Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Vodafone Group Plc Annual Report for the year ended 31 March 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Vodafone</strong> <strong>Group</strong> <strong>Plc</strong><br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong> 122<br />

Notes to <strong>the</strong> consolidated financial statements (continued)<br />

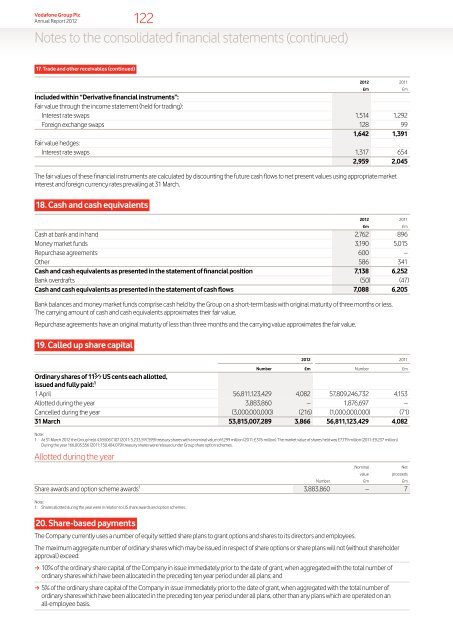

17. Trade and o<strong>the</strong>r receivables (continued)<br />

<strong>2012</strong> 2011<br />

£m £m<br />

Included within “Derivative financial instruments”:<br />

Fair value through <strong>the</strong> income statement (held <strong>for</strong> trading):<br />

Interest rate swaps 1,514 1,292<br />

Foreign exchange swaps 128 99<br />

1,642 1,391<br />

Fair value hedges:<br />

Interest rate swaps 1,<strong>31</strong>7 654<br />

2,959 2,045<br />

The fair values of <strong>the</strong>se financial instruments are calculated by discounting <strong>the</strong> future cash flows to net present values using appropriate market<br />

interest and <strong>for</strong>eign currency rates prevailing at <strong>31</strong> <strong>March</strong>.<br />

18. Cash and cash equivalents<br />

<strong>2012</strong> 2011<br />

£m £m<br />

Cash at bank and in hand 2,762 896<br />

Money market funds 3,190 5,015<br />

Repurchase agreements 600 –<br />

O<strong>the</strong>r 586 341<br />

Cash and cash equivalents as presented in <strong>the</strong> statement of financial position 7,138 6,252<br />

Bank overdrafts (50) (47)<br />

Cash and cash equivalents as presented in <strong>the</strong> statement of cash flows 7,088 6,205<br />

Bank balances and money market funds comprise cash held by <strong>the</strong> <strong>Group</strong> on a short-term basis with original maturity of three months or less.<br />

The carrying amount of cash and cash equivalents approximates <strong>the</strong>ir fair value.<br />

Repurchase agreements have an original maturity of less than three months and <strong>the</strong> carrying value approximates <strong>the</strong> fair value.<br />

19. Called up share capital<br />

<strong>2012</strong> 2011<br />

Number £m Number £m<br />

Ordinary shares of 11 3 ⁄ 7 US cents each allotted,<br />

issued and fully paid: 1<br />

1 April 56,811,123,429 4,082 57,809,246,732 4,153<br />

Allotted during <strong>the</strong> <strong>year</strong> 3,883,860 – 1,876,697 –<br />

Cancelled during <strong>the</strong> <strong>year</strong> (3,000,000,000) (216) (1,000,000,000) (71)<br />

<strong>31</strong> <strong>March</strong> 53,815,007,289 3,866 56,811,123,429 4,082<br />

Note:<br />

1 At <strong>31</strong> <strong>March</strong> <strong>2012</strong> <strong>the</strong> <strong>Group</strong> held 4,169,067,107 (2011: 5,233,597,599) treasury shares with a nominal value of £299 million (2011: £376 million). The market value of shares held was £7,179 million (2011: £9,237 million).<br />

During <strong>the</strong> <strong>year</strong> 166,003,556 (2011: 150,404,079) treasury shares were reissued under <strong>Group</strong> share option schemes.<br />

Allotted during <strong>the</strong> <strong>year</strong><br />

Number £m £m<br />

Share awards and option scheme awards 1 3,883,860 – 7<br />

Note:<br />

1. Shares allotted during <strong>the</strong> <strong>year</strong> were in relation to US share awards and option schemes.<br />

20. Share-based payments<br />

The Company currently uses a number of equity settled share plans to grant options and shares to its directors and employees.<br />

The maximum aggregate number of ordinary shares which may be issued in respect of share options or share plans will not (without shareholder<br />

approval) exceed:<br />

aa<br />

10% of <strong>the</strong> ordinary share capital of <strong>the</strong> Company in issue immediately prior to <strong>the</strong> date of grant, when aggregated with <strong>the</strong> total number of<br />

ordinary shares which have been allocated in <strong>the</strong> preceding ten <strong>year</strong> period under all plans; and<br />

aa<br />

5% of <strong>the</strong> ordinary share capital of <strong>the</strong> Company in issue immediately prior to <strong>the</strong> date of grant, when aggregated with <strong>the</strong> total number of<br />

ordinary shares which have been allocated in <strong>the</strong> preceding ten <strong>year</strong> period under all plans, o<strong>the</strong>r than any plans which are operated on an<br />

all-employee basis.<br />

Nominal<br />

value<br />

Net<br />

proceeds