Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

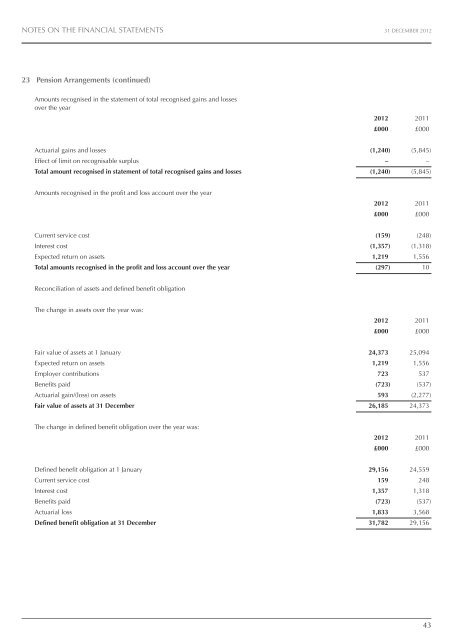

NOTES ON THE FINANCIAL STATEMENTS 31 DECEMBER <strong>2012</strong><br />

23 Pension arrangements (continued)<br />

Amounts recognised in the statement of total recognised gains and losses<br />

over the year<br />

<strong>2012</strong> 2011<br />

£000 £000<br />

Actuarial gains and losses<br />

Effect of limit on recognisable surplus<br />

total amount recognised in statement of total recognised gains and losses<br />

(1,240) (5,845)<br />

– –<br />

(1,240) (5,845)<br />

Amounts recognised in the profit and loss account over the year<br />

<strong>2012</strong> 2011<br />

£000 £000<br />

Current service cost<br />

Interest cost<br />

Expected return on assets<br />

total amounts recognised in the profit and loss account over the year<br />

(159) (248)<br />

(1,357) (1,318)<br />

1,219 1,556<br />

(297) 10<br />

Reconciliation of assets and defined benefit obligation<br />

The change in assets over the year was:<br />

<strong>2012</strong> 2011<br />

£000 £000<br />

Fair value of assets at 1 January<br />

Expected return on assets<br />

Employer contributions<br />

Benefits paid<br />

Actuarial gain/(loss) on assets<br />

Fair value of assets at 31 December<br />

24,373 25,094<br />

1,219 1,556<br />

723 537<br />

(723) (537)<br />

593 (2,277)<br />

26,185 24,373<br />

The change in defined benefit obligation over the year was:<br />

<strong>2012</strong> 2011<br />

£000 £000<br />

Defined benefit obligation at 1 January<br />

Current service cost<br />

Interest cost<br />

Benefits paid<br />

Actuarial loss<br />

Defined benefit obligation at 31 December<br />

29,156 24,559<br />

159 248<br />

1,357 1,318<br />

(723) (537)<br />

1,833 3,568<br />

31,782 29,156<br />

43