Dish TV Investor Presentation Aug 09

Dish TV Investor Presentation Aug 09

Dish TV Investor Presentation Aug 09

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DISH <strong>TV</strong> INDIA LIMITED<br />

Corporate <strong>Presentation</strong>

Disclaimer<br />

This presentation contains certain “forward looking statements.” These forward looking statements that include words or phrases such as <strong>Dish</strong> <strong>TV</strong> India Limited (the "Company") or its<br />

management “believes”, “expects”, “anticipates”, “intends”, “plans”, “foresees”, or other words or phrases of similar import. Similarly, statements that describe the Company’s<br />

objectives, plans or goals also are forward-looking statements. All such forward looking statements are subject to certain risks and uncertainties that could cause actual results to differ<br />

materially from those contemplated by the relevant forward-looking statement. Such forward looking statements are made based on management’s current expectations or beliefs as well<br />

as assumptions made by, and information currently available to, management.<br />

Neither the Company nor any of its advisors nor any of their respective affiliates, shareholders, directors, employees, agents or advisers makes expressed or implied representations or<br />

warranties as to the accuracy and completeness of the information contained herein and neither of them shall accept any responsibility or liability (including any third party liability) for<br />

any loss or damage, whether or not arising from any error or omission in compiling such information or as a result of any party’s reliance or use of such information. The information and<br />

opinions in this presentation are subject to change without notice.<br />

This presentation does not constitute a placement document, prospectus or other placement document in whole or in part. This presentation shall not constitute an offer to sell or the<br />

solicitation of an offer to buy any security. There shall be no sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to<br />

qualification under securities laws of such state or jurisdiction. This presentation must not be distributed to the press or any media organization.<br />

“This is for informational purposes only and is not a solicitation of any bid from you or any investor. Nothing in the foregoing shall constitute and/or deem to constitute an offer or an<br />

invitation to an offer, to be made to the Indian public or any section thereof through this document, and this document and its contents should not be construed to be a prospectus in India.<br />

This document has not been and will not be reviewed or approved by any statutory or regulatory authority in India or by any stock exchanges in India. This document does not comply with<br />

the disclosure requirements prescribed by the SEBI or any other applicable authority in relation to a public issue of securities on the Indian stock exchanges.<br />

This document and the contents hereof are restricted for only the intended recipient(s). This document and the contents hereof should not be (i) forwarded or delivered or<br />

transmitted in any manner whatsoever, to any other person other than the intended recipient(s); or (ii) reproduced in any manner whatsoever, and in particular, may not be<br />

forwarded to any US person or any address in the United States. Any forwarding, distribution or reproduction of this document in whole or in part is unauthorized. Failure to comply<br />

with this directive may result in a violation of the US Securities Act of 1933, as amended, or the applicable laws of other jurisdictions. The Company or any other parties whose<br />

names appear herein, shall not be liable for any statements made herein or any event or circumstance arising there from.<br />

This document has been made available to you in electronic form. You are reminded that documents transmitted via this medium may be altered or changed during the process of<br />

transmission. In accessing this document, you agree to be bound by the terms and conditions hereof, including any modifications to them any time you receive any information from us as a<br />

result of such access.”<br />

This presentation is not an offer for sale of securities in the United States. The securities of the Company have not been and will not be registered under the U.S. Securities Act of 1933, as<br />

amended (the "Securities Act"). The securities of the Company may not be offered or sold in the United States or to or for the account or benefit of U.S. persons (as such term is defined in<br />

Regulation S under the Securities Act) absent registration under the Securities Act or pursuant to an exemption from registration. There will be no public offering of the Company's<br />

securities in the United States.<br />

2

DTH Industry Overview

India <strong>TV</strong> industry and DTH overview<br />

Increasing <strong>TV</strong> Penetration<br />

Pay-<strong>TV</strong> market on a growth trajectory<br />

No of Households in MM<br />

250<br />

225<br />

200<br />

175<br />

150<br />

125<br />

100<br />

75<br />

220<br />

215<br />

2<strong>09</strong><br />

103<br />

104<br />

105<br />

106<br />

51%<br />

54%<br />

53%<br />

49%<br />

225 229 233 236 239 241 243<br />

88<br />

91 89<br />

94<br />

64%<br />

100<br />

96<br />

62%<br />

63%<br />

60%<br />

59%<br />

56%<br />

129 136 142 148 152 155<br />

103 110 116 122<br />

70%<br />

65%<br />

60%<br />

55%<br />

50%<br />

45%<br />

175<br />

150<br />

125<br />

100<br />

75<br />

50<br />

25<br />

56%<br />

57<br />

59%<br />

65<br />

62%<br />

72<br />

67%<br />

82<br />

73%<br />

94<br />

77%<br />

105<br />

81%<br />

115<br />

84%<br />

124<br />

86%<br />

131<br />

88%<br />

137<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

50<br />

2004 2005 2006 2007 2008 20<strong>09</strong>p 2010p 2011p 2012p 2013p<br />

40%<br />

-<br />

2004 2005 2006 2007 2008 20<strong>09</strong>p 2010p 2011p 2012p 2013p<br />

A nalog Cable <strong>TV</strong> DTH Digital + IP<strong>TV</strong> Pay-<strong>TV</strong> as a % of Total <strong>TV</strong> HH<br />

20%<br />

Source: MPA report 20<strong>09</strong><br />

<strong>TV</strong> HH Non-<strong>TV</strong> HH <strong>TV</strong> as of % of Total HH<br />

DTH gaining foothold in <strong>TV</strong> HHs<br />

Source: MPA report 20<strong>09</strong><br />

Share in incremental Pay <strong>TV</strong> HH added<br />

70.0%<br />

2004 2005 2006 2007 2008 20<strong>09</strong>p 2010p 2011p 2012p 2013p<br />

64% 64% 64% 64% 64% 63% 63%<br />

61%<br />

100%<br />

2%<br />

59%<br />

1% 4% 9%<br />

7%<br />

12% 11%<br />

60.0% 55%<br />

19%<br />

56%<br />

29% 43%<br />

80%<br />

27%<br />

50.0%<br />

40.0%<br />

60%<br />

60% 62%<br />

99% 96%<br />

63%<br />

89%<br />

30.0%<br />

24%<br />

40%<br />

62%<br />

22%<br />

20%<br />

67%<br />

63% 61%<br />

20.0%<br />

17 %<br />

13 %<br />

20%<br />

9%<br />

28% 26%<br />

10.0%<br />

18%<br />

3%<br />

9%<br />

0% 0% 1%<br />

0%<br />

-5%<br />

0.0%<br />

-17%<br />

2004 2005 2006 2007 2008 20<strong>09</strong>p 2010p 2011p 2012p 2013p<br />

-20%<br />

% Analog Cable <strong>TV</strong> % DTH % Digital + IP<strong>TV</strong><br />

% DTH HH to <strong>TV</strong> HH % Cable HH to <strong>TV</strong> HH<br />

Source: MPA report 20<strong>09</strong><br />

Source: MPA report 20<strong>09</strong><br />

• India is a large <strong>TV</strong> market - 129 mm HH in 2008 and expected to grow at a CAGR of 3.4% (2008-13p)<br />

• Pay-<strong>TV</strong> penetration at 73% of <strong>TV</strong> HH of which only 14% are Digital HH (2008)<br />

• Analog is highly fragmented and with limited ability to finance digitization<br />

• DTH expected to garner 60% market share of new Pay-<strong>TV</strong> HH over next 5 years as per MPA 20<strong>09</strong> estimate<br />

4<br />

% share of incremental subscribers

DTH – exponential market growth<br />

45%<br />

40%<br />

35%<br />

DTH % of HH’s – Increasing penetration<br />

• Increased competition fueling high<br />

growth<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

2004 2005 2006 2007 2008 20<strong>09</strong>p 2010p 2011p 2012p 2013p<br />

% DTH HH to Total HH % DTH HH to <strong>TV</strong> HH<br />

DTH % of Cable HH<br />

DTH % of Pay <strong>TV</strong> HH<br />

• High end audio-video quality leading<br />

to increased penetration<br />

• DTH as a % of <strong>TV</strong> HH is expected to<br />

increase to 24% by 2013 (Source: MPA<br />

20<strong>09</strong>)<br />

Source: MPA report 20<strong>09</strong><br />

No. of households in mm<br />

50<br />

40<br />

Rapidly growing - DTH Subscriber base<br />

34<br />

29<br />

30<br />

24<br />

20<br />

18<br />

11<br />

10<br />

CAGR: 20.7% (20<strong>09</strong>p -13p)<br />

38<br />

• DTH leading the nation wide<br />

digitization wave<br />

• DTH HH increased from 1 mm in 2006<br />

to 11 mm in 2008(Source: MPA 20<strong>09</strong>)<br />

• Increased DTH penetration will drive<br />

continuous growth of DTH HH<br />

4<br />

0 0<br />

1<br />

0<br />

2004 2005 2006 2007 2008 20<strong>09</strong>p 2010p 2011p 2012p 2013p<br />

Source: MPA report 20<strong>09</strong><br />

5

Key industry milestones<br />

Subscribers in mm<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

-<br />

Launch of DTH<br />

Services by <strong>Dish</strong> <strong>TV</strong><br />

in select markets<br />

DTH subs breach<br />

the 2 mn mark<br />

between 2 players<br />

Launch of DTH<br />

services by Tatasky<br />

Dispute over<br />

Trigger on<br />

content settled<br />

Digitization CAS made<br />

between <strong>Dish</strong> &<br />

mandatory in select<br />

Star<br />

parts of metros<br />

DTH subscribe<br />

Voluntary Digitization<br />

base at ~10 mn<br />

of Cable players<br />

subs<br />

started to launch<br />

digital cable services<br />

Launch of DTH<br />

operations by<br />

Reliance<br />

Launch of DTH<br />

operations by<br />

Sun Direct<br />

Launch of DTH<br />

operations by<br />

Airtel<br />

Dispute over<br />

content with Sun <strong>TV</strong><br />

settled<br />

Apr-05<br />

<strong>Aug</strong>-05<br />

Dec-05<br />

Apr-06<br />

<strong>Aug</strong>-06<br />

Dec-06<br />

Apr-07<br />

<strong>Aug</strong>-07<br />

Dec-07<br />

Apr-08<br />

<strong>Aug</strong>-08<br />

Dec-08<br />

<strong>Dish</strong> <strong>TV</strong> (mn)<br />

DTH HH (mn)<br />

Source: <strong>Dish</strong> <strong>TV</strong><br />

6

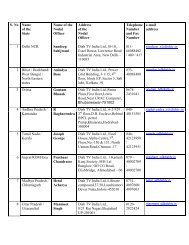

Current DTH landscape<br />

Company<br />

Group Zee Group Tatas Sun <strong>TV</strong> Reliance ADAG Bharti<br />

Launch Date 2 Oct 03 <strong>Aug</strong> 06 Jan 08 <strong>Aug</strong> 08 Oct 08<br />

Subscribers – Dec 08 1 4.5 3.2 2.3 1.1 NA<br />

Ownership 2 Public Private Private Division of R.com Division of Bharti<br />

Technology 2 MPEG2 S1 MPEG2 S1 MPEG4 S1 MPEG4 S1 MPEG4 S2<br />

Geographical Spread 2 ***** *** ** ** *<br />

Distributors 2 ***** *** ** **** *<br />

Pricing Strategy 2 ***** ***** *** ***** *****<br />

Channels tie ups 1 225 200 170 200 150 2<br />

Services 2 40 19 29 54 32<br />

Source: MPA report 20<strong>09</strong> ; 2: <strong>Dish</strong> <strong>TV</strong> estimates<br />

7

Industry -Key regulations<br />

Licensing<br />

regulations<br />

• Total Foreign investment limit of 49% with a sub limit of maximum 20% for Foreign Direct Investment<br />

• Uplink centre in India<br />

• Set-top boxes have to be BIS compliant<br />

• License Fee at 10% of subscription revenues (Proposed for 6% under approval)<br />

• Initial license validity of 10 years; renewable there after<br />

Inter Connect<br />

Regulation<br />

• Content providers have to provide content to all broadcasters; Pricing flexible<br />

• Prohibits broadcasters from guaranteeing minimum number of subscribers<br />

Quality of Service<br />

Regulation<br />

• Subscriber to be offered STBs on Rental / Hire purchase / Sale<br />

• Mechanism to handle customer complaints & grievances<br />

Reference Interconnect<br />

offers<br />

• Pricing information on content of the broadcaster<br />

• Max 50% of Non CAS Cable Rates<br />

• A-la-carte offering to be allowed<br />

8

DISH – Market leader in DTH

<strong>Dish</strong> <strong>TV</strong> – From India’s largest media conglomerate<br />

Essel Group<br />

Company<br />

Business<br />

Market cap<br />

(US$m)<br />

Revenues<br />

(US$m)<br />

<strong>Dish</strong> <strong>TV</strong> (73%) • India’s largest Direct to home satellite distribution company 888 153<br />

Zee Entertainment<br />

Enterprise Ltd (42%)<br />

• 22 entertainment channels covering genres GEC, Movies, Sports, Music,<br />

Religious, Comedy, Lifestyle<br />

1,575 453<br />

Zee News Ltd (54%) • 11 channels covering genres news, business, and regional GECs 204 106<br />

Wire & Wireless India<br />

Ltd (49%)<br />

• India’s largest Cable distribution company 87 57<br />

ETC Networks (71%) • Music and regional channels, education business 23 14<br />

Note: The % figures in bracket indicate shareholding by Mr Subhash Chandra & family; M.Cap as of July 30, <strong>09</strong> ; Revenues as per audited statements of FY 20<strong>09</strong>;<br />

Source: <strong>Dish</strong> <strong>TV</strong><br />

10

<strong>Dish</strong> <strong>TV</strong> - Business model<br />

• Up-front subsidy on set top boxes to acquire subscribers<br />

• Subscription revenues received in advance as per the chosen plan by subscribers<br />

• Other developing revenue streams<br />

• Teleport<br />

• Movies on demand<br />

• A-la carte<br />

• Carriage fees<br />

• Advertisement<br />

• Benefits of economies of scale to accrue – moved from variable payment of content cost to a fixed<br />

payment structure<br />

• Focus on improving ARPU, reducing churn and subscriber acquisition cost (“SAC”)<br />

11

<strong>Dish</strong> <strong>TV</strong> – Key strengths<br />

Market Leadership<br />

• Perceived as the industry pioneer with largest subscriber base<br />

• Carried and distributed by majority third party distributors and dealers<br />

• Strong Branding with consumers<br />

Largest channel<br />

offering with<br />

diversified<br />

content<br />

Sales & Distribution<br />

network<br />

• Largest number of channels offered on DTH platform – 240 channels & services (Jun<strong>09</strong>)<br />

• ZEE brand name and content backing ==> One of India’s leading media group<br />

• Continuous focus on strong regional content in linguistic zones<br />

• Leverage in content tie-ups due to a dominant market leadership position<br />

• Pan-India presence through 800 distributors & ~48,000 dealers across 6600 towns as of<br />

Jun <strong>09</strong><br />

• Network managed by over 200 sales personnel – 8 zonal and 9 regional offices (Jun <strong>09</strong>)<br />

• ~600 ‘<strong>Dish</strong> Shoppees’ to provide demo product experience to prospective users as of<br />

Jun-<strong>09</strong><br />

• Incentive of dealers is per STB sold<br />

Advanced<br />

infrastructure<br />

• Sufficient capacity to broadcast increasing channels – current 9 ku band transponders<br />

• Model geared to grow in future – adding to transponder capacity and technology<br />

upgrade on cards<br />

• Heavy capex investment enables to deliver a high end audio-video quality<br />

12

<strong>Dish</strong> <strong>TV</strong> – Strategy<br />

Customer<br />

acquisition<br />

strategy<br />

• Focused marketing leading to creation of a BRAND – SRK campaign<br />

• Largest content offering and digital viewing experience<br />

• Aligned dealer incentive structure-Higher incentives for subscriber at<br />

higher packs<br />

• Competitive pricing, A-la carte offerings and ease of making payments<br />

• Distribution and after sales service<br />

Customer<br />

retention<br />

strategy<br />

• Promotions and dealer incentives offered on an ongoing basis to retain<br />

customers through innovative packages<br />

• Over 350 <strong>Dish</strong> Care Centers (DCCs) & service franchisees providing<br />

installation and after sale-service as of Mar-<strong>09</strong><br />

• In-house call centre, operating 24*7 with capacity of up to 800 operators<br />

13

Select key management personnel<br />

Mr. Subhash Chandra<br />

Non-Executive Chairman<br />

Mr.Jawahar Lal Goel<br />

Managing Director<br />

Mr.Salil Kapoor<br />

Chief Operating Officer<br />

Mr. Rajiv Khattar<br />

President Projects<br />

Mr. Amitabh Kumar<br />

President Technology<br />

• Mr.Chandra is the promoter of Essel Group of Companies<br />

• His business interests include television networks and film entertainment, cable systems, satellite communications,<br />

theme parks, flexible packaging, family entertainment centers and online gaming<br />

• Mr. Chandra has been the recipient of numerous honorary degrees, industry awards and civic honors, including being<br />

named ‘Global Indian Entertainment Personality of the Year’ by FICCI for 2004, ‘Business Standard’s Businessman of<br />

the Year’ in 1999, ‘Entrepreneur of the Year’ by Ernst & Young in 1999 and ‘Enterprise CEO of the Year’ by<br />

International Brand Summit.<br />

• Jawahar Lal Goel has been the Managing Director of <strong>Dish</strong> <strong>TV</strong> since January 6, 2007<br />

• Mr. Goel is been actively involved in the creation and expansion of Essel Group of Industries and has been<br />

instrumental in establishing <strong>Dish</strong> <strong>TV</strong> as a prominent DTH brand in India.<br />

• He is the president of the Indian Broadcasting Foundation and is an active member on the Board of various<br />

committees and task forces, set up by Ministry of Information & Broadcasting.<br />

• Salil Kapoor has been the Chief Operating Officer since July 2008. He is responsible for sales, marketing, service and<br />

overall supervision of the zonal offices of Company.<br />

• He has work experience of over 18 years in the industry with various global corporations including Samsung India Elec.<br />

Ltd., Microsoft Corp.India (Pvt) Ltd., LG Electronics India, Blue Star Limited and Fedders Llyod Ltd.<br />

• Mr. Kapoor holds a bachelor of engineering from Bangalore University and MBA from University of Delhi.<br />

• Rajiv Khattar has been the President-Projects of our Company since September 1, 2005. He is responsible for<br />

strategic tie-ups and technology upgrades of the DTH platform.<br />

• Mr. Khattar has an aggregate work experience of 20 years and experience of 12 years in the telecom industry. Prior to<br />

joining <strong>Dish</strong>, he worked with Reliance Infocom Limited as the President for Netway.<br />

• Since September 2005 Mr. Amitab Kumar is responsible for broadcasting operations of the Company<br />

• Prior to joining <strong>Dish</strong>, he has held various senior positions in the Industry including the position of the acting Chairman<br />

and Managing Director of Tata Communications Limited (formerly known as Videsh Sanchar Nigam Limited)<br />

• Mr. Kumar has an aggregate work experience of 31 years in the telecom industry and holds a professional certificate<br />

in electronic data interchange from All India Management Association and Deakin University, Australia<br />

Mr. Rajeev Dalmia<br />

CFO<br />

• Mr. Dalmia has an overall work experience of 20 years in the finance industry and is responsible for maintaining<br />

finance and accounts of the company<br />

• He is a qualified fellow chartered accountant from the Institute of Chartered Accountants of India<br />

14

DISH <strong>TV</strong> - Competitive position<br />

<strong>Dish</strong> <strong>TV</strong> – Increasing number of subscribers<br />

<strong>Dish</strong> market share on total subscriber base<br />

No of Subs. MM<br />

6<br />

5<br />

4<br />

3<br />

2.7<br />

2.2<br />

3.0<br />

2.5<br />

3.4<br />

2.9<br />

3.9<br />

3.4<br />

4.7<br />

4.0<br />

5.1<br />

4.3<br />

5.5<br />

4.6<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

3.6<br />

75.7%<br />

2.7<br />

11.1<br />

42.4%<br />

4.7<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

% Share<br />

2<br />

Q3<br />

FY08<br />

Q4<br />

FY08<br />

Q1<br />

FY<strong>09</strong><br />

Q2<br />

FY<strong>09</strong><br />

Q3<br />

FY<strong>09</strong><br />

Q4<br />

FY<strong>09</strong><br />

Q1<br />

FY10<br />

0<br />

Dec-07<br />

Dec-08<br />

0%<br />

Gross Subscriber base MM<br />

Net Subscriber Base<br />

Total DTH HH <strong>Dish</strong> <strong>TV</strong> HH <strong>Dish</strong> <strong>TV</strong> Market Share<br />

Source: <strong>Dish</strong> <strong>TV</strong><br />

Source :Total DTH HH as per MPA report 20<strong>09</strong>; <strong>Dish</strong> <strong>TV</strong> HH – Gross Subscribers as per <strong>Dish</strong> <strong>TV</strong><br />

Players with large and stable subscriber base to emerge as winners in the long<br />

run…..<strong>Dish</strong> <strong>TV</strong> well placed being the largest player in the DTH industry<br />

15

<strong>Dish</strong> <strong>TV</strong> – Financials

<strong>Dish</strong> <strong>TV</strong> - Financials<br />

Revenues - Annual<br />

EBITDA - Annual<br />

9,000<br />

7377<br />

0<br />

FY 07 FY 08 FY <strong>09</strong><br />

0%<br />

7,000<br />

CAGR: 56.9%<br />

-500<br />

-20%<br />

INR MM<br />

5,000<br />

3,000<br />

19<strong>09</strong><br />

4127<br />

-1000<br />

-1500<br />

-2000<br />

-1889<br />

-53%<br />

-26%<br />

-1885<br />

-40%<br />

-60%<br />

-80%<br />

1,000<br />

Source: Audited financials<br />

FY 07 FY 08 FY <strong>09</strong><br />

Revenues - Quarterly<br />

-2500<br />

-99%<br />

Source: Audited financials<br />

-2196<br />

EBITDA - Quarterly<br />

-100%<br />

2,500<br />

2,000<br />

1927<br />

2071<br />

2467<br />

250<br />

0<br />

Q3 FY08 Q4 FY08 Q1 FY<strong>09</strong> Q2 FY<strong>09</strong> Q3 FY<strong>09</strong> Q4 FY<strong>09</strong> Q1 FY10<br />

145<br />

44<br />

6%<br />

2%<br />

20%<br />

0%<br />

INR MM<br />

1733<br />

1644<br />

1,500<br />

1363<br />

1121<br />

1,000<br />

Q3 FY08 Q4 FY08 Q1 FY<strong>09</strong> Q2 FY<strong>09</strong> Q3 FY<strong>09</strong> Q4 FY<strong>09</strong> Q1 FY10<br />

-1000<br />

Source: Published quarterly results<br />

Source: Published quarterly results<br />

-250<br />

-20%<br />

-39% -41%<br />

-390<br />

-500<br />

-50%<br />

-538<br />

-57%<br />

-642<br />

-667<br />

-750<br />

-874<br />

Aggressive subscriber acquisition coupled with higher margins<br />

-20%<br />

-40%<br />

-60%<br />

-80%<br />

-100%<br />

17

Lower content cost driving higher margins<br />

1800<br />

1600<br />

1400<br />

1200<br />

80%<br />

71% 71%<br />

73%<br />

1074<br />

70%<br />

1332<br />

1407<br />

60% 61%<br />

1517<br />

61%<br />

1641<br />

59%<br />

90%<br />

80%<br />

70%<br />

60%<br />

Subs mn<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

588<br />

880<br />

540<br />

529<br />

319<br />

41%<br />

704<br />

971<br />

591<br />

234<br />

39%<br />

29%<br />

29%<br />

40% 39%<br />

454<br />

202<br />

30%<br />

171<br />

27%<br />

91<br />

20%<br />

363 420 502 646 755 804 867 929 670<br />

M ar-07 Jun-07 Sep-07 Dec-07 M ar-08 Jun-08 Sep-08 Dec-08 M ar-<strong>09</strong><br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

<strong>Dish</strong> <strong>TV</strong> moves<br />

from variable to<br />

fixed price content<br />

cost contracts<br />

Content Cost<br />

Content Cost (% Subs Revenue)<br />

Contribution<br />

Contribution (% Subs Revenue)<br />

Source: Company<br />

Contribution margin are steadily improving…..… business heading towards EBIDTA break even<br />

18

Key business metrics<br />

ARPU<br />

INR<br />

180<br />

170<br />

160<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

164<br />

158<br />

150<br />

142<br />

142<br />

137<br />

132<br />

Q3 FY08 Q4 FY08 Q1 FY<strong>09</strong> Q2 FY<strong>09</strong> Q3 FY<strong>09</strong> Q4 FY<strong>09</strong> Q1 FY10<br />

Subscriber acquisition cost<br />

• ARPU under pressure with increased<br />

competition<br />

• Rational pricing to prevail as low pricing<br />

not sustainable over long term<br />

3,000<br />

2832<br />

2,500<br />

2634<br />

2601<br />

2505<br />

2487<br />

INR<br />

2,000<br />

1,500<br />

1880<br />

2034<br />

• Focus on reducing subsidies – Moved to a<br />

model of charging for a bare box and<br />

un-bundling of the content fees and the<br />

Set top boxes<br />

1,000<br />

Q3 FY08 Q4 FY08 Q1 FY<strong>09</strong> Q2 FY<strong>09</strong> Q3 FY<strong>09</strong> Q4 FY<strong>09</strong> Q1 FY10<br />

Source:<br />

<strong>Dish</strong> <strong>TV</strong>; ARPU = (Subscription revenue + activation charges) / Avg. subscribers during the period; SAC = Subsidy on STB+80% of marketing exp.+Comm. to dealers<br />

19

Summary Financials – Quarterly<br />

Quarter ended Jun-08 Mar-<strong>09</strong> Jun-<strong>09</strong><br />

Gross Operating Revenue 1,644 2,071 2,467<br />

Expenditure 2,311 2,027 2,322<br />

EBITDA (667) 44 145<br />

Add: Other Income 2 10 54<br />

Less: Depreciation 446 644 689<br />

EBIT (1,111) (590) (490)<br />

Less: Financial Exps 143 217 202<br />

PBT (1,254) (807) (692)<br />

Provision for Tax 2 2 0<br />

PAT (1,256) (8<strong>09</strong>) (692)<br />

Operating metrics Jun-08 Mar-<strong>09</strong> Jun-<strong>09</strong><br />

Subscribers Added (mm) 0.40 0.35 0.44<br />

SAC ( Rs/sub) 2,634 2,505 2487<br />

ARPU ( INR ) 164 131 142<br />

Source: <strong>Dish</strong> <strong>TV</strong> Earnings release and published quarterly results; Amounts in INR MM unless other wise mentioned<br />

20

Investment summary<br />

Large and growing<br />

DTH market<br />

Pioneer and leader of<br />

DTH services in India<br />

Full-service<br />

business model<br />

Largest channel<br />

offering with<br />

diversified<br />

content<br />

Advanced<br />

infrastructure<br />

• Subscribers expected to grow from c.17m in 20<strong>09</strong> to c. 37mm in 2013 (MPA 20<strong>09</strong> report)<br />

• Competition to fuel growth to the DTH industry – currently only 5 players<br />

• <strong>Dish</strong> <strong>TV</strong> is the only player in the listed space in India and has been recognised as a BRAND<br />

• First mover advantage – ~1 year lead over nearest competitor and ~ 3 year lead over<br />

others<br />

• Leader in the DTH industry - largest subscriber base ~ 5.5 mm (Jun-<strong>09</strong>)<br />

• Backed by Zee Group One of India’s leading Media group<br />

• Basic subscription packs<br />

• Value added services<br />

• Bandwidth<br />

• Teleport services<br />

• 240 channels & Services<br />

• Content tie-ups at fixed rates – largest subscriber base to provide economies of scale<br />

• Only player with sufficient capacity to broadcast increasing channels – current 9<br />

ku band transponders<br />

• Model geared to grow in future – adding to transponder capacity and technology<br />

upgrade on cards<br />

Large distribution<br />

network<br />

• Wide reach to 6,600 towns through 800 distributors and 48,000 dealers (Jun <strong>09</strong>)<br />

• 8 Zonal and 9 regional offices (Jun <strong>09</strong>)<br />

21

Questions?

Thank you