2000 - 01 - Epfo

2000 - 01 - Epfo

2000 - 01 - Epfo

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Government through an Ordinance dated 22nd September, 1997 further increased the<br />

contribution rate towards Provident Fund as under:<br />

(a) Establishments paying contribution @ 8.33% to 10%. .<br />

(b) Establishments paying contribution @ 10% to 12%.<br />

With this 172 categories of industries/establishments out of 177 categories notified are<br />

paying contribution @ 12% of the basic wages, dearness allowance including cash value of<br />

food concession and retaining allowance, if any. Contribution @ 10% of the wages is applicable<br />

in respect of following industries/class of establishments:<br />

(i) Any establishment in which less than twenty persons are employed;<br />

(ii) Any sick industrial company as defined in clause (0) of SUb-section (I) of section 3 of the<br />

Sick industrial Companies (Special Provisions) Act, 1985 (1 of 1986) and which has<br />

been declared as such by the Board for Industrial and Financial Re-construction<br />

established under Section 4 of that Act, for the period commencing on and from the date<br />

of registration of the reference in the Board and ending either on the date by which the<br />

net worth of the said company becomes positive in terms of the orders passed under<br />

sub-section (2) of section 17 of that Act or on the last date of implementation of the<br />

scheme sanctioned under section 18 of the Act;<br />

(iii) Any establishment which has at :'he end of any financial year accumulated losses to or<br />

exceeding its entire net worth that is, the; sum total to or exceeding its entire net worth<br />

that is, the sum total of paid up capital and free reserves and has also suffered cash<br />

losses in such financial year and the financial year immediately preceding such financial<br />

year. Explanation - for the purposes of clause (iii), "Cash loss U means loss as<br />

computed without providing for depreciation;<br />

(iv) Any establishment in the: - (a) Jute Industry (b) Beedi Industry (c) Brick Industry (d) Coir<br />

Industry other than the spinning sector and (e) Guar gum factories;<br />

CONTRIBUTION<br />

RECEIVED<br />

During the year, Rs.1 0728.44 crores were received as provident fund contributions. Out<br />

of this Rs. 6399.55 crores were collected from un-exempted establishments by the Organisation<br />

and Rs. 4328.89 crores were transferred to respective Board of Trustees by the exempted<br />

establishments.<br />

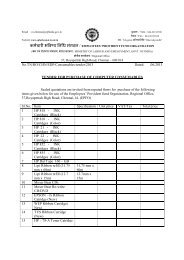

TABLE: 6 PROVIDENT FUND CONTRIBUTIONS RECEIVED (Rs. in Crores)<br />

Year<br />

% Variation<br />

% Variation % Variation<br />

Un-<br />

Exempted over<br />

over Total over<br />

exernpted :<br />

Sector Previous Previous Contribution Previous<br />

Sector<br />

Year<br />

Year<br />

Year<br />

1996-97 3055.77 19.23 2915.29 -8.98 5971.06 3.55<br />

1997-98 3174.70 3.89 3643.49 24.98 6818.19 14.19<br />

1998-99 2841.36 (-) 10.49 4954.18 35·.98 7795.54 14.33<br />

1999-00 3904.14 37.40 5778.08 16.63 9682.22 24.20<br />

<strong>2000</strong>-<strong>01</strong> 4328.89 10.88 6399.55 10.76 10728.44 10.81<br />

ADMINISTRATIVE AND INSPECTION CHARGES<br />

The administrative expenditure of Provident Funds Scheme is met out of the<br />

administrative charges received from the employers of the un-exempted establishments and<br />

inspection charges from the employers of exempted establishments.<br />

29