ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

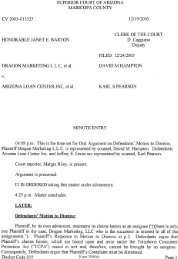

SPECIAL ADVERTISING SECTIONIRELANDers. The government’s petition to attract strong multinationalinterest has translated into excellent opportunities for start-ups ofall kind. ‘Early stage venture funding is readily available for theright opportunity and we now have a generation of technologyentrepreneurs who are looking to aggressively scale their businessesrather than exit early as was the tendency in the past’ notesColm Rafferty, corporate partner in Maples and Calder’s Dublinoffice. ‘Ireland's strong indigenous tech sector has grown becauseIrish entrepreneurs also look to foreign markets for opportunityand growth’.The reputational effects of this bunching have buoyed the sectorin Ireland to an impressive degree, and there is little doubtnow that Dublin can be deemed a technology centre with its positioningproviding access to Eurozone markets working as a bigincentive. Philip Nolan, partner and head of the commercialdepartment at Mason Hayes & Curran says that it has now hit ‘aninflection point’ as a clustering effect has taken hold to such anextent that Dublin has become the European technology hub. ‘Acritical mass of talent and know-how has come together. This,coupled with the well-established advantages of using Ireland asa business location, is driving the continued growth. Global leadersare attracted to Dublin and a technology ecosystem has developedwhich benefits local entrepreneurs’. The outcome wasinevitable; ‘success begets success’ he explains.Myra Garrett, Managing Partner & Corporate Technology Partner at William FryIreland’s strong pro-business reputation in this field has alsooffered businesses the potential to expand beyond their own sectors.While the market has already proved it has the necessary kitto establish a strong track record, it has sent out a strong signal toother potential investors. As Robert O'Shea, partner and head ofthe international business group at Matheson Ormsby Prenticesays, ‘it has really delivered on the promises it made to the likes ofGoogle and Microsoft’.‘Having so many blue-chip technology companies here sends offa strong message to other would-be investors, with Ireland’s CV givingthem confidence to set up operations here. This is taking placenot only at a sectoral or ‘cluster’ level, where Ireland has a reallystrong reputation in niche markets such as gaming, but across thewider ICT sector, where we are seen as a country with the right mixof talent, business conditions and a real can-do attitude’.As Garrett points out, ‘our geographic and very accessible locationas the first stop across the Atlantic and time zone differencesare definitely an added attraction and convenience for US corporates’.Ireland has clearly reached critical mass for success in thesector. Currently nine out of ten global ICT companies maintain apresence in Ireland, including the top five global software companies,four of the top five semiconductor firms and four of thetop five technology hardware companies. US corporates are themost significant source of foreign direct investment into Ireland,totalling approximately USD18 bn in the first half of 2011, havingmaintained record growth in the past decade.Silk PursesThese reputational benefits that Ireland has nurtured recently inthis sector will have necessarily been affected by the hardship thecountry has endured over recent years. The banking system hasbeen criticised and gruelling austerity measures have taken theirtoll both on Irish companies and international investors whoseconfidence in the market was dented.Limited funding has proved a difficult hurdle for new companiesand potential investors and a stalling economy is clearly offputting.However, far from standing in the way of the success ofthe technology sector in Ireland, these significant drawbacks haveproved themselves as somewhat of a silver lining. For a start, thesector has not drastically depended on bank financing in the sameway as industries like the beleaguered property market, and therehave been examples of start-ups garnering the capital they doneed through venture capital and some private equity.While the cutbacks necessitated by companies here have certainlytaken their toll, it has had the knock-on effect of a helpfulincrease in competitiveness. As Rafferty points out, the recessionhas resulted in significant reduction in property, professional servicesand labour costs. ‘This has definitely impacted on how overseasinvestors view the competitiveness of the Irish proposition.’In fact, the recession has, at least in part, actually played to thesector’s advantage, especially for new entrants to the market whohave made the most of a fall in rents for prime office space. Nolanclaims that the restructuring of the Irish economy resulting fromthe recession has actually improved the Irish market for technologyfirms. ‘The commercial property bubble of the last decadeMarch 2012 | americanlawyer.com