talanx group annual report 2011 en

talanx group annual report 2011 en

talanx group annual report 2011 en

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

244<br />

Financial statem<strong>en</strong>ts Notes<br />

G<strong>en</strong>eral information<br />

Talanx Group. Annual Report <strong>2011</strong><br />

Accounting principles<br />

and policies<br />

Segm<strong>en</strong>t <strong>report</strong>ing Consolidation,<br />

business combinations<br />

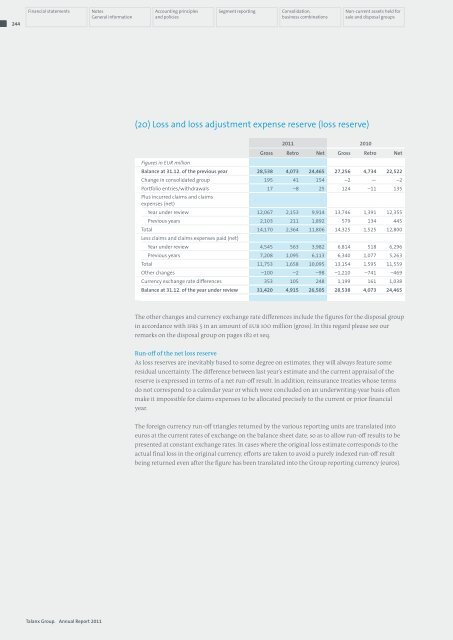

(20) Loss and loss adjustm<strong>en</strong>t exp<strong>en</strong>se reserve (loss reserve)<br />

<strong>2011</strong> 2010<br />

Non-curr<strong>en</strong>t assets held for<br />

sale and disposal <strong>group</strong>s<br />

Gross Retro Net Gross Retro Net<br />

Figures in EUR million<br />

Balance at 31.12. of the previous year 28,538 4,073 24,465 27,256 4,734 22,522<br />

Change in consolidated <strong>group</strong> 195 41 154 –2 — –2<br />

Portfolio <strong>en</strong>tries/withdrawals<br />

Plus incurred claims and claims<br />

exp<strong>en</strong>ses (net)<br />

17 –8 25 124 –11 135<br />

Year under review 12,067 2,153 9,914 13,746 1,391 12,355<br />

Previous years 2,103 211 1,892 579 134 445<br />

Total<br />

Less claims and claims exp<strong>en</strong>ses paid (net)<br />

14,170 2,364 11,806 14,325 1,525 12,800<br />

Year under review 4,545 563 3,982 6,814 518 6,296<br />

Previous years 7,208 1,095 6,113 6,340 1,077 5,263<br />

Total 11,753 1,658 10,095 13,154 1,595 11,559<br />

Other changes –100 –2 –98 –1,210 –741 –469<br />

Curr<strong>en</strong>cy exchange rate differ<strong>en</strong>ces 353 105 248 1,199 161 1,038<br />

Balance at 31.12. of the year under review 31,420 4,915 26,505 28,538 4,073 24,465<br />

The other changes and curr<strong>en</strong>cy exchange rate differ<strong>en</strong>ces include the figures for the disposal <strong>group</strong><br />

in accordance with IFRS 5 in an amount of EUR 100 million (gross). In this regard please see our<br />

remarks on the disposal <strong>group</strong> on pages 182 et seq.<br />

Run-off of the net loss reserve<br />

As loss reserves are inevitably based to some degree on estimates, they will always feature some<br />

residual uncertainty. The differ<strong>en</strong>ce betwe<strong>en</strong> last year’s estimate and the curr<strong>en</strong>t appraisal of the<br />

reserve is expressed in terms of a net run-off result. In addition, reinsurance treaties whose terms<br />

do not correspond to a cal<strong>en</strong>dar year or which were concluded on an underwriting-year basis oft<strong>en</strong><br />

make it impossible for claims exp<strong>en</strong>ses to be allocated precisely to the curr<strong>en</strong>t or prior financial<br />

year.<br />

The foreign curr<strong>en</strong>cy run-off triangles returned by the various <strong>report</strong>ing units are translated into<br />

euros at the curr<strong>en</strong>t rates of exchange on the balance sheet date, so as to allow run-off results to be<br />

pres<strong>en</strong>ted at constant exchange rates. In cases where the original loss estimate corresponds to the<br />

actual final loss in the original curr<strong>en</strong>cy, efforts are tak<strong>en</strong> to avoid a purely indexed run-off result<br />

being returned ev<strong>en</strong> after the figure has be<strong>en</strong> translated into the Group <strong>report</strong>ing curr<strong>en</strong>cy (euros).