Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Vodafone</strong> <strong>Group</strong> <strong>Plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

141<br />

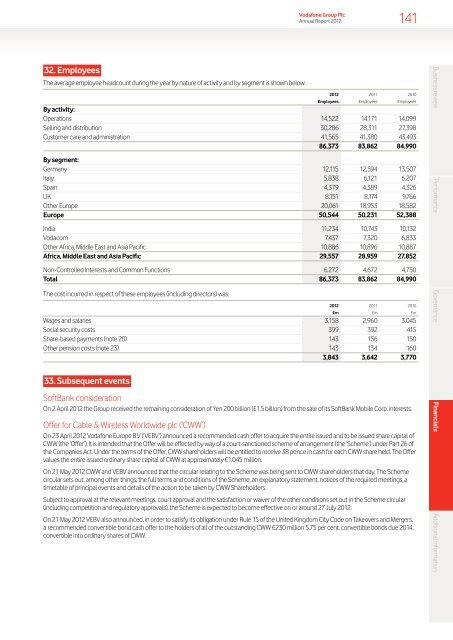

32. Employees<br />

The average employee headcount during <strong>the</strong> <strong>year</strong> by nature of activity and by segment is shown below.<br />

<strong>2012</strong> 2011 2010<br />

Employees Employees Employees<br />

By activity:<br />

Operations 14,522 14,171 14,099<br />

Selling and distribution 30,286 28,<strong>31</strong>1 27,398<br />

Customer care and administration 41,565 41,380 43,493<br />

86,373 83,862 84,990<br />

By segment:<br />

Germany 12,115 12,594 13,507<br />

Italy 5,838 6,121 6,207<br />

Spain 4,379 4,389 4,326<br />

UK 8,151 8,174 9,766<br />

O<strong>the</strong>r Europe 20,061 18,953 18,582<br />

Europe 50,544 50,2<strong>31</strong> 52,388<br />

India 11,234 10,743 10,132<br />

Vodacom 7,437 7,320 6,833<br />

O<strong>the</strong>r Africa, Middle East and Asia Pacific 10,886 10,896 10,887<br />

Africa, Middle East and Asia Pacific 29,557 28,959 27,852<br />

Non-Controlled Interests and Common Functions 6,272 4,672 4,750<br />

Total 86,373 83,862 84,990<br />

The cost incurred in respect of <strong>the</strong>se employees (including directors) was:<br />

<strong>2012</strong> 2011 2010<br />

£m £m £m<br />

Wages and salaries 3,158 2,960 3,045<br />

Social security costs 399 392 415<br />

Share-based payments (note 20) 143 156 150<br />

O<strong>the</strong>r pension costs (note 23) 143 134 160<br />

3,843 3,642 3,770<br />

33. Subsequent events <br />

SoftBank consideration<br />

On 2 April <strong>2012</strong> <strong>the</strong> <strong>Group</strong> received <strong>the</strong> remaining consideration of Yen 200 billion (£1.5 billion) from <strong>the</strong> sale of its SoftBank Mobile Corp. interests.<br />

Offer <strong>for</strong> Cable & Wireless Worldwide plc (‘CWW’)<br />

On 23 April <strong>2012</strong> <strong>Vodafone</strong> Europe B.V (‘VEBV‘) announced a recomm<strong>ended</strong> cash offer to acquire <strong>the</strong> entire issued and to be issued share capital of<br />

CWW (<strong>the</strong> ‘Offer’). It is int<strong>ended</strong> that <strong>the</strong> Offer will be effected by way of a court-sanctioned scheme of arrangement (<strong>the</strong> ‘Scheme’) under Part 26 of<br />

<strong>the</strong> Companies Act. Under <strong>the</strong> terms of <strong>the</strong> Offer, CWW shareholders will be entitled to receive 38 pence in cash <strong>for</strong> each CWW share held. The Offer<br />

values <strong>the</strong> entire issued ordinary share capital of CWW at approximately £1,045 million.<br />

On 21 May <strong>2012</strong> CWW and VEBV announced that <strong>the</strong> circular relating to <strong>the</strong> Scheme was being sent to CWW shareholders that day. The Scheme<br />

circular sets out, among o<strong>the</strong>r things, <strong>the</strong> full terms and conditions of <strong>the</strong> Scheme, an explanatory statement, notices of <strong>the</strong> required meetings, a<br />

timetable of principal events and details of <strong>the</strong> action to be taken by CWW Shareholders.<br />

Subject to approval at <strong>the</strong> relevant meetings, court approval and <strong>the</strong> satisfaction or waiver of <strong>the</strong> o<strong>the</strong>r conditions set out in <strong>the</strong> Scheme circular<br />

(including competition and regulatory approvals), <strong>the</strong> Scheme is expected to become effective on or around 27 July <strong>2012</strong>.<br />

On 21 May <strong>2012</strong> VEBV also announced, in order to satisfy its obligation under Rule 15 of <strong>the</strong> United Kingdom City Code on Takeovers and Mergers,<br />

a recomm<strong>ended</strong> convertible bond cash offer to <strong>the</strong> holders of all of <strong>the</strong> outstanding CWW £230 million 5.75 per cent. convertible bonds due 2014,<br />

convertible into ordinary shares of CWW.<br />

Business review Per<strong>for</strong>mance Governance Financials Additional in<strong>for</strong>mation