Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan Annual Report 2012 - Cadogan

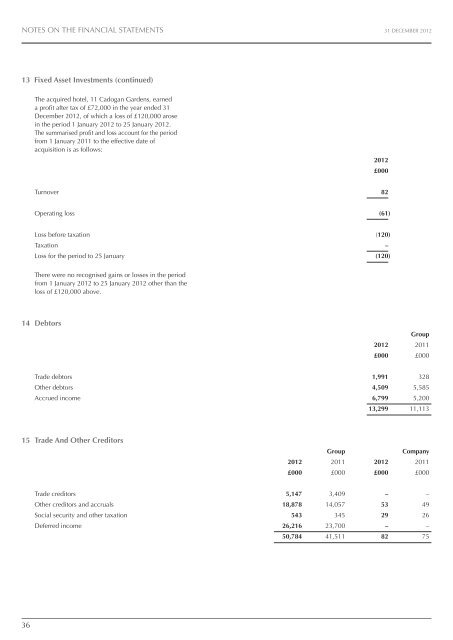

NOTES ON THE FINANCIAL STATEMENTS 31 DECEMBER 2012 13 Fixed asset investments (continued) The acquired hotel, 11 Cadogan Gardens, earned a profit after tax of £72,000 in the year ended 31 December 2012, of which a loss of £120,000 arose in the period 1 January 2012 to 25 January 2012. The summarised profit and loss account for the period from 1 January 2011 to the effective date of acquisition is as follows: 2012 £000 Turnover 82 Operating loss (61) Loss before taxation Taxation Loss for the period to 25 January (120) – (120) There were no recognised gains or losses in the period from 1 January 2012 to 25 January 2012 other than the loss of £120,000 above. 14 Debtors Group 2012 2011 £000 £000 Trade debtors Other debtors Accrued income 1,991 328 4,509 5,585 6,799 5,200 13,299 11,113 15 trade and other Creditors Group Company 2012 2011 2012 2011 £000 £000 £000 £000 Trade creditors Other creditors and accruals Social security and other taxation Deferred income 5,147 3,409 – – 18,878 14,057 53 49 543 345 29 26 26,216 23,700 – – 50,784 41,511 82 75 36

NOTES ON THE FINANCIAL STATEMENTS 31 DECEMBER 2012 16 Borrowings (a) Bank loans and overdrafts Repayable other than by instalments: Group 2012 2011 £000 £000 Bank loans and overdrafts – – At 31 December 2012 the group had committed but undrawn credit facilities of £50.0 million (2011 - £75.0 million) under a revolving credit facility arrangement. (b) other long term Borrowings Amounts falling within one year: 6.941% commercial mortgage loan 2025 Amounts falling due in two to five years: 5.75% unsecured loan notes 2016 6.941% commercial mortgage loan 2025 Amounts falling due in more than five years: 5.75% unsecured loan notes 2016 6.45% $40m unsecured loan notes 2018 7.33% £4m unsecured loan notes 2018 6.60% $45m unsecured loan notes 2020 5.04% £45m unsecured loan notes 2021 3.45% £15m unsecured loan notes 2022 6.75% $23m unsecured loan notes 2023 6.941% commercial mortgage loan 2025 3.88% £15m unsecured loan notes 2027 5.25% $60m unsecured loan notes 2028 5.53% $60m unsecured loan notes 2032 5.77% $90m unsecured loan notes 2036 6.01% £30m unsecured loan noted 2041 6.87% £20m unsecured loan notes 2042 5.92% $30m unsecured loan notes 2046 5.11% £25m unsecured loan notes 2046 7.40% $58m unsecured loan notes 2051 5.13% £40m unsecured loan notes 2056 Group Company 2012 2011 2012 2011 £000 £000 £000 £000 4,000 4,000 – – 3,080 – 3,080 – 16,000 16,000 – – 19,080 16,000 3,080 – – 3,080 – 3,080 20,141 20,141 – – 4,000 4,000 – – 22,659 22,659 – – 45,000 45,000 – – 15,000 – – – 11,581 11,581 – – 72,000 76,000 – – 15,000 – – – 37,523 37,523 – – 37,524 37,524 – – 45,720 45,720 – – 30,000 30,000 – – 20,000 20,000 – – 15,240 15,240 – – 25,000 25,000 – – 29,204 29,204 – – 40,000 40,000 – – 485,592 462,672 – 3,080 Total other long term borrowings 508,672 482,672 3,080 3,080 37

- Page 1 and 2: CADOGAN GROUP LIMITED Annual Report

- Page 3 and 4: CHAIRMAN’S STATEMENT 31 DECEMBER

- Page 5 and 6: Financial Highlights GROSS RENTS AN

- Page 8: CHIEF ExECUTIVE’S REVIEW 31 DECEM

- Page 12: CHIEF ExECUTIVE’S REVIEW 31 DECEM

- Page 16 and 17: CHIEF ExECUTIVE’S REVIEW 31 DECEM

- Page 18: CHIEF ExECUTIVE’S REVIEW 31 DECEM

- Page 21 and 22: 20 DIRECTORS’ REPORT 31 DECEMBER

- Page 23 and 24: INDEPENDENT AUDITOR’S REPORT 31 D

- Page 25 and 26: CONSOLIDATED BALANCE SHEET 31 DECEM

- Page 27 and 28: COMPANY BALANCE SHEET 31 DECEMBER 2

- Page 29 and 30: NOTES ON THE FINANCIAL STATEMENTS 3

- Page 31 and 32: NOTES ON THE FINANCIAL STATEMENTS 3

- Page 33 and 34: NOTES ON THE FINANCIAL STATEMENTS 3

- Page 35 and 36: NOTES ON THE FINANCIAL STATEMENTS 3

- Page 37: NOTES ON THE FINANCIAL STATEMENTS 3

- Page 41 and 42: NOTES ON THE FINANCIAL STATEMENTS 3

- Page 43 and 44: NOTES ON THE FINANCIAL STATEMENTS 3

- Page 45 and 46: NOTES ON THE FINANCIAL STATEMENTS 3

- Page 47 and 48: FIVE YEAR SUMMARY 31 DECEMBER 2012

NOTES ON THE FINANCIAL STATEMENTS 31 DECEMBER <strong>2012</strong><br />

13 Fixed asset investments (continued)<br />

The acquired hotel, 11 <strong>Cadogan</strong> Gardens, earned<br />

a profit after tax of £72,000 in the year ended 31<br />

December <strong>2012</strong>, of which a loss of £120,000 arose<br />

in the period 1 January <strong>2012</strong> to 25 January <strong>2012</strong>.<br />

The summarised profit and loss account for the period<br />

from 1 January 2011 to the effective date of<br />

acquisition is as follows:<br />

<strong>2012</strong><br />

£000<br />

Turnover<br />

82<br />

Operating loss<br />

(61)<br />

Loss before taxation<br />

Taxation<br />

Loss for the period to 25 January<br />

(120)<br />

–<br />

(120)<br />

There were no recognised gains or losses in the period<br />

from 1 January <strong>2012</strong> to 25 January <strong>2012</strong> other than the<br />

loss of £120,000 above.<br />

14 Debtors<br />

Group<br />

<strong>2012</strong> 2011<br />

£000 £000<br />

Trade debtors<br />

Other debtors<br />

Accrued income<br />

1,991 328<br />

4,509 5,585<br />

6,799 5,200<br />

13,299 11,113<br />

15 trade and other Creditors<br />

Group<br />

Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

£000 £000 £000 £000<br />

Trade creditors<br />

Other creditors and accruals<br />

Social security and other taxation<br />

Deferred income<br />

5,147 3,409 – –<br />

18,878 14,057 53 49<br />

543 345 29 26<br />

26,216 23,700 – –<br />

50,784 41,511 82 75<br />

36