Notes on Canonical Correlation

Notes on Canonical Correlation

Notes on Canonical Correlation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

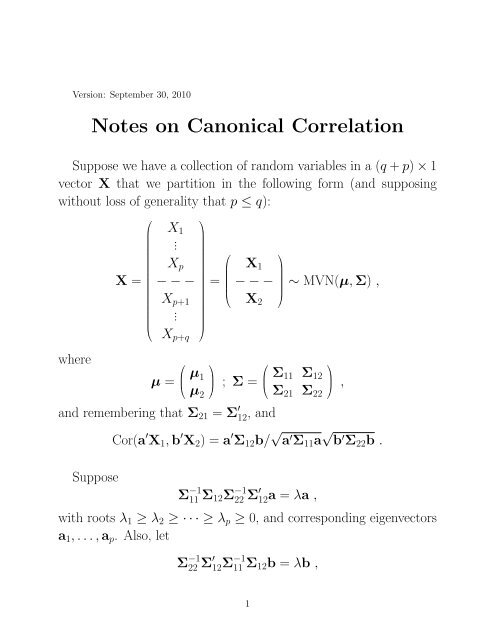

Versi<strong>on</strong>: September 30, 2010<br />

<str<strong>on</strong>g>Notes</str<strong>on</strong>g> <strong>on</strong> Can<strong>on</strong>ical Correlati<strong>on</strong><br />

Suppose we have a collecti<strong>on</strong> of random variables in a (q + p) × 1<br />

vector X that we partiti<strong>on</strong> in the following form (and supposing<br />

without loss of generality that p ≤ q):<br />

where<br />

X =<br />

⎛<br />

⎜<br />

⎝<br />

X 1<br />

.<br />

X p<br />

− − −<br />

X p+1<br />

.<br />

X p+q<br />

µ =<br />

⎞<br />

⎟<br />

⎠<br />

=<br />

⎛ ⎞<br />

⎜ µ 1 ⎟<br />

⎝<br />

µ 2<br />

⎛<br />

⎜<br />

⎝<br />

X 1<br />

− − −<br />

X 2<br />

⎠ ; Σ =<br />

and remembering that Σ 21 = Σ ′ 12, and<br />

Suppose<br />

⎛<br />

⎜<br />

⎝<br />

⎞<br />

⎟<br />

⎠<br />

∼ MVN(µ, Σ) ,<br />

Σ 11 Σ 12<br />

Σ 21<br />

⎞<br />

⎟<br />

⎠ ,<br />

Σ 22<br />

Cor(a ′ X 1 , b ′ X 2 ) = a ′ Σ 12 b/ √ a ′ Σ 11 a √ b ′ Σ 22 b .<br />

Σ −1<br />

11 Σ 12 Σ −1<br />

22 Σ ′ 12a = λa ,<br />

with roots λ 1 ≥ λ 2 ≥ · · · ≥ λ p ≥ 0, and corresp<strong>on</strong>ding eigenvectors<br />

a 1 , . . . , a p . Also, let<br />

Σ −1<br />

22 Σ ′ 12Σ −1<br />

11 Σ 12 b = λb ,<br />

1

with roots λ 1 ≥ λ 2 ≥ · · · ≥ λ p ≥ 0 and λ p+1 = λ q = 0; the<br />

corresp<strong>on</strong>ding eigenvectors are b 1 , . . . , b p .<br />

Looking at the two linear combinati<strong>on</strong>s, a ′ iX 1 (called the i th can<strong>on</strong>ical<br />

variate in the first set), and b ′ iX 2 (called the i th can<strong>on</strong>ical variate<br />

in the sec<strong>on</strong>d set), the squared correlati<strong>on</strong> between them is λ i ; the i th<br />

can<strong>on</strong>ical correlati<strong>on</strong> is √ λ i . The maximum correlati<strong>on</strong> between any<br />

two linear combinati<strong>on</strong>s is √ λ 1 , and is obtained for a 1 and b 1 . For<br />

a i and b i , these are uncorrelated with every can<strong>on</strong>ical variate up to<br />

that point, and maximize the correlati<strong>on</strong> subject to that restricti<strong>on</strong>.<br />

Points to make:<br />

a) The matrices Σ −1<br />

11 Σ 12 Σ −1<br />

22 Σ ′ 12 and Σ −1<br />

22 Σ ′ 12Σ −1<br />

11 Σ 12 are not<br />

symmetric and so the standard eigenvector/eigenvalue decompositi<strong>on</strong>s<br />

are not straightforward. However, the two matrices<br />

and<br />

are symmetric. Also,<br />

and<br />

Σ −1/2<br />

11 Σ 12 Σ −1<br />

22 Σ ′ 12Σ −1/2<br />

11<br />

Σ −1/2<br />

22 Σ ′ 12Σ −1<br />

11 Σ 12 Σ −1/2<br />

22<br />

Σ −1/2<br />

11 Σ 12 Σ −1<br />

22 Σ ′ 12Σ −1/2<br />

11 e i = λ i e i ,<br />

Σ −1/2<br />

22 Σ ′ 12Σ −1<br />

11 Σ 12 Σ −1/2<br />

22 f i = λ i f i ,<br />

where the roots, i.e., the λ i s, are the same as before. We can then<br />

obtain a i = Σ −1/2<br />

11 e i , and b i = Σ −1/2<br />

22 f i . Both Σ −1/2<br />

11 and Σ −1/2<br />

22 are<br />

c<strong>on</strong>structed from the spectral decompositi<strong>on</strong>s of Σ 11 = PDP ′ and<br />

Σ 22 = QFQ ′ as Σ −1/2<br />

11 = PD −1/2 P ′ and Σ −1/2<br />

22 = QF −1/2 Q ′ . Note<br />

2

the normalizati<strong>on</strong>s of Var(a ′ iX 1 ) = a ′ iΣ 11 a ′ i = e ′ iΣ −1/2<br />

11 Σ 11 Σ −1/2<br />

11 e i =<br />

1 and Var(b ′ iX 2 ) = 1.<br />

b) There are three different normalizati<strong>on</strong>s that are comm<strong>on</strong>ly<br />

used for a i and b i :<br />

(i) leave as unit length so a ′ ia i = b ′ ib i = 1;<br />

(ii) make the largest value 1.0 in both a i and b i ;<br />

(iii) do as we did above and make a ′ iΣ 11 a ′ i = 1 = b ′ iΣ 22 b ′ i.<br />

(c) Special cases: When p = 1 and q = 1, λ 1 is the (simple)<br />

squared correlati<strong>on</strong> between two variables; when p = 1 and q > 1,<br />

λ 1 is a squared multiple correlati<strong>on</strong>. In c<strong>on</strong>sidering a ′ iX 1 versus X 2 ,<br />

λ i is the squared multiple correlati<strong>on</strong> of a ′ iX 1 with X 2 ; b i gives the<br />

regressi<strong>on</strong> weights.<br />

(d) When moving to the sample, all items have direct analogues.<br />

The <strong>on</strong>e restricti<strong>on</strong> <strong>on</strong> sample size is n ≥ p + q + 1.<br />

(e) Suppose the variables X 1 and X 2 are transformed by n<strong>on</strong>singular<br />

matrices, A p×p and B q×q , as follows:<br />

Y 1 = A p×p X 1 + c p×1<br />

Y 2 = B q×q X 2 + d q×1<br />

The same can<strong>on</strong>ical variates and correlati<strong>on</strong>s using Y 1 and Y 2 would<br />

be generated as from X 1 and X 2 ; the weights in a i and b i would be<br />

<strong>on</strong> the transformed variables, obviously. In particular, we could work<br />

with standardized variables without loss of any generality, and just<br />

use the correlati<strong>on</strong> matrix.<br />

3

(f) To evaluate H 0 : Σ 12 = 0, a likelihood ratio test is available:<br />

∏<br />

−(n − 1 − (1/2)(p + q + 1)) ln p (1 − λ i ) ∼ χ 2 pq .<br />

Also, sometimes a sequential process is used to test the remaining<br />

roots until n<strong>on</strong>significance is reached:<br />

−(n − 1 − (1/2)(p + q + 1)) ln<br />

p ∏<br />

i=k+1<br />

i=1<br />

(1 − λ i ) ∼ χ 2 (p−k)(q−k) .<br />

This latter sequential procedure is a little problematic because there<br />

is no real c<strong>on</strong>trol over the overall significance level with this strategy.<br />

Generally, there is some tortuous difficulty in interpreting the<br />

can<strong>on</strong>ical weights substantively. I might suggest using a c<strong>on</strong>strained<br />

least-squares approach (iteratively moving from <strong>on</strong>e set to a sec<strong>on</strong>d),<br />

where the weights are forced to be n<strong>on</strong>negative.<br />

4