ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

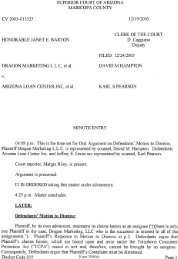

AVERAGE NUMBER OF EQU<strong>IT</strong>Y PARTNERScurrent partners fund retired partners’ benefits, thoughthey still have to pay for accrued benefits for many years.Deitch estimates that about eight in ten Am Law 100 firmsnow have some form of tax-qualified defined benefit plan.But the plans, while enormously popular, are not necessarilya panacea. “There are significant risks associated withcertain types of defined benefit plans,” most notably traditionalcash balance plans, says Deitch. Unlike in a 401(k),the payout to individual partners in a cash balance plan isnot linked to the actual performance of the investments, butto an external interest rate, such as a Treasury index rate. Ifa firm’s investment portfolio underperforms that rate andfalls short of the amount needed to fund the guaranteedlevel of benefits, partners have to make up the difference,either out of current income or in years to come. Unlessfirms adopt a stringent pay-as-you-go approach, “they riskcreating subsidies between . . . generations of partners,” saysDeitch.Firms learned this, to their dismay, in 2008 and 2009,when the balances in many firm-run retirement portfoliosfell by 20 percent or more, Deitch says. The problem wasespecially acute at firms that had established non-tax-advantagedplans with much higher guaranteed benefits thanthe tax-advantaged plans. According to a senior partnerat a New York law firm, some firms had invested retirementmoney in hedge funds, and these funds plummetedin 2008–09, just as overall firm profits slid. “Everyone gotexcited about hedge funds and their great returns” in the1990s, when their returns beat the equity markets, thispartner says. “Well, that didn’t work out so well for us.”In the first quarter of 2011, as part of its annual LawWatch survey, Citi Private Bank asked its clients, a healthyA GROWING OBLIGATIONThe average size of Am Law 100 equity partnershipshas doubled since 1986, leaving some firms’ pension plansstruggling to keep pace.200150100500198619911996200120062010**Most recent figure available. Includes worldwide equity partner counts for vereins.SOURCE: ALM LEGAL INTELLIGENCE (AM LAW 100 SURVEY)proportion of Am Law 200 firms, about their obligationsto retired partners. Roughly 40 percent of firms, includingthose with unfunded and underfunded pension liabilities,projected a shortfall between future obligations to retiredpartners and funds firms had allocated to pay for them;those indicating some shortfall included 21 of the Am Law50 firms that report to the bank, and 23 of the Am Law51–100 firms. Among firms that projected a shortfall, Citidetermined that the gap between future funds availableand projected aggregate payouts to retirees ranged widely—fromless than $1 million for some firms to more than$100 million for others; Citi did not disclose the averageamount of exposure.Firms withboth unfunded pensionplans and the newer defined benefit plans generally havemoved to limit their annual liability by instituting caps onthe percentage of firm income that can be used to fund retirementbenefits in any single year. In researching this storywe found that caps usually ranged from 3 to 5 percent.But for some firms with The Am Law 100’s highest profitsper partner, caps ranged between 10 and 15 percent, andat one firm, Cahill Gordon & Reindel, the cap was 20 percentas recently as 2007. (The firm declined to confirm orupdate that information.)In recent years many firms reduced their caps, welearned. But the caps may lead to a false sense of securitythat the firm has its financial obligations under control; inreality, most plans bar firms from giving retired partners apension haircut even if the cap is surpassed. The cap simplyallows a firm to reduce pension payouts temporarily; itthen has to pay out the shortfall as soon as it can meet itsobligations without breaching the annual cap. Meanwhile,overall future liability remains unaffected.Though our reporting did not uncover any firm thathad breached its cap, several law firm financial consultantsand managing partners say that day is soon approachingfor many firms, given the demographic realities: Throughthe nineties and well into the last decade, the size of equitypartnerships at Am Law 100 firms expanded rapidly.But firms began applying the brakes in recent years [see “AGrowing Obligation,” left]. Firms will also be paying retiredpartners longer: Average life expectancy is expectedto rise from 78 today to a projected 80 by 2020, accordingto U.S. Census Bureau data. Never will so many retiredpartners be supported by so relatively few active ones.The futurechallenges and future liabilitiesfor firms that have shifted to investment-fundeddefined benefit plans (including both tax-advantaged andnon-tax-advantaged plans) are distinct from the firms withunfunded plans. Since the 2008 recession, these firms havebeen wrestling with how best to invest funds, and howmuch to ante up now, to ensure that they can cover futureguaranteed benefits.For firms with tax-advantaged plans, relief may be onthe way. In late 2010 the IRS approved a new kind of definedbenefit plan, called a market-rate cash balance plan,that reduces investment risk. These plans for the first timelink benefit levels to actual investment continued on page 91RETIRING IN STYLEMany Am Law 100 firms maintain generous pension plans. Here are details of a sampling. Some firms were not willing to share current information ontheir plans; in those cases, which are footnoted, we used the most recent available. Because it takes several years for any change in plans (such as afreeze at current accrued benefit levels) to make a dent in future annual benefit payouts, we view even outdated information as germane.FIRMFUNDINGmechanismFORMULA for determining annual benefit,duration of benefit, and years to vestCahill 1 None Fixed amount ($245,000 as of 2007).For life. Vesting at 24 years.Cleary 1 None 12% of what the partner earned in his last yearfor first ten years of retirement, then 7.7% of thelast-year earnings. For life. Vesting at 20 years.Cravath 2 None 25% of an average of the partner’s highestcompensationyears. For life. Vesting at 30 years,including time as associate.Davis Polk None 30% of the average of a partner’s three highestcompensatedyears in the five years beforeretirement. For life. Vesting at 20 years.Debevoise 1 None 25% of average earnings in the ten years beforeretirement. For life. Vesting at 20 years.Foley & Lardner 1 None 25% of the average of the partner’s threehighest-compensation years. Duration: N/A.Vesting at 30 years.Fried, Frank 1 None Three benefit levels; as of 2007, they rangedbetween $117,000–$175,000 a year.Duration: Ten years. Vesting at 20 years.Kaye Scholer 1 None Based on firm income; annual benefit was$200,000 in 2007. For life. Vesting at 15 years.Latham 3 None 36% of the average of the partner’s threehighest-compensation years for first five yearsof retirement, then 24% of the same average.Duration: Ten years. Vesting at 20 years.Milbank 1 None 23% of the average of five of the highestcompensationyears in the last ten years ofservice. Duration: N/A. Vesting at 20 years.Paul, WeissProskauerSimpson ThacherSullivan & CromwellWeil, GotshalPartially offsetby funded plansPartially offsetby funded plansPartially offsetby funded plansFunded throughfirm investmentsPartially fundedby firm investments20% of the average of five of the highestcompensationyears in the last ten years ofservice. For life. Vesting at 20 years.0.5% per year of service, up to a maximum of30 years. This service factor is multiplied by theaverage of the partner’s eight highestcompensatedyears, capped at $2 million asof 2010. For life. Vesting at 30 years.25% of the partner’s final-year compensation.For life. Vesting at 20 years. Retired partners getan additional equity payout of 130% of annualincome, paid out over seven years.All retired partners receive the same amountannually, which depends on the firm’scontributions to its retirement fund and thereturns on the firm’s investments. Duration: N/A.Based on a percentage of a partner’s highestcompensation, subject to a maximum individualcap. For life. Vesting at 20 years.1AS OF 2007. 2 AS OF 2009. 3 AS OF 2011. N/A MEANS THAT INFORMATION WAS NOT AVAILABLE.CAP onfirm net20%RECENT CHANGES10% In 2006, the firm reduced its cap to 10% from 15%and introduced a haircut of 1–5% applicable tosenior partners.15% A previous plan vested at 20 years of service.15% Firm recently established a variable annuity plan.10%N/A8%4%