director - Ministarstvo finansija

director - Ministarstvo finansija

director - Ministarstvo finansija

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Guidebook to the tax system<br />

BULLETIN OF THE MINISTRY OF FINANCE/JANUARY-MARCH 2006<br />

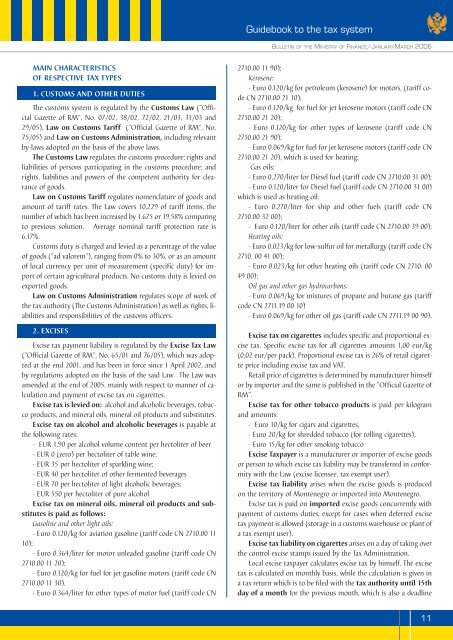

MAIN CHARACTERISTICS<br />

OF RESPECTIVE TAX TYPES<br />

1. CUSTOMS AND OTHER DUTIES<br />

The customs system is regulated by the Customs Law ("Official<br />

Gazette of RM", No. 07/02, 38/02, 72/02, 21/03, 31/03 and<br />

29/05), Law on Customs Tariff ("Official Gazette of RM", No.<br />

75/05) and Law on Customs Administration, including relevant<br />

by-laws adopted on the basis of the above laws.<br />

The Customs Law regulates the customs procedure; rights and<br />

liabilities of persons participating in the customs procedure; and<br />

rights, liabilities and powers of the competent authority for clearance<br />

of goods.<br />

Law on Customs Tariff regulates nomenclature of goods and<br />

amount of tariff rates. The Law covers 10.229 of tariff items, the<br />

number of which has been increased by 1.675 or 19,58% comparing<br />

to previous solution. Average nominal tariff protection rate is<br />

6,17%.<br />

Customs duty is charged and levied as a percentage of the value<br />

of goods ("ad valorem"), ranging from 0% to 30%, or as an amount<br />

of local currency per unit of measurement (specific duty) for import<br />

of certain agricultural products. No customs duty is levied on<br />

exported goods.<br />

Law on Customs Administration regulates scope of work of<br />

the tax authority (The Customs Administration) as well as rights, liabilities<br />

and responsibilities of the customs officers.<br />

2. EXCISES<br />

Excise tax payment liability is regulated by the Excise Tax Law<br />

("Official Gazette of RM", No. 65/01 and 76/05), which was adopted<br />

at the end 2001, and has been in force since 1 April 2002, and<br />

by regulations adopted on the basis of the said Law. The Law was<br />

amended at the end of 2005, mainly with respect to manner of calculation<br />

and payment of excise tax on cigarettes.<br />

Excise tax is levied on: alcohol and alcoholic beverages, tobacco<br />

products, and mineral oils, mineral oil products and substitutes.<br />

Excise tax on alcohol and alcoholic beverages is payable at<br />

the following rates:<br />

- EUR 1,90 per alcohol volume content per hectoliter of beer<br />

- EUR 0 (zero) per hectoliter of table wine;<br />

- EUR 35 per hectoliter of sparkling wine;<br />

- EUR 40 per hectoliter of other fermented beverages<br />

- EUR 70 per hectoliter of light alcoholic beverages;<br />

- EUR 550 per hectoliter of pure alcohol<br />

Excise tax on mineral oils, mineral oil products and substitutes<br />

is paid as follows:<br />

Gasoline and other light oils:<br />

- Euro 0.120/kg for aviation gasoline (tariff code CN 2710.00 11<br />

10);<br />

- Euro 0.364/liter for motor unleaded gasoline (tariff code CN<br />

2710.00 11 20);<br />

- Euro 0.120/kg for fuel for jet gasoline motors (tariff code CN<br />

2710.00 11 30),<br />

- Euro 0.364/liter for other types of motor fuel (tariff code CN<br />

2710.00 11 90);<br />

Kerosene:<br />

- Euro 0.120/kg for petroleum (kerosene) for motors, (tariff code<br />

CN 2710.00 21 10);<br />

- Euro 0.120/kg for fuel for jet kerosene motors (tariff code CN<br />

2710.00 21 20);<br />

- Euro 0.120/kg for other types of kerosene (tariff code CN<br />

2710.00 21 90);<br />

- Euro 0.069/kg for fuel for jet kerosene motors (tariff code CN<br />

2710.00 21 20), which is used for heating;<br />

Gas oils:<br />

- Euro 0.270/liter for Diesel fuel (tariff code CN 2710.00 31 00);<br />

- Euro 0.120/liter for Diesel fuel (tariff code CN 2710.00 31 00)<br />

which is used as heating oil;<br />

- Euro 0.270/liter for ship and other fuels (tariff code CN<br />

2710.00 32 00);<br />

- Euro 0.120/liter for other oils (tariff code CN 2710.00 39 00);<br />

Heating oils:<br />

- Euro 0.023/kg for low-sulfur oil for metallurgy (tariff code CN<br />

2710. 00 41 00);<br />

- Euro 0.023/kg for other heating oils (tariff code CN 2710. 00<br />

49 00);<br />

Oil gas and other gas hydrocarbons:<br />

- Euro 0.069/kg for mixtures of propane and butane gas (tariff<br />

code CN 2711.19 00 10)<br />

- Euro 0.069/kg for other oil gas (tariff code CN 2711.19 00 90).<br />

Excise tax on cigarettes includes specific and proportional excise<br />

tax. Specific excise tax for all cigarettes amounts 1,00 eur/kg<br />

(0,02 eur/per pack). Proportional excise tax is 26% of retail cigarette<br />

price including excise tax and VAT.<br />

Retail price of cigarettes is determined by manufacturer himself<br />

or by importer and the same is published in the "Official Gazette of<br />

RM".<br />

Excise tax for other tobacco products is paid per kilogram<br />

and amounts:<br />

- Euro 10/kg for cigars and cigarettes,<br />

- Euro 20/kg for shredded tobacco (for rolling cigarettes),<br />

- Euro 15/kg for other smoking tobacco<br />

Excise Taxpayer is a manufacturer or importer of excise goods<br />

or person to which excise tax liability may be transferred in conformity<br />

with the Law (excise licensee, tax exempt user).<br />

Excise tax liability arises when the excise goods is produced<br />

on the territory of Montenegro or imported into Montenegro.<br />

Excise tax is paid on imported excise goods concurrently with<br />

payment of customs duties, except for cases when deferred excise<br />

tax payment is allowed (storage in a customs warehouse or plant of<br />

a tax exempt user).<br />

Excise tax liability on cigarettes arises on a day of taking over<br />

the control excise stamps issued by the Tax Administration.<br />

Local excise taxpayer calculates excise tax by himself. The excise<br />

tax is calculated on monthly basis, while the calculation is given in<br />

a tax return which is to be filed with the tax authority until 15th<br />

day of a month for the previous month, which is also a deadline<br />

11