Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

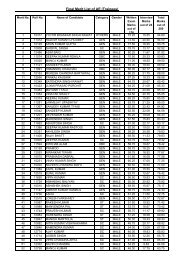

PETITION FOR TRUE-UP OF <strong>FY</strong> 2004 TO <strong>FY</strong> 2011-12 &MYT PETITION FOR THE CONTROL PERIOD <strong>FY</strong> <strong>2013</strong>-<strong>14</strong> TO <strong>FY</strong> <strong>2015</strong>-<strong>16</strong>4.2.7 INTEREST ON LOANThe interest expenditure on account of long-term loans depends on the outstanding loan, repayments,and prevailing interest rates on the outstanding loans. Further, the projected capital expenditure and thefunding of the same also have a large bearing on the long-term interest expenditure.The funding <strong>for</strong> new capital expenditure in the control period has been assumed <strong>to</strong> be undertaken at anormative debt: equity ratio of 70:30 in accordance with the <strong>Tariff</strong> Regulations, 2011 and accordingly thenew loan additions during the year has been estimated. However, in case of Old REC scheme, the debtequity ratio has been considered at 75.5:24.5. Further the New REC scheme has been considered <strong>to</strong> befunded entirely by debt. For the purpose of calculation of interest on these loans, the rate of interest hasbeen considered at 12% in respect of Old REC, New REC, REC IV, REC-V, REC-VI, REC-VII and REC-IX schemes loans and 12.5% in respect of Planned Scheme loans. The <strong>Tariff</strong> Regulation, 2011 prescribethat the normative loan outstanding shall be worked out by deducting the cumulative repayment asadmitted by the Commission from the gross normative loan. The normative repayment <strong>for</strong> each year hasbeen considered equal <strong>to</strong> the depreciation <strong>for</strong> that year.Accordingly, considering the accumulated depreciation assigned in the transfer scheme and thedepreciation allowed in various tariff orders, the cumulative normative repayment has been worked out.The interest on loans is projected in the table below:Table 30: Interest on loans projected in the plan period (Figures in Rs Crore)Debt Profile <strong>FY</strong> <strong>2013</strong>-<strong>14</strong> <strong>FY</strong> 20<strong>14</strong>-15 <strong>FY</strong> <strong>2015</strong>-<strong>16</strong>Opening Normative Loan 510.07 552.27 739.17Addition during the year 100.63 252.06 118.31Normative repayment during the year 58.44 65.17 70.79Closing Loan balance 552.27 739.17 786.69Interest charged <strong>to</strong> capital (IDC) 12.86 15.89 8.03Interest charged <strong>to</strong> revenue 68.55 76.13 91.88IDC- Interest during construction period4.2.8 RETURN ON EQUITYThe petitioner has considered return on the equity portion of the capitalised assets. Considering theopening equity computed in a<strong>for</strong>ementioned table, and considering the planned capitalisation, thecomputations in respect of equity eligible <strong>for</strong> return <strong>for</strong> the plan period are provided in the tables below:Power Transmission Corporation of Uttarakhand Ltd. Page 33