Audit-Report-on-NNPC

Audit-Report-on-NNPC

Audit-Report-on-NNPC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Investigative Forensic audit of crude oil revenues and remittances by <strong>NNPC</strong> (January 2012 – July 2013)<br />

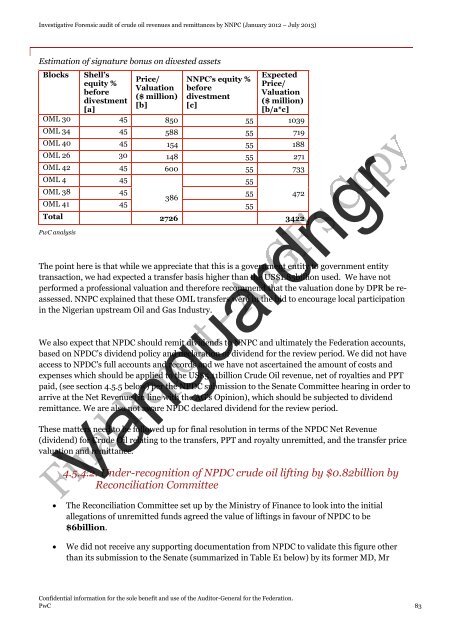

Estimati<strong>on</strong> of signature b<strong>on</strong>us <strong>on</strong> divested assets<br />

Blocks Shell’s<br />

Expected<br />

Price/ <strong>NNPC</strong>’s equity %<br />

equity %<br />

Price/<br />

Valuati<strong>on</strong> before<br />

before<br />

Valuati<strong>on</strong><br />

($ milli<strong>on</strong>) divestment<br />

divestment<br />

($ milli<strong>on</strong>)<br />

[b]<br />

[c]<br />

[a]<br />

[b/a*c]<br />

OML 30 45 850 55 1039<br />

OML 34 45 588 55 719<br />

OML 40 45 154 55 188<br />

OML 26 30 148 55 271<br />

OML 42 45 600 55 733<br />

OML 4 45<br />

OML 38 45 55<br />

386<br />

OML 41 45 55<br />

Total 2726 3422<br />

PwC analysis<br />

The point here is that while we appreciate that this is a government entity to government entity<br />

transacti<strong>on</strong>, we had expected a transfer basis higher than the US$1.85billi<strong>on</strong> used. We have not<br />

performed a professi<strong>on</strong>al valuati<strong>on</strong> and therefore recommend that the valuati<strong>on</strong> d<strong>on</strong>e by DPR be reassessed.<br />

<strong>NNPC</strong> explained that these OML transfers were in the bid to encourage local participati<strong>on</strong><br />

in the Nigerian upstream Oil and Gas Industry.<br />

We also expect that NPDC should remit dividends to <strong>NNPC</strong> and ultimately the Federati<strong>on</strong> accounts,<br />

based <strong>on</strong> NPDC’s dividend policy and declarati<strong>on</strong> of dividend for the review period. We did not have<br />

access to NPDC's full accounts and records and we have not ascertained the amount of costs and<br />

expenses which should be applied to the US$5.11billi<strong>on</strong> Crude Oil revenue, net of royalties and PPT<br />

paid, (see secti<strong>on</strong> 4.5.5 below) per the NPDC submissi<strong>on</strong> to the Senate Committee hearing in order to<br />

arrive at the Net Revenue (in line with the AG's Opini<strong>on</strong>), which should be subjected to dividend<br />

remittance. We are also not aware NPDC declared dividend for the review period.<br />

These matters need to be followed up for final resoluti<strong>on</strong> in terms of the NPDC Net Revenue<br />

(dividend) for Crude Oil relating to the transfers, PPT and royalty unremitted, and the transfer price<br />

valuati<strong>on</strong> and remittance.<br />

<br />

4.5.4.2. Under-recogniti<strong>on</strong> of NPDC crude oil lifting by $0.82billi<strong>on</strong> by<br />

Rec<strong>on</strong>ciliati<strong>on</strong> Committee<br />

55<br />

Vanguardngr<br />

The Rec<strong>on</strong>ciliati<strong>on</strong> Committee set up by the Ministry of Finance to look into the initial<br />

allegati<strong>on</strong>s of unremitted funds agreed the value of liftings in favour of NPDC to be<br />

$6billi<strong>on</strong>.<br />

472<br />

<br />

We did not receive any supporting documentati<strong>on</strong> from NPDC to validate this figure other<br />

than its submissi<strong>on</strong> to the Senate (summarized in Table E1 below) by its former MD, Mr<br />

C<strong>on</strong>fidential informati<strong>on</strong> for the sole benefit and use of the <str<strong>on</strong>g>Audit</str<strong>on</strong>g>or-General for the Federati<strong>on</strong>.<br />

PwC 83