Registration of dealers - Commercial Taxes Department, Puducherry

Registration of dealers - Commercial Taxes Department, Puducherry

Registration of dealers - Commercial Taxes Department, Puducherry

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

III. <strong>Registration</strong> <strong>of</strong> Dealers:<br />

1. When a license under VAT is to be taken?<br />

i. Dealers whose total turnover in any year is not less than Rs.5 lakhs should<br />

get registration under PVAT Act, 2007.<br />

ii.<br />

iii.<br />

Dealers who purchase and sell goods exclusively within the Union Territory<br />

and whose total turnover is not less than rupees ten lakhs should get<br />

registration under PVAT Act, 2007.<br />

Dealers dealing in IMFL, <strong>dealers</strong> registered under the Central Sales Tax Act,<br />

every commission agent, broker, auctioneer, Casual trader and non-resident<br />

dealer are required to get registration irrespective <strong>of</strong> the quantum <strong>of</strong> total<br />

turnover.<br />

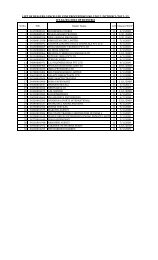

2. How to apply for <strong>Registration</strong>?<br />

The application form in Form `A' under the PVAT Act, 2007 and in<br />

Form 'A' under the CST Act, 1956 can be obtained from the Registering<br />

Authority. The application shall be submitted in the <strong>Registration</strong> cell <strong>of</strong><br />

the region concerned with the following documents:<br />

a) Two Nos. <strong>of</strong> recently taken passport size photograph <strong>of</strong> the<br />

applicant;<br />

b) Lease Agreement Deed in the case <strong>of</strong> rented building;<br />

c) Partnership Deed in the case <strong>of</strong> partnership concern;<br />

d) Memorandum & Articles <strong>of</strong> Association in the case <strong>of</strong> Limited<br />

Company;<br />

e) Xerox copy <strong>of</strong> Ration Card;<br />

f) License/ certificate issued by the Industries <strong>Department</strong> /<br />

Commune Panchayats /Pollution Control Authority / Civil Supplies<br />

etc<br />

g) Other documents as the Registering Authority deems necessary.

3. What is the <strong>Registration</strong> Fee, Payable Under the VAT Act,<br />

2007 ?<br />

a) Rs.5,000/- for IMFL <strong>dealers</strong><br />

b) Rs.10,000/- for MSI and LSI units.<br />

c) Rs.100/- for other <strong>dealers</strong> and SSI units<br />

d) Rs.100/- for every branch and godown.<br />

4.What is the <strong>Registration</strong> Fee Payable Under the CST Act?<br />

Rs.25/- in the form <strong>of</strong> court fee stamp in all cases.<br />

5. What are other salient provisions with respect to<br />

<strong>Registration</strong>?<br />

i) Once an application for registration is made in the manner<br />

prescribed and accompanied by the fees mentioned above, the<br />

Registering Authority will make enquiry and verification as<br />

considered necessary by him, and issue a certificate in Form D<br />

allotting a Taxpayer identification number within thirty days from<br />

the receipt <strong>of</strong> the same. If the certificate <strong>of</strong> registration or a<br />

notice explaining the reasons for rejection <strong>of</strong> application is not<br />

received within thirty days, the dealer shall be deemed to have<br />

been registered with effect from the date <strong>of</strong> submission <strong>of</strong> his<br />

application <strong>of</strong> registration.<br />

ii)<br />

iii)<br />

iv)<br />

The registration certificate shall be valid for one year and shall<br />

be renewed from year to year on payment <strong>of</strong> fees prescribed.<br />

If the <strong>Registration</strong> certificate is lost or is accidentally destroyed<br />

the dealer can apply to and obtain from the Registering Authority<br />

a duplicate <strong>Registration</strong> Certificate on payment <strong>of</strong> a fee <strong>of</strong> Rupees<br />

Hundred. Similarly extra copies <strong>of</strong> the <strong>Registration</strong> Certificate for<br />

each additional place <strong>of</strong> business can be obtained at a fee <strong>of</strong><br />

Rupees Hundred each.<br />

The registration certificate should be conspicuously displayed at<br />

all places <strong>of</strong> business <strong>of</strong> a registered dealer

v) Whenever there is any change in the nature, constitution or place<br />

<strong>of</strong> business the same shall be intimated to the Registering<br />

authority within 30 days and<br />

amended.<br />

the <strong>Registration</strong> Certificate duly<br />

6. What are circumstances under which a dealer’s <strong>Registration</strong> can be<br />

cancelled?<br />

Any registered dealer, where<br />

i. The business has been discontinued, transferred as a whole or otherwise<br />

disposed <strong>of</strong>, or<br />

ii.<br />

iii.<br />

The total turnover for two preceding consecutive years is less than rupees<br />

five lakhs, or<br />

The dealer dies