Annual Report 2004 - Nagarjuna Fertilizers

Annual Report 2004 - Nagarjuna Fertilizers

Annual Report 2004 - Nagarjuna Fertilizers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NFCL<br />

<strong>Nagarjuna</strong> <strong>Fertilizers</strong> and Chemicals Limited<br />

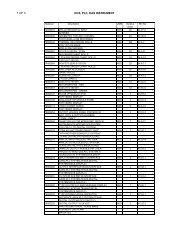

Consolidated Cash Flow Statement for the year ended 31st March, 2005<br />

Particulars 31-03-2005 31-03-<strong>2004</strong><br />

A.Cash Flow from Operating Activities<br />

Net Profit / (Loss) before Extraordinary item and Tax 5,525.07 (1,823.73)<br />

Adjustments for :<br />

Add : Depreciation 12,136.38 12,163.82<br />

Deferred revenue expenses written off 1,030.59 67.31<br />

Lease equalisation (520.38) (523.04)<br />

Interest 14,278.63 26,925.22 25,573.81 37,281.90<br />

32,450.29 35,458.17<br />

Less : Dividend received 10.07 46.58<br />

Profit / (Loss) on sale of assets (net) 203.45 117.97<br />

Profit on sale of investments (net) 6.65 1,250.43<br />

Remission of liability 1,464.70 1,684.87 841.01 2,255.99<br />

Operating Profit before working capital changes 30,765.42 33,202.18<br />

Adjustments for :<br />

Less :Trade and other receivables ✫(3,412.63) (1,916.31)<br />

Inventories 1,462.66 (1,949.97) (12,185.22) (14,101.53)<br />

32,715.39 47,303.71<br />

Add: Trade and other payables 5,112.20 (9,583.06)<br />

Cash generated from operations 37,827.59 37,720.65<br />

Interest paid - 14,028.30 31,009.69<br />

Direct taxes - 314.75 (279.16)<br />

Remission of liability 1,464.70 841.01<br />

Cash flow after extraordinary items 24,949.24 7,831.13<br />

Net cash from operating activities 24,949.24 7,831.13<br />

B. Cash Flow from Investing activities<br />

Purchase of fixed assets **** 9,383.50 6,011.05<br />

Investment in subsidiaries 12,736.97 -<br />

Purchase of Investments - 22,120.47 - 6,011.05<br />

Sale of fixed assets 1,487.02 149.78<br />

Sale of investments 22.31 2,891.05<br />

Proceeds from Amalgamation (net) 34.56 -<br />

Dividend received 10.07 1,553.96 46.58 3,087.41<br />

Net cash used in investing activities 20,566.51 2,923.64<br />

C. Cash flow from financing activities<br />

Share capital - (including premium) *6,287.84 0.02<br />

Proceeds Sales Tax Deferral 674.85<br />

Proceeds from long term borrowings 7,697.07 14,659.76 * 7,510.78 7,510.80<br />

Repayment of short term loans / FD 141.81 8,507.93<br />

Repayment of long term loans **18,581.10 4,197.26<br />

Dividend paid *** 133.50 18,856.41 116.93 12,822.12<br />

Net cash used in financing activities 4,196.65 5,311.32<br />

Net decrease in cash and Cash equivalents 186.08 (403.83)<br />

Cash and cash equivalents as at 01.04.<strong>2004</strong> 1,780.29 2,184.12<br />

Cash and cash equivalents as at 31.03.2005@@ 1,966.37 1,780.29<br />

As per our report attached<br />

For and on behalf of the Board.<br />

for M. Bhaskara Rao & Co. Field Marshal Sam Manekshaw, M.C. N C B Nath<br />

Chartered Accountants Chairman S R Ramakrishnan<br />

Directors<br />

K S Raju<br />

Vice Chairman & Managing Director<br />

44<br />

P P Singh<br />

Director (Technical)<br />

Rs. Lakhs<br />

* Conversion of differential interest (previous year Rs. Nil)<br />

** includes conversion of differential interest into OCCRPS Rs.3720.37 Lakhs (Pr year Rs. Nil )<br />

*** relating to earlier years (including transfer to Investor Education and Protection Fund Rs.115.93 lakhs, previous year Rs.89.88 lakhs).<br />

**** includes capitalisation of machinery spares Rs. Nil (previous year Rs.1461.50 lakhs) and deferred revenue expenditure Rs. Nil (previous year Rs.1065.37 lakhs)<br />

✫Net of reduction in value of Rs. 46,638.27 Lakhs in trade & other receivables adjusted against revaluation reserve (Refer Note 5(v) Schedule 15)<br />

@@ includes unclaimed dividend of Rs. 441.83 lakhs (previous year Rs.575.33 lakhs)<br />

Anilkumar Mehta M Ramakanth R S Nanda<br />

Partner Secretary Director & Chief Operating Officer<br />

K Rahul Raju<br />

Hyderabad New Delhi Director - Business Development &<br />

April 21, 2005 April 21, 2005 Strategic Planning