flip chart 6-3

flip chart 6-3

flip chart 6-3

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

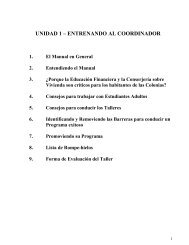

FINANCIAL LITERACY WORKSHOP 6EARNED INCOME TAX CREDIT1 Facilitator NeededEstimated Time: 1 hr 45 minThings to Prepare BEFORE THE WORKSHOPITEM APPENDIX # PAGE # USEDFlip Chart 6-1 A-6-1 6-2Flip Chart 6-2 A-6-1 6-3Flip Chart 6-3 A-6-2 6-3Flip Chart 6-4 A-6-2 6-3Flip Chart 6-5 A-6-3 6-3Flip Chart 6-6 A-6-3 6-3Handout 6-1 EITC Basic Rules A-6-4 6-3Handout 6-2 EITC Exercise A-6-5 6-4Handout 6-3 Don’t be a victim A-6-6 6-7Evaluation Form Trainer’s Section 6-8Activity Page Time MaterialsIntroduction• Introduction of facilitator,participants, icebreaker• Review Workshop Objectives6-26-215 min5 min20 minLearning Activity 1: Earned IncomeTax Credit• Group Discussion 6-3 20 minLearning Activity 2: Earned IncomeCredit Rules• Group Exercise20 min6-4 20 min20 minBreak 6-4 15 minBlank Flip Chart/MarkersPrepared Flip Chart 6-1Workshop ObjectivesHandout 6-1 EITC BasicRulesFlip Chart 6-2 EITCDefinitionFlip Chart 6-3 EITCIncome LimitsFlip Chart 6-4 EITCBenefitsFlip Chart 6-5 EITC RulesHandout 6-2 EITC ExerciseFlip Chart 6-6 EITCExercise AnswersLearning Activity 3: Earned IncomeCredit Situations• Group Discussion 1• Group Discussion 2Wrap-up• Workshop Evaluation6-56-710 min10 min20 minHandout 6-3 Don’t be aVictimCopy of Role Play 6-56-8 10 min10 min Evaluation Form6-1

IntroductionTime 20 minMaterials Need: Blank Flip Chart, Flip Chart 6-1, Markers.Reminder: The Trainer’s role is always to educate, not to provide advice• Introduction of Facilitator and ParticipantsWelcome the participants and introduce yourself to the group.Ask the participants to introduce themselves and conduct one Icebreaker selected by thefacilitator from the Icebreaker list.Tell the group that this session will focus on the Earned Income Tax Credit.• Workshop ObjectivesShow Flip Chart 6-1: Workshop Objectives and read it to them.o Review the objectives with the groupo Hang the <strong>flip</strong> <strong>chart</strong> so it is visible to the entire group6-2

Learning Activity 1: Earned Income Tax CreditTime: 20 minMaterials: Handout 6-1, Flip Chart 6-2, Flip Chart 6-3, Flip Chart 6-4, Flip Chart 6-5• Group Discussion Ask the group whether anyone knows what EITC means.o If somebody knows, tell them to explain it to the groupo If not, immediately Refer to Flip Chart 6-2: EITC Definitiono Read it to the groupo Tell the group that in order to qualify for the EITC you need to meet the IncomeLimits and Rules.Refer to Flip Chart 6-3: 2003 EITC Income Limitso Let the group know that every year the Income Limits changeo Tell the group some of the benefits of the EITCo Refer to Flip Chart 6-4: EITC BenefitsDISTRIBUTE HANDOUT 6-1: EITC Ruleso Ask the group look over the ruleso Refer to Flip Chart 6-5: EITC Ruleso Review each rule6-3

Learning Activity 2: Earned Income Tax Credit RulesTime: 20 minMaterials: Handout 6-2, Flip Chart 6-6,• Group Exercise DISTRIBUTE HANDOUT 6-2 Group Exerciseo Ask the group to complete the exerciseo Give them about 5 minutes to complete ito Ask for volunteers to provide their responseso Write Key word responses on the blank Flip Charto Refer to Flip <strong>chart</strong> 6-6: EITC Exercise for the correct answerso Explain why these answers are correct‣ 1.- NOIn order to receive the EITC they needed to file “Married filingJointly”.‣ 2.- NOITIN (Individual Taxpayer Identification Number) is not a validSocial Security Number. This number is for tax purposes only.Their niece can be claimed as a dependent but they cannot receivethe EITC for her.‣ 3.-NOElena can claim the dependency exemption for the two childrenfor whom she has provided more than half of their support and forwhom their mother did not claim the dependency exemptions. Shecannot claim the EITC for the two children since they lived in thehouse with their mother and not with Elena. Elena’s correct filingstatus would be single. Monica can claim the EITC for the twochildren she claimed and can file as head of household.‣ 4.-A) YESThey have two qualifying childrenB) YESLily can and should file a tax return since she worked partime.If she had federal income tax withheld she is entitled to arefund. However, Lily cannot claim a personal exemption forherself since her parents claimed a dependency exemption forher.C) NoLily would not qualify for the EITC. Her parents will beclaiming the EITC for Lily as explained above. Lily does notmeet the age requirement for a person with no dependents toclaim EITC.----------- 15 MIN BREAK -----------6-4

Learning Activity 3: Earned Income Credit SituationTime: 20 minMaterials: Handout 6-3, Copy of Role Play• Group discussiono Tell the group that you will be role playing a real-life situation of Mrs. Perez andher daughter Monica related to their tax refund.o Ask the group for one volunteer to do the role playing with you.o Explain to the group that Mrs. Perez has two daughters and two sons. The onlydaughter that is married is Monica. Since Mrs. Perez received a large refund, sheinvited her extended family to dinner. While Mrs. Perez and Monica are in thekitchen waiting for the food be ready, they have the following conversation:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica how much was your IRS refund?Well Mom I think we received less than what we should have. Wereceived $ 1,500.What!!! We received $4,000 mijita. Who prepared your taxes?We went to a paid tax preparer. We were supposed to receive about$2,000 but they charged us about $500.00 for a rapid refund and allthe forms we needed.You paid $500 to have your taxes prepared?Yes. I didn’t think it was so high.You should not give away your money like that.What do you mean? How much did you pay to have your taxesprepared? You got a rapid refund, didn’t you Mom?Well I did receive my money very quickly, but I did not pay for arapid refund.I don’t understand Mom.Well mijita, I went to a VITA site with your Aunt Lulu.What is a VITA site?A VITA site provides free income tax preparation as a communityservice. They are volunteers who are certified by the IRS to preparetaxes.You got your taxes prepared for free!Yes.But they charged you for the rapid refund, right?No6-5

Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:Mrs. Perez:Monica:I’m confused again. You received your refund quickly and theydidn’t charge you. Don’t they always charge for that?Monica the rapid refund like the one you received was a loan.What do you mean a loan? They never mentioned anything abouta loan.No they probably just told you that they could help you get a refundwithin a few days. But they actually made you a loan. That is whythey charged you so much.So Mom, you didn’t get a loan in order to receive your refund?No, I didn’t. My refund got deposited to my bank account withintwo weeks of preparing my taxes, which I think is a reasonable timeand the most important thing is that I didn’t get charged for any ofthe services.Oh Mom, we should get together more often. If only I had known Icould have saved $500! I’m pretty sure that my sister and brotherdon’t know anything about it either. We should mention this atdinner.Yes mijita, I’ll tell them. Now help me with the plates.Ok Mom.• Group DiscussionDISTRIBUTE HANDOUT 6-3: Earn Income Tax CreditAsk the group to tell you the key points of the role playing and explain it.o Write key word responses on the blank Flip Chart page‣ Expected Responses:-VITA sites-Rapid Refund Loanso Tell the group that income tax refunds vary with each taxpayer. Several factorsdetermine whether taxpayers get money back or have to pay, including thenumber of dependents and the amount of income. The amount of one’s incomedetermines the tax bracket. People in different tax brackets pay different taxrates. Tax rates vary – usually the more you earn the higher you tax bracket.6-6

WRAP UPTime: 10 MinutesMaterials: Evaluation Form• Evaluation of WorkshopDistribute Evaluation Forms.Ask the group to please complete Evaluation Form with their commentsLet them know that their comments are important to further improve the moduleThank them for taking the time to attend this workshop and ask them if they have anyquestions.If you cannot answer a particular question, write it down along with the contact informationfor the person who asked the question. Contact them later with an answer.6-7

FLIP CHART 6-1: WORKSHOP OBJECTIVESThe Earned Income Tax CreditDeveloping Long-term AssetsWho Qualifies?WORKSHOP OBJECTIVESLEARN ABOUTLump Sum or Monthly Advance?FLIP CHART 6-2: EITC DEFINITIONEarned Income Tax Credit (EITC)The Earned Income Tax Credit also referred to as EITC is administered through theFederal tax system. The EITC is a federal tax benefit for low-income workers that canprovide a wage supplement to help them cover their living expenses or to save forlong-term assets.A-6-1

FLIP CHART 6-3: 2003 EITC INCOME LIMITS*FilingStatusNo QualifyingChildrenOne QualifyingChildTwo or More QualifyingChildrenSingle orHead of$11,230 $29,666 $33,693HouseholdMarriedFiling Jointly $12,230 $30,666 $34,692MarriedFilingSeparatelyNot Eligible Not Eligible Not Eligible*Based on 2003 I.R.S. Earned Income Guidelines.For more or current guidelines go to www.IRS.govFLIP CHART 6-4: EITC BENEFITSHelp make ends meetGet above the poverty levelPOTENTIAL EITC BENEFITSMake big ticket purchases or repairs – vehicles, largeappliancesImprove rental housing – enough cash for deposits andmoveDevelop Long-term assets – homes, small businesses,or collegePay outstanding bills – clear credit for futureHelp family members with their needsA-6-2

FLIP CHART 6-5: EITC RULES*Part ARules for EveryoneRule 1. You, your spouse,if married, and your childmust have valid SocialSecurity NumbersRule 2. Your filing statuscannot be “Married filingSeparately”Rule 3. You must be a U.S.citizen or resident alien allyearRule 4. You cannot file atax form relating to foreignearned income(Form 2555 or 2555A)Rule 5. Your investmentincome must be $2,600 orlessRule 6. You must haveearned incomePart BRules if You Have aQualifying ChildRule 7. Your child mustmeet the relationship, age,and residency tests (mustlive with you)Rule 8. Your qualifyingchild cannot be used bymore than one person toclaim the EICRule 9. You cannot be aqualifying child of anotherpersonPart CRules if You Do Not Havea Qualifying ChildRule 10. You must be atleast age 25 but under age65Rule 11. You cannot be thedependent of anotherpersonRule 12. You cannot be aqualifying child of anotherpersonRule 13. You must havelived in the United Statesmore than half the year*Based on 2003 I.R.S. Earned Income Rules.For more or current guidelines go to www.IRS.govFLIP CHART 6-6: EITC EXERCISE ANSWERSEIC EXECISE1- NO2- NO3- YES4- A) YESB) YESC) NOA-6-3

QUALIFYINGCHILD ORCHILDREN• Relation to taxpayer:*Sons, daughters, stepsons orstepdaughters or their descendants;brothers, sisters, stepbrotheror stepsister beingcared for as taxpayer’s child;eligible foster children.• Age of child:*Under 19 at end of year; orfull-time student under 24 atend of year; or permanentlyand totally disabled at anytime during year, regardless ofage• Residency:*Child lived in the USA withthe taxpayer for more than halfthe year.DON’T BE AVICTIM!KEEP MORE OFYOUR TAXREFUND !EARNEDINCOMECREDIT TAX(EITC)BASICRULES*Based on 2003 IRS Guide LinesHANDOUT 6-1A-6-4

1. You, your spouse, if married,and child must havea valid Social SecurityNumber.2. Your filing status cannotbe “Married filing Separately”.3. You must be U.S. citizenor resident alien all year.4. You cannot file a taxform relating to foreignearned income .5. Your income cannot exceedEITC limits establishedfor the tax year offiling (changes annually)RULES FOREVERYONE6. Your investment incomemust be $2,600 or less.RULES IFYOU HAVE AQUALIFYINGCHILD7. You must have “earnedincome”8. Your child must meetthe relationship, ageand residency tests.9. Your qualifying childcannot be used bymore than one personto claim the EITC10. You cannot be aqualifying child of anotherpersonRULES IF YOUDO NOTHAVE AQUALIFYINGCHILD11. You must be atleast age 25 but underage 6512. You cannot be thedependent of anotherperson13. You cannot be thequalifying child ofanother person14. You must havelived in the UnitedStates more thanhalf the year.

HANDOUT 6-2: EITC ExerciseIdentify which cases qualify for EIC. Mark YES or NO1. Leticia Sanchez is married to Luis Sanchez and they have two children. They have livedin the US for two years. Their comadre Lolita told them that in order to receive a largerrefund they should file “Married Filing Separately”. Since most of the time Lolita’sadvice is correct should they file “Married Filing Separately”?YESNO2. Roman Perez is married to Maria Perez. They have one child and they have been takingcare of their niece Martha, a Mexican National. Martha doesn’t have a social securitynumber. The Perez would like to claim Martha for the EITC credit so they request a(ITIN) Individual Taxpayer Identification Number. This can only be used for taxpurposes. Can they claim Martha for EIC purposes?YESNO3. Monica Rodriguez and Elena Rodriguez are sisters that live on the same lot but indifferent houses. Monica has four children, however, Elena provides more than half oftheir support for two of her children. Monica does not claim these two children on herincome tax return. Can Elena claim them for EITC purposes?YESNO4. Raul Marquez is married to Lupe Marquez and they have two daughters. One of thedaughters, Lily, is a 22 year old, full-time student and has a part time job. Mr. and Mrs.Marquez will claim both of her daughters and Lily will file her own return. WouldMr. and Mrs. Marquez qualify for EITC for both daughters? Is it possible for Lily to fileher own return? Would she qualify for EITC?A) YES NOB) YES NOC) YES NOA-6-5

Every year millions of earned incometax credit dollars are lost bylow-income wage-earners to lendersand tax preparers that offerRefund Anticipation Loans and tocheck cashing services to cash refundchecks!DON’T PAY THESE FEES THIS YEAR(approximately $267)• Income Tax Preparation Fees - $85 and up• Electronic Filing Fees - $40• Refund Anticipation Loan Fees - $75• Check cashing fee - $67 and up• Have your refund in your hand inapproximately two weeks if you go to aVolunteer Income Tax Assistance (VITA)HANDOUT 6-3A-6-6site.For more information on VITA sites andIRS questions call : 1-800-829-1040