You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

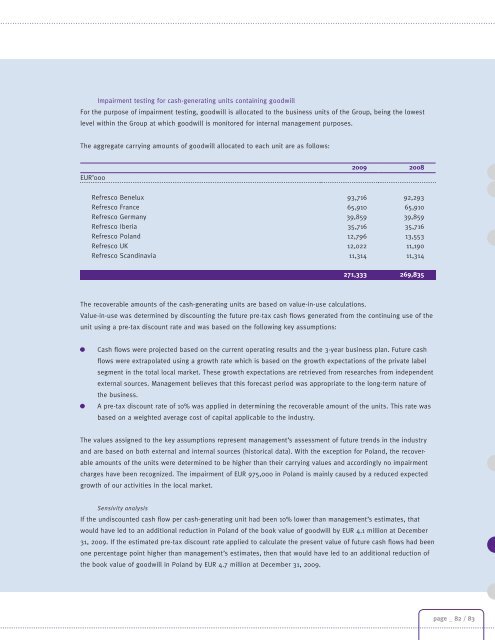

Impairment testing for cash-generating units containing goodwill<br />

For the purpose of impairment testing, goodwill is allocated to the business units of the Group, being the lowest<br />

level within the Group at which goodwill is monitored for internal management purposes.<br />

The aggregate carrying amounts of goodwill allocated to each unit are as follows:<br />

EUR’000<br />

2009 2008<br />

<strong>Refresco</strong> Benelux 93,716 92,293<br />

<strong>Refresco</strong> France 65,910 65,910<br />

<strong>Refresco</strong> Germany 39,859 39,859<br />

<strong>Refresco</strong> Iberia 35,716 35,716<br />

<strong>Refresco</strong> Poland 12,796 13,553<br />

<strong>Refresco</strong> UK 12,022 11,190<br />

<strong>Refresco</strong> Scandinavia 11,314 11,314<br />

271,333 269,835<br />

The recoverable amounts of the cash-generating units are based on value-in-use calculations.<br />

Value-in-use was <strong>de</strong>termined by discounting the future pre-tax cash flows generated from the continuing use of the<br />

unit using a pre-tax discount rate and was based on the following key assumptions:<br />

Cash flows were projected based on the current operating results and the 3-year business plan. Future cash<br />

flows were extrapolated using a growth rate which is based on the growth expectations of the private label<br />

segment in the total local market. These growth expectations are retrieved from researches from in<strong>de</strong>pen<strong>de</strong>nt<br />

external sources. Management believes that this forecast period was appropriate to the long-term nature of<br />

the business.<br />

A pre-tax discount rate of 10% was applied in <strong>de</strong>termining the recoverable amount of the units. This rate was<br />

based on a weighted average cost of capital applicable to the industry.<br />

The values assigned to the key assumptions represent management’s assessment of future trends in the industry<br />

and are based on both external and internal sources (historical data). With the exception for Poland, the recoverable<br />

amounts of the units were <strong>de</strong>termined to be higher than their carrying values and accordingly no impairment<br />

charges have been recognized. The impairment of EUR 975,000 in Poland is mainly caused by a reduced expected<br />

growth of our activities in the local market.<br />

Sensivity analysis<br />

If the undiscounted cash flow per cash-generating unit had been 10% lower than management’s estimates, that<br />

would have led to an additional reduction in Poland of the book value of goodwill by EUR 4.1 million at December<br />

31, 2009. If the estimated pre-tax discount rate applied to calculate the present value of future cash flows had been<br />

one percentage point higher than management’s estimates, then that would have led to an additional reduction of<br />

the book value of goodwill in Poland by EUR 4.7 million at December 31, 2009.<br />

page _ 82 / 83