You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

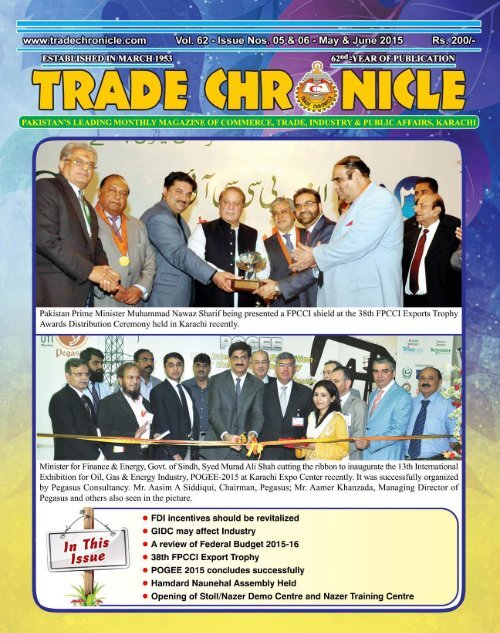

www.tradechronicle.com Vol. 62 Issue Nos. 05 & 06 <strong>May</strong>-<strong>June</strong> <strong>2015</strong> Rs. 200/-<br />

<strong>Trade</strong> <strong>Chronicle</strong><br />

PAKISTAN'S LEADING MONTHLY MAGAZINE OF COMMERCE, INDUSTRY & PUBLIC AFFAIRS<br />

Circulation Audited by<br />

ABC<br />

CONTENTS<br />

Editor:<br />

ABDUL RAB SIDDIQI<br />

Special Feature's Editor:<br />

ABDUL RAFAY SIDDIQI<br />

Manager:<br />

Shoukat Hayat<br />

Editorial & Business Office:<br />

Iftikhar Chambers<br />

Altaf Hussain Road<br />

P.O. Box # 5257<br />

Karachi-74000<br />

Phone: 92-21-32631587<br />

Fax: 92-21-32635007<br />

E-mail: arsidiqi@ptcl.net<br />

******<br />

Business Representative in<br />

Islamabad<br />

Waseem Ahmed Subhani<br />

Mob: 0333-5332280<br />

Editorial Representative in<br />

Islamabad<br />

M. Ajaib Malik<br />

Mob: 0300-5259936<br />

Representative in Lahore<br />

Humayun Iqbal<br />

Mob: 0322-4438182<br />

******<br />

Subscription Rates:<br />

Annual Rs. 1,000/-<br />

Foreign by Air Mail $75/-<br />

******<br />

Publisher:<br />

Abdul Rauf Siddiqi<br />

Printer:<br />

<strong>Chronicle</strong> Printers<br />

Altaf Hussain Road<br />

Karachi-74000<br />

<br />

<br />

<br />

FDI incentives should be revitalized<br />

GIDC may affect Industry<br />

China Pakistan Economic Corridor will usher new era of prosperity<br />

A review of Federal Budget <strong>2015</strong>-16<br />

38th FPCCI Export Trophy<br />

PM distributes award to top businessmen<br />

Country’s Largest oil refinery unveiled<br />

Nawaz says: Byco refinery would make self sufficient<br />

in crude oil refining<br />

POGEE <strong>2015</strong> concludes successfully<br />

Sindh Province: solution providers for energy crisis in Pakistan,<br />

says Syed Murad Ali Shah, Sindh Minister for Energy<br />

Aamer Khanzada said, Pakistan gets $573m FDI in Energy Sector<br />

Sindh Chief Minister inaugurates the Livestock, Dairy, Fisheries,<br />

Poultry and Agriculture Exhibition (LDFA-<strong>2015</strong>)<br />

Shura Hamdard discusses the<br />

coming National Budget <strong>2015</strong>-16<br />

Hamdard Naunehal Assembly Held<br />

Opening of Stoll/Nazer Demo Centre<br />

and Nazer Training Centre<br />

18 Years of Businessmen Group’s Public Service<br />

Siraj Teli criticises GIDC<br />

Federal Budget looks positive for Cement Industry<br />

by Abdul Rab Siddiqi<br />

<br />

<br />

<br />

<br />

<br />

<br />

EDITORIAL<br />

COMMENTS<br />

ARTICLES & FEATURES<br />

REGULAR FEATURES<br />

Leather Industry<br />

Port & Shipping News<br />

People & Events<br />

Cement Industry<br />

Telecommunication News<br />

Oil & Gas Industries<br />

<br />

<br />

<br />

<br />

Automobile News<br />

Fertilizer & Petrochemical<br />

Industries<br />

Banking & Insurance News<br />

Aviation & Hotel News

TRADE CHRONICLE<br />

We begin with the name of Allah the Magnificient<br />

FDI incentives should be revitalized<br />

From<br />

Editor's<br />

Desk<br />

ABDUL RAB SIDDIQI<br />

Pakistan’s President Mamnoon Hussain while speaking at a<br />

dinner arranged in honor of the participants of Pakistan-China<br />

Business Forum <strong>2015</strong> earlier this year, had stated that as the<br />

present government was keen to provide a level playing field to<br />

all international and local businesses, Pakistan offered<br />

tremendous opportunities for foreign direct investment on the<br />

back of skilled human resource, relatively low wages and<br />

worthwhile business incentives – which are important factors to<br />

attract investment. He said the Government ensures the<br />

protection of investment, profit repatriation and equal treatment<br />

in matters of taxation.<br />

Similarly, Chairman, Board of Investment (BoI) Miftah Ismail told<br />

local media that Pakistan was fast becoming the best country<br />

for foreign investment, as the situation here has been changed<br />

and several countries want to invest capital due to the<br />

government’s effective policies.<br />

Contrary to this tall claims, data released by State Bank of<br />

Pakistan says that the net flow of Foreign Direct Investment<br />

(FDI) fell by 47 percent during the first 11 months – ( July –<br />

<strong>May</strong>) of current fiscal year <strong>2015</strong>, mainly due to shrinkage of<br />

investment in food sector, chemicals, oil and gas exploration,<br />

cement and in some other sectors. Pakistan has attracted FDI<br />

amounting $803 million in July-<strong>May</strong> of FY15 compared to<br />

$1.509 billion in corresponding period of FY14, depicting a<br />

decline of $706 million or 46.78 percent. During the period under<br />

review, the country received FDI inflows amounting to $2.146<br />

billion as against outflow of $1.342 billion.<br />

Hopefully, implementation of Pak China Economic Corridor,<br />

some relief in Federal Budget <strong>2015</strong> – 16 for cement/construction<br />

industry and exemption of Tax/duty etc on setting up the industry<br />

in KPK and Balochistan Provinces, the flow of direct investment<br />

will improve in years to come. However, to ensure it, the Govt.<br />

should overcome energy crisis, availability of water and bring<br />

stability in law and order at the earliest.<br />

Economists say that the current trend is not surprising, as since<br />

the beginning of this fiscal year FDI is on decline. During the<br />

last fiscal year, privatisation proceeds and auction of 3G<br />

technology supported the FDI inflows, while this year government<br />

was unable to execute its privatization programme as envisaged.<br />

The government, for the last two years, has been expressing hopes<br />

of huge foreign investment in the country, particularly from<br />

China. However, the data indicates that so far it has failed to<br />

mobilize foreign investors.<br />

Analysts reportedly say that the country lacks policy to attract<br />

foreign investors, who are reluctant for variety of reasons.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 04

TRADE CHRONICLE<br />

There is dire need of exchange<br />

of delegations between<br />

Pakistan trading partners in<br />

order to improve bilateral trade<br />

relations and attract<br />

investment.<br />

Swiss food giant Nestle which<br />

recently announced to invest<br />

more than $37 million this<br />

year to improve production<br />

capacity has rightly pointed<br />

out that consistent<br />

implementation of prudent<br />

economic policies by the<br />

government remains crucial to<br />

unlocking the country’s full<br />

potential.<br />

Economic experts were of the<br />

view that low foreign direct<br />

investment inflow is an<br />

alarming situation. It is one of<br />

the many but most important<br />

indicators of what the world<br />

feels about us and our<br />

government policies. Apart<br />

from political turmoil and<br />

social unrest, there are many<br />

controllable factors which<br />

affect FDI. These include<br />

rationale monetary and fiscal<br />

policies, government’s<br />

assurance for repatriation of<br />

profits, the government’s other<br />

economic policies that attract<br />

FDI.<br />

The Overseas Investors<br />

Chamber of Commerce and<br />

Industry (OICCI) had rightly<br />

pointed out that the budget<br />

<strong>2015</strong>-16, has ambitious targets<br />

and incentives for certain<br />

sectors of the economy,<br />

looking for generating growth.<br />

However, the budget does not<br />

contain sufficient incentives to<br />

boost Foreign Direct<br />

Investment (FDI), and large<br />

investments in the country. It<br />

includes only marginal tax<br />

broadening measures and some<br />

proposals are likely to impede<br />

capital formation which is<br />

essential for investment to<br />

drive growth. The Chamber has<br />

urged the government to focus<br />

on attracting foreign direct<br />

investment with supportive<br />

taxation policies. To attract<br />

new FDI, upfront levy of<br />

withholding income and sales<br />

tax at import stage on plant and<br />

machinery should be exempted<br />

for new foreign investment,<br />

the OICCI suggested.<br />

We hope that govt. in view of<br />

the OICCI suggestions, will<br />

improve policies to facilitate<br />

flow of FDI.<br />

EDITORIAL<br />

COMMENTS<br />

GIDC may affect<br />

Industry<br />

Following National Assembly,<br />

the Senate has also passed a bill<br />

to impose and enable<br />

government to collect the Gas<br />

Infrastructure Development<br />

Cess (GIDC) from commercial /<br />

industrial consumers to finance<br />

proposed Iran - Pakistan gas<br />

pipeline and Turkmenistan -<br />

Afghanistan - Pakistan India<br />

Pipeline Project.<br />

The passage of bill will enable<br />

the government to have an<br />

access to about Rs100 billion<br />

lying in its account under the<br />

head of the GIDC. The<br />

government had set a target of<br />

Rs145bn GIDC collection for<br />

the current financial year.<br />

The GIDC was first introduced<br />

through the GIDC Act, 2011 but<br />

was declared illegal and<br />

unconstitutional by the<br />

Peshawar High Court and the<br />

Supreme Court.<br />

However, the federal<br />

government recently passed<br />

the GIDC Act, <strong>2015</strong> and included<br />

Section 8 in it for recovery of<br />

arrears for the period for which<br />

the GIDC levy was declared<br />

illegal.<br />

It is said that the bill was tabled<br />

in Parliament to get nod of<br />

legislators, in order to make it<br />

a law of land and subsequently<br />

meet conditionalities of IMF<br />

and indirectly to meet shortfall<br />

in revenue collection.<br />

All major natural gas<br />

consumers have raised voices<br />

against GIDC. The Federation of<br />

Pakistan Chamber of Commerce<br />

and Industry, Karachi Chamber<br />

of Commerce and Industry, All<br />

Pakistan Textile Mills<br />

Associations, Korangi<br />

Association of <strong>Trade</strong> and<br />

Industry, five zero rated export<br />

sectors representing seventeen<br />

associations, have requested<br />

govt. to withdraw retrospective<br />

imposition of GIDC. They were<br />

of the view that it would<br />

increase the cost of doing<br />

business tremendously. It<br />

would make export sector<br />

unviable in the global market,<br />

as gas tariff in Pakistan even<br />

without GIDC is the highest.<br />

The government should think<br />

about their worries as country<br />

export has already in hang in<br />

balance around $25 billion for<br />

the last couple of years and<br />

unrest in exporters will further<br />

hit exports. The government<br />

should support the exporters<br />

instead of pushing them to the<br />

wall.<br />

Opposition and some of the<br />

treasury benches claimed the<br />

proposed legislation: the Gas<br />

Infrastructure Development<br />

Cess Bill, <strong>2015</strong>, was in gross<br />

violation of the Constitution’s<br />

five Articles, including Articles<br />

158, 161, 162 and 172, and<br />

insisted that it should have been<br />

also placed before the Council<br />

of Common Interests (CCI).<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 05

TRADE CHRONICLE<br />

Some opposition senators<br />

asked the government to put on<br />

hold metro bus and orange train<br />

projects and utilise funds for<br />

development of gas<br />

infrastructure, fearing the<br />

funds collected under the<br />

process cess would be diverted<br />

for the favourite projects of the<br />

rulers.<br />

The government should have<br />

taken on board all stakeholders<br />

before getting passed the bill<br />

from Parliament. CNG Stations<br />

and the Industrial units have<br />

already moved petitions in<br />

Peshawar High Court against<br />

the recovery of arrears on<br />

account of GIDC through<br />

enforcing law for the period for<br />

which Superior court had<br />

declared levy as illegal.<br />

The Govt. has to make efforts<br />

for win win situation for all the<br />

stakeholders instead of going<br />

through ligitation.<br />

China Pakistan<br />

Economic Corridor<br />

will usher new era of<br />

prosperity<br />

It is heartening to note that<br />

Mian Nawaz Sharif’s<br />

government and all political<br />

parties have reached on a<br />

consensus on the<br />

implementation of China-<br />

Pakistan Economic Corridor<br />

(CPEC). The reservations being<br />

expressed by certain political<br />

parties till recently were<br />

removed by the government<br />

and the project, which has been<br />

termed a ‘game-changer’ for<br />

Pakistan, is now set to sail<br />

smoothly. China, the co-sponsor<br />

of the project, will have a sigh<br />

of relief as the project involving<br />

US $46 billion initially secured<br />

political ownership from all the<br />

political parties of Pakistan. A<br />

remarkable achievement and<br />

credit goes to all stakeholders.<br />

This consensus was necessary<br />

when India had raised objections<br />

to the China – Pakistan<br />

Economic Corridor. Both<br />

Chinese and Pakistan<br />

Governments have denied the<br />

Indian claim that the CPEC is a<br />

project against India. Although<br />

officially these projects have<br />

been approved, it is obligatory<br />

for our government to ensure<br />

that these projects in no way fall<br />

victim to bureaucratic delays or<br />

Indian hindrance in their<br />

materialization. By the grace of<br />

Almighty Allah, if utmost and<br />

sincere efforts are made to<br />

implement these projects, no<br />

internal or external force can<br />

stop Pakistan from becoming the<br />

second biggest economy in Asia.<br />

It is a good sign that even<br />

Pakistan Army has also strongly<br />

supported the project. In an<br />

encouraging note Chief of Army<br />

Staff Gen Raheel Sharif said that<br />

China Pakistan Economic<br />

Corridor (CPEC) with Gwadar port<br />

as its catalyst would be built and<br />

developed as one of the most<br />

strategic deep-sea ports in the<br />

region at any cost whatsoever.<br />

Since all the major political<br />

parties were represented<br />

through their leadership in all<br />

Parties Conferance hopefully<br />

there would be no hue and cry in<br />

future from any political parties<br />

about change of routes.<br />

It is a good sign that government<br />

is constituting a working group<br />

consisting of representatives<br />

from all the provinces to make<br />

recommendations regarding the<br />

selection of industrial parks and<br />

other development works along<br />

the corridor route.<br />

It is a matter of great<br />

satisfaction that Sindh Police<br />

have set up Foreign Security<br />

Cell to ensure security of people<br />

to be engaged for Pak China<br />

Economic Corridor Projects.<br />

Hope the other provices will<br />

follow the footstep.<br />

If the $46 billion China-<br />

Pakistan Economic Corridor,<br />

linking the Gwadar Port in<br />

Balochistan with Kashgar in the<br />

north-western Chinese province<br />

of Xinjiang is indeed completed<br />

within the next three years as<br />

is the plan, the route would<br />

quite dramatically change the<br />

geo-strategic realities for the<br />

region, bringing electricity and<br />

gas into Pakistan, offering it<br />

potentially huge trade benefits<br />

and allowing China easier<br />

access to Middle Eastern and<br />

European markets.<br />

Some of the key projects<br />

proposed to be undertaken<br />

under the CPEC program as<br />

announced by government in<br />

Federal Budget are as follows:<br />

* 2 x 660 MW Coal-Based Power<br />

Projects (IPP) at Port Qasim;<br />

* Power Evacuation from Mitiari<br />

to National Grid (IPP);<br />

* 3.5 MT/A Coal Mining and<br />

2x330 MW Power Plants based<br />

on Thar Block-II SECMC;<br />

* Solar Power Park at<br />

Bahawalpur;<br />

* 2793 MW (Three) Hydro Power<br />

Projects;<br />

* Multan-Sukkur section<br />

(387Km) of Karachi-Lahore<br />

Motorway;<br />

* Karakoram Highway (Phase-II)<br />

Raikot to Islamabad;<br />

* Fiber Optic;<br />

* Rehabilitation & Up-gradation<br />

of Karachi-Lahore-Peshawar<br />

(ML-1) Railway Track;<br />

* Gawadar Package;<br />

* East Bay Expressway at<br />

Gawadar (18.98 Km);<br />

* Jhimpir Wind-Power 200 MW;<br />

* 2 x 660 MW Coal-Based Power<br />

Projects at Sahiwal;<br />

* Jetty + Infrastructure at<br />

Gaddani as IPP (preferably) or<br />

Public Sector.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 06

TRADE CHRONICLE<br />

A review of Federal Budget <strong>2015</strong> – 16<br />

Ishaq Dar proposes incentives for real estate investment, agriculture /<br />

manufacturing sectors<br />

A target of 5.5% set for GDP growth<br />

Rs. 700 billion allocated for PSDP<br />

With a consolidated outlay of<br />

Rs.4.451tn ( +3.5% YoY), Finance<br />

Minister Ishaq Dar has presented the<br />

Federal Budget <strong>2015</strong>-16 (July - <strong>June</strong> )<br />

in Parliment on <strong>June</strong> 05, <strong>2015</strong>.<br />

According to leading brokerage house,<br />

overall, the budget represents a fine<br />

balance between the government’s<br />

intent of lifting economic<br />

growth to medium-term<br />

target and the need for further<br />

fiscal consolidtation to<br />

strengthen the macro stability<br />

gained from past two years<br />

of reforms under the IMF<br />

program. The federal budget<br />

also got mixed response from<br />

local businessmen and<br />

associations.<br />

The Finance Minister<br />

proposes incentives to real<br />

estate investment, agriculture/<br />

manufacturing sectors as well as<br />

business community with enhanced<br />

rates of withholding taxes on non-filers<br />

of returns.<br />

The Finance Minister in his two-hourlong<br />

speech mostly focused on<br />

government’s performance and<br />

promised to increase investment to<br />

GDP ratio to 16.5 percent, reduce<br />

debt to GDP ratio within the limit of<br />

the Fiscal Responsibility Act in the<br />

medium. He proposes increase in<br />

Benazir Income Support Programme<br />

(BISP) to Rs 102 billion.<br />

Dar said the government was facing<br />

fiscal constraints and thus announced<br />

a 7.5 percent ad hoc relief allowance<br />

on running basic pay to all federal<br />

government employees and merger<br />

of Ad-hoc increases of 2011 and<br />

2012 in the pay scales.<br />

The Finance Minister announced a<br />

federal outlay of Rs 4,451 billion for<br />

Federal Finance Minister Ishaq Dar presenting Federal<br />

Budget <strong>2015</strong> - 16 in Parliament. Prime Minister Muhammad<br />

Nawaz Sharif also attended budget session in Parliament<br />

House Islamabad on <strong>June</strong> 5, <strong>2015</strong>.<br />

the next fiscal year with gross revenue<br />

estimated at Rs 3,103 billion. Fiscal<br />

deficit for the next fiscal year is<br />

projected at 4.3 percent (Rs 1328<br />

billion) after excluding Rs 297 billion<br />

provincial surplus. The share of<br />

provincial governments out of these<br />

taxes will be Rs.1849 billion and net<br />

resources left with the federal<br />

government will be Rs 2463 billion.<br />

The current expenditure is estimated<br />

at Rs.3128 billion for <strong>2015</strong>-16 with<br />

defense allocation of Rs780 billion,<br />

reflecting an increase of 11 percent<br />

against Rs.700 billion for the current<br />

fiscal year. Public Sector<br />

Development Programme projected<br />

at Rs 700 billion against a revised<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 07<br />

estimate of Rs.542 billion for 2014-<br />

15, showing an increase of nearly 29<br />

percent.<br />

Dar announced that the government<br />

plan is to raise GDP to gradually rise<br />

to 7 percent by 2017-18, contain the<br />

inflation to single digit, raise<br />

investment to GDP ratio to<br />

20 percent at the end of<br />

medium term, reduce fiscal<br />

deficit to 3.5 percent and<br />

increase tax to GDP ratio<br />

to 13 percent as well as to<br />

maintain foreign exchange<br />

reserves to $20 billion. The<br />

GDP growth for <strong>2015</strong>-16 is<br />

targeted at 5.5 percent on<br />

the assumption of a 3.9<br />

percent growth by<br />

agriculture sector, 6.4<br />

percent by industry and 5.7<br />

percent by services sector.<br />

Cumulative development spending is<br />

targeted at Rs.1513 billion with<br />

federal PSDP share of Rs.700, he<br />

added.<br />

The Finance Minister added that the<br />

government has decided to increase<br />

rate of Capital Gains Tax (CGT) from<br />

12.5 percent and 10 percent to 15<br />

percent and 12.5 percent,<br />

respectively, and decided to tax the<br />

securities held for a period of more<br />

than 2 years and less than 4 years,<br />

though at a reduced rate of 7.5<br />

percent.<br />

Dar further stated that the rate of tax<br />

in the case of non-filers was

TRADE CHRONICLE<br />

increased for contractors by 3<br />

percent, suppliers by 2 percent and<br />

commission agents by 3 percent. The<br />

government also proposed that<br />

adjustable advance income tax at the<br />

rate of 0.6 percent of the amount of<br />

transaction may be collected on all<br />

banking instruments and other modes<br />

of transfer of funds through banks for<br />

those who do not file income tax<br />

returns. The income of banks from<br />

all sources is proposed to be subjected<br />

to 35 percent income tax.<br />

Tax on earning taxable income from<br />

Rs 400,000 to Rs 500,000 has been<br />

reduced to 2 percent and for nonsalaried<br />

individual taxpayers and<br />

Association of Persons earning<br />

taxable income from Rs 400,000 to<br />

Rs 500,000 are chargeable to 7<br />

percent.<br />

The peak customs duty slab was<br />

proposed to further reduce from 25<br />

percent to 20 percent and federal<br />

excise duty on cigarettes was<br />

increased from 58 percent to 63<br />

percent. The government also decided<br />

to give special incentive packages to<br />

the Construction, Agriculture,<br />

Manufacturing and Employment<br />

Generation Sectors, he said, adding<br />

that certain items are only exempted<br />

from Sales Tax and Customs Duty<br />

on import if they are not locally<br />

manufactured. However, import of<br />

Solar Panels and certain related<br />

components was exempted from this<br />

‘local manufacturing’ condition until<br />

30th <strong>June</strong> <strong>2015</strong>.<br />

He said that the energy sector would<br />

continue to remain a priority with an<br />

allocation of Rs 248 billion for the<br />

next fiscal year to add 10600 MW<br />

to the system to end load-shedding.<br />

Water sector would get Rs 31 billion<br />

in the PSDP and Roads and<br />

Highways Rs 182 billion. He said the<br />

HEC would get Rs. 51.5 billion and<br />

Railways Rs 78 billion. Finance<br />

Minister also promised that sincere<br />

efforts would be made to increase<br />

allocation for education to 4 percent<br />

by 2017-18.<br />

Dar said that mark-up rate on export<br />

finance would be further reduced to<br />

4.5 percent from July 1, <strong>2015</strong> to<br />

promote exports, and long term<br />

financing facility for 3-10 years would<br />

be further brought down to 6 percent.”<br />

He said that more measures in this<br />

regard would be announced in the<br />

trade policy by the Commerce<br />

Ministry.<br />

The Finance Minister also stated that<br />

fiscal incentives would be provided<br />

to entice private investment through<br />

promoting public private partnerships,<br />

FDI and by creating special economic<br />

zones to boost economic growth.<br />

Finance Minister said under the<br />

Textiles Policy 2014-19 a financial<br />

package of Rs.64.15 billion has been<br />

approved in order to double textiles<br />

exports and create 3 million additional<br />

jobs by the year 2019 and a benefit<br />

of drawback of local taxes & levies<br />

scheme would remain available for<br />

the textile exporter in the next fiscal<br />

year.<br />

No one will be allowed to<br />

increase prices; price of ghee and<br />

cooking oil to remain<br />

unchanged; wheat subsidy<br />

for Gilgit-Baltistan not<br />

abolished; duty imposed on<br />

import of cement to protect<br />

local industry; super tax to<br />

be imposed on 200 people<br />

and companies to generate<br />

remaining Rs20-22 bn for<br />

TDPs; country needs<br />

Charter of Economy.<br />

Federal Minister for Finance<br />

Senator Muhammad Ishaq<br />

Dar said the Federal Budget<br />

<strong>2015</strong>-2016 was poor-friendly and<br />

the government would not allow<br />

anyone to increase the prices by<br />

using the name of budget.<br />

Finance Minister, Senator Mohammad Ishaq Dar<br />

addressing post budget Press conference in<br />

Islamabad on <strong>June</strong> 6, <strong>2015</strong>.<br />

Addressing the post-budget Press<br />

conference, the minister said he didn’t<br />

agree to the perception that the budget<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 08<br />

Ishaq Dar Post - Budget Briefing<br />

<strong>2015</strong>-2016 had increased the burden<br />

on the poor.<br />

Packaged yogurt and cheese<br />

have been brought into the tax<br />

net, he said and added that<br />

there was no tax imposed on<br />

milk.<br />

On mobile phone, he said the<br />

regulatory duty was abolished<br />

to bring down the tax burden on<br />

two tiers but tax on expensive<br />

phones was increased from<br />

Rs700 to Rs1,000, jumping up<br />

by Rs300 on phone set in the<br />

price range of Rs70,000. On the<br />

internet, he said tax was rationalised<br />

as it was imposed on use of Evo.

TRADE CHRONICLE<br />

Budget Revision for<br />

Fiscal Year <strong>2015</strong> - 16<br />

Federal Finance Minister Ishaq<br />

Dar in his winding up speech on<br />

general discussion on budget <strong>2015</strong>-<br />

16 and feedback from Senate &<br />

Industry Group has announced a<br />

significant relief in taxes for<br />

agriculture sector, beverage<br />

industry, pesticides, Poultry<br />

Industry as well as an incentive<br />

package for industry to be<br />

established for manufacturing of<br />

mobile phones.<br />

He announced a reduction in GST<br />

from 17 percent to 7 percent (nonadjustable)<br />

as well as 5 percent cut<br />

in ST on oil seeds and removal of<br />

customs duty on import of oil seed.<br />

The minister also announced an<br />

increase in PIU (Per Indent Unit)<br />

for taking loan up to Rs 4000 and<br />

establishment of a Rs 20 billion<br />

fund with equal contribution by<br />

federal government and provincial<br />

governments to subsidize<br />

phosphate and potash fertilizers<br />

for increasing productivity of land.<br />

The Finance Minister also<br />

announced withdrawal of 5 per<br />

cent sale tax on poultry feed<br />

supplies locally but imposition of a<br />

5 percent sales tax on import of<br />

such feed.<br />

To facilitate beverage<br />

manufacturers, the government<br />

has cut federal excise duty on<br />

beverages to 10.5 per cent from<br />

12 per cent. The government has<br />

announced a tax incentive package<br />

for cellular phone industry for<br />

manufacturing of mobile phones.<br />

Under the package, income tax<br />

exemption would be available for<br />

a period of five years, a 90 percent<br />

deprecation allowance for plants<br />

and machinery during the first year,<br />

customs duty and sales tax<br />

exemption on the import of plants,<br />

assembly line machinery and<br />

equipment.<br />

The government has accepted the<br />

demand of the mutual fund industry<br />

that the income of Mutual Funds<br />

would not be subjected to the<br />

Workers Welfare Fund (WWF).<br />

The government has also decided<br />

to allow export of perishable items<br />

from Balochistan to Afghanistan in<br />

Pak rupee instead of dollars.<br />

According to the government, Hajj<br />

operators will continue to enjoy<br />

certain exemptions of the Income<br />

Tax Ordinance in <strong>2015</strong>. The<br />

Finance Minister also announced<br />

an increase in withholding tax on<br />

advertisements of print and<br />

electronic media for non-filers to<br />

12 percent and 15 percent for<br />

corporations and individuals,<br />

respectively, and a decrease from<br />

10 to one percent for filers.<br />

On the pattern of KPK, industries<br />

to be established in Balochistan<br />

from <strong>2015</strong>-2018 would be<br />

exempted from taxes including<br />

turnover tax. The income tax<br />

exemption to Halal meat units has<br />

been extended up to <strong>June</strong> 30, 2017.<br />

A 0.6 percent withholding tax on<br />

all banking instruments of nonfilers<br />

would not be applicable up<br />

to a transaction of Rs 50,000. Dar<br />

also stated that a 7.5 percent<br />

increase in government<br />

employees’ salary would be<br />

applicable after the merger of<br />

previously allowed two ad-hoc<br />

increases.<br />

Dar said that as many as 92 budget<br />

proposals have been received from<br />

Senate, of which 20 have been<br />

fully accepted, 21 partially while<br />

15 in principle but the<br />

implementation of 36 was not<br />

immediately possible.<br />

(Courtesy: “A <strong>Chronicle</strong> report<br />

and local media.”)<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 09

TRADE CHRONICLE<br />

Prime Minister Nawaz Sharif has<br />

distributed 38th FPCCI Trophy to top<br />

businessmen of country at a function<br />

organized by apex trade body -<br />

Federation of Pakistan Chambers of<br />

Commerce & Industry recently.<br />

38th FPCCI Export Trophy<br />

PM distributes award to top businessmen<br />

While addressing the members of<br />

Federation of Pakistan Chambers of<br />

Commerce & Industry (FPCCI) the<br />

Prime Minister said the Government<br />

would consider the proposal to waive<br />

off duties on import of new plants and<br />

machinery. He said the duties can be<br />

recovered when the plant becomes<br />

operational.<br />

The Prime Minister said work is about<br />

to begin on Karachi-Hyderabad<br />

Motorway, which would later be<br />

extended to Sukkur, Multan, Lahore<br />

and Peshawar.<br />

He said it is the effort of the present<br />

government to connect Pakistan with<br />

Central Asian States. He said<br />

construction of Gwadar-Quetta-<br />

Chaman and Kandhar route would<br />

open the entire Balochistan to<br />

development.<br />

Prime Minister Muhammad Nawaz Sharif distributing Export Awards to the<br />

winners at 38th FPCCI Exports Awards Distribution ceremony in Karachi on<br />

12-6-<strong>2015</strong>.<br />

Sindh Governor Dr Ishrat-ul-Ebad<br />

Khan, Federal Commerce Minister<br />

Engr Khurram Dastagir Khan,<br />

Federal Minister for Finance and<br />

Economic Affairs Senator<br />

Muhammad Ishaq Dar, Minister of<br />

State for Petroleum and Natural<br />

Resources Jam Kamal and Minister<br />

of State and Chairman Board of<br />

Investment Dr Miftah Ismail,<br />

Federation of Pakistan Chambers of<br />

Commerce and Industry (FPCCI)<br />

President Mian Muhammad Adrees,<br />

<strong>Trade</strong> Development Authority of<br />

Pakistan (TDAP) Chief Executive<br />

Officer S M Muneer, United<br />

Business Group (UBG) Chairman<br />

Iftikhar Ali Malik, Senior Vice<br />

President FPCCI Abdul Rahim<br />

Janoo, FPCCI vice presidents,<br />

former vice president, In-Charge<br />

WTO Cell at FPCCI Engr. M.A.<br />

Jabbar and a large number of business<br />

leaders were present.<br />

The Prime Minister said massive<br />

investment of 46 billion dollars would<br />

be made by China under China-<br />

Pakistan Economic Corridor. He said<br />

two power plants of 330 MW each<br />

are to be established at Thar which<br />

would use Thar coal.<br />

He said the ultimate objective of the<br />

Government is to eliminate load-shedding<br />

and bring down prices of electricity.<br />

Nawaz Sharif said the Government<br />

is also addressing issues of security<br />

in Karachi, Balochistan and overall<br />

in the country.<br />

Dr. Navaid ul Zafar, Managing Director, Hamdard Laboratories (Waqf) Pakistan<br />

receiving FPCCI Export Award 2014 on best export of Rooh Afza Syrup from<br />

Prime Minister of Pakistan, Mian Mohammed Nawaz Sharif in 38th FPCCI<br />

Export Awards Ceremony, held at a local hotel of Karachi.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 11

TRADE CHRONICLE<br />

Country’s largest oil refinery unveiled<br />

Nawaz says: Byco refinery would make self sufficient in crude oil refining<br />

Prime Minister Nawaz Sharif has<br />

inaugurated country’s largest Byco oil<br />

refinery complex with a crude oil<br />

refining capacity of 120,000 barrels<br />

per day at Lasbella in Balochistan<br />

recently. Hopefully it will meet<br />

around 39 per cent of country’s<br />

energy requirements and minimize<br />

down reliance on imports.<br />

The refinery built by the Byco Group<br />

has attracted in an investment of US<br />

750 million and will produce about 1.6<br />

million tons of Fuel oil, 2.4 million tons<br />

of diesel and 1.1 million tons of LPG<br />

annually.<br />

The Prime Minister said the refinery<br />

is an appreciable addition to the oil<br />

and gas sector, and will go a long<br />

way in achieving sustainable<br />

productivity and increased<br />

profitability.<br />

He said currently, Pakistan requires<br />

22 million tons oil, but the country is<br />

still short of capacity to refine crude<br />

oil. He said it would take time to<br />

achieve complete self-sufficiency.<br />

He noted the role of Byco Group in<br />

oil refining and said the setting up of<br />

the second refinery would help<br />

generate employment opportunities<br />

and help the country achieve selfsufficiency<br />

in crude oil refining.<br />

Prime Minister Nawaz Sharif said it<br />

is his government’s vision to make<br />

Gwadar a free port and assured that<br />

necessary legislation would be done<br />

soon to accord it the status.<br />

He said the Port would be connected<br />

through road, rail links to Peshawar<br />

Prime Minister Muhammad Nawaz Sharif unveiling the plaque of Byco Oil<br />

Refinery Complex II at Lasbella Baluchistan on <strong>June</strong> 12, <strong>2015</strong>.<br />

and then onwards to Central Asian<br />

Republics. He said a beautiful road<br />

was being constructed from Gwadar<br />

to Chaman, near Quetta, while<br />

another option was to link it with<br />

Wakhan corridor in Afghanistan, from<br />

where it can be connected to the<br />

Central Asian Republics.<br />

Prime Minister Sharif asked Finance<br />

Minister Ishaq Dar to consider giving<br />

more concessions to new industries<br />

in taxation to woo more foreign<br />

investment.<br />

Chief Executive of Byco Industries<br />

Amir Abbasi said the project,<br />

completed in six years, enjoys a<br />

substantial position in the value<br />

addition chain of hydrocarbon from<br />

the well-head to the consumer.<br />

He said Byco has so far invested<br />

US$750 million into country’s<br />

infrastructural and industrial<br />

development.<br />

Arif Masood Naqvi, CEO of Abraaj<br />

Capital Limited said the Middle<br />

East’s premier private equity fund<br />

would like to make more<br />

investments in Pakistan in various<br />

areas.<br />

With new refinery, Pakistan has joined<br />

the club of countries with Single Point<br />

Mooring (SPM) facilities in the deep<br />

sea to transport crude oil through a<br />

pipeline to refineries set up along the<br />

coast.<br />

Byco Terminals Pakistan Limited<br />

(BTPL) has set up its terminals in<br />

Keemari and Mahmoodkot and has<br />

acquired land at Shikarpur and<br />

Machike for terminal installation.<br />

The SPM has been set up in the North<br />

Arabian Sea at a distance of<br />

approximately 14 kilometers from the<br />

Byco’s Mouza Kund Site located at<br />

Hub, and is 10 km inside the sea at<br />

2.5 metres deep.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 12

TRADE CHRONICLE<br />

Syed Murad Ali Shah, Minister for<br />

Finance and Energy, Government of<br />

Sindh has congratulated Pegasus<br />

Consultancy (Pvt) Ltd; for holding<br />

POGEE, the 13 th International<br />

Exhibition for the Energy Industry at<br />

Karachi Expo Centre, in Karachi<br />

from 23 – 25 April, <strong>2015</strong>, in a befitting<br />

manner.<br />

He said that events like POGEE<br />

provide a chance to the industry<br />

professionals and experts to gather<br />

at a unique avenue that guarantees<br />

attainment of latest information<br />

available through latest technology<br />

display and business networking<br />

opportunities.<br />

More than 170 companies from<br />

twenty seven countries such as<br />

Australia, Austria, Bahrain, Belgium,<br />

Canada, China, Denmark, Egypt,<br />

France, Germany, Hong Kong, India,<br />

Italy, Japan, Korea, Malaysia,<br />

Netherland, Poland, Russia,<br />

Singapore, South Korea, Spain,<br />

Switzerland, Thailand, Turkey, UAE,<br />

UK, and USA have displayed their<br />

innovative engineering products.<br />

A big number of Pakistani companies<br />

had also participated. The beautifully<br />

decorated stall of Sui Southern Gas<br />

Company (SSGC) has attracted a<br />

large number of trade visitors. They<br />

also got best stall award as well.<br />

POGEE <strong>2015</strong> concludes successfully<br />

Sindh Province: solution providers for energy crisis in Pakistan,<br />

says Syed Murad Ali Shah, Sindh Minister for Energy<br />

Shoaib Warsi reviews SSGC working at POGEE<br />

Aamer Khanzada said, Pakistan gets $573m FDI in Energy Sector<br />

A <strong>Chronicle</strong> report<br />

Syed Murad Ali Shah<br />

Sindh Minister for Finance & Energy<br />

valuable insights and industry trends<br />

to the business professionals.<br />

While formally inaugurating the<br />

exhibition, Sindh Minister said, Sindh<br />

Province by the grace of Almighty<br />

Allah, has been fully endowed with<br />

natural resources such as Coal, Gas<br />

and Wind Corridor (seven largest in<br />

the world) to provide “energy<br />

solution” for the country and added,<br />

“Sindh Province has 99 percent coal<br />

reserves, supplying 70 percent and 50<br />

percent gas and oil respectively.”<br />

He expressed the hope that if these<br />

huge resources such as deposit of<br />

coal and wind corridor are exploited,<br />

can help to overcome energy crisis<br />

in the country.<br />

He applauded the efforts of Prime<br />

Minister Mian Mohammad Nawaz<br />

Sharif who alongwith former<br />

President Mr. Asif Ali Zardari<br />

inaugurated the work on the Sindh<br />

Engro Coal Mining (SECMC) project,<br />

a joint venture between government<br />

of Sindh and Engro Corporation<br />

earlier this year. This marks the<br />

beginning of coal extraction from<br />

Thar Coal block II, he remarked. The<br />

investment for other block of Thar has<br />

also been materialized following<br />

signing of financial close between<br />

Chinese banks and local financial<br />

institutions.<br />

An International Conference under<br />

the theme “Integrated Solutions to<br />

Pakistan’s Energy Needs” was also<br />

held on the sidelines of fair to provide<br />

A View of stall at Pogee <strong>2015</strong>.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 13

TRADE CHRONICLE<br />

He requested Govt. to take on board<br />

Sindh government in the power policy<br />

and the other projects being planned<br />

for Sindh Province. He was optimistic<br />

that working together will resolve<br />

energy problems. He suggested wind<br />

power projects are short solution for<br />

energy requirements while coal<br />

power plants as for long terms.<br />

Mr. Shoaib Warsi,<br />

Chief Operating Officer and<br />

Dy. Managing Director of<br />

Sui Southern Gas Company (SSGC)<br />

Mr. Shoaib Warsi, Chief Operating<br />

Officer and Dy. Managing Director<br />

of Sui Southern Gas Company<br />

(SSGC) in his brief speech at the<br />

POGEE, also appreciated role of<br />

Pegasus Consultancy (Pvt) Ltd., for<br />

organizing POGEE, and brining world<br />

class energy equipment suppliers<br />

under one roof.<br />

He said SSGC is supplying 1.2 bcf<br />

gas to its 2.6 million<br />

customers in Sindh and<br />

Baluchistan Provinces<br />

from 31 gas fields. He<br />

said domestic<br />

customers are their<br />

priority customers as<br />

per policy and due to<br />

shortfall in gas supply,<br />

they have launched gas<br />

curtailment for CNG<br />

and other industries in<br />

the Provinces.<br />

Mr. Aamer Khanzada,<br />

Managing Director,<br />

Pegasus Consultancy (Pvt.) Ltd<br />

Mr. Aamer Khanzada, Managing<br />

Director, Pegasus Consultancy<br />

(Pvt.) Ltd in his address of welcome<br />

has extended thanks to all the local<br />

and international exhibitors and<br />

trade delegates for their presence<br />

in the 13th International Exhibition<br />

for the Energy Industry — POGEE<br />

<strong>2015</strong>.<br />

He said government has signed<br />

number of energy projects with<br />

Chinese government and firms that<br />

will bring $34 billion investment in<br />

10400 mw power projects and will<br />

Air Mix Synthetic natural gas plants<br />

in 22 small villages, where gas<br />

pipeline cannot be laid due to<br />

economic viability. Four plants are<br />

already working. He appreciated the<br />

Govt. for facilitating import of LNG<br />

ensure solution to energy crisis and<br />

provide employments.<br />

He said Pakistan’s energy<br />

requirement is increasing every<br />

year with the growing population<br />

and fast-paced industrial<br />

developments. To meet the rising<br />

demand of the energy, the<br />

Government is currently focused in<br />

the development of hydropower and<br />

coal based power plants, tapping of<br />

renewable energy sources and<br />

sustainable Oil & Gas supply to the<br />

country.<br />

In his special message, he said,<br />

“attractive investment policies of<br />

the Government and business<br />

friendly environment have brought<br />

foreign direct investment of USD<br />

573 millions in the Energy sector<br />

last year. The sector has registered<br />

an import of USD 2.1 billion<br />

machinery during last year to<br />

maximize the power generation in<br />

the country”.<br />

through Engro Terminal at Port<br />

Qasim. The shipment came on 28th<br />

March, earlier this year. He said<br />

another terminal would come on<br />

stream by 16th December later this<br />

year.<br />

The company is<br />

planning to install LPG<br />

SSGC's Corporate booth at Pakistan's Premier Energy Exhibition POGEE remained the centre<br />

of attraction for the visitors.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 14

TRADE CHRONICLE<br />

He said that SSGC was updating its<br />

transmission and distribution systems<br />

to provide uninterrupted gas with<br />

required gas pressure to its<br />

customers.<br />

Mr. Abdul Sami Khan, Chairman,<br />

CNG Dealer Association and<br />

Chairman, Pakistan Petroleum Dealer<br />

Association highlighted problems<br />

faced by CNG industry in the country.<br />

He requested for regular supply of<br />

gas to CNG stations in Sindh province.<br />

The Vice President FPCCI<br />

Muhammad Ikram Rajput also<br />

applauded the efforts of Pegasus<br />

Consultancy (Pvt) Ltd; for bringing<br />

world class energy equipment<br />

suppliers in the country for the mutual<br />

co-operation of the local companies.<br />

A View of stall at Pogee <strong>2015</strong>.<br />

The Ambassador of Belgium, Peter<br />

Claes commented on the occasion<br />

that events like POGEE are much<br />

helpful in providing solutions to the<br />

energy issues. He said that his<br />

country is willing to extend<br />

technological assistance to Pakistan<br />

in resolving its energy crisis.<br />

Mr. Aasim A. Siddiqui, Chairman<br />

Pegasus Consultancy (Pvt.) Ltd is his<br />

special message said, POGEE is<br />

considered as the Regional Gateway<br />

for Energy Industry and has always<br />

played a vital role in the development<br />

of energy sector of Pakistan”.<br />

"Foreign exhibitors displaying their products at Pakistan oil, gas & energy<br />

exhibition, POGEE-<strong>2015</strong>, held at Expo Centre, Karachi.<br />

14TH INTERNATIONAL<br />

EXHIBITION FOR<br />

THE ENERGY INDUSTRY<br />

The next POGEE will be held<br />

in Lahore Expo Centre<br />

from 19-21 st <strong>May</strong> in Lahore.<br />

Uzair Ahmed Khan, on behalf of SSGC’s Corporate Communication Department,<br />

receiving the ‘Best Corporate Booth’ award from the representative of Pegasus at<br />

Pakistan Oil and Gas Energy Exhibition (POGEE), held from April 23-25, <strong>2015</strong>.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 15

TRADE CHRONICLE<br />

Sindh Chief Minister<br />

inaugurates the<br />

Livestock, Dairy,<br />

Fisheries, Poultry and<br />

Agriculture Exhibition<br />

(LDFA-<strong>2015</strong>)<br />

Sindh Chief Minister Syed Qaim Ali<br />

Shah has said that the provincial<br />

government is committed to promoting<br />

agriculture, livestock, dairy and other<br />

sectors and will provide incentives<br />

and facilities to investors.<br />

He said this while inaugurating the<br />

Livestock, Dairy, Fisheries, Poultry<br />

and Agriculture Exhibition (LDFA-<br />

<strong>2015</strong>) at the Expo Centre Karachi<br />

recently. The exhibition was held to<br />

promote business and investment<br />

opportunities in the agriculture sector<br />

of Sindh and bring the government<br />

and investors on a single platform.<br />

Shah, while visiting the stalls put up<br />

at the show, said the fair would help<br />

the government to identify the sectors<br />

for increasing productivity. “The<br />

exhibition will help our industries in<br />

capitalising on the potential of<br />

livestock and dairy as millions of<br />

people and hundreds of industries<br />

depend on these sectors.”<br />

Chief Minister Sindh Syed Qaim Ali Shah inaugurating a Livestock Dairy,<br />

Fisheries, Poultry and Agriculture (LDFA) Exhibition at Expo Centre recently.<br />

He added the Sindh government had<br />

been striving to support these sectors<br />

so that they could be modernised and<br />

could capitalise on the immense<br />

potential available in the province.<br />

This will help them to not only meet<br />

local demand but also export various<br />

products.<br />

Sindh Minister for Livestock and<br />

Fisheries Jam Khan Shoro said the<br />

LDFA-<strong>2015</strong> would bring a visible<br />

impact on Sindh’s economy and had<br />

set the path for the development and<br />

exploration of new markets.<br />

“It is heartening that a large number<br />

of foreign and local companies from<br />

the agriculture sector are participating<br />

in the exhibition and sharing their<br />

experiences in modernising the<br />

products,” he said.<br />

Sindh Board of Investment Chairman<br />

Dr Asif Brohi said the livestock and<br />

dairy sectors were the backbone of<br />

the country’s agrarian economy.<br />

“Therefore, the provincial<br />

government wants to bring in new<br />

investment in the dairy sector not only<br />

for food security but also to improve<br />

value addition and the value chain.”<br />

Around 50 local and five international<br />

companies have displayed their<br />

products and services at the fair.<br />

A collection of short stories titled Kuchh<br />

aur by Dr Huma Mir was launched at the<br />

Arts Council Karachi recently. The<br />

launching was addressed by writer Anwar<br />

Maqsood; former interior minister retired<br />

Lt-Gen Moinuddin Haider; actor Talat<br />

Husain; scholar Dr Alia Imam; Journalist<br />

Nazeer Laghari. Earlier, Ahmed Shah<br />

welcomed the guests. Dr Huma Mir<br />

conducted the programme. Others who<br />

were present on the occasion to speak on<br />

the salient features of the book were Prof<br />

Sahar Ansari (who presided over the<br />

launch), Dr Aamir Liaquat (chief guest),<br />

Abdul Haseeb Khan, Kamal Ahmed Rizvi<br />

and Sardar Yasin Malik.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 16

TRADE CHRONICLE<br />

Speakers at the meeting of Shura<br />

Hamdard Karachi Chapter urged the<br />

government to try its level best to<br />

make the coming national budget<br />

<strong>2015</strong>-16 people friendly as the masses<br />

are already under the burden of high<br />

prices of daily use commodities. The<br />

meeting was held on <strong>May</strong> 14, <strong>2015</strong><br />

on the theme: “National Budget <strong>2015</strong>-<br />

16 and public expectation”, presided<br />

over by Justice (Rtd) Haziqul Khairi<br />

at a local hall.<br />

Speaking on the occasion, Dr. Shahid<br />

Hassan Siddiqui, an economist said<br />

that Pakistan was legged behind in<br />

collecting taxes than seven other<br />

Asian countries. There was a<br />

powerful group in Pakistan which<br />

didn’t allow to tax agricultural income<br />

and documentation of economy in the<br />

country.<br />

Zafar Iqbal, President, Association of<br />

Small and Medium Size Enterprises<br />

(SAMEA) while giving the budget<br />

recommendations said that small and<br />

medium size enterprises are the<br />

engine and backbone of country’s<br />

economy, having 40 per cent share in<br />

GDP and consisting of small and<br />

medium size industrial and trading<br />

units, involving 80 per cent labour<br />

force of the country and progress of<br />

this sector was tantamount to the<br />

progress of the country.<br />

Mrs. Sadia Rashid, President,<br />

Hamdard Foundation Pakistan said<br />

that national census should be<br />

conducted in order to make it clear<br />

how many population and resources<br />

country have and what can be done<br />

to meet the requirement of the people.<br />

Commodore (Rtd) Sadeed Anwar<br />

Malik said that nature had bestowed<br />

upon Pakistan with good opportunities<br />

for the production of Shrimps in<br />

Balochistan and other places too. We<br />

should improve the production of<br />

Mrs. Sadia Rashid, President Hamdard Foundation Pakistan addressing<br />

on“National Budget <strong>2015</strong>-16 and public expectation”, presiding over by Justice<br />

(Rtd) Haziqul Khairi at a local hall. Dr.Shahid Hasan Siddiqi is also present on<br />

this occasion.<br />

shrimps which could give us good<br />

enough amount of foreign exchange<br />

as there was great demand of this<br />

species throughout the world.<br />

Haq Nawaz Akhtar, former<br />

Chairman, Pakistan Steel Mills said<br />

that it should be made obligatory for<br />

banks that they must put their shares<br />

Shura Hamdard discusses the<br />

coming National Budget <strong>2015</strong>-16<br />

in micro finance and the money of<br />

Benazir Income Support Programme<br />

be attached to micro finance in order<br />

to provide respectful support to the<br />

poor. Dr. Abubakar Sheikh, Ms.<br />

Shamim Kazmi, Prof. Mohammed<br />

Rafi, Khalid Ikramullah Khan, Col<br />

(Rtd) Mukhtar Ahmed Butt and<br />

Anwar Aziz Jakartawalla also spoke.<br />

A renowned Social Worker & TV Artist Mrs. Jehan Ara Hai cutting the ribbon of<br />

inauguration of 24th Annual Eid Card Competition at Bait al Hikmah<br />

Auditorium, Madinat al Hikmah organized by Hamdard Public School &<br />

Hamdard Village School. Mrs. Sadia Rashid, President, Hamdard Foundation<br />

Paistan, Fatema Munir Ahmed, Vice President Madinat al Hikmah , Prof. Hakim<br />

Abdul Hakim Abdul Hannan, Vice Chancellor Hamdard University, Dr. Khalid<br />

Nasim, Administrator Hamdard Public School, Ms. Saba Khalid, Headmistress<br />

& others are present on this occasion. While judges are selecting the cards for<br />

1st, 2nd & 3rd position.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 17

TRADE CHRONICLE<br />

Mehmood Arshad, Chief Guest, Chairman, Standing Committee for Islamic Banking and Executive Vice President, Pak<br />

Qatar Takaful addressing on “Hard Working is essential to achieve greatness” at Hamdard Naunehal Assembly at a local<br />

hotel. Mrs. Sadia Rashid, President, Hamdard Foundation Pakistan, Ms. Fatema Muneer Ahmed and Mr. Furrukh Imdad<br />

are also present on the occasion.<br />

Hamdard Naunehal<br />

Assembly Held<br />

A function, comprised recitation from<br />

Holy Quran, naat, speeches, tableau<br />

and dua-i-Said was held <strong>May</strong> 19,<br />

<strong>2015</strong> on the theme “Hard Working is<br />

essential to achieve greatness” at a<br />

local hotel.<br />

world were born in poor or middle<br />

class families but they reached to the<br />

highest pedestal of their societies due<br />

to their sincerity to their purpose and<br />

hard work of day and night for<br />

example William Henry Bill Gates,<br />

founder of Microsoft company, who<br />

born in a middle class family in<br />

Washington, USA, but today he was<br />

one of the richest men of the world.<br />

Speaking on the occasion, Mehmood<br />

Arshad Chief Guest, Chairman,<br />

Standing Committee for Islamic<br />

Banking and Executive Vice<br />

President, Pak Qatar Takaful said:<br />

‘Trust in God, self confidence and<br />

hard work are the keys of success in<br />

life as Allah says in Quran: “How<br />

much a man tries and puts its efforts<br />

in achieving some thing he would get<br />

according to his efforts” and Islam<br />

ordains to take care of deen (religion)<br />

together with dunya (world).<br />

Mrs. Sadia Rashid, President,<br />

Hamdard Foundation Pakistan while<br />

addressing the gathering of children<br />

said that Islam had given great<br />

importance to hard work and labour<br />

as the life of our Holy Prophet<br />

(PBUH) was filled with action and<br />

hard working. There was a common<br />

value of hard working in all our great<br />

leaders, including Hakim Mohammed<br />

Said and mostly great men of the<br />

Prof. Dr. Hakim Abdul Hannan, Vice Chancellor, Hamdard University, Prof. Dr.<br />

Javaid A. Khan, Department of Medicine, Agha Khan University, Dr. Sara<br />

Salman, World Health Organization (W.H.O). Prof. Dr. Mohammad Javed, Dean,<br />

Faculty of Health & Medical Sciences, H.U. and Prof. Dr. Muhammad Furqan,<br />

Principal, Hamdard College of Medicine & Dentistry addressing at a seminar<br />

organized by the Department of Community Health Sciences, Hamdard College<br />

of Medicine & Dentistry, Hamdard University on the occasion of World No-<br />

Tobacco Day at Bait al Hikmah Auditorium, H.U.<br />

Mrs. Sadia Rashid, Chairperson, Hamdard Laboratories (Waqf ) Pakistan<br />

receiving Consumers Choice Award on Rooh Afza from Chairman Senate<br />

Mian Raza Rabbani at 10 Consumers Choice Award 2014 at a local hotel.<br />

Kaukab Iqbal, Chairman, Consumers Association of Pakistan and others are<br />

present on this occasion.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 18

TRADE CHRONICLE<br />

Opening of Stoll/Nazer Demo Centre<br />

and Nazer Training Centre<br />

Holding true to its commitment to<br />

serving the Pakistani textile<br />

industry, Nazer & Co. has recently<br />

established two facilities: a flat<br />

knitting demonstration center in<br />

collaboration with H. Stoll GmbH<br />

and a training center.<br />

Through these mediums, Nazer &<br />

Co. aims to introduce the latest<br />

technological developments in<br />

Knitting, Textile Processing and<br />

Finishing to the Pakistani Textile<br />

manufacturers and processors and<br />

by doing so, help them achieve a<br />

competitive edge in an ever<br />

increasingly competitive market.<br />

The opening ceremony of these<br />

centers was held earlier this year<br />

and was well attended by many of<br />

Nazer & Co’s customers and<br />

principals.<br />

Opening of Stoll/Nazer Demo Centre (Mr. Luqman Ali Mooraj, Mr. Rizwan Fasih<br />

of RKM Knitwear, Mr. Abbas Mooraj and Mr. Thomas Hoffmann Area Sales<br />

Manager of Stoll.)<br />

Mr. Thomas Hoffmann from H.<br />

Stoll GmbH had inaugurated the<br />

Stoll Nazer Demonstration Centre<br />

while Mr. Manfred Schulte-<br />

Austum of Brückner inaugurated<br />

the Nazer Training Centre.<br />

The Nazer Stoll Demonstration<br />

Center includes three of Stoll’s<br />

latest multigauge machine; two<br />

CMS 502 HP in 3,5.2 gauge and<br />

7.2 gauge and one CMS 530HP<br />

machine in 6.2 gauge.<br />

View of training centre.<br />

The demonstration centre was<br />

established to provide training to<br />

the flat-knit produces in machine<br />

operation and flat knitting design<br />

(on Stoll’s M 1 plus software),<br />

as well as to help customers<br />

develop new innovative knitted<br />

products.<br />

The Nazer Training Centre,<br />

established with the support of<br />

Nazer & Co’s principals is a forum<br />

where seminars and training<br />

sessions will take place, introducing<br />

our customers to the latest<br />

developments in textile technology.<br />

It is through the provision of<br />

these facilities that Nazer &<br />

Co. reaffirms its commitment<br />

of support to the Pakistani<br />

Textile Industries as it has done<br />

so since its establishment in<br />

1952.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 19

TRADE CHRONICLE<br />

At the training centre<br />

Visitors at the opening of the training centre.<br />

Opening of the Nazer Training Centre by Mr. Manfred<br />

Schulte Austum of Brueckner and Mr. Abrar Ali Mooraj of<br />

Nazer & Co.<br />

Mr. Thomas Hoffmann addressing to the guests at the opening<br />

ceremony of Stoll/Nazer Demo Centre.<br />

Guests at the opening ceremony of Stoll/Nazer Demo Centre<br />

Visitors at the opening ceremony of Stoll/Nazer Demo Centre<br />

View of the stoll machines at the stoll / Nazer Demo Centre.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 20

TRADE CHRONICLE<br />

Port t & Shipping News<br />

German delegation<br />

visits KPT<br />

A high-level German<br />

parliamentarians delegation visited<br />

the Karachi Port Trust recently, for<br />

a briefing to gain awareness about<br />

the avenues offered by the premier<br />

port of Pakistan for investments<br />

and joint ventures, a statement said.<br />

The delegation was led by Niels<br />

Annen with other members Carey<br />

Lay, Tabea Rößner, Michael Donth,<br />

Thorsten Frei, Prof Dr Egon Jüttner,<br />

Ingrid Brenda Behrmann<br />

(conference interpreter), Monika<br />

Hein (German Foreign Office) was<br />

briefed about the management,<br />

administrative areas, functions and<br />

present / future projects of KPT.<br />

PNSC<br />

ponders ferry services<br />

Pakistan National Shipping Corporation<br />

(PNSC) held a meeting at its head office<br />

to explore the options for establishing<br />

ferry services. Proposals included a fast<br />

ferry cargo service from Pakistan to<br />

UAE, cargo cum passenger service<br />

from Karachi to Gwadar, and a special<br />

ferry for pilgrims between Karachi and<br />

Iran/Iraq.<br />

Ports and Shipping Minister Kamran<br />

Michael, Ports and Shipping<br />

Secretary Khalid Pervez, Ports and<br />

Shipping Director General Abdul<br />

Malik Ghouri, PNSC Chairman Arif<br />

Elahi, SP&PL Executive Director<br />

Capt Muhammad Sarfaraz, and<br />

private entrepreneurs, including<br />

National Management Consultants<br />

(Pvt) Ltd Chairman Dr Junaid Ahmad,<br />

Al Qaem Pilgrims, Saleem Akbar Ali,<br />

and Shoaib Shipping CEO Jawaid<br />

Iqbal attended the meeting.<br />

Chairman KPT and DG Transport Department of China are exchanging MOU<br />

folders after signing.<br />

KPT signs MoU with China<br />

A six member’s delegation of the<br />

Guangdong Province, China, led by<br />

Mr Liu Zhigeng, Vice Governor,<br />

Guangdong Province of China, visited<br />

Karachi Port Trust recently, for<br />

signing Memorandum of<br />

Understanding (MOU) for<br />

strengthening of port and shipping<br />

connectivity and for establishing<br />

cooperation between Guangdong<br />

Provincial Transportation Department<br />

and Karachi Port Trust. It was signed<br />

by Chairman KPT Vice Admiral<br />

Shafqat Jawed and Director General,<br />

Department of Transport Guangdong<br />

Province, People’s Republic of China,<br />

Mr Zeng Zhaogeng. The MOU<br />

envisages promoting cooperation in<br />

port and shipping logistics,<br />

strengthening communications and<br />

establishing closer ties between the<br />

two countries. The ceremony was<br />

well attended by Minister for Ports<br />

and Shipping Senator Kamran<br />

Michael, Chairman KPT Vice<br />

Admiral (R) Shafqat Jawed and other<br />

top officials of the Ministry of Ports<br />

and Shipping and KPT apart from the<br />

six member delegation of Guangdong<br />

Province, China, that called on<br />

Karachi Port Trust Head Office on<br />

28th <strong>May</strong>, <strong>2015</strong>.<br />

Photograph of vessel KMTC Dubai is taken on the occasion of its arrival at<br />

Karachi Port on maiden voyage. The vessel has length overall of 265 meters and<br />

is capable of carrying 5,500 TEU containers at a time is called by their agents<br />

in Pakistan – The United Marine Agency. Chairman KPT Vice Admiral Shafqat<br />

Jawed HI (M) and COMKAR Vice Admiral S. Arifullah Hussaini HI (M) are both<br />

the Chief Guests on the occasion which was attended by top officials of KPT,<br />

UMA and PICT.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 21

TRADE CHRONICLE<br />

Karachi Port registers a<br />

record container<br />

handling<br />

Karachi Port witnessed a record<br />

handling of containers during the<br />

month ending <strong>May</strong> <strong>2015</strong> and it<br />

reflects the favourable policies<br />

practiced by Karachi Port Trust<br />

under the leadership of Chairman<br />

KPT Vice Admiral (R) Shafqat<br />

Jawed. The port has registered<br />

handling of 160,649 TEUs (Twenty<br />

Equivalent Unit) of cumulative<br />

imports and exports containers at<br />

its two terminals – the Karachi<br />

International Container Terminal<br />

(KICT) and Pakistan International<br />

Container Terminal (PICT) during<br />

the month of <strong>May</strong> surpasses the<br />

previous handling of 156,254 TEUs<br />

that it handled in the month of<br />

January <strong>2015</strong>.<br />

The breakup shows that KICT<br />

handled 45,486 TEUs of import<br />

containers and 44,592 TEUs of<br />

exports containers during the month<br />

ending <strong>May</strong> whereas the PICT<br />

handled 38,213 TEUs of import<br />

containers and 30,920 TEUs of<br />

export containers respectively from<br />

31 and 36 vessels arrived at the two<br />

terminals. Handling of containers<br />

more than their existing capacities<br />

reflects the efficient handling<br />

operations of both the private<br />

terminals.<br />

A third terminal is to commence<br />

operations soon at the deep water<br />

container port also promises to<br />

attract domestic, in-transit and<br />

transhipment traffic of containers<br />

which will further boost up the<br />

container handling efficiency of<br />

Karachi Port which is surely the<br />

premier and main port of Pakistan<br />

and provides all kind of facilities that<br />

modern trade requires.<br />

M V Zi Jingson of China Overseas Shipping Company Leaves the Gwadar Port<br />

for Jebel Ali, Dubai on 11 <strong>May</strong>, <strong>2015</strong> after loading reefer containers.<br />

First export ship leaves<br />

Gwadar<br />

The Gwadar Port, which started its<br />

operations about eight years ago, for<br />

the first time on 11 <strong>May</strong>, <strong>2015</strong><br />

handled commercial containerised<br />

cargo for export of seafood. M V<br />

Zi Jingson, a bullebrealc vessel of<br />

the China Overseas Shipping Co<br />

(Cosco) took loading and later sailed.<br />

The export shipment will be<br />

unloaded at Jebel Ali, Dubai, from<br />

where a larger ship will carry these<br />

reefer containers to Far-East with<br />

its expected destination to Malaysia<br />

and China.<br />

Federal Minister for Ports and<br />

Shipping Kamran Michael, speaking<br />

at a ceremony organised at the<br />

Gwadar port to see off the ship, said<br />

that soon Gwadar will soon be<br />

connected with its hinterland<br />

through motorway M-8 and<br />

National Highway N-85, thereby<br />

providing connectivity to upcountry<br />

and beyond to Afghanistan and<br />

Central Asian states and western<br />

China.<br />

IFC signed a memorandum with Engro Elengy Terminal for 20 percent equity in<br />

the project. The agreement was signed by members from IFC team which included<br />

Mouayed Makhlof - Regional Director IFC, Nadeem Siddiqui - Country Head of<br />

Pakistan IFC, Adil Marghub - Senior Manager, Azhar Hussain - Senior Investment<br />

Officer. Also present at the occasion were Ali Ansari - President Engro<br />

Corporation; Naz Khan, CFO Engro Corporation; Sheikh Imran Ul Haque -<br />

CEO Engro Elengy Terminal Limited amongst others.<br />

<strong>Trade</strong> <strong>Chronicle</strong> - <strong>May</strong> - <strong>June</strong> <strong>2015</strong> - Page # 22

TRADE CHRONICLE<br />

People & Events<br />

Muttahida’s Khawaja<br />

Izhar appointed<br />

opposition leader in PA<br />

Muttahida Qaumi Movement<br />

legislator Khawaja Izhar-ul-Hassan<br />

was appointed leader of the<br />

opposition in the Sindh Assembly<br />

recently.<br />

“On request of 44 members of the<br />

provincial assembly of Sindh, the<br />

speaker, in accordance of the<br />

provisions of sub-rule (3) of Rule<br />

25 of Rules of Procedure of the<br />

Provincial Assembly of Sindh, has<br />

been pleased to declare Khawaja<br />

Izhar-ul-Hassan as leader of<br />

opposition with effect from April 29,<br />

<strong>2015</strong>,” said the official notification<br />

issued by the Assembly Secretary<br />

G.M. Umar Farooq.<br />

The new opposition leader is a longtime<br />

MQM worker. His association<br />

with the MQM began in 1988 when<br />

he joined the All Pakistan Mohajir<br />

Students Organisation — the<br />

student wing of the MQM — in St<br />

Patrick’s College. He completed his<br />

MBA degree from a private institute<br />

in the metropolis and went to<br />

Malaysia in 1996 for job. The<br />

MQM gave him a party ticket for<br />

the 2008 general election from PS-<br />

99, a provincial assembly<br />

constituency comprising areas of<br />

North and New Karachi, and also<br />

retained him in the 2013 general<br />

election.<br />

Rajwana new<br />

Governor of Punjab<br />

Malik Rafique Rajwana was<br />

appointed the Governor of Punjab.<br />

The position of Punjab Governor<br />

had been lying vacant since the<br />

resignation of Chaudhry<br />

Mohammad Sarwar in January this<br />

year. Rajwana, who hails from<br />

Subhani new<br />

Engro president<br />