ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

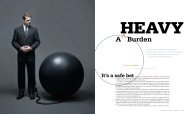

THEHOW TOGUIDEWhether you need competitive, career or customer intelligence, the online LegalIntelligence Database provides easy access to essential market data and insights.In three simple steps, you can capture your CI advantage.STEP Clarify your market STEP Cut into the largest STEP Compare and1position with more2300 to 400 global3contrast all ofthan 40 Surveys,firms with Law Firmour data with theLists and RankingsReportsrobust search toolGET STARTED TODAY: Schedule a free demonstration withPhil Flora | 212-457-7767 | PFlora@alm.comALMLegalIntel.comcle led a—and I use this term with knowledge of its strength—criminalorganization,” he wrote in a 2009 ruling denying Greenberg’s motionto dismiss. “The diversity, pervasiveness, and materiality of the allegedfinancial wrongdoing at AIG is extraordinary.” (That case later settled.)In last year’s ruling involving Massey Energy—which owned the UpperBig Branch coal mine where 29 men were killed—his ruling drips withcontempt for the company and its former CEO, Don Blankenship.Strine is troubled by what happened in the last financial crisis, andhas written extensively on the subject. In a 2009 article for the Times’sDealbook, he wrote that stronger regulation is needed to protect longterminvestors from “corporate idiocy.” He’s also repeatedly taken aimat institutional investors for their “myopic concern for short-term performance,”calling this phenomenon a problem that “vexes our corporategovernance system.”“Here we’ve had a period with the financial crisis, Gulf oil spill, and[coal mine disasters], and people are talking about regulation holdingdown America?” he exclaims during the interview in his office. “Lotsof people are hurting because of massive regulatory failure and speculation.”Strine offers an ambitious vision for some sort of worldwideA HEAVY BURDEN continued from page 76 performance on a chosen portfolio,much as 401(k) plans do. “We’ve seen many of the largest firms upand down The Am Law 100 looking at these plans,” Deitch says. He saysmany firms that want to implement the new market-rate plans are consideringwhether to terminate their old cash balance plans. The IRS allowspartners to roll the accrued assets into IRAs.Banks like Citi, meanwhile, are advising firms that want to terminatetheir underfunded plans about new ways to fund the shortfall. Accordingto Michael McKenney, who heads credit origination at Citi Private Bank’sLaw Firm Group, firms are exploring financing the difference betweenprojected funds and payouts through term loans or life insurance. (In thelatter scenario, firms buy insurance on all their partners; the firm’s pensionfund is the beneficiary.) Because interest rates are low, McKenney says, dependingon a firm’s demographics and future pension obligations, it couldmake sense to borrow money now to fill a projected funding gap, ratherthan waiting until later, when borrowing costs may be higher.It’s much harderregulatory regime. “We need regulatory structures to be globalized,” hesays. “We have to understand the extent to which our fates are alignedwith others,” he says. “It’s not easy, but what is your choice?”Yet Strine says he doesn’t see the need for his court to make corporationsmore accountable. “Corporate law has almost nothing to dowith this,” he says. “The role of corporate law is not to police externalities.. . . Corporate law is a specialized contract law between investorsand managers.”Strine stresses above all that judges must know their place in thesystem. “The judicial branch has a special role of impartiality,” he says.“You must be willing to subordinate the personal.” But that doesn’tmean Strine plans to be boring.When Strine was elevated to chancellor last summer, he said at thetime: “I will do everything in my power to ensure we have a strongCourt of Chancery.” Then he added, “I’m sure at times I’m going to saythings that aren’t the most diplomatic. I will always be mindful of thereputation of my state, but I am going to be myself.”E-mail: sbeck@alm.com.to substantially reducefuture liability with the unfunded plans. Eliminating or substantiallyscaling back the benefit formulas is tough. With partners closest to retirementunwilling to make sacrifices, and new partners lacking clout,it is often the partners in their late forties and early fifties that have totake the initiative—and absorb the brunt of any reductions. Many whohave gone through it say that the process is an emotional minefield.“We fought about this,” recalls the head of one Am Law 100 firm, discussingefforts to reduce his firm’s future benefit guarantees. “The olderpartners should have exhibited leadership. They didn’t.”One recently retired partner from Foley & Lardner says that there waswidespread tension over the management committee’s decision in 2009to freeze the firm’s traditional pension plan to current participants and atcurrent prorated vesting levels; the old plan guaranteed partners with 30years of service an annual benefit of a quarter of the average of their threehighest-earning years. Says this partner: “I worked under a partnershipagreement that promised me something. I don’t feel that I’ve gotten a gift.But I feel for the people who will be missing out on that benefit.” (Foleydeclined to comment on its pension plan or changes to the plan.)To “avoid pulling the rug out from anyone,” as one managing partnerput it, some firms are gradually reducing their benefits levels. Beginningin 2008, for example, Paul, Weiss, Rifkind, Wharton & Garrison reducedits benefit percentage from 25 percent of the average of a partner’s topcompensationyears to 20 percent. The firm will continue to reduce thepercentage by a half-percentage each year until the obligation drops to15 percent. The firm has also gradually lowered its cap, from 15 to 8.5percent of total firm income; by 2014, the cap will be 7.5 percent. (Thechanges apply only to active partners, not retirees.)To get rid of the unfunded plans entirely takes a strong commitmentfrom firm leadership and years to accomplish. Charles Smith, a seniorERISA partner at K&L Gates who spearheaded his firm’s overhaul inthe mid-eighties and manages current benefit plans, says he had tomeet with and persuade each of the roughly 100 partners then at thefirm to agree to phase out the unfunded plan and change over to 401(k)retirement funding. At the time, retiring partners could look forward toreceiving 40 percent of their last three years of compensation for life. “Iknew it was a time bomb if the firm continued to do it,” Smith says.Even so, the firm is still whittling down its unfunded liability morethan 25 years later; there are two or three partners still receiving benefitsunder the old plan.K&L Gates has also recently sought opportunities to increase retirementbenefits. In 2009 the firm was an early adopter of the new marketrate plans (it set up the program under draft rules that became fullyeffective this year). In exchange for security down the road, the firmpromises a very low growth rate, investing in short-term Treasuries andsimilar instruments. “This is your sleep-at-night money,” Smith says. “IfI can get, in today’s market, 30 basis points, I’m doing just fine.”Such plans still expose firms to limited liability. Under IRS rules,when a retired partner receives a distribution from the plan, he or shemust receive an amount at least equal to the contributions he or shehas made to the plan. In the unlikely event of a shortfall, the firm mustcover it, but in turn, the firm charges that payout against the partnershipaccount of the partner receiving the distribution.K&L Gates got the job done at a time when its partnership wasyoung, small, and spread between just two offices. Most firms hoping tochange their plans now aren’t so lucky. But doing nothing has becomeincreasingly risky. At a time when it is by no means certain that eventhe best-positioned firms can continue to grow their way out of a pensionproblem, it is worth considering whether the sums being paid topartners who were lucky enough to retire at the tail end of an economicboom can still be justified.Let the conversation begin.E-mail: jtriedman@alm.com.The <strong>American</strong> Lawyer | March 2012 91