Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

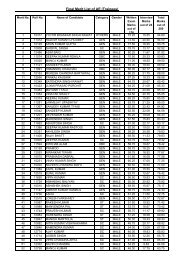

PETITION FOR TRUE-UP OF <strong>FY</strong> 2004 TO <strong>FY</strong> 2011-12 &MYT PETITION FOR THE CONTROL PERIOD <strong>FY</strong> <strong>2013</strong>-<strong>14</strong> TO <strong>FY</strong> <strong>2015</strong>-<strong>16</strong>Table 55: Projected Guarantee Fee <strong>to</strong>wards UITP Projects (Figures in Rs Crore)Particulars <strong>2013</strong>-<strong>14</strong> 20<strong>14</strong>-15 <strong>2015</strong>-<strong>16</strong>Outstanding Loan Balance 410.89 1103.65 1557.41Projected Guarantee Fee 4.11 11.04 15.574.3.9 INTEREST ON WORKING CAPITALThe interest on working capital is worked out on normative basis and is based on norms specified underthe Regulation 34 (2) of <strong>Tariff</strong> Regulations, 2011. The rate of interest <strong>for</strong> calculation of interest on workingcapital has been considered at 13.25% which is the rate approved by the Hon‟ble Commission in its tarif<strong>for</strong>der <strong>for</strong> PTCUL <strong>for</strong> <strong>FY</strong> 2012-13 dated April 4, 2012.Accordingly, the interest on working capital has been calculated as given below:Table 56: Interest on Working Capital <strong>for</strong> UITP Projects (Figures in Rs Crore)Particulars <strong>2013</strong>-<strong>14</strong> 20<strong>14</strong>-15 <strong>2015</strong>-<strong>16</strong>Computation of Working CapitalO&M Expenses of one month 0.34 1.00 2.69Maintenance spares 0.61 1.80 4.84Two months receivables 4.40 19.02 29.79Working Capital 5.35 21.82 37.32Rate of interest on working capital 13.25% 13.25% 13.25%Interest on Working Capital 0.71 2.89 4.944.3.10 INCOME TAX AND OTHER TAXESAs per Regulation 35 of the <strong>Tariff</strong> Regulations, 2011; income tax payable <strong>for</strong> each year of the controlperiod is based on the actual income tax paid. Any variation in income tax actually paid & approved shallbe reimbursed at the time of truing up <strong>for</strong> each year of the control period. Taxes on incomes and othertaxes would be recovered on actual basis as and when incurred.4.3.11 INCENTIVE FOR ACHIEVING TARGET AVAILABILITYThe incentive would be claimed in accordance with the <strong>Tariff</strong> Regulations 2011 on month <strong>to</strong> month basisbased on the procedure prescribed in Appendix IV of the <strong>Tariff</strong> Regulations, 2011.Power Transmission Corporation of Uttarakhand Ltd. Page 48