ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

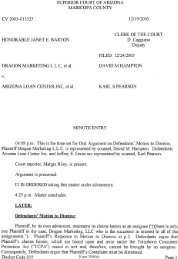

BARTALKCOMING HOME TO ROOST?Law firms have evaded blame from companies harmed during the financialcrisis. But that may be changing.THE GAME OF WHO’S TOblame for the complexfinancial instruments thathelped create the global financialcrisis has been under way for justover four years now. Banks, regulators,rating agencies, and individualshave all taken their turns on thehot seat. Law firms, on the otherhand, have largely escaped scrutiny.But that could be changing.During the last week of January,two law firms found themselveson the receiving end of complaintsover their involvementin financial transactions that unraveledduring the recession. OnJanuary 25 Orrick, Herrington& Sutcliffe was slapped with amalpratice suit by a Dallas-basedinvestment company over lossesfrom a collapsed loan deal. Andfive days later Greenberg Traurigwas sued by an investor in a nowbankruptprivate mortgage brokerand real estate loan provider.In the Orrick lawsuit, whichwas filed in Texas state court,Highland Financial Partners andits affiliates allege that the firmacted negligently in a 2008 multimillion-dollarcollateralized debtobligation (CDO) transaction betweenHighland and The RoyalBank of Scotland. (Full disclosure:RBS is an investor in the parentcompany of The <strong>American</strong> Lawyer.)Highland had hired Orrick to reviewtwo amendments that weresupposed to extend the deadline toclose the CDO transaction. Highlandalleges in its complaint thatOrrick failed to tell the companyabout a provision of the deal thatallowed RBS to cancel the agreementat any time. Highland claimsthat it had paid nearly $65 millionto extend the negotiations ofthe deal, but RBS terminated theagreement in October 2008. Orrickdenies any wrongdoing.Greenberg Traurig is beingsued for fraud and breach of fiduciaryduty in California statecourt in a class action suit broughtby David Nolan, who, along withother investors, lost a collective$700 million through now-defunctmortgage broker RE Loans, LLC.The complaint alleges that GreenbergTraurig helped secure a loanfrom codefendant Wells FargoCapital Finance that would hideRE Loans’s losses from a portfolioof loans that fell into defaultand foreclosure, even though thefirm knew that RE Loans’s agreementwith its investors barred thebroker from taking on third-partydebt. Nolan further alleges thatthe defendants advanced the allegedcover-up by forming a newinvestment vehicle that was usedto solicit new capital from existinginvestors to conceal the broker’scash flow problems. GreenbergTraurig says it “acted properly andin no way wrongfully.”While it’s too soon for the Orrickand Greenberg Traurig suitsto have gained traction, the suitsare not without precedent. In NewYork state court, Nomura AssetCapital Corporation, a Japanesesecurities company, has been waginga five-year malpractice battleagainst Cadwalader, Wickersham& Taft. Nomura sued Cadwaladerin 2006, accusing the firm ofbotching a 1997 assignment toadvise Nomura on the originationand securitization of 156commercial loans in a fund worth$1.8 billion. (Cadwalader signeda tolling agreement that prolongedthe statute of limitations.)The most significant claims stemfrom a $50 million loan made toa hospital that fell into default in2000. Cadwalader, acting as Nomura’scounsel, had asserted indocuments that this loan qualifiedfor special tax treatment as a RealEstate Mortgage Investment Conduit(REMIC). Nomura later discoveredthat the loan didn’t meetthe REMIC requirements. Whenthe hospital defaulted, the fundtrustee sued Nomura over theloan’s REMIC qualification. Aftersettling with the trustee, Nomurathen sued to recover the moneyfrom Cadwalader. The suit hassurvived a motion to dismiss anda motion for summary judgmentfiled by Cadwalader’s counsel atCravath, Swaine & Moore.In the end, however, it mayturn out that the plaintiffs in thesesuits have little legal ground tostand on. While the laws governingsecurities fraud can vary fromstate to state, it’s tough to hold lawfirms liable for soured financialproducts and transactions becausefirms base their opinions on factsthey receive from their clients,says Jonathan Macey, a corporateand securities law professor atYale Law School. “If the facts ona document are wrong, that’s theclient’s fault,” Macey says. “Whathas to be shown is that the lawfirm is doing more than just paperingthe transaction. It has tobe directly involved in piecing thedeal together.” —CLAIRE ZILLMANThe power of togetherC<strong>IT</strong>ATIONS“One is a practicing polygamist, and he’s not even the Mormon.”—Retired U.S. Supreme Court justice SANDRA DAY O’CONNOR jokingabout the difference between Republican presidential candidatesMitt Romney and Newt Gingrich in a speech at the Alfalfa Club.Above The Law, February 3.“Abandoned by counsel, Maples was left unrepresented at acritical time for his postconviction petition . . . no just system wouldlay the default at Maples’s death-cell door.”—JUSTICE RUTH GINSBURG, in a Supreme Court ruling abouta death row inmate who had been represented by lawyersfrom Sullivan & Cromwell. The National Law Journal, January 18.“Picture a law written by James Joyce and edited bye.e. cummings. Such is the Medicare statute, which has beendescribed as ‘among the most completely impenetrable textswithin human experience.’ ”—A memorandum opinion, issued by the U.S. districtcourt for the District of Columbia in Catholic Health Initiativesv. Kathleen Sebelius, January 30.WILLIAM RIESER20 March 2012 | americanlawyer.com