the quest for best prices, liquidity & consolidated data - Neonet

the quest for best prices, liquidity & consolidated data - Neonet

the quest for best prices, liquidity & consolidated data - Neonet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

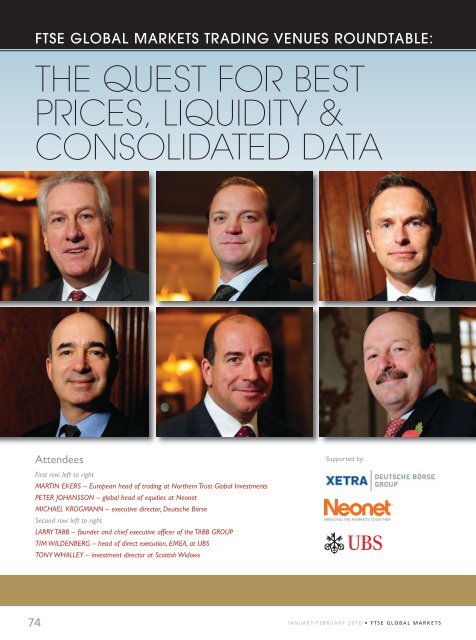

FTSE GLOBAL MARKETS TRADING VENUES ROUNDTABLE:<br />

THE QUEST FOR BEST<br />

PRICES, LIQUIDITY &<br />

CONSOLIDATED DATA<br />

Attendees<br />

First row: left to right<br />

MARTIN EKERS – European head of trading at Nor<strong>the</strong>rn Trust Global Investments<br />

PETER JOHANSSON – global head of equities at <strong>Neonet</strong><br />

MICHAEL KROGMANN – executive director, Deutsche Börse<br />

Second row: left to right<br />

LARRY TABB – founder and chief executive officer of <strong>the</strong> TABB GROUP<br />

TIM WILDENBERG – head of direct execution, EMEA, at UBS<br />

TONY WHALLEY – investment director at Scottish Widows<br />

Supported by:<br />

74 J A N U A R Y / F E B R U A R Y 2 0 1 0 • F T S E G L O B A L M A R K E T S

MARKET STRUCTURES & THE SPEED<br />

OF CHANGE<br />

TONY WHALLEY – investment director, Scottish Widows:<br />

Most notable is <strong>the</strong> speed of change, both to market<br />

structures and <strong>liquidity</strong>, so much so that we need to adapt<br />

and modify our trading strategy on a far more regular basis<br />

than ever be<strong>for</strong>e. Post-Lehman Bro<strong>the</strong>rs’ collapse <strong>the</strong>re’s<br />

been a significant impact on <strong>the</strong> <strong>liquidity</strong> that’s made<br />

available to us. Moreover, <strong>the</strong> rise of MTFs has had quite a<br />

dramatic influence on what we’re doing. The next trend is<br />

volume business transacted within dark pools. Whe<strong>the</strong>r<br />

that is to <strong>the</strong> good or bad, we are yet to find out. There are<br />

obvious benefits. Even so, it is imperative that we secure<br />

access to those dark pools in a way that is beneficial to us.<br />

Additionally, <strong>the</strong>re are issues surrounding market<br />

transparency. As market fragmentation continues, <strong>the</strong>re are<br />

concerns about <strong>the</strong> effect that has on <strong>the</strong> way <strong>the</strong> whole<br />

market is seen. A key requirement now, to mitigate some of<br />

<strong>the</strong> detrimental effects of market fragmentation, is to have<br />

<strong>consolidated</strong> market <strong>data</strong>; on both a pre- and post-trade<br />

basis. Without it our job is increasingly difficult.<br />

LARRY TABB – founder and ceo of Tabb Group: MiFID has<br />

changed <strong>the</strong> ground rules of how <strong>the</strong> European markets<br />

work. We are in a process of fragmentation and increased<br />

competition within <strong>the</strong> marketplace, which is changing how<br />

<strong>the</strong> buyside and <strong>the</strong> sellside interact. New <strong>liquidity</strong> providers<br />

are moving into <strong>the</strong> market, increasing <strong>liquidity</strong> within<br />

certain MTFs. Meanwhile, <strong>the</strong> buyside needs a wider range of<br />

tools to be able to trade against a fragmented infrastructure<br />

as well as protect trading flow from possibly predatory<br />

<strong>liquidity</strong> providers and high frequency traders. Moreover, US<br />

and European regulators are looking at <strong>the</strong> new players,<br />

technologies and market centres, trying to determine <strong>the</strong><br />

right market structure and how we should be operating, and<br />

that will <strong>the</strong>n change <strong>the</strong> landscape again.<br />

MICHAEL KROGMANN – executive director, Deutsche Börse:<br />

An important observation is that <strong>the</strong> algorithms<br />

implemented on our central plat<strong>for</strong>m worked well, even with<br />

a decrease in volumes and increasing volatility during <strong>the</strong><br />

crisis. It is vital <strong>for</strong> us to confirm this fact. When <strong>the</strong><br />

algorithms were first implemented (and we can actually track<br />

<strong>the</strong>m back on our plat<strong>for</strong>m to 2002) we recognised that <strong>the</strong>y<br />

provided significant <strong>liquidity</strong> to <strong>the</strong> market. However, that<br />

was in <strong>the</strong> good times, when volumes and turnover were on<br />

an upward trajectory. Over <strong>the</strong> last year, we saw that our<br />

major market participants and <strong>liquidity</strong> providers kept on<br />

providing <strong>liquidity</strong> and <strong>the</strong> market share of algo flow on <strong>the</strong><br />

central plat<strong>for</strong>m remained constant. Elsewhere, customers<br />

who are very active today in <strong>the</strong> US markets have set up<br />

subsidiaries and entities within <strong>the</strong> European Union and<br />

have started trading and implementing <strong>the</strong>ir algorithms over<br />

here and now provide additional <strong>liquidity</strong> into <strong>the</strong> market.<br />

We think <strong>the</strong> game is now a European one. Moreover, crossborder<br />

trading, clearing and settlement continue to be very<br />

important. Finally, consolidation has to occur. We need it,<br />

because <strong>the</strong>re are too many plat<strong>for</strong>ms out <strong>the</strong>re.<br />

TONY WHALLEY – investment director, Scottish Widows<br />

PETER JOHANSSON – global head of equities, <strong>Neonet</strong>: From<br />

<strong>the</strong> brokerage viewpoint, <strong>the</strong> market provides ample<br />

opportunities. As fragmentation continues we interact in a<br />

different way with our clients and <strong>the</strong> dynamics of<br />

buyside/sellside client interaction nowadays focuses more on<br />

service solutions. Overall, <strong>the</strong> biggest change is <strong>the</strong> level of<br />

innovation and roll out of technology. However, <strong>the</strong> big<br />

challenge this year has been finding <strong>liquidity</strong>; and it has been<br />

hard, <strong>for</strong> both <strong>the</strong> buyside and sellside. I’m not as bearish<br />

perhaps on <strong>the</strong> fragmentation issue. Yes, consolidation is<br />

needed, but we need to find <strong>the</strong> right solutions to a market<br />

which in <strong>the</strong> near term looks to be continuing to fragment.<br />

MiFID has been good. It has brought competition, it has<br />

brought more <strong>liquidity</strong> into <strong>the</strong> marketplace. We could argue<br />

is it good <strong>liquidity</strong> <strong>for</strong> <strong>the</strong> buyside, <strong>for</strong> end clients?<br />

Never<strong>the</strong>less, it has encouraged technology innovation in<br />

terms of market interaction, which by <strong>the</strong> end of <strong>the</strong> day will<br />

affect transactions costs in a positive way.<br />

MARTIN EKERS – European head of trading, Nor<strong>the</strong>rn Trust<br />

Global Investments: Just to get a bit controversial, I slightly<br />

disagree with Larry. I don’t think <strong>the</strong> buyside is going to have<br />

this huge IT challenge that you kind of imply and that’s really<br />

because, as Peter intimated, of <strong>the</strong> service solutions that are<br />

being provided by <strong>the</strong> brokerage side. I share his view about<br />

fragmentation too. Everyone says <strong>the</strong> US is always big: big<br />

numbers, big Macs, and <strong>the</strong>re are so many different venues.<br />

Actually, <strong>the</strong>re aren’t. Even at a recent presentation at <strong>the</strong><br />

White House <strong>the</strong> claim that <strong>the</strong>re were 42 separate trading<br />

venues in <strong>the</strong> US was knocked back to 32!. So, <strong>the</strong>re’s a bit of<br />

puff here. It can be very scary when you’re faced with<br />

supposedly all <strong>the</strong>se venues, supposedly new entrants and<br />

supposedly new <strong>liquidity</strong>. Really, how meaningful is that to<br />

<strong>the</strong> buyside? It’s probably noise to Tony [Whalley] and I. It’s<br />

<strong>the</strong> white noise that you want to somehow exploit and <strong>the</strong><br />

sellside has been pretty good so far at clearing our TV screens<br />

<strong>for</strong> us. The two big issues that will help us significantly are<br />

market <strong>data</strong> and inter-operable clearing systems.You’ve got to<br />

have that open up and once that’s opened up, <strong>the</strong> issues aren’t<br />

as scary as <strong>the</strong>y seem today.<br />

FTSE GLOBAL MARKETS TRADING VENUES ROUNDTABLE<br />

F T S E G L O B A L M A R K E T S • J A N U A R Y / F E B R U A R Y 2 0 1 0<br />

75

FTSE GLOBAL MARKETS TRADING VENUES ROUNDTABLE<br />

TIM WILDENBERG – head of<br />

direct execution, EMEA, UBS:<br />

I think <strong>the</strong>re are three things: <strong>the</strong><br />

first is competition, which seems<br />

to get harder every year. You<br />

think you’re getting better at<br />

what you do but, sadly, your<br />

competitor seems to be doing<br />

<strong>the</strong> same, which is always a<br />

slight frustration. The second is<br />

fragmentation; MiFID is a work<br />

in progress, if you like. Definitely<br />

some good things have come<br />

out of it. However, <strong>the</strong>re has also<br />

been some unintended<br />

consequences that people may not have anticipated. Tony<br />

Whalley’s point about transparency and market <strong>data</strong> is<br />

pertinent in this regard. Third: <strong>the</strong>“dark pool”debate is raging<br />

in <strong>the</strong> regulatory world and it’s an important one.The thing we<br />

can ask from regulators is to help us get clean and accurate <strong>data</strong>.<br />

Also, we need to put this so-called problem in perspective, <strong>for</strong><br />

<strong>the</strong> market and <strong>for</strong> regulators,as <strong>the</strong>re is a danger that it is being<br />

inflated out of proportion. There are a number of post-MiFID<br />

issues and <strong>the</strong>y all need to be addressed. While <strong>the</strong> dark pool<br />

issue is one of <strong>the</strong>m, it is not <strong>the</strong> biggest.<br />

TRADING PLACES: THE NEW<br />

BUYSIDE/SELL SIDE RAPPORT<br />

TIM WILDENBERG: There’s an extra dimension now to<br />

stockbroking. In reality it’s become a kind of technology and<br />

service provision role that, 15 years ago, wasn’t <strong>the</strong> case.Then,<br />

it was about being able to find <strong>liquidity</strong>; advising clients with<br />

regard to <strong>the</strong> market; and making recommendations on stocks.<br />

There’s a wider range of things that brokers do nowadays,<br />

driven by an evolution of <strong>the</strong> stock market itself as it has<br />

moved from <strong>the</strong> floor to an electronic model. In consequence,<br />

brokers have had to compete more as technologists. The<br />

<strong>quest</strong>ion now is: when does that stop? Actually, I’m not sure it<br />

stops any time soon. It will continue to get busier and tougher<br />

and harder. As long as <strong>the</strong>re are competitors in <strong>the</strong><br />

marketplace, <strong>the</strong>re will always be somebody trying to invent a<br />

better mousetrap or a faster service. Competition drives that<br />

and will continue to, but we must face that it is a new<br />

dimension to brokerage that wasn’t <strong>the</strong>re be<strong>for</strong>e.<br />

TONY WHALLEY: Brokers are constantly coming up and saying:<br />

“We’ve got a new this and that, which does this quicker than<br />

everyone else’s.” By <strong>the</strong> time we’ve tested it, checked<br />

connectivity issues and installed it, someone else comes along<br />

and says <strong>the</strong>y’ve got something faster and better.From a buyside<br />

perspective, long-term relationships are paramount.You go with<br />

people you know can deliver.Brokers are now putting in front of<br />

us a lot more products that we can use, and it is down to us to<br />

choose which products we think are most suitable. There is a<br />

fairly substantial technology cost to <strong>the</strong> buyside of all this, as we<br />

have to test <strong>the</strong>m and ensure <strong>the</strong>y are compatible with our<br />

legacy systems and that can be time and cost consuming.Those<br />

LARRY TABB – founder and chief executive officer,TABB GROUP<br />

brokers that are able to innovate<br />

and connect will over <strong>the</strong> longterm<br />

do better. The buyside<br />

meanwhile is asking, on a<br />

monthly/quarterly basis, <strong>for</strong><br />

destination reports, to check that<br />

making good use of all <strong>the</strong><br />

different <strong>for</strong>ms of <strong>liquidity</strong> out<br />

<strong>the</strong>re. However, as Martin will<br />

testify, 20 years ago if we were<br />

looking <strong>for</strong>, let’s say, 50m Tescos,<br />

you’d ring up a trusted broker<br />

and you’d tell him:“I’m looking<br />

<strong>for</strong> 50m Tescos. Don’t take <strong>the</strong>m,<br />

but if you see anything, make<br />

sure we don’t get overlooked.”The broker would sit <strong>the</strong>re and<br />

say nothing. Two, even four days later someone in <strong>the</strong> trading<br />

room shouts:“I’m a seller of 20m Tescos!”The broker says,“I’ll<br />

buy those, thank you very much”. That was your original dark<br />

pool. Now that happens electronically.<br />

PETER JOHANSSON: Tony, do you feel more secure about<br />

<strong>the</strong> old dark pool or <strong>the</strong> new dark pool? What’s <strong>the</strong> overall<br />

buyside feeling?<br />

TONY WHALLEY: The buyside has become immensely more<br />

professional and more diligent than it was 20 years ago and<br />

cognisant of what is going on in <strong>the</strong> market in terms of<br />

structure, pricing, volumes.Today’s good buyside trader is much<br />

better equipped than <strong>the</strong> buyside trader of 20/30 years ago.<br />

PETER JOHANSSON: I do believe we’ve seen that<br />

trans<strong>for</strong>mation on <strong>the</strong> sellside too, i.e. in <strong>the</strong> way in which our<br />

traders interact with clients and <strong>the</strong>ir overall approach to<br />

trading. Now we’re just moving into hybrid areas, in between,<br />

low touch and high touch service. I believe you have to utilise<br />

all of <strong>the</strong> technology and innovation and market access<br />

toge<strong>the</strong>r with <strong>the</strong> old school personal approach to trading,<br />

because it is still a relationship business.<br />

TONY WHALLEY: Yes. It’s about prioritising your order<br />

flow, isn’t it? As you say, high touch, low touch. You now<br />

have systems whereby any order which is worth less than,<br />

let’s say, £5,000 is automatically routed somewhere and<br />

executed and comes back and you don’t even need to see<br />

it. It is not only low touch, it’s no touch.<br />

LARRY TABB: It isn’t that <strong>the</strong> buy side’s going to develop<br />

an entire suite of algos and build <strong>the</strong>ir infrastructures.<br />

However, <strong>the</strong>y will need more order management<br />

technology. Eventually, you will wind up with a whole suite<br />

of really good algorithms provided by brokers. To some<br />

degree, we’re seeing this in <strong>the</strong> States, where even those<br />

buyside firms that you would think wouldn’t have<br />

independent execution management tools are<br />

implementing <strong>the</strong>m to take a little bit more control of <strong>the</strong><br />

execution process, and not necessarily putting everything<br />

through a broker — whe<strong>the</strong>r to hide strategy or take more<br />

control of it. Now, you’re not going to be building those<br />

plat<strong>for</strong>ms from <strong>the</strong> ground up, instead implementing<br />

vendor-based plat<strong>for</strong>ms and some canned outsidealgorithms,<br />

but it’s more than you had in <strong>the</strong> past.<br />

76 J A N U A R Y / F E B R U A R Y 2 0 1 0 • F T S E G L O B A L M A R K E T S

CROSSING & DARK LIQUIDITY<br />

TIM WILDENBERG: No <strong>quest</strong>ion, MiFID has enabled new<br />

trading venues. Now we have <strong>the</strong> arrival of dark MTFs, which<br />

are publicly accessible non-displayed pools. We’ve always had<br />

crossing services that brokers were operating solely because<br />

we were trading <strong>for</strong> our clients. We know that we’ve got a<br />

buyer of Alcatel and we’ve got a seller of Alcatel, so we’re going<br />

to try, if it makes sense from a <strong>best</strong> execution standpoint, to<br />

cross <strong>the</strong>m. That is exactly what we’ve always done as<br />

stockbrokers. We are obliged to look after our clients’interests.<br />

To whom we might – or might not — show bits of <strong>the</strong>ir order<br />

rests on our understanding of our clients’requirements.<br />

One thing that brokers, with hindsight, have perhaps<br />

done badly is that we’ve allowed <strong>the</strong> perception to develop<br />

over time that crossing services offered by brokers are <strong>the</strong><br />

equivalent of dark pools that are public MTFs. Actually,<br />

<strong>the</strong>y are quite different. It goes to <strong>the</strong> point mentioned<br />

earlier: about <strong>the</strong> importance of knowing whom you trust.<br />

MICHAEL KROGMANN: Being progressive and<br />

considering that <strong>the</strong>re is crossing and <strong>liquidity</strong>, it is vital in<br />

an efficient market that we streng<strong>the</strong>n <strong>the</strong> elements of<br />

transparency and price <strong>for</strong>mation. Never<strong>the</strong>less, big<br />

investment firms must be able to cross large-in-scale orders<br />

on <strong>the</strong> basis of public in<strong>for</strong>mation and price. We should<br />

consider in order to account <strong>for</strong> economic necessities and<br />

existing trading practices, MiFID originally allowed few<br />

exemptions from <strong>the</strong> strict transparency regime. Again: <strong>the</strong><br />

basis <strong>for</strong> <strong>the</strong> waivers was to avoid“excessive transparency”<br />

<strong>for</strong> large-in-scale orders, and this is <strong>the</strong> very area waivers<br />

should be restricted to, besides <strong>the</strong> o<strong>the</strong>r waivers that are<br />

already in place. If <strong>the</strong>y are, <strong>the</strong>y might indeed support a<br />

transparent and efficient market structure.<br />

LARRY TABB: The problem is, when you’re looking at blocks<br />

that are large in scale, a lot of <strong>the</strong> blocks that wind up getting<br />

executed in <strong>the</strong> broker dark pools look a lot like small little<br />

pieces. The issue <strong>the</strong>n becomes that sometimes <strong>the</strong>re is only<br />

one side of <strong>the</strong> order that’s block and what winds up crossing<br />

against it is lots of small orders or an algorithm, and if you<br />

start banning dark pools or putting too many restrictions on<br />

dark pools, investment managers aren’t going to put a million<br />

shares into a pool. They’re just going to leave it on <strong>the</strong>ir desk<br />

or put it into an algorithm or give it to a broker over a period<br />

of time.You wind up moving that <strong>liquidity</strong> out of <strong>the</strong> market<br />

completely and it makes it just more difficult <strong>for</strong> <strong>the</strong> buy side.<br />

TIM WILDENBERG: There needs to be more granularity and<br />

transparency. To Larry’s point: in reality <strong>the</strong> crossing<br />

executions that are happening are not always traditional<br />

“blocks.” There are many reasons <strong>for</strong> that. The nature of <strong>the</strong><br />

instructions we get from a client varies. He may want to<br />

trade discretely throughout <strong>the</strong> day, so executions are done<br />

in micro-portions. We need to be transparent about where<br />

we’re printing those executions. Do we print <strong>the</strong>m today<br />

instantly? Yes, and we print <strong>the</strong>m at <strong>the</strong> midpoint. While<br />

improved transparency has a positive impact, <strong>the</strong>re also<br />

need to be protections in place when crossing with nondisplayed<br />

flow to ensure that people are not trading outside<br />

of <strong>the</strong> spread or at bad <strong>prices</strong>. One of <strong>the</strong> points that Tony<br />

raised about seeing more free trade could actually be a<br />

problem. The trader is our client, but some fund managers<br />

are looking at <strong>the</strong>ir dealing desk, saying:“Well, I know that<br />

<strong>the</strong> crossing pools might be trading at a different price, but<br />

I’m measuring you on <strong>the</strong> primary.” There<strong>for</strong>e, though an<br />

algorithm can manage multiple curves across multiple<br />

markets in order to achieve price improvement, brokers may<br />

be compelled to “dumb <strong>the</strong>m down”, providing our clients<br />

with a benchmark primary because that’s what <strong>the</strong>y<br />

<strong>the</strong>mselves are being benchmarked against.This tells us that<br />

if <strong>the</strong>re was actually one <strong>consolidated</strong> tape, <strong>the</strong>y wouldn’t be<br />

having that conversation because everyone would be<br />

looking in <strong>the</strong> right place <strong>for</strong> <strong>the</strong> market <strong>data</strong>.<br />

TONY WHALLEY: The big worry with dark pools is if, <strong>for</strong><br />

example, and I’m using Tesco again, I’m looking to buy 5m<br />

Tesco through UBS’s dark pool and Martin is looking to sell<br />

5m Tesco through Merrill Lynch’s dark pool, <strong>the</strong>y’ll sit <strong>the</strong>re<br />

all day and nothing happens.<br />

TIM WILDENBERG: That would have also happened<br />

be<strong>for</strong>e in your old floor based system. You would have<br />

talked to only one broker.<br />

TONY WHALLEY: Yes, but wouldn’t it be so much better<br />

and so much more advantageous to our side of <strong>the</strong> fence<br />

not necessarily your side of <strong>the</strong> fence because <strong>the</strong>re’s a<br />

vested interest here if dark pools were <strong>consolidated</strong> and<br />

everything came toge<strong>the</strong>r?<br />

TIM WILDENBERG: Then <strong>the</strong>y would all be public open<br />

pools. In <strong>the</strong> same way you’ve talked us through your Tesco<br />

example, <strong>the</strong>re are going to be certain times where you’re<br />

not going to want anybody else to know about your order.<br />

So, <strong>the</strong> problem is that this is a bit like <strong>the</strong> indications of<br />

interest (IOI) debate.<br />

TONY WHALLEY: Absolutely. It’s protectionism.<br />

MARTIN EKERS: Do buyside desks prefer <strong>the</strong> old dark<br />

pools or <strong>the</strong> new dark pools? My reply to that is that you<br />

can walk into a very nasty pool in both <strong>the</strong> old or <strong>the</strong> new<br />

style pools or, equally, you can decide to swim very badly<br />

with your eyes shut. Ei<strong>the</strong>r way, you will end up damaged.<br />

Dark pools have always been <strong>the</strong>re and our biggest risk as<br />

an industry is that <strong>the</strong> regulators don’t understand that dark<br />

pools have always been <strong>the</strong>re. This isn’t some nasty new<br />

plague that’s suddenly coming across <strong>the</strong> industry <strong>for</strong> which<br />

<strong>the</strong>y prescribe some prohibitive regulation. They often use a<br />

sledgehammer to crack a nut, and it’s a hell of a way back<br />

once <strong>the</strong>y’ve done that. It is our duty as industry<br />

professionals to ask everyone else who’s involved to guide<br />

regulators towards a sensible solution. As we’ve discussed,<br />

technology has only enhanced what was already <strong>the</strong>re.<br />

TIM WILDENBERG: In non-displayed <strong>liquidity</strong>, everyone<br />

wants to see your IOIs, and not show <strong>the</strong>ir own. The<br />

problem rests in certain types of orders. When you give us<br />

an order, we will put it in some of <strong>the</strong> public dark pools. We<br />

will also allow some of our o<strong>the</strong>r clients’ orders to match<br />

against it because we know it’s usually good <strong>for</strong> <strong>the</strong>m and<br />

you. The problem with a dark pool is implicit. If it’s a public<br />

dark pool, <strong>the</strong>n in reality it’s not that dark, because you just<br />

F T S E G L O B A L M A R K E T S • J A N U A R Y / F E B R U A R Y 2 0 1 0<br />

77

FTSE GLOBAL MARKETS TRADING VENUES ROUNDTABLE<br />

don’t know who’s going into it<br />

or what <strong>the</strong>y are doing with<br />

<strong>the</strong> in<strong>for</strong>mation <strong>the</strong>y are<br />

getting from <strong>the</strong>ir interactions.<br />

You don’t know that Martin<br />

Ekers has been sitting <strong>the</strong>re<br />

thinking: “There’s a buyer on<br />

Tesco, I’ll just wait.” What’s <strong>the</strong><br />

fine line between someone<br />

being a great trader and<br />

someone gaming a dark pool?<br />

It’s a very subtle difference.<br />

MARTIN EKERS: I was reading<br />

this morning about a major US<br />

company that’s launching in<br />

London very soon and <strong>the</strong>ir<br />

average trade size in <strong>the</strong> States<br />

is 415 shares. I’m not sure that<br />

that’s of any benefit to my order<br />

book or Tony’s order book and<br />

yet this is a major headline and<br />

<strong>the</strong>re’s a big fanfare.<br />

TIM WILDENBERG: To be fair,<br />

though, <strong>the</strong>re is an intellectual<br />

debate that says if new people<br />

come to <strong>the</strong> market with<br />

volume each day, but leave <strong>the</strong><br />

market at <strong>the</strong> end of every night<br />

flat, have <strong>the</strong>y brought <strong>liquidity</strong><br />

or have <strong>the</strong>y not? In aggregate,<br />

you’re right, 415 shares isn’t<br />

going to make a difference.<br />

However, if every time you trade<br />

you manage to trade that 415<br />

shares with half a basis point<br />

price improvement, that over<br />

time is going to make a pretty<br />

major difference to you. If, as<br />

you say, all this frequency trader<br />

does is take money out of <strong>the</strong> business, <strong>the</strong>n that will stimulate<br />

a debate around: have you brought a new buyer to <strong>the</strong> market?<br />

I don’t know <strong>the</strong> answer, but I can see that <strong>the</strong>re actually is<br />

more turnover, <strong>the</strong>re is some more <strong>liquidity</strong> been brought into<br />

play. Is <strong>liquidity</strong> all about institutional long only clients buying<br />

stocks, keeping <strong>the</strong>m and selling <strong>the</strong>m to ano<strong>the</strong>r long only<br />

guy? I don’t know, but <strong>the</strong> accumulation of good 415 share<br />

executions adds up.<br />

LARRY TABB: In <strong>the</strong> US,TABB Group counts all <strong>the</strong> dark pools<br />

through our LiquidityMatrix. We ga<strong>the</strong>r <strong>the</strong> in<strong>for</strong>mation that<br />

providers give us and if you look at <strong>the</strong> dark pools that have<br />

large-in-size trades — such as Liquidnet — <strong>the</strong> amount of <strong>the</strong>ir<br />

<strong>liquidity</strong> is much more limited than if you look at <strong>the</strong> ones that<br />

are trading 100, 200 and 400 shares. There<strong>for</strong>e, if you’ve got<br />

your 5m Tescos, you’re going to put that in a Liquidnet. If<br />

somebody else is in Liquidnet and you can match that off,that’s<br />

great, no leakage. The <strong>quest</strong>ion <strong>the</strong>n becomes, if everybody’s<br />

buying Tesco, who is going to take <strong>the</strong> o<strong>the</strong>r side? That’s when<br />

PETER JOHANSSON – global head of equities , <strong>Neonet</strong><br />

MARTIN EKERS – European head of trading, Nor<strong>the</strong>rn<br />

Trust Global Investments<br />

you start getting into <strong>the</strong> broker<br />

dark pools that bring in different<br />

types of <strong>liquidity</strong>. I’ve been on<br />

desks where <strong>the</strong>y’re starting to<br />

get fills and, yes, <strong>the</strong>y’re getting<br />

100 and 200 share fills but<br />

<strong>the</strong>y’re getting a huge number of<br />

<strong>the</strong>m, really filling quickly. The<br />

<strong>quest</strong>ion <strong>the</strong>n is: is that, <strong>for</strong><br />

example, Martin or is that Tony<br />

on <strong>the</strong> o<strong>the</strong>r side with an<br />

algorithm feeding into <strong>the</strong> o<strong>the</strong>r<br />

side of that? Or is it Mr. Get Go<br />

taking <strong>the</strong> o<strong>the</strong>r side and laying<br />

it off heaven knows where?<br />

Un<strong>for</strong>tunately, it’s hard to tell. If<br />

you look at <strong>the</strong> numbers of<br />

Credit Suisse, Sigma-X or UBS,<br />

even though <strong>the</strong>y don’t tell us<br />

<strong>the</strong>ir numbers, <strong>the</strong>y’re actually<br />

doing far more volume than <strong>the</strong><br />

big block dark pools.<br />

TIM WILDENBERG: Ultimately,<br />

dark <strong>liquidity</strong> is one part of a<br />

larger function. It’s a tool. There<br />

are times where you need a<br />

visible and public market, and<br />

often most of <strong>the</strong> time, you need<br />

to advertise you’re a buyer or<br />

you’re a seller. You want to be<br />

sitting on <strong>the</strong> <strong>best</strong> bid and you<br />

want to be visible, because you<br />

need to find <strong>the</strong> o<strong>the</strong>r side of <strong>the</strong><br />

order. There are many times,<br />

however, where you don’t want<br />

this visibility. There is also<br />

sometimes an unhealthy blur<br />

between what is over <strong>the</strong><br />

counter (OTC), or off exchange,<br />

and what is dark.There is a misplaced perception that all OTC<br />

is dark or non displayed <strong>liquidity</strong>, which is not <strong>the</strong> case. The<br />

percentage of orders that are truly dark is probably 5% in<br />

Europe, compared to <strong>the</strong> 40% that is OTC. As an industry we<br />

need to be more transparent around that OTC number,because<br />

an OTC trade report might <strong>for</strong> example just be relating to some<br />

swap or give-up going on behind <strong>the</strong> scenes, or a risk trade, or<br />

all sorts of o<strong>the</strong>r things that (chances are) have actually been<br />

through <strong>the</strong> public lit market first, anyway.<br />

MICHAEL KROGMANN: If you want to get fills in small<br />

sizes, you can just send a certain proportion of your big<br />

order to <strong>the</strong> order book and get executed against 260<br />

market participants to execute against you fully and<br />

anonymously. If it comes to execution of small proportions<br />

of a big order, it should be distributed in <strong>the</strong> price discovery<br />

process that is publicly available. We have a big conflict<br />

here, because no individual is interested in sending his<br />

order to <strong>the</strong> public order book. However, everybody is<br />

78 J A N U A R Y / F E B R U A R Y 2 0 1 0 • F T S E G L O B A L M A R K E T S

interested, of course, in high quality price discovery that he<br />

can read as an indication <strong>for</strong> all kinds of executions.<br />

LARRY TABB: In <strong>the</strong> US, <strong>the</strong> public markets have been very<br />

open to <strong>the</strong> high frequency set and to a lesser extent, <strong>the</strong><br />

dark books, or at least certain dark books. When we talk<br />

with institutional traders, <strong>the</strong>re’s a much greater desire to<br />

keep things, even if <strong>the</strong>y’re getting 100 to 200 share fills and<br />

<strong>the</strong>y’re dark. That’s because <strong>the</strong>y feel that when <strong>the</strong>y get to<br />

<strong>the</strong> lit markets <strong>the</strong>y’re absolutely playing with <strong>the</strong> Mr<br />

GetGos. Sometimes, when you need to get filled, you need<br />

that, but <strong>the</strong>y want a little bit more shelter.<br />

PETER JOHANSSON: There will always be different types<br />

of vendors, <strong>the</strong>re will always be different types of brokers.<br />

There will always be different types of algos, dark pools,<br />

marketplaces. I just think that we need to take one step<br />

back and understand, specifically from <strong>the</strong> buy side’s<br />

perspective: what is <strong>the</strong> investment decision behind this<br />

trade? Where shall I go? Who shall I interact with? You<br />

should keep close interaction and notes and make sure that<br />

you get all of <strong>the</strong> in<strong>for</strong>mation you require. Where did I<br />

trade it? How did I trade it? Where was <strong>the</strong> EBBO? It is<br />

also vital to measure your execution quality, because <strong>the</strong>re’s<br />

always going to be different venues to choose from.<br />

BUYSIDE APPROACHES TO TRADING<br />

TONY WHALLEY: Our fund managers are supposed to be<br />

taking a three-year view.The high frequency traders are taking<br />

a three nanosecond view. Now, as far as I’m concerned, <strong>the</strong>re<br />

has always been a fear in <strong>the</strong> market as to who you’re trading<br />

against. It used to be: am I trading against natural on <strong>the</strong><br />

o<strong>the</strong>r side or am I trading against <strong>the</strong> market maker? Then it<br />

became: am I trading against a hedge fund? Now it’s become:<br />

am I trading against a high frequency trader? Well, actually,<br />

provided I’m fulfilling my objective, which is buying or selling<br />

<strong>the</strong> shares that <strong>the</strong> fund manager wants to buy and sell on a<br />

three, four, five-year view, I’m doing my job. In any case, this<br />

fear about who we’re trading against actually shouldn’t<br />

matter. These guys are providing <strong>liquidity</strong> and our job, as<br />

much as anything else, is to find that <strong>liquidity</strong>.<br />

MARTIN EKERS: I’m glad Peter has posed <strong>the</strong> <strong>quest</strong>ions, it’s<br />

better coming from <strong>the</strong> sell side. At what point does <strong>the</strong><br />

buyside and <strong>the</strong> whole variety of buyside desks that <strong>the</strong>re are<br />

become accountable? I fully acknowledge that you and Tim<br />

and all <strong>the</strong> o<strong>the</strong>r brokers have got orders but I do not know<br />

any o<strong>the</strong>r transaction that you would make that you’d be<br />

prepared to complete based on a future price. For example,<br />

Larry, have you flown over here only to find out how much<br />

your flight will cost you when you get home? Of course you<br />

haven’t. None of us would do that and <strong>the</strong> justifications given<br />

<strong>for</strong> those sorts of instructions concern me. We’ve got a huge<br />

core business and if <strong>the</strong> benchmark is <strong>the</strong> closing auction, I<br />

fully understand why we’re going into <strong>the</strong> close, even though<br />

we could have traded at four o’clock. We’re going to trade at<br />

<strong>the</strong> auction at 4:35 and that is absolutely crystal clear and fully<br />

defendable. For example, if my equity manager has made a<br />

decision to buy 50m Tescos based on <strong>the</strong> price at 25 past one,<br />

<strong>the</strong>n it’s my job to get that done as quickly as possible with as<br />

little impact as possible with whoever else is out <strong>the</strong>re.<br />

PETER JOHANSSON: The buyside trading desk is now also<br />

asking <strong>for</strong> help with alpha from <strong>the</strong> sellside. There<strong>for</strong>e, I do<br />

believe <strong>the</strong>re’s an interaction between <strong>the</strong>m, however, with<br />

<strong>the</strong> options available today, you should feel fully secure that<br />

giving out <strong>the</strong> trades that Martin is talking about, that you<br />

are sure about <strong>the</strong> added value in just giving out straight<br />

benchmark. I cannot agree more with you.<br />

MICHAEL KROGMANN: There has always been a demand<br />

<strong>for</strong> crossing of big orders outside <strong>the</strong> order book, as we’ve<br />

discussed. Xetra MidPoint allows trading members to trade<br />

stocks without disclosing <strong>the</strong> volume and <strong>the</strong> limit of <strong>the</strong>ir<br />

order. The functionality <strong>the</strong>reby enables market<br />

participants to execute market neutral orders of greater<br />

volume. The orders are entered into a closed order book<br />

and executed at midpoint between <strong>the</strong> <strong>best</strong> bid and ask<br />

price of <strong>the</strong> open Xetra order book. There<strong>for</strong>e <strong>the</strong> Xetra<br />

MidPoint, is not a dark pool, it is a reference pricematching.<br />

However due to <strong>the</strong> execution at midpoint<br />

between <strong>the</strong> <strong>best</strong> bid and ask price, implicit transaction<br />

costs <strong>for</strong> investors are reduced. Xetra MidPoint <strong>the</strong>reby not<br />

only ensures full transparency concerning price<br />

determination but also enables trading members to<br />

minimise <strong>the</strong>ir trading costs.<br />

Additionally, as Larry mentioned be<strong>for</strong>e, all <strong>the</strong> public dark<br />

pools are not as successful as <strong>the</strong> broker-owned dark pools.As<br />

far as I know, <strong>the</strong>re has not been a single public or exchangeowned<br />

dark pool in Europe that has been successful.<br />

GROWING TRANSPARENCY<br />

LARRY TABB: What Tony and Martin were saying earlier<br />

about pre-and post-trade market transparency, that tends<br />

to be <strong>the</strong> biggest challenge we hear from European buyside<br />

traders; that it’s very difficult to get a complete view of<br />

what’s happening in <strong>the</strong> market. Hand in hand with that is<br />

clearing and settlement. Pre- and post-trade transparency<br />

will be a challenge but it’s more easily solved than <strong>the</strong> posttrade<br />

clearing issue with five or six CCPs and a significant<br />

number of depositories to take into account.<br />

MARTIN EKERS: Condition codes are fairly boring, yet<br />

crucial. There is a whole swa<strong>the</strong> of <strong>data</strong> out <strong>the</strong>re that we’re<br />

all trying to decipher and if we can get a very clear common<br />

set of condition codes across Europe, <strong>the</strong>n it just becomes so<br />

much easier <strong>for</strong> everyone. Any agency transaction, any OTC<br />

cross should be printed, reported and published immediately<br />

and marked as such. For example, if I decide to buy 5mTescos<br />

from Tim on writ, that should not print. That should be<br />

privileged in<strong>for</strong>mation <strong>for</strong> Tim and me to know. When he<br />

unwinds it in <strong>the</strong> marketplace or from <strong>the</strong> high frequency<br />

trade or from Tony, <strong>the</strong>n that should print, and I don’t think<br />

<strong>the</strong>re’d be anyone on <strong>the</strong> sellside or <strong>the</strong> buyside who would<br />

argue against a very commonsense solution.<br />

PETER JOHANSSON: We spoke about <strong>the</strong> old days<br />

previously. Wasn’t <strong>the</strong>re some kind of gentleman’s agreement<br />

in between buyside and sellside of unwinding <strong>the</strong> position?<br />

F T S E G L O B A L M A R K E T S • J A N U A R Y / F E B R U A R Y 2 0 1 0<br />

79

FTSE GLOBAL MARKETS TRADING VENUES ROUNDTABLE<br />

TIM WILDENBERG: MiFID has<br />

actually, though many don’t<br />

wish to admit it, made <strong>the</strong> world<br />

more transparent. However, if<br />

you were a London stock<br />

market operator, ei<strong>the</strong>r on <strong>the</strong><br />

buyside or <strong>the</strong> sellside, <strong>the</strong> new,<br />

more transparent rules of MiFID<br />

are actually a step backwards<br />

from what was visible in<br />

London be<strong>for</strong>e. In aggregate<br />

<strong>the</strong>re is more visibility, <strong>the</strong>re is<br />

more trade reporting and <strong>the</strong>re’s<br />

more detail because actually<br />

anything that traded in<br />

Germany could have been<br />

traded OTC almost anywhere on <strong>the</strong> planet and was just<br />

getting booked and not shown. Now we’re in a scenario where<br />

all of <strong>the</strong>se OTC executions are actually visible. People don’t yet<br />

have <strong>the</strong> tools, although <strong>the</strong>y’re starting to build <strong>the</strong>m and<br />

understand how to drive <strong>the</strong>m, to do that. However, to<br />

Martin’s point, <strong>the</strong>re is a debate in <strong>the</strong> market about <strong>the</strong> value<br />

of MiFID. Some of Michael’s colleagues, I’m sure, in <strong>the</strong> legacy<br />

exchange world are facing intense competition and may find<br />

some of <strong>the</strong> developments in <strong>the</strong> OTC space ra<strong>the</strong>r<br />

threatening. In reality, though, at a granular level, we discover<br />

that <strong>the</strong> dark <strong>liquidity</strong> that everybody’s so very worried about is<br />

only 5% or 6% of all <strong>the</strong> aggregate, tradable volume. What is<br />

displayed remains a massive proportion. For example, if you<br />

look on <strong>the</strong> Fidessa website today, <strong>the</strong>y’ve got a thing called<br />

“The Fragulator,”where you can see how much is trading dark,<br />

how much is lit, and on which venues. There is a big chunk<br />

that is OTC and that needs to be flagged in a way that explains<br />

that this is a client to client cross, this is a client to book cross<br />

or whatever.<br />

MICHAEL KROGMANN: If I look at <strong>the</strong> whole proportion of<br />

OTC trading, in some months it is near 45%. Even so, <strong>the</strong>re<br />

is no <strong>for</strong>mal and publicly available in<strong>for</strong>mation that says how<br />

much is going on in broker internal dark pools. There<strong>for</strong>e, all<br />

<strong>the</strong> figures, even <strong>the</strong> figures that Larry is providing, are just a<br />

good guess about what’s going on in <strong>the</strong>se dark pools. So,<br />

we need some more transparency <strong>the</strong>re.<br />

TONY WHALLEY: On a European basis we are far more<br />

transparent than we were pre-MiFID and <strong>the</strong> issue that we<br />

have is very much one that we have on all European<br />

legislation, not just in <strong>the</strong> financial sector, where you’re trying<br />

to get lots of different shaped things all to fit in <strong>the</strong> same hole<br />

and, actually, it doesn’t always work <strong>for</strong> me. Ironically, <strong>the</strong><br />

transparency we enjoyed in <strong>the</strong> UK market pre-MiFID was<br />

actually far greater than <strong>the</strong> level of transparency we now have.<br />

People are pushing back to a certain extent and slightly<br />

concerned that what <strong>the</strong>y used to be able to see and what used<br />

to enable <strong>the</strong>m to do <strong>the</strong>ir job is now no longer available and<br />

that is a big concern. I also think that if you look at what is<br />

going to happen in MiFID Stage 2, if such a thing does go<br />

ahead, which I believe it will, <strong>the</strong>n you’re going to find that<br />

unless <strong>the</strong> transparency/<strong>consolidated</strong> tape argument is<br />

mandated by <strong>the</strong> regulators, it<br />

simply will not happen. That is<br />

because <strong>the</strong>re is a certain<br />

amount of vested interest in <strong>the</strong><br />

mix, where transparency is not a<br />

big thing. You ask anyone and<br />

<strong>the</strong>y will say:“I want everyone’s<br />

business to be 100% transparent<br />

except mine.” However, it<br />

doesn’t work that way. Even so,<br />

if you have a greater degree of<br />

transparency in markets, it<br />

encourages <strong>liquidity</strong>, which is<br />

what we all want.<br />

LARRY TABB: I had a<br />

discussion recently here in<br />

London with a market operator who was also very sceptical<br />

of getting complete pre-and post-trade transparency. He felt<br />

that if <strong>the</strong>re was complete pre-and post-trade transparency, a<br />

lot of <strong>the</strong> <strong>liquidity</strong> from Europe would wind up in London,<br />

mostly because more of <strong>the</strong> trading venues are <strong>the</strong>re and that<br />

it would disadvantage a lot of <strong>the</strong> smaller countries trying to<br />

build up <strong>the</strong>ir own bourses. Now, that might not necessarily<br />

affect Xetra because that’s a big market centre, but it might<br />

affect some of <strong>the</strong> smaller countries, and <strong>the</strong>y would never go<br />

<strong>for</strong> it. That’s only one market operator’s viewpoint but...<br />

TIM WILDENBERG: We’ve seen recently in <strong>the</strong> US <strong>the</strong> SEC<br />

discussing <strong>the</strong>“Fair Access”point, saying basically that <strong>the</strong>y’re<br />

considering changing <strong>the</strong> threshold at which <strong>the</strong> dark pools<br />

that publish IOIs will need to display <strong>prices</strong> more visibly.<br />

Moreover, <strong>the</strong> SEC is also talking about a tape where people<br />

would have to immediately declare where a non-displayed<br />

trade happens. So, ra<strong>the</strong>r than just take an execution report<br />

that says IBM just traded at ten, it will say IBM traded at ten<br />

in Sigma-X or in UBS PIN or New York Stock Exchange or<br />

Xetra, <strong>for</strong> instance. In Europe if we cross something today, <strong>for</strong><br />

instance, we put it in BOAT in real time, so it is already being<br />

published in real time and we are happy to do it. The<br />

interesting feedback I’m getting from my US colleagues is that<br />

<strong>the</strong> US client base does not want that level of granularity to go<br />

on a public tape, as <strong>the</strong> SEC are proposing. That is,<br />

in<strong>for</strong>mation that shows a block go through and who traded it.<br />

TONY WHALLEY: You’ve got to give it a bit of time where<br />

people actually see <strong>the</strong> benefit of having full transparency.As<br />

long as <strong>the</strong> client name isn’t shown, I don’t have a problem.<br />

In <strong>the</strong> old days in <strong>the</strong> market where a broker just crossed up<br />

stock, if you had business to do in that stock, you gave that<br />

particular broker a call, knowing where <strong>the</strong> business was<br />

going on, meaning that <strong>the</strong>y get more business and we end<br />

up getting our business executed with less market impact.<br />

TIM WILDENBERG: Except <strong>the</strong>re is a general trend<br />

throughout Europe and around <strong>the</strong> world to “anonymise”<br />

<strong>the</strong> public markets (i.e. hide <strong>the</strong> broker codes) , because <strong>the</strong><br />

in<strong>for</strong>mation leakage is viewed as detrimental to <strong>the</strong> players<br />

in <strong>the</strong> market.<br />

PETER JOHANSSON: I’ve been involved in those discussions<br />

regarding anonymity on <strong>the</strong> exchanges. There has been, and<br />

MICHAEL KROGMANN – executive director, Deutsche Börse<br />

80 J A N U A R Y / F E B R U A R Y 2 0 1 0 • F T S E G L O B A L M A R K E T S

I do believe <strong>the</strong>re still is, a strong resistance among<br />

Scandinavians, both buyside and sellside, to go completely<br />

anonymous on <strong>the</strong> post-trade scenario. So, how does that<br />

affect <strong>the</strong> market? I’m a strong believer that we should<br />

become totally anonymous because I’ve seen some patterns<br />

within <strong>the</strong> markets where orders get shuffled around and you<br />

have some front-running. I’m not saying that I could point it<br />

out precisely, but you can have a good guess at it. The<br />

execution per<strong>for</strong>mance in anonymous markets versus nonanonymous<br />

markets tells us that all markets should embrace<br />

total anonymity. However, <strong>the</strong> debate is still raging.<br />

MICHAEL KROGMANN: The market needs to be fully<br />

anonymous because o<strong>the</strong>rwise all <strong>the</strong> market participants<br />

might have a problem with <strong>the</strong> counterparty risk when<br />

<strong>the</strong>y see small broker names in <strong>the</strong> book. All trades should<br />

be fully anonymous and fully secured by CCP afterwards.<br />

TIM WILDENBERG: Well, that’s contrary to what is being<br />

asked <strong>for</strong> in <strong>the</strong> dark pool debate by <strong>the</strong> SEC. In that debate<br />

we are being asked to print in real time and put our name<br />

on it. So, to some extent <strong>the</strong>re’s a conflict. Maybe a solution<br />

is we publish it in real time and later on we tell you this was<br />

our total number and we mark it in someway or<br />

something. I absolutely agree with you. Transparency, in<br />

my view, takes <strong>the</strong> debate away because <strong>the</strong> dark pool<br />

debate, in my view, has become too big unnecessarily.<br />

MICHAEL KROGMANN: However, your internal dark pool<br />

is obviously not a public marketplace and not everybody<br />

can have access. On an exchange, actually, everybody can<br />

have access. That is <strong>for</strong> me a totally different discussion.<br />

TIM WILDENBERG: Never<strong>the</strong>less, <strong>the</strong> risks around<br />

anonymity remain.<br />

MARTIN EKERS: There was <strong>quest</strong>ion a little while ago<br />

about whe<strong>the</strong>r we feel <strong>the</strong>re’s a reluctance to publicise <strong>the</strong><br />

venue, where <strong>the</strong> things trade. If <strong>the</strong>re is, its very<br />

misguided. I would fully, fully support it and I don’t really<br />

get Michael’s difference here because we’re in a public<br />

market and a Sigma-X or UBS PIN. If <strong>the</strong> trade’s going on<br />

in <strong>the</strong> public market, <strong>the</strong>n all market participants are going<br />

to get <strong>the</strong>re. They’re going to know very quickly. If all <strong>the</strong><br />

volume of Siemens is on Xetra, <strong>the</strong>y’re going to trade it on<br />

Xetra, <strong>the</strong>re’s no doubt about that. If Tim is putting up<br />

crosses after crosses after crosses and you can see it going<br />

though real time on <strong>the</strong> tape and it’s all got his little flag on<br />

it, <strong>the</strong>n it’s quite right that I get hold of Tim and he rings up<br />

Tony and he does a huge great cross and we’re both happy.<br />

MICHAEL KROGMANN: I’m not.<br />

MARTIN EKERS: That’s competition, right? One of <strong>the</strong><br />

biggest threats to us as an industry is lack of trust in <strong>the</strong> price<br />

<strong>for</strong>mation process, lack of reliability about <strong>the</strong> tape, which is<br />

why it’s so important to consolidate it, misunderstanding<br />

about what is real volume and what isn’t real volume and<br />

how much is going on where and what and it’s within our<br />

grasp as practitioners to help solve that problem. We should<br />

be publishing. You’ll all have your different ways of<br />

advertising it. People will have it on <strong>the</strong> tape <strong>Neonet</strong> just<br />

crossed this and I’ve got an interest in <strong>the</strong> name and I’m<br />

going to be calling you up. That’s <strong>the</strong> way it should be.<br />

LARRY TABB: Some of <strong>the</strong> debate in <strong>the</strong> United States is<br />

not necessarily about larger mid-cap and large cap names<br />

but some of <strong>the</strong> smaller cap names. These smaller cap<br />

names are easier to game and traders are worried that realtime<br />

printing of smaller cap names, especially in <strong>the</strong> dark,<br />

may help facilitate <strong>the</strong> gaming of <strong>the</strong>se names. Now, I don’t<br />

know whe<strong>the</strong>r that’s right or not.<br />

MARTIN EKERS: Because it’s a trade and it’s complete, <strong>the</strong><br />

gaming risk, and this is to Larry’s point, really, about <strong>the</strong><br />

small cap, is no greater or less than any o<strong>the</strong>r scenario. It’s<br />

no different in 25,000 little shares with a small company<br />

and a 50m Tesco. The chance of that being gained after <strong>the</strong><br />

trade has hit <strong>the</strong> tape is exactly <strong>the</strong> same.<br />

LARRY TABB: That’s <strong>the</strong> issue: when you wind up with one<br />

after ano<strong>the</strong>r print of 200 share prints in a dark pool of a<br />

smaller cap stock that trades over a period of time. It’s not<br />

when you’re done all at once.<br />

TONY WHALLEY: There’s no doubt at all that <strong>the</strong> fund<br />

management industry is becoming more and more global<br />

and will continue to do so. However, I do think, like all<br />

things, it is very, very important that we get what’s going on<br />

our own doorstep correct be<strong>for</strong>e we start trying to branch<br />

out. If we try and branch out be<strong>for</strong>e we’ve got <strong>the</strong> stuff close<br />

to home working properly, all that’s going to happen is that<br />

a lot of <strong>the</strong> problems we have close to home we will export<br />

to <strong>the</strong> o<strong>the</strong>r markets and make <strong>the</strong>m worse than <strong>the</strong>y are<br />

right now. So, we’ve got to be very, very careful about that.<br />

The trend itself is to move to a global basis in terms of fund<br />

management, in terms of analysis and probably in terms of<br />

trading from a fund management perspective as well. You<br />

see more and more desks starting to split <strong>the</strong>ir order flow,<br />

not so much on a geographical basis but on a sectoral basis<br />

and that is probably going to continue as time goes on.<br />

However, please, please can we concentrate on getting<br />

what’s at home right be<strong>for</strong>e we try and move overseas?<br />

LARRY TABB: Also, <strong>the</strong> issue is that Europe through <strong>the</strong> EU<br />

process and Brussels is coming toge<strong>the</strong>r while at <strong>the</strong> same<br />

time Asia is really fragmented and not coming toge<strong>the</strong>r.<br />

You have <strong>the</strong> Asian markets with some linkages but those<br />

markets are really very different.<br />

THE VERDICT ON MiFID<br />

MARTIN EKERS: I’d give MiFID six or seven out of ten. It<br />

hasn’t quite achieved what <strong>the</strong>y wanted it to but it has<br />

been a wake-up call <strong>for</strong> <strong>the</strong> industry. The first words in<br />

this roundtable were about change being continuous and<br />

ongoing. That sounds good and that continues to be <strong>the</strong><br />

case. I don’t think you ever get to a point in this industry<br />

where everything is sorted and we stop developing or<br />

stop innovating and changing. I’m reasonably optimistic<br />

that <strong>the</strong> market fragmentation will, in <strong>the</strong> short term,<br />

worsen but in <strong>the</strong> medium term improve. I share Tony’s<br />

reflection that <strong>the</strong> quality of buyside has improved and<br />

continues to do so.<br />

FRANCESCA CARNEVALE: Do you think <strong>the</strong> buyside of <strong>the</strong><br />

sellside has benefited most from a post-MiFID world?<br />

F T S E G L O B A L M A R K E T S • J A N U A R Y / F E B R U A R Y 2 0 1 0<br />

81

FTSE GLOBAL MARKETS TRADING VENUES ROUNDTABLE<br />

TIM WILDENBERG: At first<br />

glance, <strong>the</strong> perception will be<br />

that <strong>the</strong> sell side has benefited<br />

more, especially if your business<br />

is selling technology that<br />

aggregates fragmented markets.<br />

However when somebody does<br />

some qualitative work around<br />

<strong>the</strong> <strong>liquidity</strong> of <strong>the</strong> market, I<br />

believe we’ll actually discover<br />

that <strong>the</strong> buyside and some of<br />

<strong>the</strong>ir clients have also benefited.<br />

I’m not sure that’s clear yet<br />

because <strong>the</strong>re is scant research<br />

in <strong>the</strong> marketplace that<br />

demonstrates how spreads are<br />

tighter, <strong>liquidity</strong> has become easier, and <strong>the</strong> cost of trading has<br />

dramatically changed. I think trading costs have come down;<br />

but we need empirical proof.<br />

MARTIN EKERS: Just a PS on that. The problem, as we<br />

already mentioned, is about <strong>the</strong> quality of <strong>the</strong> <strong>data</strong> but also<br />

you have to accept from any position that 2008 was an<br />

extraordinary year and you’ve almost got to lift it out of <strong>the</strong><br />

equation. You’ve got to go back to 2007 and you’ve got to<br />

compare 2009 and 2007 and just say, right, 2008 was a real<br />

aberration, an outlier that’s going to make a mess of any stats.<br />

TIM WILDENBERG: Have you thought of doing some of<br />

that work, Larry?<br />

LARRY TABB: Yes, we’re actually in <strong>the</strong> process of looking<br />

at <strong>the</strong> last four years, <strong>the</strong> two pre-MiFID and two years<br />

post-MiFID, analysing effective spreads not across <strong>the</strong><br />

whole market but a tier of, say, 30 stocks. That includes top<br />

tier as well as mid tier and small tier, across <strong>the</strong> FTSE, <strong>the</strong><br />

CAC and <strong>the</strong> DAX.<br />

MICHAEL KROGMANN: Of course, <strong>the</strong>re have been a lot of<br />

changes in <strong>the</strong> last two years but at Deutsche Börse and<br />

Xetra we were always in <strong>the</strong> position where we had to<br />

compete with <strong>the</strong> markets. Compared to o<strong>the</strong>r European<br />

markets we did not have a concentration rule in Germany,<br />

so it was always possible <strong>for</strong> retail as well as institutional<br />

investors to trade OTC off <strong>the</strong> markets. Then we have <strong>the</strong><br />

peculiarity in Germany that we still have seven regional<br />

exchanges that are, of course, not a competitor on an<br />

institutional scale, but which are certainly competitive on<br />

<strong>the</strong> retail scale and we have had to innovate all <strong>the</strong> time. We<br />

have implemented around two releases of Xetra every year<br />

even be<strong>for</strong>e <strong>the</strong> implementation of MiFID. So, we have<br />

listened to <strong>the</strong> market, have been innovative and so on, but,<br />

of course, <strong>the</strong> dynamics increased as regulatory changes<br />

have been implemented but at <strong>the</strong> same time technology<br />

implementation on <strong>the</strong> customer side also increased, so we<br />

have really had to adapt our business model to new market<br />

conditions.That is why we are launching Xetra International<br />

Market, a dedicated segment <strong>for</strong> trading of European Blue<br />

Chip equities with an efficient home market settlement<br />

process. In terms of a market share comparison of what was<br />

traded in German instruments and in <strong>the</strong> transparent order<br />

TIM WILDENBERG – head of direct execution, EMEA, UBS<br />

books, it looks like we don’t<br />

have <strong>the</strong> same proportion that<br />

we had probably two years<br />

ago, but I’m not so sure<br />

whe<strong>the</strong>r that would have been<br />

routed to our plat<strong>for</strong>m even<br />

be<strong>for</strong>e MiFID.<br />

PETER JOHANSSON: There’s<br />

been great opportunities and<br />

<strong>the</strong>re’s been some great issues<br />

as well. We’ve seen<br />

fragmentation. It is here to<br />

stay. One could debate<br />

whe<strong>the</strong>r it will continue. There<br />

will be consolidation on <strong>the</strong><br />

trading venue side, but also in<br />

<strong>the</strong> asset management space. You might see it also on <strong>the</strong><br />

brokerage side. We might see some more consolidation on<br />

<strong>the</strong> sellside because, with this fragmentation, <strong>the</strong>re’s a lot of<br />

brokers out <strong>the</strong>re that do not have <strong>the</strong> capability or <strong>the</strong><br />

infrastructure or <strong>the</strong> money to actually invest in what’s<br />

needed to actually reach all <strong>the</strong> different <strong>liquidity</strong> pools.<br />

Moreover, on <strong>the</strong> o<strong>the</strong>r side of consolidation, which we<br />

haven’t spoken about, I’m actually in a market where<br />

suddenly exchanges are starting to compete with me on<br />

out-routing, <strong>for</strong>ward-routing. I’m just starting to see <strong>the</strong><br />

whole map, defining a new but still exciting market. The<br />

buyside has benefited from MiFID in <strong>the</strong> changing way that<br />

it now needs to utilise <strong>the</strong> sellside more as a consultancy <strong>for</strong><br />

solutions, and to actually reach <strong>the</strong> market in a more<br />

technological way. The old relationship will still stand<br />

however, and I do believe that’s one of <strong>the</strong> core things<br />

within our business. Going <strong>for</strong>ward <strong>the</strong>re’s still<br />

opportunities out <strong>the</strong>re and we just have to embrace <strong>the</strong>m<br />

and finally, <strong>liquidity</strong> will continue to move into market.<br />

TONY WHALLEY: I wouldn’t say it’s much improved, I<br />

would say it’s different. MiFID was <strong>the</strong>re primarily as a driver<br />

<strong>for</strong> change and to ask <strong>quest</strong>ions and <strong>the</strong>re is no doubt<br />

whatsoever we have seen some change and <strong>the</strong>re’s still a<br />

certain amount of change to come and it will possibly be in<br />

areas where we don’t expect to see that change. The<br />

discussions we’ve had over <strong>the</strong> previous hour and a half<br />

show that <strong>the</strong>re’s still some <strong>quest</strong>ions which definitely need<br />

to be answered. So, from that point of view MiFID has done<br />

a very good job. In terms of exchanges, in terms of ECNs, in<br />

terms of MTFs, <strong>the</strong> <strong>quest</strong>ion is whe<strong>the</strong>r we’ve actually<br />

reached <strong>the</strong> stage where fragmentation is going to continue<br />

or start to consolidate. If we look at <strong>the</strong> example of <strong>the</strong> LSE<br />

with Baikal, and potential take-over of Turquoise, we’re<br />

starting to see <strong>the</strong> consolidation starting to take place. What<br />

<strong>the</strong> marketplace will look like longer term, I’m not sure, but<br />

I do believe that it’s given us and it’s also given <strong>the</strong> sellside a<br />

huge amount more choice as to how we execute that<br />

business and choice is good. Choice in itself allows you to<br />

use a little bit more discretion, to add a little value to <strong>the</strong> way<br />

trades are executed and that in itself has led to a higher<br />

quality of people on both sides of <strong>the</strong> fence.<br />

82 J A N U A R Y / F E B R U A R Y 2 0 1 0 • F T S E G L O B A L M A R K E T S