Annual Report 2004 - Nagarjuna Fertilizers

Annual Report 2004 - Nagarjuna Fertilizers

Annual Report 2004 - Nagarjuna Fertilizers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NFCL<br />

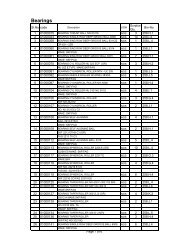

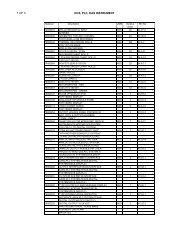

Schedules to the Consolidated Balance Sheet as at 31st March, 2005<br />

Schedule 1 - Share Capital<br />

Rs. Lakhs<br />

Particulars 31.03.2005 31.03.<strong>2004</strong><br />

Authorised<br />

60,00,00,000 Equity shares of Rs. 10/- each 60,000.00 60,000.00<br />

2,00,00,000 Preference Shares of Rs 100/- each 20,000.00 20,000.00<br />

Total 80,000.00 80,000.00<br />

Issued<br />

41,97,25,062 Equity shares of Rs. 10/- each 41,972.51 41,972.51<br />

37,20,372 Optionally Convertible Cumulative Redeemable 3,720.37 -<br />

Preference Shares of Rs.100/- each<br />

Total 45,692.88 41,972.51<br />

Subscribed and Paid Up<br />

41,70,20,593 Equity shares of Rs. 10/- each fully called-up 41,702.06 41,702.06<br />

Of the above 18,33,333 Shares were<br />

allotted as fully Paid pursuant to the approved<br />

Scheme of amalgamation without payments<br />

being received in Cash.<br />

Calls in arrears - Others (41.11) (41.27)<br />

37,20,372 Optionally Convertible Cumulative Redeemable 3,720.37 -<br />

Preference Shares of Rs.100/- each fully called<br />

up (previous year Nil)<br />

(refer Note 6 A of schedule 15)<br />

Equity Share Capital pending allotment<br />

1,11,61,228 Equity Shares of Rs.10/- each<br />

(Pr. year Nil) pending allotment to shareholders<br />

of <strong>Nagarjuna</strong> Palma India Limited (NPIL)<br />

consequent to amalgamation of NPIL as per<br />

the scheme of amalgamation. 1,116.12 -<br />

(refer Note 6 B of schedule 15)<br />

Total 46,497.44 41,660.79<br />

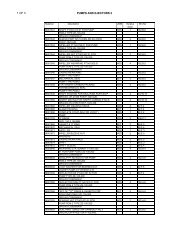

Schedule 2 - Reserves and Surplus<br />

Rs. Lakhs<br />

Particulars 31.03.2005 31.03.<strong>2004</strong><br />

Capital Reserve<br />

As per last Balance Sheet 301.10 301.10<br />

add: Capital reserve on amalgamation 279.03 580.13 - 301.10<br />

Capital Subsidy 20.00 -<br />

(refer note 15 of schedule 15)<br />

Revaluation Reserve<br />

As per last Balance Sheet 8,326.61 8,326.61<br />

Additions during the year<br />

(refer note 5 (v) of schedule 15) 93,332.47 -<br />

101,659.08 8,326.61<br />

Less: Transfer to Profit & Loss a/c 22.72 -<br />

101,636.36 8,326.61<br />

Share Premium<br />

As per last Balance Sheet 9,243.93 9,243.92<br />

Receipts during the year 0.09 0.01<br />

9,244.02 9,243.93<br />

Debenture Redemption Reserve<br />

As per last Balance Sheet 9,582.50 9,582.50<br />

General Reserve<br />

As per last Balance Sheet 5,117.91 5,117.91<br />

Profit and Loss Account-Balance<br />

As per last Balance Sheet 11,660.34 9,916.52<br />

Less:Debit balance on amalgamation (590.03) -<br />

Add: Profit for the year 2,952.50 14,022.81 1,743.82 11,660.34<br />

Total 140,203.73 44,232.39<br />

Schedule 3 - Loan Funds<br />

Particulars 31.03.2005<br />

Rs. Lakhs<br />

31.03.<strong>2004</strong><br />

Secured Loans<br />

(Refer Note 7 of Schedule 15)<br />

A. Debentures - unquoted<br />

i) 75,00,000 14.5% Secured Redeemable<br />

Non - convertible Debentures of Rs. 100 each 7,500.00 7,500.00<br />

ii) 6,71,602 14.5% Secured Redeemable<br />

Non - convertible Debentures of Rs. 100 each 503.70 503.70<br />

iii) 80,00,000 15% Secured Redeemable<br />

Non - convertible Debentures of Rs. 100 each 2,933.50 2,933.50<br />

iv) 1,53,30,000 15% Secured Redeemable<br />

Non - convertible Debentures of Rs. 100 each 15,330.00 15,330.00<br />

v) 25,00,000 15% Secured Redeemable<br />

Non - convertible Debentures of Rs. 100 each 2,500.00 2,500.00<br />

vi) 30,00,000 13.25% Secured Redeemable<br />

Non - convertible Debentures of Rs. 100 each 3,000.00 3,000.00<br />

vii) 32,00,000 12.50% Secured Redeemable<br />

Non - convertible Debentures of Rs. 100 each 1,800.00 2,577.98<br />

viii) 33,49,36,238 0% Secured Redeemable<br />

Non - convertible Debentures of Rs. 1/- each 3,349.36 -<br />

ix) Interest accrued and due 344.86 60.21<br />

37,261.42 34,405.39<br />

B. From Institutions - Term Loans<br />

i) In Rupees 78,657.94 80,709.59<br />

ii) In Foreign Currency 5,377.77 10,953.93<br />

iii) Differential Interest - 5,161.12<br />

iv) Interest accrued and due 8.82 26.94<br />

C. From Banks<br />

i) Working Capital Demand Loan / Cash Credit 13,018.85 12,226.76<br />

ii) Overdraft/Term Loan 25,130.34 24,272.69<br />

iii) Differential Interest - 1,914.65<br />

iv) Interest accrued and due 796.07 449.80<br />

Total 160,251.21 170,120.87<br />

Unsecured Loans<br />

Fixed Deposits 0.15 50.85<br />

From Banks - Foreign Currency - -<br />

From Banks - Rupee Loan - 15.81<br />

Sales Tax Deferral - Loan 4,362.68 3,687.83<br />

HDFC Loan 106.80 182.10<br />

Others 42.56 42.56<br />

Total 4,512.19 3,979.15<br />

45