Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Multi-Year Tariff Petition for FY 2013-14 to FY 2015-16 - UERC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

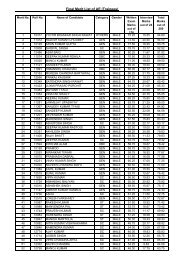

PETITION FOR TRUE-UP OF <strong>FY</strong> 2004 TO <strong>FY</strong> 2011-12 &MYT PETITION FOR THE CONTROL PERIOD <strong>FY</strong> <strong>2013</strong>-<strong>14</strong> TO <strong>FY</strong> <strong>2015</strong>-<strong>16</strong>compiled and presented in “Annexure-I”. The details have been presented <strong>for</strong> each scheme distinctlynamely Old REC, New REC Schemes, NABARD, REC-IV, REC-V and Computer loans from PFC.2.8 RETURN ON EQUITYThe computation of Return on Equity (RoE) has been undertaken as per the stipulations of Regulation 20of <strong>UERC</strong> (Terms & Conditions <strong>for</strong> determination of Transmission <strong>Tariff</strong>) Regulations, 2004 <strong>for</strong> thepurposes of true-up. The Regulation states that:“Return on equity shall be computed on the equity base determined in accordance with regulation 15(5)and shall be @ <strong>14</strong>% per annum”The equity base has been calculated on the basis of scheme-wise equity contributions. The average ofopening and closing equity balance <strong>for</strong> a financial year has been considered <strong>for</strong> calculation of return onequity. The table below shows the return on equity <strong>for</strong> <strong>FY</strong> 2004-05 <strong>to</strong> <strong>FY</strong> 2011-12.Table 5: Proposed Return on Equity (Figures in Rs Crore)Particulars <strong>FY</strong> 05 <strong>FY</strong> 06 <strong>FY</strong> 07 <strong>FY</strong> 08 <strong>FY</strong> 09 <strong>FY</strong> 10 <strong>FY</strong> 11 <strong>FY</strong> 12Return on Equity 0.07 0.50 1.94 4.58 6.59 7.79 9.95 15.<strong>14</strong>The details of the computation of return on equity have been presented in Annexure-II.2.9 NON-TARIFF INCOMEThe <strong>Petition</strong>er requests the Hon‟ble Commission <strong>to</strong> allow the non-tariff income as per the auditedaccounts as tabulated below:Table 6: Proposed Non-tariff Income (Figures in Rs Crore)Particulars <strong>FY</strong> 05 <strong>FY</strong> 06 <strong>FY</strong> 07 <strong>FY</strong> 08 <strong>FY</strong> 09 <strong>FY</strong> 10 <strong>FY</strong> 11 <strong>FY</strong> 12Non-<strong>Tariff</strong> Income 0.79 2.30 1.79 2.70 0.51 2.87 1.09 2.352.10 SUMMARY OF YEAR-WISE GAPBased on the parameters discussed above, revenue gap <strong>for</strong> each year from <strong>FY</strong> 2004-05 <strong>to</strong> <strong>FY</strong> 2011-12have been computed as provided in table below:Table 7: Revenue Gap <strong>for</strong> <strong>FY</strong> 2004-05 <strong>to</strong> <strong>FY</strong> 2011-12 <strong>for</strong> True-up (Figures in Rs Crore)Particulars <strong>FY</strong> 05 <strong>FY</strong> 06 <strong>FY</strong> 07 <strong>FY</strong> 08 <strong>FY</strong> 09 <strong>FY</strong> 10 <strong>FY</strong> 11 <strong>FY</strong> 12O&M Costs 19.<strong>16</strong> 26.41 30.74 48.00 49.76 55.46 62.20 78.79Depreciation 8.38 7.90 9.81 12.92 <strong>14</strong>.90 15.90 17.75 23.89Power Transmission Corporation of Uttarakhand Ltd. Page <strong>14</strong>