ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

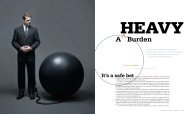

etire by 2022, providing that most do so around the firm’snormal retirement age of 62. Assuming a handful die early,the firm may see 43 new full-freight retirees within thedecade. Assuming that this batch of senior partners havebeen earning $3.5 million during their highest-compensatedyears—a conservative estimate, consultants say, at afirm that posted average profits per partner of $2.6 millionin 2010—a soon-to-retire partner can expect roughly$875,000 a year in benefits, plus roughly $650,000 in eachof the first seven years from the additional distribution(subtracting roughly $50,000 offset by another definedbenefit plan funded by the firm). Over the decade, thefirm’s annual liability gradually creeps up to roughly $65million for the new retirees by 2022, not including benefitsfor those already in retirement. But as long as the firmincreases its net by about 3–4 percent a year (since 2000,PPP has grown an average of 4.68 percent annually), thedrag on profits will remain just about what it is now.At Simpson and many other Am Law 200 firms, pensionsare the elephant in the room. Several firms continue to guaranteetheir equity partners far richer pension plans than theyprobably should. And that future pension liability is growingat a time when it is looking less than certain that profits andpartner head count will grow in step with them.The recession, with its double whammy of retirementinvestment portfolio declines and firm revenue slowdowns,was a broad wake-up call for firms that fund pensions outof current income, as well as for the broader swath of firmsA PENSIONS PRIMERThe fine print about how firm retirement plans work.UNTIL 1987, the Internal Revenue Servicedidn’t allow firms to put more than$7,500 per partner into tax-advantagedpension plans each year. In 2000 and2002 the IRS sharply increased theamounts that firms could set aside indefined benefit programs, and many lawfirms adopted the new plans as an alternativeto their then common unfundedplans. Currently the maximum retireebenefit permitted under the tax-advantagedplans is $200,000; it rises yearlywith the cost of living. (Non-tax-advantagedplans continue to have no benefitor contribution limits.)Here is a guide to what many firmsnow offer:DEFINED BENEF<strong>IT</strong> PLAN This is anumbrella term for any plan where theannual retirement benefit is determinedby a set formula, including traditionalplans and the newer-generation cashbalance and variable-annuity plans. Theformula establishing the benefit mayincorporate past compensation, yearsof employment, age at retirement, andother factors.CASH BALANCE PLAN Sometimescalled a “partner parity” plan, this isa defined benefit plan that looks like abank account. Traditionally, each partnerhas a notional retirement account whereinterest is credited on the basis of anexternal index, such as a Treasury rate.The firm pays a contribution annually,charged back to the current partners,to fund the plan up to a defined targetor level of “pay credit” (usually based ondeferred compensation). If the investmentgains do not meet the externalinterest rate returns credited to eachpartner’s account, the firm—and indirectly,the current partners—must makean additional contribution to top up theinvestment pool.MARKET-RATE CASH BALANCE PLANThis IRS–approved plan, which is permittedas of October 2010, allows retirementannuity levels to fluctuate alongwith the actual return on a firm’s investmentportfolio, thus reducing the possibilityof a shortfall. A similar plan thatallows payouts to fluctuate is known asa “variable annuity.”—J.T.that fund benefits out of firm-run investment portfolios.Many in the latter category had to dig into earnings tocover shortfalls in guaranteed benefits funded by firm investments.But the problems created by the sagging economybrought into relief a bigger, looming issue: The ranksof retired partners is swelling just as the number of equitypartners—who are ultimately responsible for funding thepension plans—is leveling off. “This is an issue that cutsacross all regions and all sizes of firms,” says Dan DiPietro,chair of the Law Firm Group of Citi Private Bank. “It’s agenerational issue: As firms face the bubble of baby-boomerpartner retirement, the problem will only get bigger.”The firms facing the largest future liability are the AmLaw 100 firms with rich guaranteed benefits paid out of currentincome. We independently obtained information aboutthe plans currently or recently active at 15 of the top 50Am Law 100 firms [see “Retiring in Style,” page 77]. All buttwo—Sullivan & Cromwell and Weil, Gotshal & Manges—offered unfunded pension plans. We shared our informationwith each firm and offered them the chance to update it;only five chose to do so. For the rest, we corroborated theinformation independently to the extent possible.Many partners we interviewed told us they had littleknowledge or understanding of their benefit plans ortheir firms’ financial liabilities. But it’s not surprisingthat some firms aren’t being open with their partnership:Unfunded plans, in particular, tend to divide partnershipsalong generational lines. “Younger partnersare saying, ‘I’m never going to see the money; I’m payingto guys who were here when I was in high school,’ ”says Bradford Hildebrandt, president of Hildebrandt ConsultingLLC. “Then you have guys who are about to retirewho are saying, ‘Are you kidding me? You owe it to me.’ ”It’s a division that will only intensify with time. Simpledemographics dictate that payouts to retired partnerswill be an increasing weight on profits for at least thenext decade, and maybe two. “The 45-year-old types areenormously productive and are diverting money to satisfy68-year-olds,” says Peter Kalis, chair of K&L Gates, a firmthat phased out its unfunded plan in the late 1980s. “Whenthose [younger partners] are attracted to go to firms withoutthat overhang, that business model [of the firm withthe pension] fails. That day may never come, but it’s importantto consider.”Historically,many firms set up unfundedplans. Many of these plans are still in place, thoughoften current partners are no longer accruing benefits underthem. “The theory was that these partners built thefirm, and we owe it to them,” says Hildebrandt. There isno mechanism for funding; retired partners’ pension benefitsare scooped out of the firm’s current profits—in muchthe way that Social Security payouts are funded by payrollcontributions from current workers.Generally, it is the lockstep or modified lockstep firmsthat still embrace unfunded plans. At these firms the benefitis usually calculated as a percentage of compensation,typically 20–30 percent of the average of a retiring partner’shighest-compensation years. Partners vest in the plansafter 20–30 years of equity partnership, though in somecases partners can partially vest in as few as ten.Firm leaders describe these unfunded plans as goldenhandcuffs. Noncompete clauses built into nearly all the unfundedplans mean that partners lose their pensions if theyjoin another firm [see “Taking It with You,” right]. As a partnerapproaches the age of 48 or 49, with vesting just aroundthe corner, it becomes hard to leave. “Those of us who havebeen seeing our net income get hit every year are lookingforward to receiving [the pension],” says one senior partner.Because benefit levels are linked to a partner’s highestearningyears, payouts have ballooned, as the Simpson exampleshows. In the early to mid-nineties, senior partnersat the most profitable firms earned around $1 million; a 30percent annual benefit of $300,000 might have been typical.But these days, senior partners at the most profitableWall Street firms may take home $3–4.5 million a year,generating an entitlement of $1 million or more for life.“They’re making a fortune in their retirements,” says consultantPeter Zeughauser, chair of the Zeughauser Group.“There are many who are making more in retirement thanthey ever imagined.”Such plans assume a level of confidence in future financialperformance. “Our plan works as long as the firmcontinues to grow profitably,” says Thomas Reid, managingpartner of Davis Polk & Wardwell, which guaranteespartners 30 percent of their highest compensation yearsfor life. “We have a handle on our demographic in termsof who is approaching retirement. We have sufficient associatesmoving toward partnership, and we’re confident thatretiring partners can be replaced without any adverse impacton profitability. I know there are some firms that havestruggled with this, but it’s not an issue for us.”Some younger partners at the firms with unfundedplans, however, lament the drain on their current income,and many also worry that their firms’ business strategiesare increasingly driven by the need to fund partner retirement.An unfunded plan “puts a huge onus on the firm,”says a partner at a firm with a generous plan who spoke oncondition that he and his firm not be identified. “It forcesyou . . . to grow in order to pay the pension fund.”Younger partners also express skepticism about the futureviability of unfunded plans. “Everyone understandsit’s a crapshoot,” one such partner wrote in an anonymousflash survey we conducted in January on this topic. “It is, ineffect, deferred compensation.”In 1997the Internal Revenue Service beganallowing firms to establish prefunded, tax-advantaged definedbenefit plans. Under these plans, firms invest a portionof current income in a firm-managed portfolio eachyear, with the contributions and investment proceedsdedicated to funding future retirement payouts. The planslooked more like 401(k) plans—partners were assigned notional“accounts” that are credited with a set growth rate—but just like pension plans, they guarantee a benefit [see “APensions Primer,” page 74].Additional IRS changes in 2000 and 2002 substantiallyincreased the maximum individual annual benefit underthese plans. (For 2012 the maximum per retiree under anIRS–approved defined benefit plan is $200,000 a year; theannual contribution limit under defined contribution planslike the Keogh or HR.10 plans is $50,000; and for 401(k)plans, $17,000.) Increasingly, a combination of IRS–qualifiedplans began to look like an attractive alternative to theunfunded plans, says Philip Deitch, a partner at PricewaterhouseCoopersLLP who specializes in law firm actuarialplanning. Firms hoped to thereby eventually avoid havingTAKING <strong>IT</strong> W<strong>IT</strong>H YOULateral movement can complicate the pensions picture.LAST YEAR SAW A STRONG increasein lateral movement among Am Law 200firms. It’s a trend that’s unlikely to slow.But what happens to a partner’s retirementbenefits when he or she joins anotherfirm?Any vested money in IRS–approvedplans, whether defined contribution planslike 401(k)s, Keoghs, or defined benefitplans like cash balance or variable annuityplans, is safe. A partner keeps thoseassets and can roll them over into an IndividualRetirement Account.But for partners leaving or joiningfirms with unfunded plans, the situationis more complicated. Typically, lateralswho join firms with active unfunded pensionsystems have the most to gain: Theyare folded into their new firm’s plan afterachieving a specified amount of tenure.Conversely, partners who leave firmswith the richest unfunded plans to joinnew ones risk leaving a lot of money onthe table. While retiring early from thosefirms may be encouraged—some firmsoffer partners a reduced benefit beginningat around ten years’ service as apartner—firms with unfunded plans generallyhave the right to cut off all benefitsif a partner joins a rival firm.If lost benefits are an issue, hiringfirms often have ways to make a lateralpartner whole. “It really depends on ‘howmuch does the firm want this partner?’”says Jon Lindsey, managing partner atlegal recruiting firm Major, Lindsey & Africa.“You have to be creative to find away to make it work for both sides.”At one extreme, firms have offered aone-off payment to replace the net presentvalue of benefits that were forfeited;LeBoeuf, Lamb, Greene & MacRae wassaid to have awarded prominent litigationpartner Ralph Ferrera an $8 millionspecial payment to replace the Debevoise& Plimpton pension he forfeitedwhen he joined that firm (now Dewey &LeBoeuf) in 2005. (The firm declined tocomment.) In other cases, “a firm mayhave to buy them an annuity that willmake up the bulk of lost benefits,” Lindseysays. In some situations, he says, thefirm will make a loan, which is forgivenover time to net out an equivalent sumby the time a partner finally retires. Orthe firm may increase current compensationenough for a partner to put asideenough money to offset some or all ofthe loss. Such arrangements are relativelyrare, and older partners or thosewithout a large and portable book ofbusiness seldom receive them.But disputes over terminated benefitsare on the rise, according to ArthurCiampi, a New York lawyer who representspartners in litigating such disputes.Many pension disputes arose during therecession, when some firms eased outpartners who were on the cusp of vestingand then cut off benefits, arguingthat those lawyers forfeited them whensome inevitably joined other firms.Ciampi says his firm has handleda half-dozen cases recently involvingbreach of fiduciary duty and age-discriminationclaims; most such disputes aresettled. With the laws regarding age discriminationin partnerships still in flux,firms don’t want to risk a bad ruling.Another type of dispute concernsthe validity of pension plan noncompeteprovisions. Ciampi says that, while firmsare permitted to have such provisionsin plans that are considered genuine retirementbenefits, they sometimes areinconsistent about who gets to keep thebenefits. In the course of reporting thisstory, we were told of several instanceswhere firms permitted retired partnersto join smaller firms that they don’t considerrivals without losing benefits; inone case, however, when the small firmwas acquired by a larger firm, a retiredpartner had to leave the merged firmin order to retain the benefits from hisoriginal firm.“It can be a very scary time,” Ciampisays. “You anticipate a benefit will bethere. You’re at a vulnerable time in yourcareer. This has now been taken awayfrom you. And when you try to replaceit, the plans are not available.” —J.T.74 March 2012 | americanlawyer.comThe <strong>American</strong> Lawyer | March 2012 75