Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

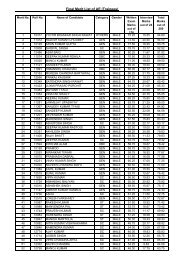

PETITION FOR TRUE-UP OF <strong>FY</strong> 2004 TO <strong>FY</strong> 2011-12 &MYT PETITION FOR THE CONTROL PERIOD <strong>FY</strong> <strong>2013</strong>-<strong>14</strong> TO <strong>FY</strong> <strong>2015</strong>-<strong>16</strong>12.50% of PFC loans, 3% <strong>for</strong> ADB loans, 12% <strong>for</strong> REC 8 and 10 loans and 12.5% <strong>for</strong> planned schemeloansThe interest on loans in respect of UITP projects are projected in the table below:Table 47: Interest on loans <strong>to</strong>wards UITP Projects (Figures in Rs Crore)Particulars <strong>2013</strong>-<strong>14</strong> 20<strong>14</strong>-15 <strong>2015</strong>-<strong>16</strong>Opening Loan <strong>14</strong>9.59 410.89 1,103.65Receipts during the year (includingIDC)269.95 734.88 581.58Repayments during the year 8.64 42.13 127.82Closing Loan 410.89 1,103.65 1,557.41Interest during construction period(included above)20.10 41.39 76.39Interest charged <strong>to</strong> revenue 7.91 40.56 56.104.3.4 DEPRECIATIONThe projected gross fixed asset has been provided in the <strong>for</strong>egoing section. Depreciation <strong>for</strong> the year hasbeen calculated on the opening gross fixed asset base considering the rates prescribed by the <strong>Tariff</strong>Regulations, 2011. Pro-rata deprecation has been calculated <strong>for</strong> assets which are in operation <strong>for</strong> part ofthe year. Average rate of 5.28% has been considered <strong>for</strong> computing the depreciation. Regulations 29 ofthe <strong>Tariff</strong> Regulations 2011 provide that depreciation would not be allowable on assets funded throughconsumer contributions, capital subsidies and grants. Accordingly the PTCUL has deducted theproportionate depreciation from ADB scheme related capital additions which have been created out ofgrants.The tables below indicate the Depreciation <strong>for</strong> the Control Period:Table 48: Depreciation <strong>for</strong> <strong>FY</strong> <strong>2013</strong>-<strong>14</strong> in respect of UITP Projects (Figures in Rs Crore)ParticularsOpening GFA ason 1.4.<strong>2013</strong>Additions in <strong>FY</strong><strong>2013</strong>-<strong>14</strong>Depreciation <strong>for</strong><strong>FY</strong> <strong>2013</strong>-<strong>14</strong>REC-IV 39.37 - 2.08PFC Schemes - - -ADB Schemes - 205.55 4.54Planned Schemes <strong>to</strong> be funded by PFC/REC - - -Less: Depreciation on ADB assets created ou<strong>to</strong>f grants-2.86Total 39.37 205.55 3.76Table 49: Depreciation <strong>for</strong> <strong>FY</strong> 20<strong>14</strong>-15 in respect of UITP Projects (Figures in Rs Crore)ParticularsOpening GFA ason 1.4.20<strong>14</strong>Additions in <strong>FY</strong>20<strong>14</strong>-15Depreciation <strong>for</strong><strong>FY</strong> 20<strong>14</strong>-15REC-IV 39.37 - 2.08Power Transmission Corporation of Uttarakhand Ltd. Page 45