talanx group annual report 2011 en

talanx group annual report 2011 en

talanx group annual report 2011 en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

234<br />

Financial statem<strong>en</strong>ts Notes<br />

G<strong>en</strong>eral information<br />

Talanx Group. Annual Report <strong>2011</strong><br />

Accounting principles<br />

and policies<br />

Segm<strong>en</strong>t <strong>report</strong>ing Consolidation,<br />

business combinations<br />

Non-curr<strong>en</strong>t assets held for<br />

sale and disposal <strong>group</strong>s<br />

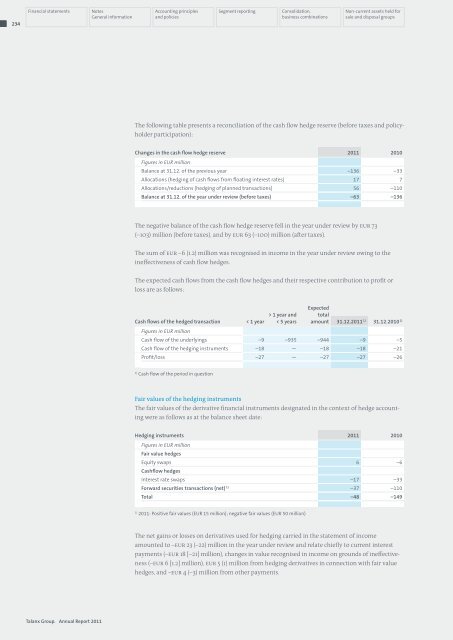

The following table pres<strong>en</strong>ts a reconciliation of the cash flow hedge reserve (before taxes and policyholder<br />

participation):<br />

Changes in the cash flow hedge reserve <strong>2011</strong> 2010<br />

Figures in EUR million<br />

Balance at 31.12. of the previous year –136 –33<br />

Allocations (hedging of cash flows from floating interest rates) 17 7<br />

Allocations/reductions (hedging of planned transactions) 56 –110<br />

Balance at 31.12. of the year under review (before taxes) –63 –136<br />

The negative balance of the cash flow hedge reserve fell in the year under review by EUR 73<br />

(–103) million (before taxes), and by EUR 63 (–100) million (after taxes).<br />

The sum of EUR –6 (1.2) million was recognised in income in the year under review owing to the<br />

ineffectiv<strong>en</strong>ess of cash flow hedges.<br />

The expected cash flows from the cash flow hedges and their respective contribution to profit or<br />

loss are as follows:<br />

Cash flows of the hedged transaction < 1 year<br />

> 1 year and<br />

< 5 years<br />

Expected<br />

total<br />

amount 31.12.2010 1)<br />

31.12.<strong>2011</strong> 1)<br />

Figures in EUR million<br />

Cash flow of the underlyings –9 –935 –944 –9 –5<br />

Cash flow of the hedging instrum<strong>en</strong>ts –18 — –18 –18 –21<br />

Profit/loss –27 — –27 –27 –26<br />

1) Cash flow of the period in question<br />

Fair values of the hedging instrum<strong>en</strong>ts<br />

The fair values of the derivative financial instrum<strong>en</strong>ts designated in the context of hedge accounting<br />

were as follows as at the balance sheet date:<br />

Hedging instrum<strong>en</strong>ts <strong>2011</strong> 2010<br />

Figures in EUR million<br />

Fair value hedges<br />

Equity swaps<br />

Cashflow hedges<br />

6 –6<br />

Interest rate swaps –17 –33<br />

Forward securities transactions (net) 1) –37 –110<br />

Total –48 –149<br />

1) <strong>2011</strong>: Positive fair values (EUR 15 million); negative fair values (EUR 50 million)<br />

The net gains or losses on derivatives used for hedging carried in the statem<strong>en</strong>t of income<br />

amounted to –EUR 23 (–22) million in the year under review and relate chiefly to curr<strong>en</strong>t interest<br />

paym<strong>en</strong>ts (–EUR 18 [–21] million), changes in value recognised in income on grounds of ineffectiv<strong>en</strong>ess<br />

(–EUR 6 [1.2] million), EUR 5 (1) million from hedging derivatives in connection with fair value<br />

hedges, and –EUR 4 (–3) million from other paym<strong>en</strong>ts.