ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

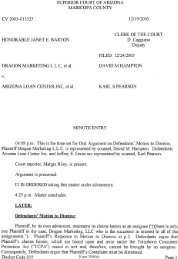

BARTALKthat glass ceiling, but whether oneperson can do that remains to beseen. He certainly can’t just wavea magic wand and make thingschange overnight.”Angel comes into the job with astrong resume. When he took controlof Linklaters in 1998, it wasalready one of the top practices inLondon. When he left the firm tenyears later, to take a senior positionat credit ratings agency Standard& Poor’s, its revenues hadincreased by 385 percent and averagepartner profits by 167 percent,and it had cemented its reputationas a world leader.Much of Angel’s success atLink laters was due to his ability totake concepts and practices fromthe business world and successfullytransplant them within the confinesof an organization that, like mostlaw firms at the time, was fairlylightly managed. He pioneered amore rigorous and quantitativeapproach to performance management,narrowed the firm’s practiceto focus on doing more profitablework for fewer, larger clients, andestablished a new executive committeeto help him implement hisstrategy—an operational templatethat would be mimicked by firmsthroughout the city.Chief among Angel’s goals atDLA is to solve the firm’s longrunningintegration issues; bolster“There will inevitably be areas of [DLA] that don’t fit, andTHERE MAY WELL BE INSTANCES WHERE <strong>IT</strong>’S BETTER FOR PEOPLE TO PARTcompany than trying to get oil and water to mix,” says Angel.its underweight corporate and financeofferings in London, Paris,and Germany; strengthen thefirm’s presence in Asia; and weedout the legacy clients and practicesthat are unwanted remnants of itsmerger-filled past.DLA’s international practice isthe cumulative result of a staggering31 mergers, acquisitions, andjoint ventures—21 of which havetaken place since 2000. Its vast networkspans 76 offices in 31 countries,and its army of 4,200 lawyersmakes it, by head count, the largestfirm in the world. (RevenuesFRIENDS W<strong>IT</strong>H BENEF<strong>IT</strong>SRopes & Gray profits from its connection to Mitt Romney.of $1.96 billion in fiscal year 2010were enough to place it third onlast year’s Global 100.)“We probably get too muchstick for this, but there’s no doubtthat we are still far too siloed,” saysone London-based DLA partner,who spoke under the conditionof anonymity. “After the merger,everything was about coming togetherto be one firm globally, butthat slowly faded away.Management absolutelyhates it when people labelus a franchise, but insome respects it’s a prettyaccurate description.”In fairness, DLA already has proceduresin place for its U.S. and internationalbranches to share costsrelating to joint initiatives, such asnew office launches and Angel’s loftysalary. The firm is also investigatingproposals to convert its U.K.–basedpartnership to the same all-equitymodel it operates in North America,and last spring its U.S. and internationalarms adopted their firsteverjoint strategy. The plan callsfor partners on both sides of theAtlantic to target the same leadingnational and multinational corporations—suchas Kraft Foods Inc. andPfizer Inc., which currently retainDLA in a range of areas—and towork for this select group of clientsacross a greater number of practiceareas and geographies.While Angel stresses that DLAis not looking to become anotherLinklaters, he nonetheless predictsthat it will begin to challenge themajor law firm players more regularlywhen it comes to premiumtransactional work. DLA co–CEONigel Knowles believes that it isalready doing much better on thisfront than many give it credit for,pointing to deals such as advisingBanco Santander on its €2.9 billion($3.8 billion) acquisition ofPolish financial institution BankZachodni WBK, and its representationof an Asian consortium onthe £5.8 billion ($9 billion) purchaseof EDF’s U.K. electricity distributionassets. (Both deals werecompleted in 2010.)But while it’s true that DLA isan increasingly common fixtureamong the upper echelons of theend-of-year deal rankings, a closerinspection of the data highlightsjust how far behind the firm iscompared to its competitors. DLAwas not present on any of the tenGES: MARK MAINZ (BEGLEY, JR.); JORDAN STRAUSS (FREEMAN); JON FURNISS (CLOONEY); DILLIP VISHWANAT (OLSON);JASON LAVERIS (L<strong>IT</strong>HGOW); ANDY KROPA (SHEEN). CRAIG LASSIG/LANDOV (BOIES)largest M&A deals of 2011, andalthough it racked up 347 suchtransactions globally—more thanany other firm in 2011, accordingto Mergermarket Limited—theaverage size of those deals was just$167 million. Baker & McKenzie,which has arguably been moresuccessful in realizing DLA’s integratedservice mantra, had an averageM&A deal size of almost twicethat at $330 million.As DLA attempts to close thatgap, some partners—and potentiallyeven offices—may find that theirpractices no longer meet the grade.“There will inevitably be areasof the business that don’t fit, andthere may well be instances whereit’s better for people to part companythan trying to get oil andwater to mix,” says Angel. He insiststhat it is “far too early” to saywhether any regional bases arelikely to close as a result, addingthat “having offices in lower-costcenters can turn out to be a significantadvantage, if you manageit right.” But several current partners,who asked not to be named,say that a number of office locationsare under intense scrutiny.The spotlight is most stronglyfocused, they say, on Central andEastern Europe, which has seenother international firms withdrawfrom the market in recent years, aswell as on DLA’s extensive band ofregional U.K. offices—excludingLondon, the firm currently has fiveoffices in other English cities andanother two in Scotland. (Globalcochair Frank Burch insists thatthe firm’s network will continueto expand, however, adding thata host of new jurisdictions—includingCanada, South Korea, andMexico—are currently being consideredfor future office launches.)Clearly, Angel has his work cutout for him. “It’s a bit like a jigsawpuzzle,” Angel says. “Some ofthe pieces are missing, some aren’tquite the right shape, and othersprobably shouldn’t be in the box atall, but the important thing is thatwe’ve got an incredibly clear visionof what the finished picture shouldlook like. It’s my job to help put itall together.”In doing so, DLA may finally gofrom being a jumble of merged entitiesto an aligned business that’smore than just the sum of its parts.E-mail: cjohnson@alm.com.RecountMay 2008 TV8Sept. 2011 Stage reading8March 2012 Benefit readingED BEGLEY, JR. MORGAN FREEMAN GEORGE CLOONEYPortrayingDAVID BOIES<strong>IT</strong> WOULD BE A STRETCH to call it typecast-In early March, George Clooneying.and Martin Sheen were planning toplay David Boies of Boies, Schiller & Flexnerand Ted Olson of Gibson, Dunn & Crutcher,respectively, in a private reading from 8, aplay based on the fight over California’s banon same-sex marriage.This wasn’t the first time that actors havestepped in to play Boies and Olson. Last year,SEPARATED at BIRTH?Morgan Freeman (Boies) and John Lithgow(Olson) performed the same reading at theEugene O’Neill Theatre in New York. Andthree years earlier, Boies was portrayed byEd Begley, Jr., and Olson by Paul Jeans, inRecount, an HBO docudrama about the Bushv. Gore 2000 election battle. (Boies repre-sented Al Gore and Olson representedGeorge W. Bush.)Who’s next? Brad Pitt and RyanGosling?–MARY ELLEN EGANROPES & GRAY HAS HAD A LONGand fruitful relationship withBain Capital and its cofounder,Republican presidential hopefulMitt Romney. For more than 20years, Ropes has advised the privateequity and venture capitalfirm on a host of big acquisitionsand leveraged buyouts. Additionally,Ropes’s chairman, R. BradfordMalt, counsels Romney on avariety of personal and politicalmatters. Malt played a key rolein saving Bain & Company, theconsulting firm Romney joinedin 1977, from bankruptcy (BainCapital was spun off as a separatecompany in 1984). He alsohelped Romney stay on the Massachusettsgubernatorial ballot in2002 when Democrats challengedRomney’s residency. When Romneytook office the following year,Malt helped set up a blind trust toavoid potential conflicts of interest.Today, Ropes’s chair serves asthe trust’s trustee and tax plannerand operates in the same capacityfor the Romney family’s TylerCharitable Foundation.Here are some of the otherties that bind Romney, Bain Capital,and Ropes & Gray.HISTORIC DEALS: Bain purchaseda controlling interest in Domino’sPizza Inc. in 1998 for $1 billionwith Ropes partners Patrick Diazand David McKay advising. In2005 partner Alfred Rose representedBain, along with six otherprivate equity firms, in a $11.3billion leveraged buyout of Sun-Gard Data Systems Inc. In 2006Rose and David Chapin took thelead on Bain’s $26 billion acquisi-tion of Clear Channel CommunicationsInc., the largest U.S. radiostation owner, while Chapinpitched in on Bain’s $2.4 billiondeal for Dunkin’ Brands, Inc., theoperator of Dunkin’ Donuts. Thatsame year, partners R. NewcombStillwell and William Shieldshelped Bain and The BlackstoneGroup buy Michaels Stores Inc.for $6 billion.RECENT DEALS: Ropes partnersTsuyoshi Imai of Tokyo and MichaelNicklin of Hong Kong ledBain’s $2.1 billion acquisition ofJapan’s Skylark restaurant chainlast October. Nicklin and HongKong partner Brian Schwarzwalderadvised on the private equityfirm’s $1.3 billion purchaseof a majority stake in Australiansoftware giant MYOB Ltd. in August.Partner Craig Marcus waslead counsel for Bain’s $460 millioninitial public offering forDunkin’ Brands last July. AndStillwell took the lead for Bainwhen it bought The GymboreeCorporation in October 2010 for$1.8 billion.COMMON BONDS: Sean Doherty,formerly an associate at Ropes,joined Bain Capital as its firstin-house lawyer in 2005 and iscurrently its chief legal officer.Bain associate general counselMichael Butler is also a formerRopes associate. And EdwardConard, a former managing directorat Bain who retired in 2007,consulted with Ropes to set upa phantom company in order todonate $1 million to the RomneybackingSuper PAC Restore OurFuture last April. —Victor LiPAUL JEANSRecountMay 2008 TVPortraying TED OLSONJOHN L<strong>IT</strong>HGOW8Sept. 2011 Stage readingMARTIN SHEEN8March 2012 Benefit reading16 March 2012 | americanlawyer.comThe <strong>American</strong> Lawyer | March 2012 17