Payments to Foreign Nationals - International Center - University of ...

Payments to Foreign Nationals - International Center - University of ...

Payments to Foreign Nationals - International Center - University of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Payments</strong> <strong>to</strong> <strong>Foreign</strong> <strong>Nationals</strong><br />

Information about Tax Treaties,<br />

Taxpayer Identification Numbers and IRS Forms<br />

Compiled By:<br />

<strong>University</strong> Payroll Office<br />

Revised June, 2011<br />

nra-brochure2011.doc<br />

1

OVERVIEW<br />

Generally, every person born or naturalized in the U.S. and subject <strong>to</strong> its jurisdiction<br />

is a citizen. All other individuals are aliens. Aliens are classified as either nonresident<br />

aliens or resident aliens. Section 1441 <strong>of</strong> the Internal Revenue Code<br />

provides a separate tax system with a different set <strong>of</strong> tax rules and regulations for<br />

individuals deemed <strong>to</strong> be “non-resident aliens.” <strong>Payments</strong> made <strong>to</strong> non-resident<br />

aliens are subject <strong>to</strong> different tax withholding, reporting and liability requirements.<br />

The general rule is that 30 percent must be withheld on all fixed and determinable<br />

payments <strong>of</strong> U.S. source income <strong>to</strong> non-resident aliens unless the income is excluded<br />

under a specific provision in the Internal Revenue Code. Income includes: wages or<br />

salary payments made <strong>to</strong> faculty and staff; payments made <strong>to</strong> independent<br />

contrac<strong>to</strong>rs; fellowship/scholarship payments made <strong>to</strong> students, scholars and trainees;<br />

and payments made for royalties.<br />

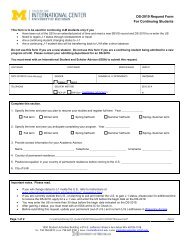

ALIEN CERTIFICATE<br />

An “Alien Certificate” is a <strong>University</strong> <strong>of</strong> Michigan form that is used by the <strong>University</strong><br />

Payroll Office <strong>to</strong> collect information about foreign nationals. The “Alien Certificate”<br />

should be completed and sent <strong>to</strong> the <strong>University</strong> Payroll Office by all foreign nationals<br />

when they first enter the United States and arrive at U<strong>of</strong>M. The information that is<br />

collected is as follows:<br />

• Name<br />

• Social Security Number or Individual Taxpayer ID Number<br />

• Country <strong>of</strong> Residence<br />

• Visa Type<br />

• Original date <strong>of</strong> Entry in<strong>to</strong> the U.S.<br />

Please make sure this information is accurate. This information is used <strong>to</strong> determine<br />

appropriate tax withholding and Substantial Presence Test applicability. They must<br />

include their original date <strong>of</strong> entry in<strong>to</strong> the United States, not only <strong>University</strong> <strong>of</strong><br />

Michigan visits but all visits <strong>to</strong> the United States.<br />

It does not need <strong>to</strong> be completed annually; however, if any information changes, such as<br />

a change in visa type or the person is out <strong>of</strong> the United States more than one year, an<br />

updated “Alien Certificate” should be sent <strong>to</strong> the <strong>University</strong> Payroll Office.<br />

A copy <strong>of</strong> the “Alien Certificate” and Instructions can be found on the <strong>University</strong> Payroll<br />

Office web site at: http://www.finops.umich.edu/system/files/Alien_Certificate.pdf<br />

2

TAXPAYER IDENTIFICATION NUMBERS<br />

Social Security Number or Individual Taxpayer Identification Number<br />

The <strong>University</strong> <strong>of</strong> Michigan is responsible for reporting, <strong>to</strong> the Internal Revenue<br />

Service (IRS), fellowship/scholarship payments, payments made <strong>to</strong> independent<br />

contrac<strong>to</strong>rs, royalties and wages/salary paid <strong>to</strong> all non-resident aliens. IRS reporting<br />

procedure mandates that the <strong>University</strong> supply a Social Security Number (SSN) or an<br />

Individual Taxpayer Identification Number (ITIN) as part <strong>of</strong> the reporting that is done<br />

at the end <strong>of</strong> a calendar year.<br />

Who is eligible for a Social Security Number?<br />

In general, non-immigrant visaholders are only eligible for a SSN IF they<br />

have permission <strong>to</strong> work from the Department <strong>of</strong> Homeland Security (DHS).<br />

They will need <strong>to</strong> show documents demonstrating their immigration status and<br />

DHS permission <strong>to</strong> work in the United States in addition <strong>to</strong> pro<strong>of</strong> <strong>of</strong> age and<br />

identity. For more information about this procedure, please see<br />

http://www.ssa.gov/pubs/10096.html .<br />

F-1 students and J-1 students and scholars must follow special rules.<br />

F-1 students are only eligible for a SSN if they:<br />

• are currently employed on campus, or<br />

• have evidence that they have been <strong>of</strong>fered on-campus<br />

employment, or<br />

• if they have one <strong>of</strong> the following forms <strong>of</strong> employment<br />

authorization:<br />

Curricular Practical Training (CPT),<br />

Optional Practical Training (OPT), or<br />

Employment authorization due <strong>to</strong> severe economic hardship.<br />

F-1 students must provide pro<strong>of</strong> that they meet these requirements when<br />

they apply for a SSN. Detailed instructions and procedures are at<br />

http://internationalcenter.umich.edu/taxes/taxssnapply.html<br />

J-1 students and scholars: In addition <strong>to</strong> the Social Security application<br />

and originals and copies <strong>of</strong> identity and immigration documents, J-1<br />

students and scholars whose Form DS-2019 was issued by the U-M will<br />

need a letter from the <strong>International</strong> <strong>Center</strong> (usually provided at the<br />

Manda<strong>to</strong>ry Check-In). J-1 students and scholars whose Form DS-2019<br />

was not issued by U-M must request the letter from the organization that<br />

issued their Form DS-2019. Detailed instructions are at<br />

http://internationalcenter.umich.edu/taxes/taxssnapply.html<br />

Note: For non-student J-1 Exchange Visi<strong>to</strong>rs, the Social Security<br />

Administration will sometimes accept pro<strong>of</strong> <strong>of</strong> employment by U-M<br />

3

instead <strong>of</strong> the letter from the <strong>International</strong> <strong>Center</strong>, but the <strong>International</strong><br />

<strong>Center</strong> advises using the letter <strong>to</strong> avoid possible delays.)<br />

Applications for Social Security Numbers (SSNs) are submitted <strong>to</strong> the Social Security<br />

Administration Office located at 3971 S. Research Drive, Ann Arbor MI 48108. You<br />

can get there by AATA bus #6 <strong>to</strong> the s<strong>to</strong>p at W. Ellsworth and S. Research Park Drive.<br />

If an individual is eligible <strong>to</strong> apply for a SSN, he/she should do so as soon as possible.<br />

Social Security Cards will be mailed one or two weeks after application. Those<br />

scheduled <strong>to</strong> begin employment soon are advised <strong>to</strong> request a receipt from the Social<br />

Security Administration Office. Also, it is sometimes possible <strong>to</strong> obtain the number,<br />

although not <strong>of</strong> course the card itself, from the Social Security Administration by<br />

calling 1-800-772-1213 and providing identifying details.<br />

Who is eligible for an Individual Taxpayer ID Number?<br />

A non-resident alien who is from a tax treaty country is eligible <strong>to</strong> apply<br />

for an Individual Taxpayer ID Number (ITIN) through the Payroll<br />

Office ONLY if he/she will be receiving scholarship/fellowship funds or<br />

will be an independent contrac<strong>to</strong>r.<br />

The list <strong>of</strong> tax treaty countries for scholarship/fellowship payments can be<br />

found at: http://www.finops.umich.edu/system/files/Scholarship-<br />

Fellowship+Treaty+Countries.pdf<br />

The list <strong>of</strong> tax treaty countries for independent contrac<strong>to</strong>rs can be found at:<br />

http://www.finops.umich.edu/system/files/Independent+Personal+Service+<br />

Treaty+Countries.pdf<br />

If a non-resident alien is not from a tax treaty country they can not apply for<br />

an ITIN through the payroll <strong>of</strong>fice but can apply with the IRS at the time<br />

they file a U.S. federal income tax return.<br />

A non-resident alien is not eligible <strong>to</strong> apply for an ITIN solely <strong>to</strong> use for<br />

opening a bank account or applying for a credit card.<br />

Non-resident alien receiving scholarship/fellowship income, the following<br />

steps and information are necessary <strong>to</strong> apply for an ITIN:<br />

1. Even though the individual is not eligible for a SSN, he/she must apply<br />

for a SSN using the process above and be denied a SSN.<br />

2. The non-resident alien should then contact the <strong>University</strong> Payroll Office<br />

<strong>to</strong> apply for an ITIN. An appointment should be made with the Tax<br />

Supervisor in the Payroll Office. The following original documents are<br />

required and should be brought <strong>to</strong> the appointment:<br />

• alien certificate<br />

• passport<br />

4

• visa information<br />

• DS-2019 or I-20<br />

• denial letter from the Social Security Administration (issued when<br />

application for SSN was denied)<br />

• completed Form W-7 (can be found on the Payroll Office web site:<br />

http://www.irs.gov/pub/irs-pdf/fw7.pdf<br />

A Form W-8BEN will also be completed at this time and when the ITIN is<br />

received the payroll <strong>of</strong>fice will complete the Form W-8BEN with the ITIN<br />

<strong>to</strong> begin taking tax treaty benefits on the scholarship/fellowship payments.<br />

If an individual who has only an ITIN is eventually employed at the<br />

<strong>University</strong> or elsewhere, he/she should then apply for a SSN and begin using<br />

the SSN in place <strong>of</strong> the ITIN.<br />

Non-resident alien who are being paid as independent contrac<strong>to</strong>rs through a<br />

People Pay form, the following steps and information are necessary <strong>to</strong> apply<br />

for an ITIN:<br />

1. The department should then contact the Tax Supervisor in the Payroll<br />

Office <strong>to</strong> set up an appointment <strong>to</strong> have the nonresident alien apply for<br />

an ITIN. The following original documents are required and should be<br />

brought <strong>to</strong> the appointment:<br />

• alien certificate<br />

• passport<br />

• visa information<br />

• invitation letter from department<br />

• completed Form W-7 (can be found on the Payroll Office web site:<br />

http://www.irs.gov/pub/irs-pdf/fw7.pdf<br />

If possible when applying for an ITIN for a People Pay form payment<br />

bring the People Pay form and completed Form 8233 <strong>to</strong> the appointment<br />

<strong>to</strong> keep all the paperwork <strong>to</strong>gether.<br />

If an individual who has only an ITIN is eventually issued a SSN they<br />

should begin using the SSN in place <strong>of</strong> the ITIN.<br />

DETERMINATION OF TAX STATUS<br />

<strong>Foreign</strong> nationals authorized <strong>to</strong> work in the U.S. are classified as either resident aliens<br />

or non-resident aliens for U.S. tax purposes. The distinction between these two<br />

classifications is important since resident aliens, like U.S. citizens, are taxed on their<br />

worldwide income, while non-resident aliens are taxed only on their U.S. source<br />

income. The individual will be considered a non-resident unless it can be established<br />

that he or she is a resident alien as evidenced by the following:<br />

1. Lawful Permanent Residency Test (also called the “Green Card” test): If you<br />

have been given the privilege according <strong>to</strong> the immigration laws <strong>of</strong> residing<br />

5

permanently in the U.S. as an immigrant, and this status has not been revoked or<br />

abandoned, then you are a lawful permanent resident <strong>of</strong> the U.S.<br />

2. Substantial Presence Test: (Resident Alien Status)<br />

To qualify for the Substantial Presence Test:<br />

a. A student, temporarily present in the U.S. under an F-1 or J-1 visa must be in<br />

the U.S. for 5 calendar years (counting all or part <strong>of</strong> a year as a full year) plus<br />

183 days in the current year.<br />

b. A teacher or trainee, temporarily present in the U.S. under a J-1 visa must be<br />

in the U.S. for at least 2 years plus 183 days in the current year.<br />

c. Aliens on all other visas must be present in the U.S. for 183 days or more<br />

during the calendar year <strong>to</strong> claim resident alien status for U.S. tax purposes.<br />

To determine resident alien status, all international faculty and staff must complete<br />

and return an Alien Certificate <strong>to</strong> the <strong>University</strong> Payroll Office (G395 Wolverine<br />

Tower, 1279) for processing. Alien Certificates can be found in the “Forms/Tables”<br />

option on the Payroll Web site:<br />

http://www.finops.umich.edu/system/files/Alien_Certificate.pdf<br />

FICA (Social Security and Medicare Tax)<br />

Information on the “Alien Certificate” is used <strong>to</strong> determine whether an individual is<br />

exempt from FICA tax. To be exempt from FICA tax withholding an individual must<br />

be:<br />

1. A non-resident alien;<br />

2. Present in the U.S. under an F-1, J-1, M-1, or Q-1 visa; and<br />

3. Performing services in accordance with the primary purpose <strong>of</strong> the visa’s<br />

issuance.<br />

Students holding an F-1, J-1, M-1 or Q-1 visa are exempt from FICA for the first 5<br />

calendar years they are in the U.S. Once they become resident aliens under the<br />

Substantial Presence Test, they are eligible for FICA tax withholding on January 1st<br />

<strong>of</strong> the calendar year in which they become a resident alien.<br />

For example, an F-1 student arrives for the first time in the United States August 2010<br />

he will be exempt from FICA taxes through December 2014. On January 1 st 2015 he<br />

must have FICA txes withheld from his payments.<br />

Pr<strong>of</strong>essors and researchers holding J-1 visas are exempt from FICA for either the first<br />

2 calendar years they are in the U.S., or for 2 out <strong>of</strong> the last 6 calendar years in the<br />

U.S. Once they become resident aliens under the Substantial Presence Test, they are<br />

eligible for FICA withholding beginning on January 1st <strong>of</strong> the calendar year in which<br />

they become a resident alien.<br />

For example, a J-1 teacher/researcher arrives for the first time in the United States<br />

August 2010 she will be exempt from FICA taxes through December 2011. On<br />

January 1 st 2012 she must have FICA taxes withheld from her payments.<br />

6

NOTE: If an individual expects <strong>to</strong> stay in the U.S. less than 183 days in the<br />

year in which his/her status changes <strong>to</strong> “resident alien”, the individual may<br />

provide pro<strong>of</strong> <strong>to</strong> the <strong>University</strong> Payroll Office that he/she will be leaving<br />

within 183 days and FICA tax will not be withheld. A plane ticket <strong>to</strong> return<br />

<strong>to</strong> the country <strong>of</strong> residence is considered pro<strong>of</strong>.<br />

FORM W-4 PROCESSING<br />

<strong>Payments</strong> made <strong>to</strong> non-resident alien employees are subject <strong>to</strong> special withholding<br />

rules. Generally, their filing status is restricted and the number <strong>of</strong> allowable<br />

exemptions is limited. This is required because the non-resident alien cannot claim<br />

the standard deduction. The federal Form W-4 for a non-resident alien must:<br />

1. Indicate only “Single” marital status (regardless <strong>of</strong> actual marital status).<br />

2. Claim only one withholding allowance, unless a resident <strong>of</strong> Canada, Mexico or<br />

South Korea.<br />

3. Have “NRA” written on Line 6.<br />

4. Be blank on line 7. (Do not write the word “exempt”).<br />

Even if the individual is married with two or more children the Form W-4 must be<br />

completed as instructed above.<br />

Federal and state Forms W-4 completed by nonresident aliens must be completed on<br />

paper they cannot enter this information in Wolverine Access. These forms should be<br />

submitted <strong>to</strong> the <strong>University</strong> Payroll Office when the individual first begins <strong>to</strong> receive<br />

salary. These forms do not have <strong>to</strong> be updated annually. (All U.S. citizens must<br />

complete their Federal and state Forms W-4 online in Wolverine Access).<br />

Questions can be directed <strong>to</strong> a Payroll Tax Representative in the HR/Payroll Service<br />

<strong>Center</strong> at 5-2000 (from campus); 615-2000 (from within the Ann Arbor area); or <strong>to</strong>llfree<br />

1-866-647-7657 (outside <strong>of</strong> the Ann Arbor area).<br />

INCOME TAX TREATIES<br />

The <strong>University</strong> makes various types <strong>of</strong> payments <strong>to</strong> non-resident aliens who may be<br />

non-taxable for United States and State <strong>of</strong> Michigan income tax purposes if:<br />

• There is a tax treaty in effect with their country <strong>of</strong> permanent residence, and<br />

• Specific articles under the tax treaty grant the exemption.<br />

These various types <strong>of</strong> payments <strong>to</strong> non-resident aliens include:<br />

• Fellowship/Scholarship payments<br />

• <strong>Payments</strong> for independent personal services (People Pay Forms)<br />

• Wages paid <strong>to</strong> students<br />

• Wages paid <strong>to</strong> teachers/researchers<br />

• Royalty <strong>Payments</strong><br />

If income cannot be exempt from tax based on a tax treaty, tax withholding for<br />

salary/wages paid <strong>to</strong> non-resident aliens uses the graduated tax rates.<br />

7

Fellowship/Scholarship payments <strong>to</strong> non-resident aliens are taxed at a 14% rate and<br />

People Pay Form payments at a 30% rate.<br />

Countries With Relevant Tax Treaty Provisions<br />

The “<strong>Foreign</strong> Students, Faculty & Staff” section <strong>of</strong> the Payroll web site, under the<br />

“Tax Treaty Country List and Information” link, lists the country/tax treaty<br />

provisions for the types <strong>of</strong> payments mentioned above. Please note that these<br />

tables are updated in April <strong>of</strong> every calendar year. The web site is:<br />

http://www.finops.umich.edu/payroll/forms/taxtreaties<br />

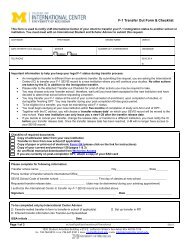

Forms To Be Used To Claim Tax Treaty Exemption<br />

If a payment can be considered non-taxable under a tax treaty, the recipient <strong>of</strong> the<br />

payment may request that no taxes be withheld by completing and submitting the<br />

proper form(s) <strong>to</strong> the <strong>University</strong> <strong>of</strong> Michigan Payroll Office, G395 Wolverine<br />

Tower, 1279. The form(s) <strong>to</strong> use for each type <strong>of</strong> payment is indicated below.<br />

The forms can be found in the “Forms/Tables” section <strong>of</strong> the Payroll web site<br />

under <strong>Foreign</strong> Students, Faculty & Staff. The website is:<br />

http://www.finops.umich.edu/payroll/forms<br />

Payment Type<br />

Teaching/Research Wages<br />

Independent Personal Services (People Pay form)<br />

Student Wages<br />

Fellowship/Scholarships<br />

Royalty <strong>Payments</strong><br />

Resident Alien for tax purposes<br />

Documents<br />

Alien Certificate & Form 8233 plus<br />

Attachment* (SSN only)<br />

Form 8233 plus Attachment* (SSN or ITIN)<br />

Alien Certificate & Form 8233 plus<br />

Attachment* (SSN only)<br />

Alien Certificate & Form W-8BEN* (SSN or<br />

ITIN)<br />

Alien Certificate & Form W-8BEN* (SSN or<br />

ITIN)<br />

W-9 plus Attachment (SSN only)<br />

*Please note that a SSN or an ITIN is a requirement for a non-resident <strong>to</strong> claim a<br />

Tax Treaty benefit. Forms 8233 and Forms W-8 BEN submitted without a SSN<br />

or an ITIN cannot be processed and the individual will be taxed at the rates<br />

mentioned above. Therefore, if an individual does not have a SSN or an<br />

ITIN, only complete and submit an Alien Certificate.<br />

See examples <strong>of</strong> a completed Alien Certificate, Form 8233 and Form W-8 BEN in<br />

Appendix III.<br />

Frequency <strong>of</strong> Submitting Forms<br />

Type <strong>of</strong> Form<br />

Alien Certificate<br />

Forms W-4<br />

8<br />

Frequency <strong>to</strong> Submit Form<br />

Once - upon initial arrival at U-M. Updated if<br />

visa type changes.<br />

Once - at beginning <strong>of</strong> employment relationship.

Updated when individuals attains “resident alien”<br />

status.<br />

Form 8233 & Attachment<br />

Form W-8 BEN<br />

Form W-9<br />

Annually – prior <strong>to</strong> the beginning <strong>of</strong> each<br />

calendar year. ONLY submit if country <strong>of</strong><br />

residence has a tax treaty with the United States<br />

and ONLY if individual has a SSN or ITIN.<br />

Once - at beginning <strong>of</strong> student/scholar<br />

relationship with the <strong>University</strong>. ONLY submit if<br />

country <strong>of</strong> residence has a tax treaty with the<br />

United States and ONLY if individual has a SSN<br />

or ITIN.<br />

When individual has attained a “resident alien”<br />

status, but are still tax treaty eligible. ONLY<br />

submit if country <strong>of</strong> residence has a tax treaty<br />

with the United States and ONLY if individual<br />

has a SSN or ITIN.<br />

9

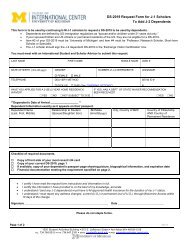

NAME OF Non-resident Alien<br />

SSN or ITIN<br />

Choose<br />

One<br />

Complete if<br />

applicable<br />

Choose<br />

One<br />

10

All highlighted<br />

fields must be<br />

completed for the<br />

Form 8233 <strong>to</strong> be<br />

valid.<br />

Box checked<br />

for student,<br />

teacher or<br />

researcher. Not<br />

independent<br />

contrac<strong>to</strong>r.<br />

11

12<br />

Box must be<br />

completed for<br />

independent<br />

contrac<strong>to</strong>r.

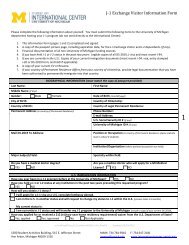

NAME OF Non-resident Alien<br />

Individual’s country <strong>of</strong> residence<br />

0%<br />

Scholarship/Fellowship<br />

Student at the <strong>University</strong> <strong>of</strong> Michigan<br />

13