talanx group annual report 2011 en

talanx group annual report 2011 en

talanx group annual report 2011 en

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

138<br />

Financial statem<strong>en</strong>ts Notes<br />

G<strong>en</strong>eral information<br />

Talanx Group. Annual Report <strong>2011</strong><br />

Accounting principles<br />

and policies<br />

Segm<strong>en</strong>t <strong>report</strong>ing Consolidation,<br />

business combinations<br />

Non-curr<strong>en</strong>t assets held for<br />

sale and disposal <strong>group</strong>s<br />

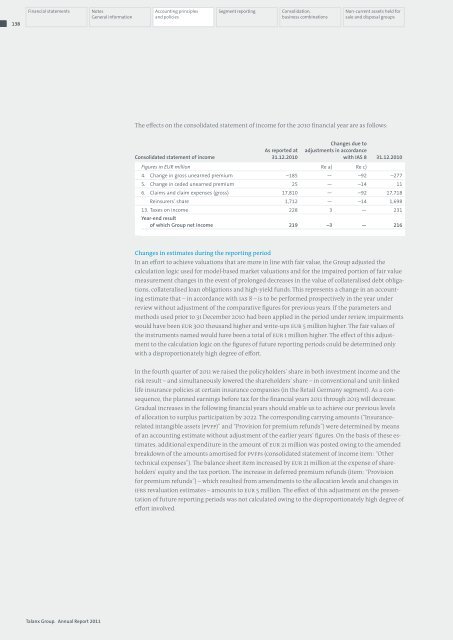

The effects on the consolidated statem<strong>en</strong>t of income for the 2010 financial year are as follows:<br />

Consolidated statem<strong>en</strong>t of income<br />

As <strong>report</strong>ed at<br />

31.12.2010<br />

Changes due to<br />

adjustm<strong>en</strong>ts in accordance<br />

with IAS 8 31.12.2010<br />

Figures in EUR million Re a) Re c)<br />

4. Change in gross unearned premium –185 — –92 –277<br />

5. Change in ceded unearned premium 25 — –14 11<br />

6. Claims and claim exp<strong>en</strong>ses (gross) 17,810 — –92 17,718<br />

Reinsurers’ share 1,712 — –14 1,698<br />

13. Taxes on income 228 3 — 231<br />

Year-<strong>en</strong>d result<br />

of which Group net income 219 –3 — 216<br />

Changes in estimates during the <strong>report</strong>ing period<br />

In an effort to achieve valuations that are more in line with fair value, the Group adjusted the<br />

calculation logic used for model-based market valuations and for the impaired portion of fair value<br />

measurem<strong>en</strong>t changes in the ev<strong>en</strong>t of prolonged decreases in the value of collateralised debt obligations,<br />

collateralised loan obligations and high-yield funds. This repres<strong>en</strong>ts a change in an accounting<br />

estimate that – in accordance with IAS 8 – is to be performed prospectively in the year under<br />

review without adjustm<strong>en</strong>t of the comparative figures for previous years. If the parameters and<br />

methods used prior to 31 December 2010 had be<strong>en</strong> applied in the period under review, impairm<strong>en</strong>ts<br />

would have be<strong>en</strong> EUR 300 thousand higher and write-ups EUR 5 million higher. The fair values of<br />

the instrum<strong>en</strong>ts named would have be<strong>en</strong> a total of EUR 1 million higher. The effect of this adjustm<strong>en</strong>t<br />

to the calculation logic on the figures of future <strong>report</strong>ing periods could be determined only<br />

with a disproportionately high degree of effort.<br />

In the fourth quarter of <strong>2011</strong> we raised the policyholders’ share in both investm<strong>en</strong>t income and the<br />

risk result – and simultaneously lowered the shareholders’ share – in conv<strong>en</strong>tional and unit-linked<br />

life insurance policies at certain insurance companies (in the Retail Germany segm<strong>en</strong>t). As a consequ<strong>en</strong>ce,<br />

the planned earnings before tax for the financial years <strong>2011</strong> through 2013 will decrease.<br />

Gradual increases in the following financial years should <strong>en</strong>able us to achieve our previous levels<br />

of allocation to surplus participation by 2022. The corresponding carrying amounts (“Insurancerelated<br />

intangible assets (PVFP)” and “Provision for premium refunds”) were determined by means<br />

of an accounting estimate without adjustm<strong>en</strong>t of the earlier years’ figures. On the basis of these estimates,<br />

additional exp<strong>en</strong>diture in the amount of EUR 21 million was posted owing to the am<strong>en</strong>ded<br />

breakdown of the amounts amortised for PVFPs (consolidated statem<strong>en</strong>t of income item: “Other<br />

technical exp<strong>en</strong>ses”). The balance sheet item increased by EUR 21 million at the exp<strong>en</strong>se of shareholders’<br />

equity and the tax portion. The increase in deferred premium refunds (item: “Provision<br />

for premium refunds”) – which resulted from am<strong>en</strong>dm<strong>en</strong>ts to the allocation levels and changes in<br />

IFRS revaluation estimates – amounts to EUR 5 million. The effect of this adjustm<strong>en</strong>t on the pres<strong>en</strong>tation<br />

of future <strong>report</strong>ing periods was not calculated owing to the disproportionately high degree of<br />

effort involved.