Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

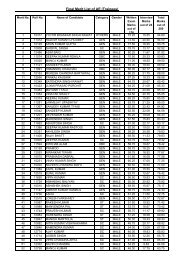

3.1.6 INTEREST ON WORKING CAPITAL LOANSPETITION FOR TRUE-UP OF <strong>FY</strong> 2004 TO <strong>FY</strong> 2011-12 &MYT PETITION FOR THE CONTROL PERIOD <strong>FY</strong> <strong>2013</strong>-<strong>14</strong> TO <strong>FY</strong> <strong>2015</strong>-<strong>16</strong>The interest on working capital is worked out on normative basis as per the norms specified in the <strong>UERC</strong><strong>Tariff</strong> Regulations, 2004. The rate of interest <strong>for</strong> calculation of interest on working capital has beenconsidered at 13.25% which is similar <strong>to</strong> the rate considered in the <strong>Tariff</strong> Order <strong>for</strong> <strong>FY</strong> 2012-13.Table 15: Computation of Interest on Working Capital <strong>for</strong> <strong>FY</strong> 2012-13 (Figures in Rs Crore)Particulars 2012-13Computation of Working CapitalO&M Expenses of one month 8.59Maintenance spares 11.96Two months receivables 37.70Working Capital Requirement 58.26Rate of interest on working capital 13.25%Interest on Working Capital 7.723.1.7 RETURN ON EQUITYThe closing balance of equity <strong>for</strong> <strong>FY</strong> 2011-12 as computed in the true-up section has been considered asthe opening <strong>for</strong> <strong>FY</strong> 2012-13 and equity portion of the capitalized assets have been considered as equityaddition during <strong>FY</strong> 2012-13.ParticularsTable <strong>16</strong>: Computation of Reasonable Equity <strong>for</strong> <strong>FY</strong> 2012-13 (Figures in Rs Crore)OpeningEquity baseas on1.4.2012Additions <strong>to</strong>GFA duringthe yearEquity % ofcapitalisedassetsEquity portionof capitalisedassetsClosingEquity as on31.3.<strong>2013</strong>(a) (b) ('c) (d=b*c) (e=a+d)REC Old Scheme 28.5 54.23 24.5% 13.29 41.79NABARD Scheme 64.8 - 22.0% - 64.80REC New Scheme - 7.<strong>14</strong> 0.0% - -REC-IV Scheme 13.0 34.84 30.0% 10.45 23.45REC-V Scheme 20.1 22.84 30.0% 6.85 26.95REC-VI - 30.0% - -REC-VII - 30.0% - -REC-VIII - 30.0% - -REC-IX 11.47 30.0% 3.44 3.44REC-X - 30.0% - -Planned Schemes <strong>to</strong> be- 30.0%funded by PFC/REC- -Grants, Deposit Works, etc - - -Other than schemes 8.6 11.42 30.0% 3.42 12.02Total Eligible Equity 135.0 <strong>14</strong>1.92 37.45 172.45Power Transmission Corporation of Uttarakhand Ltd. Page 21