sustainable development 20 years on from the ... - José Eli da Veiga

sustainable development 20 years on from the ... - José Eli da Veiga

sustainable development 20 years on from the ... - José Eli da Veiga

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

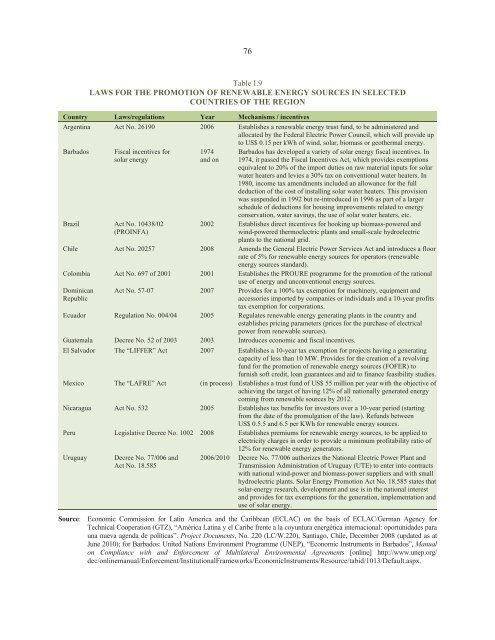

76<br />

Table I.9<br />

LAWS FOR THE PROMOTION OF RENEWABLE ENERGY SOURCES IN SELECTED<br />

COUNTRIES OF THE REGION<br />

Country Laws/regulati<strong>on</strong>s Year Mechanisms / incentives<br />

Argentina Act No. 26190 <str<strong>on</strong>g>20</str<strong>on</strong>g>06 Establishes a renewable energy trust fund, to be administered and<br />

allocated by <strong>the</strong> Federal Electric Power Council, which will provide up<br />

to US$ 0.15 per kWh of wind, solar, biomass or geo<strong>the</strong>rmal energy.<br />

Barbados<br />

Fiscal incentives for<br />

solar energy<br />

Brazil Act No. 10438/02<br />

(PROINFA)<br />

1974<br />

and <strong>on</strong><br />

Barbados has developed a variety of solar energy fiscal incentives. In<br />

1974, it passed <strong>the</strong> Fiscal Incentives Act, which provides exempti<strong>on</strong>s<br />

equivalent to <str<strong>on</strong>g>20</str<strong>on</strong>g>% of <strong>the</strong> import duties <strong>on</strong> raw material inputs for solar<br />

water heaters and levies a 30% tax <strong>on</strong> c<strong>on</strong>venti<strong>on</strong>al water heaters. In<br />

1980, income tax amendments included an allowance for <strong>the</strong> full<br />

deducti<strong>on</strong> of <strong>the</strong> cost of installing solar water heaters. This provisi<strong>on</strong><br />

was suspended in 1992 but re-introduced in 1996 as part of a larger<br />

schedule of deducti<strong>on</strong>s for housing improvements related to energy<br />

c<strong>on</strong>servati<strong>on</strong>, water savings, <strong>the</strong> use of solar water heaters, etc.<br />

<str<strong>on</strong>g>20</str<strong>on</strong>g>02 Establishes direct incentives for hooking up biomass-powered and<br />

wind-powered <strong>the</strong>rmoelectric plants and small-scale hydroelectric<br />

plants to <strong>the</strong> nati<strong>on</strong>al grid.<br />

Chile Act No. <str<strong>on</strong>g>20</str<strong>on</strong>g>257 <str<strong>on</strong>g>20</str<strong>on</strong>g>08 Amends <strong>the</strong> General Electric Power Services Act and introduces a floor<br />

rate of 5% for renewable energy sources for operators (renewable<br />

energy sources stan<strong>da</strong>rd).<br />

Colombia Act No. 697 of <str<strong>on</strong>g>20</str<strong>on</strong>g>01 <str<strong>on</strong>g>20</str<strong>on</strong>g>01 Establishes <strong>the</strong> PROURE programme for <strong>the</strong> promoti<strong>on</strong> of <strong>the</strong> rati<strong>on</strong>al<br />

use of energy and unc<strong>on</strong>venti<strong>on</strong>al energy sources.<br />

Dominican<br />

Republic<br />

Act No. 57-07 <str<strong>on</strong>g>20</str<strong>on</strong>g>07 Provides for a 100% tax exempti<strong>on</strong> for machinery, equipment and<br />

accessories imported by companies or individuals and a 10-year profits<br />

tax exempti<strong>on</strong> for corporati<strong>on</strong>s.<br />

Ecuador Regulati<strong>on</strong> No. 004/04 <str<strong>on</strong>g>20</str<strong>on</strong>g>05 Regulates renewable energy generating plants in <strong>the</strong> country and<br />

establishes pricing parameters (prices for <strong>the</strong> purchase of electrical<br />

power <strong>from</strong> renewable sources).<br />

Guatemala Decree No. 52 of <str<strong>on</strong>g>20</str<strong>on</strong>g>03 <str<strong>on</strong>g>20</str<strong>on</strong>g>03 Introduces ec<strong>on</strong>omic and fiscal incentives.<br />

El Salvador The “LIFFER” Act <str<strong>on</strong>g>20</str<strong>on</strong>g>07 Establishes a 10-year tax exempti<strong>on</strong> for projects having a generating<br />

capacity of less than 10 MW. Provides for <strong>the</strong> creati<strong>on</strong> of a revolving<br />

fund for <strong>the</strong> promoti<strong>on</strong> of renewable energy sources (FOFER) to<br />

furnish soft credit, loan guarantees and aid to finance feasibility studies.<br />

Mexico The “LAFRE” Act (in process) Establishes a trust fund of US$ 55 milli<strong>on</strong> per year with <strong>the</strong> objective of<br />

achieving <strong>the</strong> target of having 12% of all nati<strong>on</strong>ally generated energy<br />

coming <strong>from</strong> renewable sources by <str<strong>on</strong>g>20</str<strong>on</strong>g>12.<br />

Nicaragua Act No. 532 <str<strong>on</strong>g>20</str<strong>on</strong>g>05 Establishes tax benefits for investors over a 10-year period (starting<br />

<strong>from</strong> <strong>the</strong> <strong>da</strong>te of <strong>the</strong> promulgati<strong>on</strong> of <strong>the</strong> law). Refunds between<br />

US$ 0.5.5 and 6.5 per KWh for renewable energy sources.<br />

Peru Legislative Decree No. 1002 <str<strong>on</strong>g>20</str<strong>on</strong>g>08 Establishes premiums for renewable energy sources, to be applied to<br />

electricity charges in order to provide a minimum profitability ratio of<br />

12% for renewable energy generators.<br />

Uruguay<br />

Decree No. 77/006 and<br />

Act No. 18.585<br />

<str<strong>on</strong>g>20</str<strong>on</strong>g>06/<str<strong>on</strong>g>20</str<strong>on</strong>g>10 Decree No. 77/006 authorizes <strong>the</strong> Nati<strong>on</strong>al Electric Power Plant and<br />

Transmissi<strong>on</strong> Administrati<strong>on</strong> of Uruguay (UTE) to enter into c<strong>on</strong>tracts<br />

with nati<strong>on</strong>al wind-power and biomass-power suppliers and with small<br />

hydroelectric plants. Solar Energy Promoti<strong>on</strong> Act No. 18.585 states that<br />

solar-energy research, <str<strong>on</strong>g>development</str<strong>on</strong>g> and use is in <strong>the</strong> nati<strong>on</strong>al interest<br />

and provides for tax exempti<strong>on</strong>s for <strong>the</strong> generati<strong>on</strong>, implementati<strong>on</strong> and<br />

use of solar energy.<br />

Source: Ec<strong>on</strong>omic Commissi<strong>on</strong> for Latin America and <strong>the</strong> Caribbean (ECLAC) <strong>on</strong> <strong>the</strong> basis of ECLAC/German Agency for<br />

Technical Cooperati<strong>on</strong> (GTZ), “América Latina y el Caribe frente a la coyuntura energética internaci<strong>on</strong>al: oportuni<strong>da</strong>des para<br />

una nueva agen<strong>da</strong> de políticas”. Project Documents, No. 2<str<strong>on</strong>g>20</str<strong>on</strong>g> (LC/W.2<str<strong>on</strong>g>20</str<strong>on</strong>g>), Santiago, Chile, December <str<strong>on</strong>g>20</str<strong>on</strong>g>08 (up<strong>da</strong>ted as at<br />

June <str<strong>on</strong>g>20</str<strong>on</strong>g>10); for Barbados: United Nati<strong>on</strong>s Envir<strong>on</strong>ment Programme (UNEP), “Ec<strong>on</strong>omic Instruments in Barbados”, Manual<br />

<strong>on</strong> Compliance with and Enforcement of Multilateral Envir<strong>on</strong>mental Agreements [<strong>on</strong>line] http://www.unep.org/<br />

dec/<strong>on</strong>linemanual/Enforcement/Instituti<strong>on</strong>alFrameworks/Ec<strong>on</strong>omicInstruments/Resource/tabid/1013/Default.aspx.