEurope and North America, thoughthe trend in some segments, suchas formed products, improvedthroughout the year. In 2009 S&Badjusted its production base andoperating cost to the new economicreality and –the prevailing at thetime- adverse macro-economic conditions.Enhanced demand in <strong>2010</strong>led to higher production volume andimproved financial results.In Greece, S&B’s domestic market,the economy deteriorated sharply in<strong>2010</strong>, directly related to the country’ssovereign debt issues and theintroduction of an austerity programaimed at reducing drastically thelarge fiscal deficits. However, thestrength of S&B’s geographic andproduct diversification shielded us toa large extent from these developments,as we generate less than 8%of the Group’s revenue in our domesticmarket. Ineffective bureaucracyled to delays in obtainingpermits and a temporary suspension,by court order, of mining operationsin specific key bauxitedeposits, adversely influenced productionand profitability. We arepleased to report that most of thesechallenges were resolved in the latterpart of the year. The temporarysuspension was lifted at the end ofthe summer period and bauxite operationsstarted to return graduallyto more normal production levels, atrend which is expected to continueduring 2011. Similarly, delays in theprocess for obtaining permits relatedto our operations on Milos,were resolved to a great extent. Inthese difficult times for Greece, weare gratified by the support of ourcolleagues and of local communitiesin our efforts to ensure continuedand smooth operations.Group revenue in <strong>2010</strong> increased by25% compared to the previous year,to €420.1 million. Volumes producedand sold were significantlyhigher during the year, driving higherutilization of capacity and efficiencygains in production costs, acrossour operations. Higher volumes –coupled with a favorable productmix, improved pricing and our targetedcost-containment actions in2009 – resulted in increased operatingleverage and therefore an expansionof operating margins.Ebitda and operating margins expandedby 260 and 230 basispoints, respectively, and as a result,EBITDA of €59.8 million and operatingprofit of €27.6 million acceleratedahead of revenue growth withincreases of 53% and 92%, respectively.Despite the adverse impacton profits of approximately €12 millionfrom the bauxite related challenges,pre-tax consolidatedearnings were €21.8 million; 3 timeshigher compared to the previousyear. Similarly, net profit attributableto shareholders was €13.1 millioncompared to €2.1 million in 2009.Our stronger operational resultswere also supported by sound managementof our financial position. Indeed,during this period of recovery,our focus remained on controllingcosts, managing cash and furtherreducing our debt position.Alongside our efforts to recapturevalue, we maintained positive momentumthroughout the year in furtherdeveloping our business. Earlyin <strong>2010</strong>, in line with our strategy to expandour geographical presenceand offer value-added solutions inhigher growth markets, we establisheda joint venture between ourContinuous Casting Fluxes (CCF) Divisionand the Angang IndustryGroup, in China. Through our new,jointly established operating facilities,which were commissioned in December<strong>2010</strong>, we started to provideleading technological expertise anda best-in-class product palette to thesecond largest steel-maker in China.Similarly, in Brazil, by increasing utilizationof existing capacity and commissioninga new production line inthe month of August, we started tosupply our longstanding customersThyssenKrupp with 50% of their syntheticslag needs for their new oper-<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>17

<strong>2010</strong>: Recapturing value• Strengthened demand supports return to growth and value recapture• Opportune capacity investments focused in high growth geographies• Continued emphasis on environmental, health and safety improvements• Operational challenges related to permitting procedures largely resolvedating facilities in the city of SantaCruz. Furthermore, in the latter partof the year, our Perlite Division establishedanother joint venture in Turkey,through which we will gain access tohigh quality reserves and target thehigh performing construction marketsof the CIS and Asia. Last but notleast, in June, we embarked on anew partnership with Canada-basedAdventus, this time in the field of environmentalremediation. A new venturethat fits perfectly with ourcorporate vision for sustainability andinnovation, leverages our existingbusiness and service capabilities incivil and environmental engineeringprojects, and allows us to diversifyinto more specialized and valueaddedenvironmental applications.Beyond new business developmentthrough investments in ventures andacquisitions, we remained active oninnovative initiatives through whichwe can gain access to new marketsegments with pioneering highervalueproducts. We seek to use innovativetechnologies for thedevelopment of a new generation ofeco-friendly products, such as functionalfillers for paints and plastics,special additives for building materialsand insulating formulations. Theresearch team of our Perlite Divisionhas made great progress through itssuccessful involvement in various EUfundedprograms, such as ExPerl,EE-Quarry, NIKER and ARISTON.These programs will derive newvalue-added products based on engineeredamorphous aluminosilicatesor from specially treated perlite rejectswhich were previously not commerciallyuseable. Similarly, our otherbusiness Divisions continue to be engagedin innovation programs thatrange from transferring Europeanbentonite technology for applicationon U.S. raw materials, to developingsoftware programs for the depictionof the steel casting process that willdeliver a new level of customer serviceand enhance further the competitivenessfor our CCF Division.We maintained our commitment toCorporate Social Responsibility andmade notable progress on varioussustainability initiatives. Safety remaineda priority for our operationsworldwide with emphasis on behaviorimprovement at work. The proactivesafety practices, which havebeen on the top of our sustainabilityagenda for the past decade, havebeen further extended to our operationsin Germany and also initiated inBulgaria during <strong>2010</strong>. Greater emphasiswas placed on encouragingnear miss reports, which doubledcompared to 2009, with actions tofacilitate reporting and sharing of informationamong all Group sites.<strong>2010</strong> also marked a governance reviewof Environmental Health &Safety (EHS) structures with the establishmentof a third EHS Council inNorth America. We have not yetreached the “zero accidents” targetset forth in 2002, however, we arecontinuously improving our procedures,the working environment andmore importantly, workers’ capacityto recognize and mitigate risk that willultimately lead the Group to achievethis target. Sustainable developmentfor our business is secured by longtermaccess to quality mineral andore reserves. Proactive in our approach,we go to great lengths to ensurethis by working closely with localcommunities, by continuously reviewingour environmental performanceand by developing commonprojects not related directly to ourbusiness. We account for our overallperformance and for the past 10years have published <strong>Annual</strong> Social<strong>Report</strong>s, mostly in accordance withthe GRI Sustainability <strong>Report</strong>ingGuidelines. In this context, our socialcontribution initiatives continued unabatedin Greece, but also abroad,always with emphasis on the localcommunities where we operate. Inparallel, we honored the declarationof <strong>2010</strong> by the United Nations as InternationalYear of Biodiversity by executinga number of initiatives thatpromoted the value of protecting biodiversity.Last but not least, in ourcontinuous quest to strengthen theaccountability and methodologicalrigor of our non-financial reporting,we initiated an Assurance ReadinessCheck of our Social <strong>Report</strong> at theend of <strong>2010</strong>, to identify gaps andareas for improvement and work towardsestablishing an assuranceprocess over the next two years.As we look forward, we draw confidencefrom our solid performancein <strong>2010</strong> and the value we have recapturedin our business. Our recoveryhas been supported by theincreasingly favorable economicconditions in the market segmentswe serve. We anticipate steady andcontinued progress during 2011. Atthe same time, we are closely monitoringexternal cost parameters,such as third party raw materials andfuel prices, which have been risingsharply in the past few months. Ouraim will be to sustain our momentumfrom last year into 2011 and our effortswill remain focused on costcontrol and further profit margin expansion.In addition, we expect thatthe gradual return of bauxite operationsto normal levels will contributepositively to the Group’s overall performance.As in <strong>2010</strong>, we will activelyseek targeted investments throughwhich we can increase our capacityand our presence in high growth geographies.Our acquisition pipelineis active, while our balance sheetand cash position remain strong,able and ready to support our plansfor additional shareholder value creation.In relation to the latter, andwith the intent to efficiently rewardour shareholders, our Board proposeda capital return of €0.25 pershare, to be approved at its <strong>Annual</strong>General Meeting on 1 June 2011.This proposal reflects our optimismin a very tangible way and is consistentwith our practice of rewardingshareholders in alignment with earningsprogression over time.The past couple of years have beenextremely challenging for our company.The adverse macro-economicconditions have tested the commitmentof our employees, the trust ofour shareholders, the support of ourcustomers. We believe that our abilityto emerge from the global financialcrisis stronger than before bears testamentto the goodwill and faith ofour stakeholders, whom we wouldlike to thank sincerely. Importantly,we also believe that S&B's strategicvision has been vindicated by theevents of the last two years, confirmingthe actions taken by the leadershipteam over the same period. Weare confident that we are well placedto continue our journey and we areexcited by the many opportunitiesthat lie ahead for our company.Ulysses P. KyriacopoulosChairman of the BoardEfthimios O. VidalisChief Executive Officer18 S&B Industrial Minerals S.A.

CEO successionEfthimios O. VidalisKriton AnavlavisOn behalf of our Board, I wish to welcome KritonAnavlavis, former Group CFO, in his successionof Efthimios Vidalis as Chief ExecutiveOfficer of the S&B Group, effective the secondquarter of 2011 and following the conclusionof legal and statutory procedures. Mr.Anavlavis’ selection as the right candidate tosucceed to the CEO position was the culminationof a pioneering and successful processthat adhered to strict and high-level CorporateGovernance practices. It underscores the emphasisplaced by our organization on the internaldevelopment of human resources toassume top-ranking positions, as well as onthe creation of management depth and continuationof professional leadership. It reflectsour Board’s trust in and respect for high-levelknowledge of our business, loyalty, and assuranceof timely and smooth leadership transitions.Last but not least, I take this opportunity tocongratulate and thank Mr. Vidalis for his cooperation,his immense contribution to S&Bduring his term of office and his skills in successfullyconfronting the challenges in ourbusiness environment, especially over the lastcouple of years.I extend to both gentlemen and esteemed colleaguesmy warmest wishes for further successand prosperity in their professional andpersonal lives.Ulysses P. KyriacopoulosChairman of the Board<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>19

Market-to-mine is S&B’s approachto bringing its Purpose to life.Market-to-mineThe deep understanding of how ourproducts can be applied in variousindustrial processes and add valueaccording to customers’ needs (the“market”), is the key, in developing andtransforming natural resources (the “mine”),into value creating industrial solutions.Our commercial teams continuously buildknowledge on the various processes in theproduction of a multitude of end products.They possess the skills needed, to identifyproblems, design and propose solutionsthrough our product offering, that addnew value to an existing product and/ormanufacturing customer process.MarketBeing close to our customers allowsus to understand in detail,what they produce and how. Ideasof how our products can improvethe performance of a customer’sproduction process are drawn upby our commercial teams or requestedby our customers themselves.Concurrently, our “out ofthe box” thinking brings to ourR&D teams, conceptions of whatwe wish to propose to our customersfor bringing additional valueand efficiency to their process.The feasibility and validity of theseconceptions are put to the test.Depending on the outcome of thisevaluation and also on whether ornot our current product portfoliocan provide the solution, the necessaryactions are considered allthe way from process redesign tonew reserve identification.We aim to be the preferred supplier to over1,500 customers by offering customizedsolutions to various industrial applications.MineAll the current and potential marketneeds are accumulated andtranslated into reserve requirements.Our mining and processingexperts will validate that the qualityof the product can be availableconsistently in depth of time. Theforecasted quantities will be incorporatedin our medium and longterm plans. With the assistance ofour engineers and our R&D department,the necessary processingwill be designed in order to tailorthe product to the desired specificationsfor the customer’s use. Potentialcapital investments will beinvestigated and evaluated if necessary.The new value adding customizedsolution will find its wayback to the market.20 S&B Industrial Minerals S.A.

Standard procedure ofraw material evaluation:Casting of a congealedglass bead for detectionby X-ray fluorescencespectrometer (XRF)

Product DivisionsBauxitespecialty classAlumina, Iron / Steel Making,Aluminous Cements, PortlandCements, Abrasives, MineralFibersBauxite is the primary raw material for the production of aluminium, while italso has several other specialty applications. S&B leases and owns bauxitemines in the Parnassos and Giona mountain regions in central Greece. Itsbauxite reserves are of diasporic and boehmitic nature. From the standpointof chemical composition, bauxite contains mainly alumina (more than 55%).It also contains other oxides such as those of silicon, iron, titanium and calcium.S&B also controls the bauxite reserves of Sardinia, which are ofboehmitic type and represent a complementary product to Greek bauxite.Bentoniteleading innovationsFoundry, Pelletizing,Civil engineering, Oil Drilling,Pet litter, SpecialtiesBentonite is a plastic clay generated from the in situ alteration of volcanicash, consisting predominantly of montmorillonite. It acquired its name fromFort Benton of the State of Montana in the U.S.A. where it was first discoveredand extracted. Bentonite presents strong colloidal properties and increasesits volume several times when coming into contact with water,creating a gelatinous and viscous substance. The special properties of bentonite(swelling, water absorption, viscosity, thixotropy) make it a very valuableclay for a wide range of uses and applications.ContinuousCasting Fluxesengineered solutionsContinuous Casting Fluxes,Covering Compounds,Metallurgical Active SlagsCasting fluxes under the Stollberg brand are a range of specialized and highvalue adding products utilized for the facilitation of the continuous castingprocess in steel casting. They are available as granules or as powders. Theyare applied to the mould during the continuous casting process of steelmaking. This method of pouring steel into a near to net-shape like slabs,blooms and billets represents the most efficient way to produce innovativeand high-grade steel products.Minerals Tradingbuilding new chainsGlass, Ceramics, Refractory,MetallurgyThe Minerals Trading Division processes and markets a variety of specialty minerals–such as wollastonite– under the “OTAVI” brand, from its own sources orfrom its partners world wide, serving the glass, ceramics, refractory and metallurgymarkets. Otavi acts as a “window of opportunity” for S&B by developingnew businesses on a Market-to-Mine basis. Otavi strives to be a reliableprovider of solutions to its customers by developing profitable and sustainablesupply chains in specialty industrial minerals and new geographical areas.Perliteexpanding marketsBuilding Materials, Construction,Horticulture, Cryogenics, FilterAids, Industrial ApplicationsPerlite is a natural volcanic glassy material, formed by rapidly cooled lavatrapping water within its mass. This phenomenon gives perlite its most importantphysical property, the ability to expand at temperatures of 800-950°C. White mass of tiny, glass-sealed bubbles is formed when suddencontrolled heating causes perlite to expand as a result of the trapped waterbeing evaporated. Its volume increases 10 to 20 times and its bulk densitydecreases accordingly, giving perlite excellent thermal and acoustic insulationproperties, particularly in lightweight aggregates.22 S&B Industrial Minerals S.A.

Casting fluxes areexposed to severalroutine rechecksduring the productioncycle, here: at apacking station

From nature...Milling& MixingRefractoryMineralsBFACalcined bauxiteChamotteRefractory Bricks& MonolithicsIron oreBentoniteBentonitemineBentoniteas a binderPelletizingmachineIron OrePelletsBlastFurnaceOtheringredientsBauxite in lumpsPerliteContinuousCastingFluxesPerlitemineOtherMineralsSpray DryerContinuous CastingPowders & GranulesOtherMineralsWollastonitemineBauxiteBauxitemineBayer ProcessDigestionSmelting24 S&B Industrial Minerals S.A.

...to everyday livingCivil EngineeringWorksFoundryBentonite basedbinders forSand MoldingAutomotive Industry• Steel Parts• Glass• AluminiumParts• PolymersMoltensteelPig IronContinuousCastingFormed SteelShip BuildingReinforced ConcretePet Litter(Bentonite)GranulatedPerlite as a slagcoagulantExpansion FurnaceExpanedPerliteBuilding MaterialsPerlite• Formed• Mortars• Plasters• LightweightConcreteGarden(Perlite)Bauxite• Portland Cements• Aluminium Frames• Rockwool insulationSlag Valorizationby adding BauxiteBlast FurnaceSlag CementsCeramics(Wollastonite,Spodumene)• Ceramic Tiles• Sanitaryware• TablewareFormedAluminiumHydroponics<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>25

€32 millionin sales16bauxite-basedproducts7bauxiteapplicationsin 15countriesBauxiteA conveyor belt facilitatesship-loading operationsat our bauxite storage sitein Itea, Greece.26 S&B Industrial Minerals S.A.

<strong>2010</strong> Bauxite Salesby SegmentAlumina 60%<strong>2010</strong> Bauxite Salesby Geographical AreaWesternEurope 83%Other 5%Iron smelting 12%CementIndustry 23%Other 1%North America 10%Eastern Europe 6%Operations for the BauxiteDivision in <strong>2010</strong> faced aserious challenge in keepingup with trends in demand. Thisresulted from critical delays faced inthe permitting procedures for someof our mines. Despite the earlysigns of demand recovery in almostall of our key segments, the delaysin permit approvals restricted ouraccess to some of our designateddeposits and constrained our miningoperations to very low activitylevels. As a consequence, our abilityto adjust our production capacityeffectively to the growing market requirementsthroughout <strong>2010</strong> wasseverely limited. However, after thesummer period, operating conditionsin specific areas improved, followingthe lifting of a temporarysuspension of operations by theHellenic Council of State in some ofthose areas. This enabled operationsto start a gradual return tomore normal production rates in thelatter part of the year.In spite of the challenges faced, theDivision achieved sales of €31.7 million,which represents an increaseof 4.9% compared to the previousyear. This increase is attributedmainly to the upward trend in thesteel segment in Germany and theU.S., which showed enhanced demandduring the first half of <strong>2010</strong>,and the substantial growth in salesof our Sardinian bauxite to construction-relatedmarkets.In the alumina segment -accountingfor 60% of the Division’s turnoversalesremained fairly stable despitethe adverse effects of productionrestrictions.In contrast, sales revenues relatedto the cement market declined by16% compared to the previousyear, reflecting our limited ability toincrease production in order to satisfythe growing demand for calciumaluminate cements.In this adverse environment, we reactedquickly in an effort to mitigatethe effects from limited productionand resorted to the import of Sardinianand Turkish bauxite. Althoughthis helped us to partially satisfy ourcontractual obligations, it entailed increasedcosts. In addition, and dueto the uncertainty of the operatingenvironment, we adopted a moreconservative costing approach andalso accelerated depreciation chargesin the second quarter of theyear. All these factors had an acutenegative impact on profitability andresulted in EBITDA being slightly positiveat €1.1 million compared to€8.3 million in the previous year. However,accounting for depreciation,profitability was negative at approximately-€12 million.Looking ahead, production capacityis expected to reach normal levelsfor 2011, which will allow us tokeep up with market demand. Thelifting of the temporary suspensionof our mining activities in <strong>2010</strong>, inconjunction with the progress observedin obtaining pending permitsfor certain key deposits, willenable our operations to return graduallyto the required production levels.Among the main efforts beingundertaken to speed up our processesis the exploration for newreserves and mine development,areas to which our capital expenditureis also directed. These effortsare supplemented by a systematicapproach to controlling costs andsustaining optimized working capitalrequirements.Our investment programme remainsin line with our long-termplan to develop a set of mines, allowingus to align production appropriatelywith market growthdrivers and also to effectively convertresources into mineable reserves.Finally, our strong focus onoptimizing production mix towardshigher margin products will enableus to improve our financial performance,strengthen our position inthe bauxite market and ultimatelycreate long-term business value.in € million4732301382008 2009 <strong>2010</strong>Sales EBITDA1<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>27

€190 millionin saleswith more than 1,000product formulationsin 58countries40 minesand plantsin 12countriesBentoniteS&B’s worldwidenetwork of bentoniteprocessing facilitiesguarantees customerproximity28 S&B Industrial Minerals S.A.

<strong>2010</strong> Bentonite Salesby Segment<strong>2010</strong> Bentonite Salesby Geographical AreaFoundry 53%Iron OrePelletising 14%WesternEurope 72%Drilling 9%CivilEngineering 12%Pet Litter Absorbents 6%Specialty applications 6%Other 3%EasternEurope 6%NorthAmerica 19%The economic environmentimproved significantly during<strong>2010</strong>, and this had a positiveeffect on almost all the marketsegments served by the BentoniteDivision. For some segments in particular,such as foundry and iron-orepelletizing, business activity outpacedanticipated levels, requiringa swift reaction on our part in orderto satisfy the quickly reboundingdemand. Overall, the Division’sturnover reached €190.4 million,representing an increase of 23.9%over 2009. While not back to precrisislevels, our revenue performancewas profitable, as EBITDAincreased by 52.1% compared to2009, reaching €49.9 million.The global foundry industry, which isdirectly linked to the automotive sector,picked up considerably in <strong>2010</strong>.Foundry is the largest segment notonly of the division but of the Groupas well. Foundry revenue increasedsubstantially with German andFrench foundries enjoying thestrongest growth. In Europe, passengercar output remained stable,but production of light and heavy utilityvehicles increased significantly.This came as a result of the exportledrecovery in northern Europe (Germanyin particular), which wasfavored by a weaker euro on averageduring <strong>2010</strong>. In the U.S., the metalcastingindustry experienced a moderateupswing in production outputof nearly 10% compared to the previousyear, enabling us to drive revenuegrowth in U.S. foundries. Inparallel with responding to the recoveringdemand from traditionallyestablished geographies, we continuedto invest in foundry operations inhigher growth areas. Aiming at introducingEuropean technology standardsto Eastern Mediterraneanfoundries and establishing a strongermarket presence, we extended ouroperational capabilities in Turkeythrough the addition of a new blendingunit in <strong>2010</strong>.Global steel production, which isthe demand driver for iron-ore pellets,had a record year in <strong>2010</strong>,mainly attributed to double digitgrowth in Europe and North America,as well as in the Middle East.Hence, bentonite requirements foriron-ore pelletizing recoveredstrongly and swiftly.In the drilling segment, the upturn inOil and Gas production in the NorthSea had a positive impact on bentoniteand baryte demand for drillingfluids. We leveraged our strong positionin this segment through ourDutch joint-venture CEBO, which in<strong>2010</strong> extended its activities into theNorwegian oilfield market throughnew long-term contracts. In addition,the investment in new transportationmeans will support thedistribution of drilling materials tovarious customers around the NorthSea region. Furthermore, a new liquidmud plant in the northern part ofthe Netherlands was completed.Demand from the paper and cardboardsegment also recovered during<strong>2010</strong>, mainly due to the increaseddemand for packaging of goods. Asa result, the industry segment expandedby approximately 10% comparedto 2009.In Civil Engineering applications, thetrend up to the end of 2009 was relativelystrong. However, during <strong>2010</strong>,Civil Engineering and infrastructurerelatedprojects in particular, weresubdued, mainly as a result of the crisisthat extended to Eastern Europeanand CIS countries and thedeceleration in government stimulusprograms. The impact of these developmentshad an adverse effect onthe division’s sales to this segment.The pet litter market continued tobe weak in <strong>2010</strong>, driven by consumerpreference for price bargainsin private labels. Our efforts restedin promoting high value brandedproducts through close collaborationwith key customers.In the environmental segment, anew cooperation was establishedtogether with Adventus IntellectualProperty Inc., Canada. We formedAdventus Europe GmbH, in Germany,to provide in-situ bioremediationfor groundwater and soil,extending the know-how and servicecapabilities of the Bentonite Divisionin civil and environmentalengineering.Looking ahead, we will remain focusedon further strengthening anddiversifying our product portfolioand we will explore and invest in innovativeand eco-efficient industrialsolutions. In parallel, we will pursueprospects for regional or organicgrowth that build on our existingleadership positions.in € million2071901544750332008 2009 <strong>2010</strong>Sales EBITDA<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>29

€94 millionin salesplants in 7countries1.000customizedsolutionsin 57countriesContinuous Casting FluxesBased on well calculatedrecipes the moving scaleautomatically selectsthe correct componentsfrom our raw material silos30 S&B Industrial Minerals S.A.

<strong>2010</strong> Continuous Casting Fluxes Salesby Segment<strong>2010</strong> Continuous Casting Fluxes Salesby Geographical AreaContinuousCasting Fluxes 81%NorthAmerica 25%WesternEurope 23%Asia 22%Metallurgicalactive slags 5%Coveringcompounds 14%EasternEurope 15%Other 1%Africa 3%SouthAmerica 11%Global steel production, akey business indicator forour CCF Division, continuedat the start of <strong>2010</strong> at the samehigh levels it had reached at theend of 2009. In the first 6 months,we witnessed the highest level insteel production ever recorded,with a peak of 125 million tons inthe month of May, while a very highlevel of approximately 115 milliontons per month was maintained forthe rest of the year.With our global production networkstrategically located close to ourcustomers, we were able to outperformthe momentum of globalsteel production, despite the persistenceof a highly challenging businessenvironment. As a result, wemanaged to grow ahead of themarket, increase market shares inall major steel-producing areas ofthe world and consequently attainsales revenues of €93.9 million.This is a record revenue level forthe division and represents an increaseof 44.6% compared to2009, while it is also higher by 7.4%compared to 2008.Responsiveness and flexibility enabledus to take full advantage of thequick economic recovery, as we focusedour resources and our effortson optimizing and further developingour business. Early in <strong>2010</strong>, weconsolidated our European granularflux production sites by successfullyrelocating production fromFrance to Germany, at the sametime maintaining all our customersthrough the transition process. Weimproved capacity utilization inIndia to serve the local market,which showed a 20% increase insteel production compared to2009. As a result, we were able todrive a 38% revenue increase fromour operations in that market. InBrazil, we also stepped up our investmentsto increase existing capacitythrough the addition of a newproduction line for desulphurisationmaterials. This is anticipated tostrengthen our market position,especially with our customer CSAof the ThyssenKrupp Steel group,which recently commissioned newoperating facilities in the area. Lastbut not least, in December <strong>2010</strong>,we commissioned new operatingfacilities in China, established jointlywith the Angang Industry Group,with which we entered into a longtermagreement at the start of <strong>2010</strong>to supply metallurgical fluxes underthe Stollberg brand for their steelproduction division.During the past couple of years –in2008 and 2009– we optimized thecost structures in all our operationsworldwide in order to adjust our businessto the global economicdownturn prevailing at the time. Thesustainable improvements realizedin profitability during <strong>2010</strong> vindicateour actions. Benefitting from soliddemand and strong operating leverage,our margins expanded significantly,driving EBITDA to €20.1million, a historic record for the CCFdivision and an increase of 106.7%compared to 2009.Global steel production in 2011 isexpected to continue at the samelevel as late <strong>2010</strong> and possibly trendupwards, as economic recoverycontinues worldwide. In the mediumterm, steel production mayreach pre-crisis levels by 2014,again with major growth occurringin the BRIC countries. With leadingmarket shares globally, we are wellplaced to capitalize on any opportunitiesthat arise to consolidate thecasting flux market. We will continueto invest in capacity increases, aswe did in <strong>2010</strong>, especially in highgrowth geographies. In addition, weare looking for opportunities to increasemarket share in covering materials,and to that end we areevaluating different processes andlocations. Last but not least, in recognitionof our ever-important customerrelationships, we have, andcontinue to develop, after-sales servicesthat help increase customerloyalty and profitability margins.in € million94876516<strong>2010</strong>2008 2009 <strong>2010</strong>Sales EBITDA<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>31

€37 millionin sales9 productionlines in Germany5 distributioncentersin 4countries30mineral-basedproductsselling in 23countriesMinerals TradingPlant & Warehousein Neuss, Germany.Securing the supplyof high quality industrialminerals.32 S&B Industrial Minerals S.A.

<strong>2010</strong> Minerals Trading Salesby Segment<strong>2010</strong> Minerals Trading Salesby Geographical AreaRefractories 43% Glass 32%Germany 54% France 17%Metallurgy 7%Ceramics 18%Italy 11%Spain 6%Other 7%Benelux 3%Poland 2%During <strong>2010</strong>, the MineralsTrading Division managedto respond successfully tothe market’s recovery by leveragingits preparation in 2009 in the followingtwo areas: supply chainefficiency and marketing capabilityof industrial minerals. Optimizationof our comprehensive resourcenetwork -which includes mines,processing plants and warehousesacross main industrial centers in Europeand Northern China- enabledour OTAVI branded minerals to regaintheir momentum and strengthmuch faster than anticipated.The division’s turnover amounted to€36.8 million, representing an increaseof 43.4% compared to 2009and reflecting strong demand fromall market segments. In addition, revenueand profitability benefitedfrom appropriate pricing based on anew ‘value-to-the-customer’ approach,which guaranteed the assuranceof product supply, as well asthe possibility of developing commonobjectives with our customersbased on their needs for quality.EBITDA more than tripled to €4.5million compared to reported lossesof €1.9 million in 2009. (on a comparablebasis, excluding the non-recurringasset impairment charge of€3.2 million in 2009, the EBITDA increasewas about 250%).The Glass & Ceramics BusinessUnit relied on the spodumene andwollastonite minerals as its springboardto recovery. This strategydrove revenue and profitability topre-crisis levels, supported by therecovery of traditional customersalong with new business developmentefforts mainly in the glass, ceramicsand polymers applications.More specifically, spodumene wasmarketed successfully to the leadingmanufacturers of glass ceramicovens and fiber glass withinEurope. Similarly, with wollastonite,the OTAVI brand managed to furtherenhance its position in all the leadingmetallurgical & ceramics gradesmarkets. Moreover, in the area ofpolymers and construction uses, itmanaged to increase its sales throughnew undertakings both in Europeand Asia. On an operationallevel, we successfully concluded aconsolidation of our wollastonite miningand processing assets underthe local government’s supervisionin the Jilin Province in China. As a resultour OTAVI brand stands readyto develop its full potential and restructureand enhance its mining &processing operations.The Refractory Business Unit, basedon its palette of high–alumina contentsources, such as Brown FusedAlumina, mullite and bauxite, createdthe necessary coherence in its salesand marketing focus for an additionalrecovery. Our persistence in assuringproprietary access to relevant materialsfrom China, and the accelerationof new product development –suchas new mineral-coating techniquesand the Thermocarbon® family ofproducts– were two actions thatopened new fields of operational activityand were positively perceivedby our customers.We anticipate that 2011 will bemore than just a year of stabilizationfor our division. This is notbased only on all the aforementionedefforts. During the period of theeconomic slowdown, from late2008 to mid-<strong>2010</strong>, we focused ourefforts on optimizing our businessin order to adapt to the new environmentand increase our efficiency.During <strong>2010</strong> we realized thebenefits from those efforts and hada strong and profitable recovery.We look forward with optimism andanticipation to sustained momentumin this recovery. In parallel, weremain constantly aware of, andready to capitalize on, any opportunitiesrelated to materials, applicationsand geographic regions,that will enable us to drive additionalvalue from our Division.in € million4037265512008 2009 <strong>2010</strong>Sales EBITDA<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>33

€66 millionin sales109perlite-basedproductsto 26countries37mines, plants& distributioncentresin 11countriesPerliteView of the Perliteprocessing plant andpart of the loading porton Milos Island in Greece.Silos and storage facilitiesenable the simultaneousloading of different perlitegrades.34 S&B Industrial Minerals S.A.

<strong>2010</strong> Perlite Salesby Segment<strong>2010</strong> Perlite Salesby Geographical AreaConstruction &Building Materials 66%WesternEurope 36%NorthAmerica 36%Other 2% Horticulture 28%Filteraids 2%Cryogenics 2%Other 2%Far East 7%EasternEurope 19%<strong>2010</strong>has beena year ofslow recoveryfor the Perlite Division. Thecontinuing deterioration of the constructionmarkets in southern Europewas only partially offset bymoderate volume increases in CentralEurope and North America. Weachieved revenue of €66.2 million,an 8.3% increase over the €61.1 millionof the previous year. Revenuegrowth in Europe, which accountsfor more than half of the Division’stotal revenue, was modest, while werecorded double-digit revenuegrowth in North America and strongdouble-digit growth in Asian markets.Through discipline in maintaining ourpricing policy and our efforts to reducecosts, we recorded EBITDA of€9.9 million, at par with 2009, despitethe significant increase in freightand energy costs. In line with Groupwidetargets, we continued during<strong>2010</strong> to achieve significant improvementsin our working capital and alsocontained our planned investmentsbelow 2009 levels.Despite the protracted period ofchallenges for the Division for a thirdconsecutive year, we managed toretain our customer base and remainedactive in our efforts tolaunch new products. In addition, inline with our strategy to increasevalue from expanded perlite in thesoutheastern part of the UnitedStates, we succeeded in filling thecapacity of both of the expansionplants we have acquired in the areain the previous two years.A key highlight for the Perlite Divisionin <strong>2010</strong> was the establishment ofPergem SA, a joint venture companyin Turkey, through which weexpect to enter the former CIS andAsian markets and benefit from thegrowth anticipated in these regions.In the raw perlite business in Europe,we achieved a modest revenue increaseversus 2009. This performancewas largely driven by theconstruction segment, mainly due torobust demand for ceiling tiles in Germanyand France. Intense competitionin pozzolanic materials resultedin pricing pressure, but we neverthelesssucceeded in maintaining ourmarket share. In contrast, in the marketsof southern Europe, our expandedperlite business related toconstruction was faced with doubledigitdeclines in Greece, remainedstable in Spain, where subdued constructionactivity persisted, and wasfavorable in Bulgaria compared tothe previous year. The prospects forexpanded perlite for the constructionsegment are not promising for 2011,mainly because of the protracted recessionin the construction sector inSouthern Europe, the main concernbeing Greece.In North America, construction activitybottomed out in <strong>2010</strong> in line with stablenew housing starts and flat homesales, keeping raw perlite volumes at2009 levels. However, the related revenuesfor the Division were improved,mainly owing to the fact that throughthe two expansion plants, we sellproducts at higher value.In Asia, construction-related salesposted a significant increase comparedto 2009, supported stronglyby pricing which was significantlyhigher than in the previous year. InChina, the market for new buildingmaterials is booming and theprospects are similar for 2011.In the horticulture segment, raw perlitevolumes in Europe have been increasedby gaining market sharefrom competition. Expanded perliteperformed particularly well, supportedby strong activity in Spain,where we also acquired a newbrand from the competition to complementour product line. In NorthAmerica, the horticultural perlite marketremained resilient and balancedthroughout the economic crisis.While plant and vegetable nurserieswere hit the hardest by the crisis,small retailers supplying home improvementstores were less affected.Our performance in theNorth American horticulture marketwas quite strong, as we recordedhigh double-digit growth in <strong>2010</strong>.This achievement was made possibleby a full year of sales from the twoexpansion plants that we have acquiredon the southeastern coastover the last two years. The outlookfor 2011 is uncertain, as Nationalbuilders anticipate stabilization inhome sales and a potential reductionin landscaping needs.Our Business and Product Developmentefforts produced some verygood results, as we have projectsthat are entering implementationstage. Furthermore, we have developedand marketed new products,like Phyllomat and SpeedSorb,which offer good development potentialin the fillers and absorbentsmarkets for our Division. Our participationin EU funded R&D programshas been and remains a key priority,and we expect to participate in additionalrelevant projects in 2011.in € million742008 2009 <strong>2010</strong>Sales61669 10 10EBITDAWe are cautious in our 2011 outlook,despite having positive signs fromkey areas and markets. The mainchallenges will be the sustainability ofrecovery in U.S. housing and thestrengthening of major Europeaneconomies like Germany andFrance. We will focus on the furtherdownstream expansion of our currentbusiness, as well as on the developmentof our business into newminerals related to the markets we alreadyserve.<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>35

Successful reclamationof a perlite mine

Sustaining Values<strong>2010</strong> has been a year of recovery for our businessperformance, sustained by our Values and our diligentquest for Sustainable Development. Our commitmentsto our customers, to our people and to the localcommunities where we operate, as well as the soundpursuit of occupational safety and mitigation of ourenvironmental footprint across our operations, driveour sustainable development strategy and guide ourperformance objectives.

Our strategic approach to Sustainable Developmentand consequently to Corporate Social Responsibilityis anchored on our sustained Values.Corporate Social ResponsibilityOur key sustainability challenges• Securing access to and responsible management of natural resourcesin order to be able to meet present and future demand forour products and, at the same time, improve efficiency in the useof natural resources• Safeguarding occupational health & safety• Valuing S&B’s people and fostering their development• Minimizing the environmental footprint of our activities: prevent,protect, mitigate, restore• Caring for local communities: promoting their balanced and sustainabledevelopment; achieving balance between the company’sactivity and other economic activities, such as tourismDrive our strategic approach to sustainable development• Setting our principles and our codes on the basis of our Valuesand our Purpose• Establishing policies in the areas of CSR that we and our stakeholdersidentify as most important, and upon which we focus• Developing comprehensive practices in these areas• Monitoring and measuring our performance• Communicating and reporting on all of these as a way of beingaccountable to our stakeholdersWe link our key challenges to specificcommitments which we pursuethrough a strategic approach supportedby appropriate governancestructures.38 S&B Industrial Minerals S.A.We have been publishing a Social<strong>Report</strong> for the past ten years, applyingthe Global <strong>Report</strong>ing Initiative’s(GRI) Sustainability Guidelinesand checked for our ApplicationLevel by the GRI for the last four.The Social <strong>Report</strong> provides an overviewof our sustainability activitiesand performance. In our continuousquest to strengthen the accountabilityand methodological rigor ofour non-financial reporting, we initiatedan Assurance readinesscheck of our Social <strong>Report</strong> by athird party auditor at the end of<strong>2010</strong>, in order to identify gaps andareas for improvement and work towardsestablishing an assuranceprocess over the next two years.Values, Principles & CodesS&B Group• S&B Values• United Nations Global Compact• S&B Corporate Governance Principles, 4th revision, <strong>2010</strong>• S&B Group Management PoliciesS&B’s European activities• Industrial Minerals Association-Europe (IMA-Europe)Sustainable Development Charter• IMA-Europe Biodiversity Statement• Voluntary Agreement on Crystalline SilicaS&B Industrial Minerals S.A. (parent company)• Greek Mining Enterprises Association (GMEA) Codeof Principles for Sustainable Development• SEV Hellenic Federation of Enterprises Charter of Rightsand Obligations of Enterprises• SEV Business Council for Sustainable DevelopmentCode for Sustainable Development• S&B Internal Operating Regulation• Externally developed principles and codes, to which S&B complies voluntarily

<strong>2010</strong> at a GlancePeopleHealth & SafetyEnvironmentSocioeconomic ContributionAt the end of the year, our workforcenumbered 1,983 employees globally.We also used the services of 544 contractors’workers in Greece, Germany,the USA, Bulgaria, Italy, South Koreaand the Netherlands. Employee voluntaryturnover rate across the Groupremained relatively low, at 1.94%. Forwhat accounts to more than half ofour workforce we remain a major localemployer in many countries of our activityand in 80% of our significant locationssenior managers are locals.We support equal treatment andoffer equal opportunities for bothsexes in covering vacant positionsand in planning the career developmentof employees. Although miningand processing is not a traditionalcareer choice for women, 17% ofS&B’s total workforce, two out of theeight members of S&B’s top executiveteam, and four out of fifteenBoard of Directors members, werefemale during <strong>2010</strong>.We place special emphasis in developingour people. The election of theGroup’s CFO as the new CEO, vividlydemonstrates our unfailing commitmentto unfold the talent of our peopleand foster our leaders.Safety remained a priority for our operationsworldwide with emphasis onbehavior improvement at work.Adaptation to the internationally acclaimedstandard OHSAS 18001:2for Health & Safety at Work was completedin our Continuous CastingFluxes German facilities.Training for behavior improvementmethods aiming at accidents’ preventionand at change of attitude towardssafety was initiated in Bulgaria.Even greater emphasis was placedon encouraging near miss reports,which doubled compared to 2009,with actions to facilitate reporting andsharing of information among allGroup sites.6,972 hours of Health & Safety trainingwere realized in Greek, European,N. America, Brazil and Indiashowing a notable increase to previousyears.Application of the REACH and CLPRegulation was concluded for all S&Bproducts, as well as those providedby third parties, ensuring complianceand product safety across our supplychain.Early in the year we reviewed the governancestructure of Environment,Health & Safety (EHS) and expandedit further with the establishment of athird EHS Council in North America.In August and November <strong>2010</strong>, S&Bwas granted, after a long proceduralperiod before the administration authorities,two very important environmentalpermits in its Greekoperations, on Milos and Fokis, respectively,enabling the smooth continuanceof activities.<strong>2010</strong> also marked achievement of thetarget of using only local and endemicplants in all our Greek reclamationworks. The five-year research programwith the Institute of MediterraneanForest Ecosystems of theNational Agricultural Research Foundationand the University of Athenswas concluded. This project has producedmany positive results and“lessons learned” and has improvedour reclamation methods and knowhowover the years.Read more in section Environmentof our Social <strong>Report</strong> <strong>2010</strong>.We contributed €4.9 million to shareholders,€68.2 million to employeesin compensation and benefits, €280million to suppliers of all kinds and€31.5 million for taxes, duties and socialcontribution.We continued our contribution to localinfrastructure works in support of ouroperations (i.e. roads) or as direct localcommunity social contribution, thusimproving socioeconomic conditionsfor inhabitants of these areas.Read more in section Social Contributionof our Social <strong>Report</strong> <strong>2010</strong>.Read more in section Our People ofour Social <strong>Report</strong> <strong>2010</strong>.Read more in section Health &Safety of our Social <strong>Report</strong> <strong>2010</strong>.<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>39

The Corporate Governance System aims at doing business througha fair, sound and effective management system, in compliancewith regulations and professional conduct and ethics.Corporate GovernanceS&B’s CorporateGovernanceSystem is anevolution of business principles thatwere formulated already since the1980s, in order to replace the traditionalmanagement system of a family-ownedbusiness. Following theedition of the “OECD Principles ofCorporate Governance” in 2000,S&B readily adopted them and transformedits Corporate GovernancePrinciples accordingly. As a result,the first codified edition of “S&B Principlesof Corporate Governance”was published in 2001, the first of itskind in Greece. The Group’s CorporateGovernance System evolves inorder to respond to the continuallychanging business and social conditionsand in the first quarter of <strong>2010</strong>S&B concluded its 4th CorporateGovernance System revision.The “S&B Principles of CorporateGovernance” reflect the Group’sconduct towards its Stakeholders,comprising not only the Company’slegal and statutory obligations, butalso its self-imposed commitmentsthat stem from its Corporate BusinessEthics.The main objective of S&B CorporateGovernance System is the longtermdevelopment of the Company,dictated by an equal and fair defenceof the interests of all Shareholderswith no exception, as well as by thedemands of social responsibility andpublic acceptance.Accordingly, the Company is concernedwith:• safeguarding the Principles andValues of the Group• clarifying the authority and dutiesof the various bodies involved inCorporate Governance• evaluating entrepreneurial threats/ opportunities and taking calculatedrisks (risk management)• ensuring the effective utilization ofthe available resources• monitoring and efficiently controllingthe Company’s Managementactivities• safeguarding the transparency ofcorporate activities• safeguarding the Shareholders’ rightsand facilitating their exercise• promoting the effective and consistentimplementation of CorporateSocial Responsibility• safeguarding efficient applicationof the Group’s Environmental,Health & Safety Policy• protecting the rights of the StakeholdersThe above objectives are fulfilled by:• Transferring the management ofthe Group to professional managers,who, as a rule, have no familyconnection with those whocontrol the majority of the Company’sequity,• Securing an effective corporateoperational control, consisted ofindependent internal and externalauditing bodies, and• Establishing an active Board ofDirectors, which acts as the topguiding body for the effective safeguardingof the interests of theCompany and all the shareholders,as well as those of the Stakeholdersin general.Our Corporate Governance System continuously evolves tokeep abreast of wider socio-economic developments ensuringalignment with international best practices. The 4th and mostrecent revision to our standards occurred in early <strong>2010</strong> placingfurther emphasis on transparency and on our risk managementprocesses, but also on Sustainable Development as a strategicchoice for the Group, in response to the globally unstablebusiness environment.40 S&B Industrial Minerals S.A.

The Board of Directors acts as the trusteeof our Corporate Governance principles.Board of DirectorsBoard composition and responsibilitiesOur Board during <strong>2010</strong> comprised of15 members out of which, only 2were executives of the company. Ofthe 13 non-executive Directors 9 independentDirectors have been appointedas defined by Greeklegislation on Corporate Governance(law 3016/2002).The non-executive members are entrustedwith the monitoring and controllingof Management’s activities.They are professionals selectedamong successful business andacademic individuals with rich domesticand international experience,on the basis of educational level andsocial status. Their role is to providean unbiased, clear and non-executiveperspective within the Boardand express objective opinion oncompany matters.S&B’s Board measures its effectivenesson a yearly basis, by self-assessmentthrough a questionnaireanswered by all of its members, relatedto its activities in the precedingyear. The evaluation forms the basisfor a deliberation on the improvement,performance and effectivenessof the Board and its establishedCommittees.The Board meets at regular intervalson matters for its full consideration.Board members are provided in advancewith all necessary and relevantinformation to enable them tocarry out their responsibilities. Dutiesof the Board include among othersthe approval, review and integrationof Group policies and principles, theimplementation of mid- and longtermstrategic imperatives throughgoal-setting, approval and review of,budgets, investment plans and theGroup’s general course of action.Furthermore, the Board ensures theexistence of an efficient risk analysissystem and risk taking framework,transparency, credibility and integrityof publicized financial statements,while it also safeguards the effectiveimplementation of the Group’s EnvironmentalPolicy.Further information on the Boardmembers can be found in the Directors’Biographies section.<strong>2010</strong> Board of DirectorsKitty Kyriacopoulos Honorary Chairman ●Ulysses Kyriacopoulos Chairman ■Emmanuel Voulgaris Vice-Chairman ●Efthimios Vidalis Chief Executive Officer ■Stelios Argyros Member ▲Robert J. Champion de Crespigny AC Member ▲Iakovos Georganas Member ▲Florica Kyriacopoulos Member ●Raphael Moissis Member ▲Nicholas Nanopoulos Member ▲Calypso-Maria Nomicos Member ▲Helen Papaconstantinou Member ▲Alexandros Sarrigeorgiou Member ▲Maarten Schönfeld Member ▲Alain Speeckaert Member ●■ Executive Members (2) ● Non-Executive Members (4) ▲ Independent Non-Executive Members (9)<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>41

Directors' BiographiesKitty KyriacopoulosHonorary ChairmanMrs. Kyriacopoulos has been withthe company since 1965 and hasserved as Managing Director of S&BIndustrial Minerals S.A., Bauxite ParnasseMining Co. S.A., and EliopoulosBrothers S.A. for many years. Shehas studied Physics and Mathematicsat Mount Holyoke College (B.A.)and at Columbia University.Mrs. Kyriacopoulos is a member ofthe Board of "College Year in Athens"and of “Anatolia College of Thessaloniki”.She is also Member ofthe "Presidents' Club", of "BiopoliticsInternational Organization in Greece",the Cerebral Palsy Greece (formerSpastics Society Athens) andHonorary Co-President of the "Women'sProfessional Forum". She hasalso founded the “Kitty KyriacopoulosChair of Finance” at ALBA GraduateBusiness School in Athens in 1998.Ulysses KyriacopoulosChairman of the BoardMr. Kyriacopoulos has studied MiningEngineering at MontanuniversitaetLoeben in Austria and at the Universityof Newcastle-upon-Tyne in England.He holds a M.B.A. from theEuropean Institute of Business Administration(INSEAD) in Fontainebleau,France. He has been with the companysince 1979 and served as ManagingDirector from 1990 to 2001.Mr. Kyriacopoulos has served aschairman of the Hellenic Federationof Enterprises from 2000 to 2006,Vice President of BusinessEurope(ex UNICE) President of the Boardof Directors of the Greek NationalOpera (2006-2009) and Vice- Presidentof Hellenic Exchanges HoldingsS.A. He is currently a memberof the General Council of Bank ofGreece, member of the Board ofI.Boutaris & Son Holding S.A., of LavipharmS.A. and of Lamda DevelopmentS.A.Emmanuel J. VoulgarisVice - Chairman of the BoardMr. Voulgaris has been with the companysince 1974. He has graduatedwith Honors in Chemistry from AthensUniversity and received his M.Scin Petroleum Engineering at the Universityof Tulsa, U.S.A.In the period 1974-2000 he servedin various top executive positionsof S&B including that of ManagingDirector.Mr. Voulgaris has served as Presidentand Managing Director of HellenicAspropyrgos Refineries S.A.,President of Eviam, Vice-President ofthe Federation of Greek Industries,President of the Perlite Institute Inc.and Secretary General of the GreekMining Enterprises Association.Efthimios VidalisManaging Directorand Board MemberMr. Vidalis graduated from HarvardUniversity with a BA in Governmentand earned a MBA from the HarvardGraduate School of BusinessAdministration.During his 20 year career at OwensCorning, USA, he held General Managementpositions including VicePresident of the European Reinforcementbusiness for the period1986-1993, President of the GlobalComposites business 1994-1996and President of the insulation businessfrom 1996-1998.Mr. Vidalis was appointed Chief OperatingOfficer of S&B in 1998 and becameChief Executive officer in 2001.He has also served as Chairman ofthe Greek Mining Enterprises Associationfrom 2005 to 2009.He is currently Vice-Chairman of theBoard of Directors of the Hellenic Federationof Enterprises (SEV), and chairmanof the Business Council ofSEV for Sustainable Development,Chairman and board member of subsidiarycompanies of the S&B Group,and member of the Board of TITANS.A., RAYCAP S.A., Zeus Real EstateFund, and Future Pipe Industriesheadquartered in Dubai.Stelios ArgyrosMember of the Board since 1996Mr. Argyros holds a B.Sc in Chemistryfrom Amherst and a M.Sc andan Sc.D. in Materials Science andEngineering from MIT.He is chairman of the Board andChief Executive Officer of FILIACOMS.A. and chairman of the Board of FI-LIASOL Renewable Energy SourcesS.A. and of FILIA ENVIRONMENTALINDUSTRIES S.A.. He is a memberof the Board of P.G.NIKAS S.A.. Hehas served as chairman of the Boardof WIND Hellas, Vice-Chairman of theBoard of ASPIS Bank and memberof the Board of DELTA Holdings S.A..He has also served as a member ofthe Executive Committee of the TRI-LATERAL COMMISSION, memberof the Board of ALBA (Athens Laboratoryof Business Administration)and a former Member of the EuropeanParliament (M.E.P.).Finally, he has served as Presidentand Chairman of the Board of theFederation of Greek Industries, VicePresident of UNICE and Presidentof the World Textile Institute (U.K.).Robert J. Championde Crespigny ACMember of the Board since 2009Chairman of Crosby-Textor ResearchStrategies Results, BoardMember of Oxford University's SaidBusiness School, Advisor to BarclaysNatural Resource Investments.Mr. Champion de Crespigny wasthe founder (1985), Chairman andChief Executive of Normandy MiningLimited until its merger in 2002with Newmont Mining Corporation.At the time of the merger NormandyMining Ltd was Australia's largestgold company and in the top fivegold companies in the world.He has also served as Chairman ofthe Economic Development Boardof South Australia, Chancellor ofThe University of Adelaide, Chairmanof the South Australian Museum,non-executive Chairman ofa number of publicly listed Australiancompanies and advisor to theExecutive Committee of the SouthAustralian Cabinet. Furthermore,he has served as Australia's representativeon the Commonwealth'sExpert Group on Democracy andDevelopment, Chairman of the AustralianGold Council, and Memberof the Business Council of Australia,the Minerals Council of Australiaand the National Gallery ofAustralia.Iakovos GeorganasMember of the Board since 1996Mr. Georganas studied Economicsand Commercial Sciences and has attendedthe Harvard Business SchoolAdvanced Management Program.He is Chief Financial Advisor andMember of the Board of Directors ofPiraeus Bank Group as well as Chairmanof the Board of Directors ofHellenic Exchanges Group, amongothers.Mr. Georganas has served as ExecutiveVice Chairman of the Boardof Directors of Piraeus Bank S.A.(1991-2004), Governor of ETVA, Chairmanof Hellenic Investment Co.42 S&B Industrial Minerals S.A.

S.A., Vice Chairman of the CapitalMarkets Committee and Member ofthe Executive Committee of theGreek Banking Association. He hasalso been a member of the Committeeof Alternate Governors of theLong-Term Credit Institutions of theEuropean Union and Member of theBoard of IOVE.Florica KyriacopoulosMember of the Board since 1990Ms. Kyriacopoulos studied PoliticalScience and Economics at the Universityof Geneva and Mount HolyokeCollege in the U.S. andPolitical Philosophy at Brandeis Universityin the U.S.She is a journalist, an artist and a businesswoman.As a journalist sheworked for more than 10 years forLambrakis Press SA, as a correspondentfor “Τhe Guardian” in Greeceand as the CEO of a radiostation in Athens. As an artist shehas held 10 solo exhibitions in Greeceand abroad. As a businesswomanshe was the Managing Directorof an exporting fruit company for 10years, while she currently sits on theboard of various corporations. In thepast decade she has founded theArtShop and has been working onthe establishment and operation ofthe Fougaro, a major ContemporaryCenter of Art and Culture in the cityof Nafplion in Greece.Raphael A. MoissisMember of the Board since 1996Mr. Moissis holds a B.Sc in MechanicalEngineering with First Class Honoursfrom the University of Manchesterand a M.Sc and D.Sc. from MIT,where he has also served as assistantprofessor from 1960 to 1963.He is presently Deputy Chairman ofthe Foundation for Economic and IndustrialStudies (IOBE), Deputy Chairmanof College Year in Athens, andHonorary Chairman of ALFA BETAVASSILOPOULOS S.A., where heserved as Chairman for several years.He has previously served as ExecutiveSecretary of the National EnergyCouncil at the Ministry of Coordination,Deputy Governor of the HellenicIndustrial Development Bank(ETBA), Governor of the PublicPower Corporation, Chairman of theBoard of ATTIKO METRO S.A., Presidentof the Public Gas Corporation(DEPA), and President of the NationalEnergy Strategy Council.He has also been a member of theExecutive Committee of the Federationof Greek Industries (SEV), hewas the founding Chairman of theMIT Club of Greece, and served asSecretary and Treasurer of AthensCollege, member of the Board ofthe Centre for Political and EducationalStudies (KPEE).In 1982 he was named Officer of theLegion of Honor by the President ofFrance and in 2008 Commander inthe Order of the Crown of the Kingdomof Belgium.Nicholas NanopoulosMember of the Board since 1996Mr. Nicholas Nanopoulos is theChief Executive Officer of EFG EurobankErgasias S.A.He holds degrees in Mechanical Engineering(B.Sc., M.Sc. from MIT), Economics(M.Sc. from LSE), BusinessAdministration (MBA from INSEAD) aswell as a PhD. Degree in Economicsfrom the University of Reading.From 1982 to 1988, he worked atthe World Bank in Washington DCwhere in 1986 he became SeniorManager of the Investment Department.From 1988 to 1990, he becameManaging Director of CarollMcEntee & McGinley (member ofthe HSBC Banking Group).Upon his return to Greece in 1990,he held the position of General Managerof Euromerchant Bank. In1996, when the Bank was renamedto EFG Eurobank S.A., NicholasNanopoulos became Managing Directorand CEO of the Bank, a positionhe holds until this day.Mr. Nanopoulos serves on theBoard of EFG Eurobank ErgasiasS.A. and on the Board of various entitiesaffiliated with the Bank. He isalso a member of the Board of theHellenic Bank Association.Calypso-Maria NomikosMember of the Board since 2001Mrs. Nomikos has studied Economicsand Business Administration(BSc) and participates in specializedseminars organized by internationalorganizations and universities, suchas the Harvard Business School.Today she holds the position of chairwomanof the Board of Directorsof A.M. Nomikos Transworld MaritimeAgencies S.A., a company activein international ship managementof several ship-owning companiesand shipping related commercialventures.Helen PapaconstantinouMember of the Boardsince September, 2004Mrs. Papaconstantinou studied lawat the London School of Economicsand Political Science (LL.B.), and undertookpostgraduate studies(LL.M.) at Harvard Law School in theU.S.A. Thereafter, she continuedher studies in Brussels and she wasawarded a PhD degree from theUniversité Libre de Bruxelles.Today, Mrs. Papaconstantinou is apracticing lawyer at PapaconstantinouLaw Offices in Athens, with expertisein commercial, corporateand antitrust law. Among others,she is legal counsel of Toyota Hellas,Philip Morris/Papastratos, Kraftfoods, Swarovski and Amadeus.She also teaches mergers & acquisitionsand antitrust law at ALBA(Athens Laboratory of Business Administration).She is president of theHarvard Club of Greece and memberof the Board of Directors of theHellenic Foundation for Europeanand Foreign Policy (ELIAMEP).Alexandros SarrigeorgiouMember of the Board since 2002Mr. Sarrigeorgiou holds a B.Sc. anda M.Sc. in Civil Engineering fromColumbia University and an M.B.A.in Finance from the Wharton Schoolof the University of Pennsylvania.He started his career as FinancialAnalyst with Owens Corning Fiberglasfor three years and spend thenext seven years with the JeffersonInsurance group (Allianz Group Companies)in the USA where he reachedthe level of Senior Vice President incharge of Asset Management andOperations. He moved to Athens in1992, becoming General Manager ofthe Allianz Group, Greece, in chargeof Mutual Funds and Financial Servicesuntil 1997 and Group CFO until1999. From 1999 until 2004 he wasthe Managing Director and CEO ofthe Allianz Group, Greece and theChairman and Managing Director ofAllianz Dresdner Asset Management,Hellas. Since 2004 he is theManaging Director & CEO of the EFGEurolife Insurance Group (Group EurobankEFG) and Chairman of EFGInsurance Services.He is a member of the Board of theGreek Association of InsuranceCompanies. He has also served asmember of the Board of the HellenicCapital Markets Committee.Maarten SchönfeldMember of the Board since 2009Mr. Schönfeld has studied BusinessEconomics at the University ofGroningen, Netherlands and holdsa MBA from INSEAD, Fontainebleau,France.He is currently member of the SupervisoryBoard of Arcadis N.V. andDraka NV, member of the SupervisoryBoard of Technical UniversityDelft., member of the SupervisoryBoard of Royal ArtAcademy andConservatorium The Hague, memberof the Board of "Vereniging EffectenUitgevende Ondernemingen"(VEUO), member of the SupervisoryBoard "Stichting Sanquin Bloedvoorziening",member of AFM Committeeon Financial <strong>Report</strong>ing; all inthe NetherlandsMr. Schönfeld has previously servedas Vice-Chairman of the Board andCFO of Stork B.V., has held various financialfunction positions with RoyalDutch Shell Plc (CFO: Shell NederlandN.V. and Deutsche Shell AG; InvestorRelations Officer; Controllingin USA, Argentina, Portugal, Switzerland,Germany and The Netherlands)and also worked for the United NationsDevelopment Programme(UNDP) in Malawi (Africa).Alain SpeeckaertMember of the Board since 2009Mr. Speeckaert has studied FinancialAccounting at the Institute forPostgraduate Education in Antwerpand Management at INSEAD, Fontainebleau,France. He holds aCommercial certificate from theSanderus School in Antwerp.He has served as President andCEO of the Sibelco Group ManagementCommittee from 2002 until theend of 2009. During his long-standingcareer, he served as CommercialRepresentative of SCR-Sibelco,deputy Manager of De NieuweZandgroeven van Mol, president ofthe Board of Sibelco Nederland, GeneralManager and Managing Directorof SCR-Sibelco.He currently holds the Chairmanshipof the Belgian National Federationof Silica Producers and is still amember of the Board of Directorsof SCR-Sibelco NV (and will continueto serve the Group specificallyin the field of external relations).<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>43