Cableways Impact Assessment Study - Final Report - saferail.nl

Cableways Impact Assessment Study - Final Report - saferail.nl

Cableways Impact Assessment Study - Final Report - saferail.nl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Risk & Policy Analysts<br />

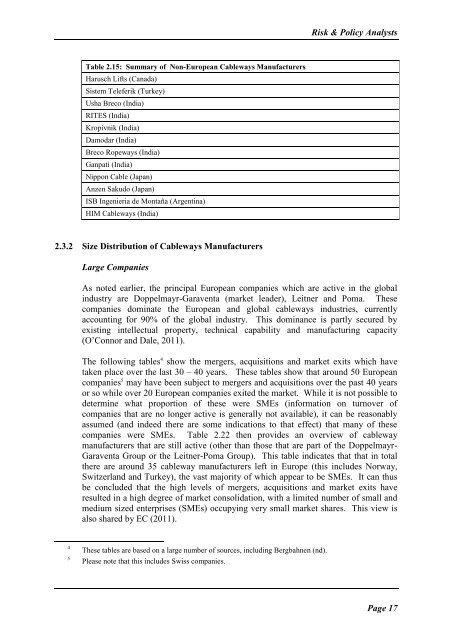

Table 2.15: Summary of Non-European <strong>Cableways</strong> Manufacturers<br />

Harusch Lifts (Canada)<br />

Sistem Teleferik (Turkey)<br />

Usha Breco (India)<br />

RITES (India)<br />

Kropivnik (India)<br />

Damodar (India)<br />

Breco Ropeways (India)<br />

Ganpati (India)<br />

Nippon Cable (Japan)<br />

Anzen Sakudo (Japan)<br />

ISB Ingenieria de Montaña (Argentina)<br />

HIM <strong>Cableways</strong> (India)<br />

2.3.2 Size Distribution of <strong>Cableways</strong> Manufacturers<br />

Large Companies<br />

As noted earlier, the principal European companies which are active in the global<br />

industry are Doppelmayr-Garaventa (market leader), Leitner and Poma. These<br />

companies dominate the European and global cableways industries, currently<br />

accounting for 90% of the global industry. This dominance is partly secured by<br />

existing intellectual property, technical capability and manufacturing capacity<br />

(O’Connor and Dale, 2011).<br />

The following tables 4 show the mergers, acquisitions and market exits which have<br />

taken place over the last 30 – 40 years. These tables show that around 50 European<br />

companies 5 may have been subject to mergers and acquisitions over the past 40 years<br />

or so while over 20 European companies exited the market. While it is not possible to<br />

determine what proportion of these were SMEs (information on turnover of<br />

companies that are no longer active is generally not available), it can be reasonably<br />

assumed (and indeed there are some indications to that effect) that many of these<br />

companies were SMEs. Table 2.22 then provides an overview of cableway<br />

manufacturers that are still active (other than those that are part of the Doppelmayr-<br />

Garaventa Group or the Leitner-Poma Group). This table indicates that that in total<br />

there are around 35 cableway manufacturers left in Europe (this includes Norway,<br />

Switzerland and Turkey), the vast majority of which appear to be SMEs. It can thus<br />

be concluded that the high levels of mergers, acquisitions and market exits have<br />

resulted in a high degree of market consolidation, with a limited number of small and<br />

medium sized enterprises (SMEs) occupying very small market shares. This view is<br />

also shared by EC (2011).<br />

4<br />

5<br />

These tables are based on a large number of sources, including Bergbahnen (nd).<br />

Please note that this includes Swiss companies.<br />

Page 17