measure and monitor the processes and report results ... - Refresco.de

measure and monitor the processes and report results ... - Refresco.de

measure and monitor the processes and report results ... - Refresco.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial review 2010<br />

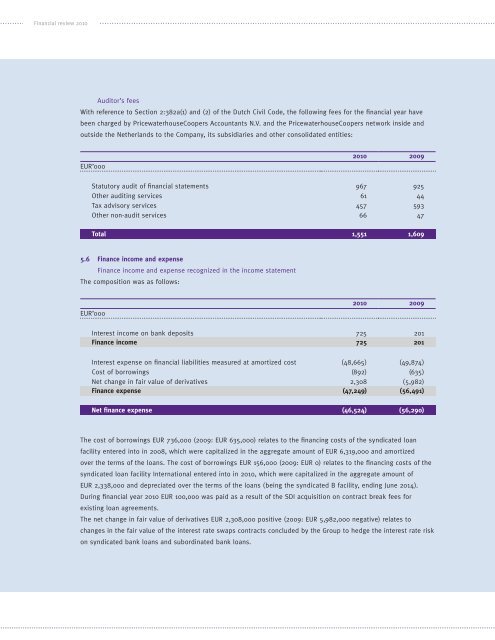

Auditor’s fees<br />

With reference to Section 2:382a(1) <strong>and</strong> (2) of <strong>the</strong> Dutch Civil Co<strong>de</strong>, <strong>the</strong> following fees for <strong>the</strong> financial year have<br />

been charged by PricewaterhouseCoopers Accountants N.V. <strong>and</strong> <strong>the</strong> PricewaterhouseCoopers network insi<strong>de</strong> <strong>and</strong><br />

outsi<strong>de</strong> <strong>the</strong> Ne<strong>the</strong>rl<strong>and</strong>s to <strong>the</strong> Company, its subsidiaries <strong>and</strong> o<strong>the</strong>r consolidated entities:<br />

EUR’000<br />

2010 2009<br />

Statutory audit of financial statements 967 925<br />

O<strong>the</strong>r auditing services 61 44<br />

Tax advisory services 457 593<br />

O<strong>the</strong>r nonaudit services 66 47<br />

Total 1,551 1,609<br />

5.6 Finance income <strong>and</strong> expense<br />

Finance income <strong>and</strong> expense recognized in <strong>the</strong> income statement<br />

The composition was as follows:<br />

EUR’000<br />

2010 2009<br />

Interest income on bank <strong>de</strong>posits 725 201<br />

Finance income 725 201<br />

Interest expense on financial liabilities <strong>measure</strong>d at amortized cost (48,665) (49,874)<br />

Cost of borrowings (892) (635)<br />

Net change in fair value of <strong>de</strong>rivatives 2,308 (5,982)<br />

Finance expense (47,249) (56,491)<br />

Net finance expense (46,524) (56,290)<br />

The cost of borrowings EUR 736,000 (2009: EUR 635,000) relates to <strong>the</strong> financing costs of <strong>the</strong> syndicated loan<br />

facility entered into in 2008, which were capitalized in <strong>the</strong> aggregate amount of EUR 6,319,000 <strong>and</strong> amortized<br />

over <strong>the</strong> terms of <strong>the</strong> loans. The cost of borrowings EUR 156,000 (2009: EUR 0) relates to <strong>the</strong> financing costs of <strong>the</strong><br />

syndicated loan facility International entered into in 2010, which were capitalized in <strong>the</strong> aggregate amount of<br />

EUR 2,338,000 <strong>and</strong> <strong>de</strong>preciated over <strong>the</strong> terms of <strong>the</strong> loans (being <strong>the</strong> syndicated B facility, ending June 2014).<br />

During financial year 2010 EUR 100,000 was paid as a result of <strong>the</strong> SDI acquisition on contract break fees for<br />

existing loan agreements.<br />

The net change in fair value of <strong>de</strong>rivatives EUR 2,308,000 positive (2009: EUR 5,982,000 negative) relates to<br />

changes in <strong>the</strong> fair value of <strong>the</strong> interest rate swaps contracts conclu<strong>de</strong>d by <strong>the</strong> Group to hedge <strong>the</strong> interest rate risk<br />

on syndicated bank loans <strong>and</strong> subordinated bank loans.