Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Vodafone</strong> <strong>Group</strong> <strong>Plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 124<br />

Notes to <strong>the</strong> consolidated financial statements (continued)<br />

20. Share-based payments (continued)<br />

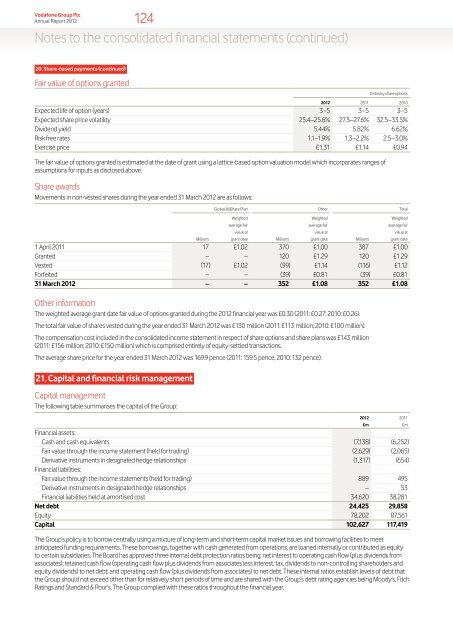

Fair value of options granted<br />

Ordinary share options<br />

<strong>2012</strong> 2011 2010<br />

Expected life of option (<strong>year</strong>s) 3–5 3–5 3–5<br />

Expected share price volatility 25.4–25.6% 27.5–27.6% 32.5–33.5%<br />

Dividend yield 5.44% 5.82% 6.62%<br />

Risk free rates 1.1–1.9% 1.3–2.2% 2.5–3.0%<br />

Exercise price £1.<strong>31</strong> £1.14 £0.94<br />

The fair value of options granted is estimated at <strong>the</strong> date of grant using a lattice-based option valuation model which incorporates ranges of<br />

assumptions <strong>for</strong> inputs as disclosed above.<br />

Share awards<br />

Movements in non-vested shares during <strong>the</strong> <strong>year</strong> <strong>ended</strong> <strong>31</strong> <strong>March</strong> <strong>2012</strong> are as follows:<br />

Global AllShare Plan O<strong>the</strong>r Total<br />

Weighted Weighted Weighted<br />

average fair average fair average fair<br />

value at value at value at<br />

Millions grant date Millions grant date Millions grant date<br />

1 April 2011 17 £1.02 370 £1.00 387 £1.00<br />

Granted – – 120 £1.29 120 £1.29<br />

Vested (17) £1.02 (99) £1.14 (116) £1.12<br />

Forfeited – – (39) £0.81 (39) £0.81<br />

<strong>31</strong> <strong>March</strong> <strong>2012</strong> – – 352 £1.08 352 £1.08<br />

O<strong>the</strong>r in<strong>for</strong>mation<br />

The weighted average grant date fair value of options granted during <strong>the</strong> <strong>2012</strong> financial <strong>year</strong> was £0.30 (2011: £0.27; 2010: £0.26).<br />

The total fair value of shares vested during <strong>the</strong> <strong>year</strong> <strong>ended</strong> <strong>31</strong> <strong>March</strong> <strong>2012</strong> was £130 million (2011: £113 million; 2010: £100 million).<br />

The compensation cost included in <strong>the</strong> consolidated income statement in respect of share options and share plans was £143 million<br />

(2011: £156 million; 2010: £150 million) which is comprised entirely of equity-settled transactions.<br />

The average share price <strong>for</strong> <strong>the</strong> <strong>year</strong> <strong>ended</strong> <strong>31</strong> <strong>March</strong> <strong>2012</strong> was 169.9 pence (2011: 159.5 pence, 2010: 132 pence).<br />

21. Capital and financial risk management<br />

Capital management<br />

The following table summarises <strong>the</strong> capital of <strong>the</strong> <strong>Group</strong>:<br />

<strong>2012</strong> 2011<br />

£m £m<br />

Financial assets:<br />

Cash and cash equivalents (7,138) (6,252)<br />

Fair value through <strong>the</strong> income statement (held <strong>for</strong> trading) (2,629) (2,065)<br />

Derivative instruments in designated hedge relationships (1,<strong>31</strong>7) (654)<br />

Financial liabilities:<br />

Fair value through <strong>the</strong> income statements (held <strong>for</strong> trading) 889 495<br />

Derivative instruments in designated hedge relationships – 53<br />

Financial liabilities held at amortised cost 34,620 38,281<br />

Net debt 24,425 29,858<br />

Equity 78,202 87,561<br />

Capital 102,627 117,419<br />

The <strong>Group</strong>’s policy is to borrow centrally using a mixture of long-term and short-term capital market issues and borrowing facilities to meet<br />

anticipated funding requirements. These borrowings, toge<strong>the</strong>r with cash generated from operations, are loaned internally or contributed as equity<br />

to certain subsidiaries. The Board has approved three internal debt protection ratios being: net interest to operating cash flow (plus dividends from<br />

associates); retained cash flow (operating cash flow plus dividends from associates less interest, tax, dividends to non-controlling shareholders and<br />

equity dividends) to net debt; and operating cash flow (plus dividends from associates) to net debt. These internal ratios establish levels of debt that<br />

<strong>the</strong> <strong>Group</strong> should not exceed o<strong>the</strong>r than <strong>for</strong> relatively short periods of time and are shared with <strong>the</strong> <strong>Group</strong>’s debt rating agencies being Moody’s, Fitch<br />

Ratings and Standard & Poor’s. The <strong>Group</strong> complied with <strong>the</strong>se ratios throughout <strong>the</strong> financial <strong>year</strong>.