talanx group annual report 2011 en

talanx group annual report 2011 en

talanx group annual report 2011 en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overall assessm<strong>en</strong>t of<br />

the economic situation<br />

Non-financial<br />

performance indicators<br />

Group solv<strong>en</strong>cy<br />

As an insurance holding company, Talanx AG is subject to regulatory<br />

provisions pursuant to §1 b) Insurance Supervision Act (VAG).<br />

For the Talanx Group, supervision is carried out at the Group level<br />

by the Federal Financial Supervisory Authority (BaFin). For this<br />

purpose the par<strong>en</strong>t company HDI V. a. G. <strong>report</strong>s supplem<strong>en</strong>tary information<br />

to the BaFin in accordance with the “adjusted solv<strong>en</strong>cy”<br />

rules.<br />

Corporate Governance Remuneration <strong>report</strong> Ev<strong>en</strong>ts of special<br />

significance<br />

Solv<strong>en</strong>cy refers to the ability of an insurer to meet the obligations<br />

assumed under its contracts on a lasting basis. Above all, this <strong>en</strong>tails<br />

fulfilling defined minimum capital requirem<strong>en</strong>ts. The aim of the<br />

“adjusted solv<strong>en</strong>cy” rules is to prev<strong>en</strong>t the multiple use of equity<br />

to cover risks from underwriting business at differ<strong>en</strong>t levels of the<br />

Group hierarchy. To calculate the adjusted solv<strong>en</strong>cy, the minimum<br />

equity required for the volume of business transacted (required<br />

solv<strong>en</strong>cy margin) is compared with the eligible equity actually available<br />

(actual solv<strong>en</strong>cy margin) on the basis of the IFRS consolidated<br />

financial statem<strong>en</strong>ts. To determine the eligible capital elem<strong>en</strong>ts,<br />

the IFRS equity is adjusted; in particular, it is increased by some of<br />

the subordinated liabilities and valuation reserves not included in<br />

equity and is reduced by the intangible assets. The Talanx Group’s<br />

eligible capital is twice as high as legally required.<br />

Adjusted solv<strong>en</strong>cy 1) <strong>2011</strong> 2010 2009<br />

Eligible capital of the Group In EUR million 6,843 6,363 5,639<br />

Solv<strong>en</strong>cy ratio In % 201.8 196.7 184.2<br />

1) Calculated pro rata for Talanx from the adjusted solv<strong>en</strong>cy of the HDI Group<br />

The increase in the adjusted solv<strong>en</strong>cy ratio from 196.7% to 201.8%<br />

can be attributed ess<strong>en</strong>tially to the rise in the IFRS Group shareholders’<br />

equity as a consequ<strong>en</strong>ce of the Group’s net income being<br />

allocated to the retained earnings. The other items to be deducted<br />

or added were virtually unchanged from the previous year.<br />

Rating of the Group and its major subsidiaries<br />

In the year under review the Talanx Group and its companies again<br />

maintained their very good ratings from the international rating<br />

ag<strong>en</strong>cies Standard & Poor’s (S&P) and A. M. Best. It is important<br />

to distinguish betwe<strong>en</strong> the “Insurer Financial Str<strong>en</strong>gth Rating”,<br />

which primarily assesses our ability to meet our obligations to<br />

our policyholders, and the “Issuer Credit Rating” or “Counterparty<br />

Credit Rating”, which provides investors with information from an<br />

indep<strong>en</strong>d<strong>en</strong>t source about a company’s credit quality in g<strong>en</strong>eral.<br />

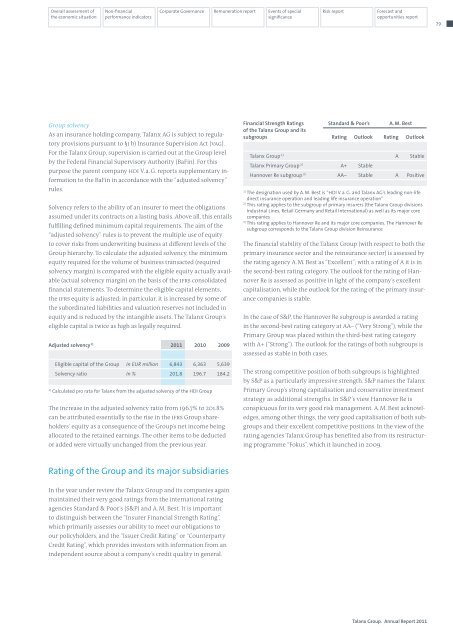

Financial Str<strong>en</strong>gth Ratings<br />

of the Talanx Group and its<br />

sub<strong>group</strong>s<br />

Risk <strong>report</strong> Forecast and<br />

opportunities <strong>report</strong><br />

Standard & Poor’s A. M. Best<br />

Rating Outlook Rating Outlook<br />

Talanx Group 1) A Stable<br />

Talanx Primary Group 2) A+ Stable<br />

Hannover Re sub<strong>group</strong> 3) AA– Stable A Positive<br />

1) The designation used by A. M. Best is “HDI V. a. G. and Talanx AG’s leading non-life<br />

direct insurance operation and leading life insurance operation”<br />

2) This rating applies to the sub<strong>group</strong> of primary insurers (the Talanx Group divisions<br />

Industrial Lines, Retail Germany and Retail International) as well as its major core<br />

companies<br />

3) This rating applies to Hannover Re and its major core companies. The Hannover Re<br />

sub<strong>group</strong> corresponds to the Talanx Group division Reinsurance<br />

The financial stability of the Talanx Group (with respect to both the<br />

primary insurance sector and the reinsurance sector) is assessed by<br />

the rating ag<strong>en</strong>cy A. M. Best as “Excell<strong>en</strong>t”; with a rating of A it is in<br />

the second-best rating category. The outlook for the rating of Hannover<br />

Re is assessed as positive in light of the company’s excell<strong>en</strong>t<br />

capitalisation, while the outlook for the rating of the primary insurance<br />

companies is stable.<br />

In the case of S&P, the Hannover Re sub<strong>group</strong> is awarded a rating<br />

in the second-best rating category at AA– (“Very Strong”), while the<br />

Primary Group was placed within the third-best rating category<br />

with A+ (“Strong”). The outlook for the ratings of both sub<strong>group</strong>s is<br />

assessed as stable in both cases.<br />

The strong competitive position of both sub<strong>group</strong>s is highlighted<br />

by S&P as a particularly impressive str<strong>en</strong>gth. S&P names the Talanx<br />

Primary Group’s strong capitalisation and conservative investm<strong>en</strong>t<br />

strategy as additional str<strong>en</strong>gths. In S&P’s view Hannover Re is<br />

conspicuous for its very good risk managem<strong>en</strong>t. A. M. Best acknowledges,<br />

among other things, the very good capitalisation of both sub<strong>group</strong>s<br />

and their excell<strong>en</strong>t competitive positions. In the view of the<br />

rating ag<strong>en</strong>cies Talanx Group has b<strong>en</strong>efited also from its restructuring<br />

programme “Fokus”, which it launched in 2009.<br />

Talanx Group. Annual Report <strong>2011</strong><br />

79