New I-9 Handbook for Employers - Immigration Lawyer

New I-9 Handbook for Employers - Immigration Lawyer

New I-9 Handbook for Employers - Immigration Lawyer

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

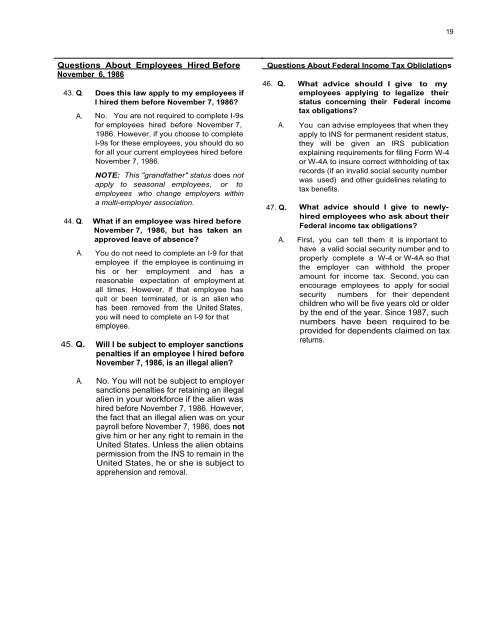

19Questions About Employees Hired Be<strong>for</strong>e Questions About Federal Income Tax ObliclationsNovember 6, 198646. Q. What advice should I give to my43. Q. Does this law apply to my employees if employees applying to legalize theirI hired them be<strong>for</strong>e November 7, 1986?status concerning their Federal incomeA. No. You are not required to complete I-9s<strong>for</strong> employees hired be<strong>for</strong>e November 7,1986. However, if you choose to completeI-9s <strong>for</strong> these employees, you should do so<strong>for</strong> all your current employees hired be<strong>for</strong>eNovember 7, 1986.tax obligations?A. You can advise employees that when theyapply to INS <strong>for</strong> permanent resident status,they will be given an IRS publicationexplaining requirements <strong>for</strong> filing Form W-4or W-4A to insure correct withholding of taxrecords (if an invalid social security numberwas used) and other guidelines relating totax benefits.NOTE: This "grandfather" status does notapply to seasonal employees, or toemployees who change employers withina multi-employer association.47. Q. What advice should I give to newlyhired44. Q. employees who ask about theirWhat if an employee was hired be<strong>for</strong>eFederal income tax obligations?November 7, 1986, but has taken anapproved leave of absence? A. First, you can tell them it is important tohave a valid social security number and toA. You do not need to complete an I-9 <strong>for</strong> thatproperly complete a W-4 or W-4A so thatemployee if the employee is continuing inthe employer can withhold the properhis or her employment and has aamount <strong>for</strong> income tax. Second, you canreasonable expectation of employment atencourage employees to apply <strong>for</strong> socialall times. However, if that employee hassecurity numbers <strong>for</strong> their dependentquit or been terminated, or is an alien whochildren who will be five years old or olderhas been removed from the United States,by the end of the year. Since 1987, suchyou will need to complete an I-9 <strong>for</strong> thatnumbers have been required to beemployee.provided <strong>for</strong> dependents claimed on tax45. Q. Will I be subject to employer sanctionsreturns.penalties if an employee I hired be<strong>for</strong>eNovember 7, 1986, is an illegal alien?A. No. You will not be subject to employersanctions penalties <strong>for</strong> retaining an illegalalien in your work<strong>for</strong>ce if the alien washired be<strong>for</strong>e November 7, 1986. However,the fact that an illegal alien was on yourpayroll be<strong>for</strong>e November 7, 1986, does notgive him or her any right to remain in theUnited States. Unless the alien obtainspermission from the INS to remain in theUnited States, he or she is subject toapprehension and removal.