talanx group annual report 2011 en

talanx group annual report 2011 en

talanx group annual report 2011 en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overall assessm<strong>en</strong>t of<br />

the economic situation<br />

Non-financial<br />

performance indicators<br />

Corporate Governance Remuneration <strong>report</strong> Ev<strong>en</strong>ts of special<br />

significance<br />

tion to industrial bonds, were increasingly favoured as investm<strong>en</strong>t<br />

targets due to their positive risk-return cred<strong>en</strong>tials. Investm<strong>en</strong>ts in<br />

governm<strong>en</strong>t bonds were somewhat limited in the wake of downgrading<br />

by the rating ag<strong>en</strong>cies in the course of the year. Thus, our<br />

portfolio of governm<strong>en</strong>t securities or securities with a similar level<br />

of security in this category of holdings amounted to EUR 10.2 billion<br />

or 13% of the total investm<strong>en</strong>t portfolio.<br />

By the <strong>en</strong>d of the year, the Group had only minor exposure to<br />

governm<strong>en</strong>t bonds from the so-called GIIPS countries. At the <strong>en</strong>d<br />

of the year, our investm<strong>en</strong>t exposure to these countries was worth<br />

EUR 1.3 billion, 1.7% of the total assets under own managem<strong>en</strong>t.<br />

Our Italian exposure (market value of EUR 634 million) is due to<br />

the Group’s pres<strong>en</strong>ce in this country. As part of our ongoing risk<br />

managem<strong>en</strong>t, we int<strong>en</strong>d to reduce this exposure nominally by<br />

EUR 86 million by the <strong>en</strong>d of the first quarter of 2012. Giv<strong>en</strong> the<br />

inher<strong>en</strong>t risk factor, we int<strong>en</strong>d to adhere to our curr<strong>en</strong>t strategy of<br />

not expanding our investm<strong>en</strong>t exposure to the GIIPS countries any<br />

further. At this point, we refer to our remarks on page 104 of the<br />

risk <strong>report</strong>.<br />

<strong>2011</strong> also witnessed an increase in our investm<strong>en</strong>t portfolio in the<br />

“Financial assets held to maturity” category, which was largely<br />

attributable to the two reinsurance segm<strong>en</strong>ts. The increase in this<br />

item was made possible by divestm<strong>en</strong>ts and reclassifications in<br />

“Financial assets available for sale”. In the reinsurance segm<strong>en</strong>t, the<br />

Group reclassified fixed-income securities with a total market value<br />

of EUR 1.3 billion from “Financial assets available for sale” to the<br />

“held to maturity” category. The option and int<strong>en</strong>tion of holding<br />

these assets to maturity <strong>en</strong>ables the companies to reduce the volatility<br />

of their balance sheets due to interest rate movem<strong>en</strong>ts.<br />

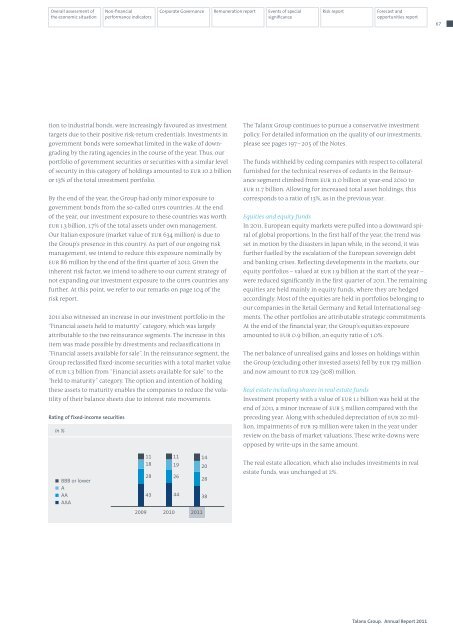

Rating of fixed-income securities<br />

In %<br />

BBB or lower<br />

A<br />

AA<br />

AAA<br />

11<br />

18<br />

28<br />

11<br />

19<br />

26<br />

43 44<br />

2009 2010 <strong>2011</strong><br />

14<br />

20<br />

28<br />

38<br />

Risk <strong>report</strong> Forecast and<br />

opportunities <strong>report</strong><br />

The Talanx Group continues to pursue a conservative investm<strong>en</strong>t<br />

policy. For detailed information on the quality of our investm<strong>en</strong>ts,<br />

please see pages 197 – 205 of the Notes.<br />

The funds withheld by ceding companies with respect to collateral<br />

furnished for the technical reserves of cedants in the Reinsurance<br />

segm<strong>en</strong>t climbed from EUR 11.0 billion at year-<strong>en</strong>d 2010 to<br />

EUR 11.7 billion. Allowing for increased total asset holdings, this<br />

corresponds to a ratio of 13%, as in the previous year.<br />

Equities and equity funds<br />

In <strong>2011</strong>, European equity markets were pulled into a downward spiral<br />

of global proportions. In the first half of the year, the tr<strong>en</strong>d was<br />

set in motion by the disasters in Japan while, in the second, it was<br />

further fuelled by the escalation of the European sovereign debt<br />

and banking crises. Reflecting developm<strong>en</strong>ts in the markets, our<br />

equity portfolios – valued at EUR 1.9 billion at the start of the year –<br />

were reduced significantly in the first quarter of <strong>2011</strong>. The remaining<br />

equities are held mainly in equity funds, where they are hedged<br />

accordingly. Most of the equities are held in portfolios belonging to<br />

our companies in the Retail Germany and Retail International segm<strong>en</strong>ts.<br />

The other portfolios are attributable strategic commitm<strong>en</strong>ts.<br />

At the <strong>en</strong>d of the financial year, the Group’s equities exposure<br />

amounted to EUR 0.9 billion, an equity ratio of 1.0%.<br />

The net balance of unrealised gains and losses on holdings within<br />

the Group (excluding other invested assets) fell by EUR 179 million<br />

and now amount to EUR 129 (308) million.<br />

Real estate including shares in real estate funds<br />

Investm<strong>en</strong>t property with a value of EUR 1.1 billion was held at the<br />

<strong>en</strong>d of <strong>2011</strong>, a minor increase of EUR 5 million compared with the<br />

preceding year. Along with scheduled depreciation of EUR 20 million,<br />

impairm<strong>en</strong>ts of EUR 19 million were tak<strong>en</strong> in the year under<br />

review on the basis of market valuations. These write-downs were<br />

opposed by write-ups in the same amount.<br />

The real estate allocation, which also includes investm<strong>en</strong>ts in real<br />

estate funds, was unchanged at 2%.<br />

Talanx Group. Annual Report <strong>2011</strong><br />

67