Annual Report 2004 - Nagarjuna Fertilizers

Annual Report 2004 - Nagarjuna Fertilizers

Annual Report 2004 - Nagarjuna Fertilizers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NFCL<br />

shares of Rs. 10/- each to be issued and allotted to the shareholders of erstwhile <strong>Nagarjuna</strong> Palma India Ltd<br />

pursuant to the scheme of Amalgamation.<br />

6. Secured Loans:<br />

A - DEBENTURES<br />

i 75,00,000, 14.50% Secured Redeemable Non-Convertible Debentures (NCD) of Rs.100/- each are redeemable<br />

as follows<br />

(a) 45,00,000 issued to UTI in six half yearly instalments commencing from July 2003 as per reschedulement.<br />

The first four instalments of Rs. 450 lakhs each, due on 20 th July 2003, 20 th January <strong>2004</strong>, 20 th July <strong>2004</strong><br />

and 20 th January 2005, aggregating to Rs.1800 lakhs are overdue.<br />

(b) 30,00,000 issued to LIC in 41 structured quarterly instalments commencing from 31st March 2006 as per<br />

reschedulement in line with the CDR Package.<br />

ii 6,71,602, 14.50% Secured Redeemable Non-Convertible Debentures (NCD) of Rs.100/- each issued to UTI<br />

are redeemable in 24 monthly instalments commencing from October 2002 as per reschedulement. The<br />

balance outstanding is Rs.503.70 lakhs (Previous year Rs. 503.70 lakhs).<br />

The entire outstanding of Rs. 503.70 lakhs is overdue.<br />

iii 80,00,000, 15.00% Secured Redeemable Non-Convertible Debentures (NCD) of Rs.100/- each issued to<br />

IFCI redeemable in 41 quarterly instalments commencing from 31 st March 2006 as per reschedulement in line<br />

with the CDR Package. The balance outstanding is Rs.2,933.50 lakhs (previous year Rs. 2,933.50 lakhs).<br />

iv 1,53,30,000, 15.00% Secured Redeemable Non-Convertible Debentures (NCD) of Rs.100/- each issued to<br />

ICICI redeemable in 41 quarterly instalments commencing from 31 st March 2006 as per reschedulement in line<br />

with the CDR Package.<br />

v 25,00,000, 15.00% Secured Redeemable Non-Convertible Debentures (NCD) of Rs.100/- each issued to<br />

IFCI redeemable in 41 quarterly instalments commencing from 31 st March 2006 as per reschedulement in line<br />

with the CDR Package.<br />

vi 30,00,000, 13.25% Secured Redeemable Non-Convertible Debentures (NCD) of Rs.100/- each issued to LIC<br />

redeemable in 41 structured quarterly instalments commencing from 31st March 2006 as per reschedulement<br />

in line with the CDR Package.<br />

The interest rates stand revised to 10.50% w.e.f. 01.04.<strong>2004</strong> in respect of Debentures stated at i (b), iii, iv, v, and vi<br />

as per CDR package sanctioned on 20 th February <strong>2004</strong>.<br />

vii 32,00,000 12.50% Secured Redeemable Non-Convertible Debentures (NCD) of Rs.100/- each issued to SBI<br />

redeemable in 20 equal quarterly instalments commencing from 31st March 2005 as per reschedulement in<br />

line with the CDR Package. The balance outstanding is Rs.1800.00 lakhs (previous year Rs. 2,577.98 lakhs).<br />

The interest rates stand revised to 7.00% w.e.f. 01.04.<strong>2004</strong> in respect of Debentures stated above as per CDR<br />

package sanctioned on 20 th February <strong>2004</strong>.<br />

The above debentures (excluding Rs.4300.00 lakhs, relating to assets given on lease, issued to ICICI), together<br />

with accrued interest, remuneration and other expenses thereof are secured by a registered mortgage and an<br />

exclusive charge on the Company’s immovable property situated at Ahmedabad and an equitable mortgage and a<br />

charge on the other immovable and movable properties of the Company in favour of the debenture trustees, save<br />

and except stock in trade, book debts given as security to banks for obtaining working capital facilities and assets<br />

given on lease with exclusive charge in favour of the funding institution. Charge creation in respect of Rs. 9371.60<br />

lakhs is pending, for which specific approvals from the lenders (as per CDR package) is awaited.<br />

Out of Rs.15,330.00 lakhs 15% Non-Convertible Debentures issued to ICICI Bank, Rs.4300.00 lakhs are secured<br />

by exclusive mortgage of assets given on lease.<br />

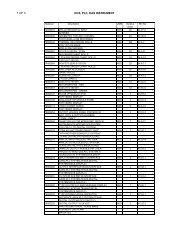

viii 33,49,36,238 0% Secured Redeemable Non-Convertible Debentures of Rs.1/- each issued to various lenders<br />

viz. State Bank of India, State Bank of Hyderabad, State Bank of Bikaner and Jaipur, State Bank of Patiala,<br />

State Bank of Travancore, State Bank of Saurashtra, Bank of India, Bank of Baroda, Canara Bank, Indian<br />

Overseas Bank, Punjab National Bank, UCO Bank, Union Bank of India, The Bank of Rajasthan Ltd.,<br />

SICOM, Oriental Bank of Commerce, Rabo India Finance (Pvt) Ltd., Karur Vysya Bank, Karnataka Bank,<br />

IndusInd Bank, and ICICI Bank, as envisaged in the CDR Package. The debentures are redeemable after the<br />

entire debt liabilities are fully repaid.<br />

The above debentures are secured by way of second charge on the fixed assets of the Company ranking pari-passu<br />

with the working capital banks. This is subject to receiving NOCs from the second charge holders which is still<br />

awaited.<br />

B – LONG TERM LOANS :<br />

The Long Term Loans from Institutions are secured by way of a charge created through an equitable mortgage of<br />

immovable properties by deposit of title deeds and hypothecation of movable properties of the Company including<br />

movable plant and machinery, spares, tools and other movables, present and future, save and except stock in<br />

trade, book debts, and stores & spares, given as security to banks for obtaining working capital facilities and assets<br />

given on lease with exclusive charge in favour of the funding institution. They are further secured by way of a second<br />

34