Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

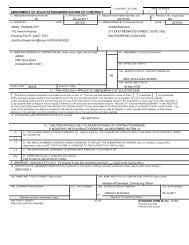

Exhibit 5. Fundamental Questi<strong>on</strong>s Drive <str<strong>on</strong>g>Integrati<strong>on</strong></str<strong>on</strong>g><br />

How will we<br />

create value?<br />

• What must we preserve to realize <strong>the</strong> potential of this deal? What are we<br />

prepared to give up?<br />

• Where do we redesign, create, adopt, or eliminate? (By segment, organizati<strong>on</strong>,<br />

process, or geography?)<br />

• Where do we need to compete as an instituti<strong>on</strong>?<br />

• What must be integrated immediately? What can wait?<br />

Visi<strong>on</strong><br />

How will we<br />

approach this<br />

merger?<br />

• Do we absorb, integrate, create, or attach?<br />

• Will we apply a “best of both” philosophy, or is <strong>the</strong>re a preference for ei<strong>the</strong>r<br />

company’s model?<br />

• Will this philosophy apply to <strong>the</strong> senior team selecti<strong>on</strong>?<br />

How will<br />

this merger<br />

be led?<br />

• What role should <strong>the</strong> CEO play?<br />

• How will we run <strong>the</strong> business while simultaneously maintaining focus <strong>on</strong> <strong>the</strong><br />

integrati<strong>on</strong> and its synergies?<br />

• How aggressive do we want to be?<br />

• How should teams be formed? How much line involvement?<br />

What people<br />

strategy is<br />

required?<br />

• What is <strong>the</strong> decisi<strong>on</strong>-making model? (Top-down, bottom-up?)<br />

• What degree of cultural change is required to make this work?<br />

• How do we identify, select, and retain a superior team?<br />

• How can we ensure that we treat people fairly?<br />

Source: <strong>Booz</strong> • <strong>Allen</strong> & Hamilt<strong>on</strong><br />

when it comes to adopting <strong>the</strong><br />

companies’ practices, or will <strong>on</strong>e<br />

company clearly dominate <strong>the</strong><br />

o<strong>the</strong>r? Finally, will this philosophy<br />

apply to your selecti<strong>on</strong> of<br />

<strong>the</strong> senior team? The nature and<br />

strategic intent of <strong>the</strong> deal will<br />

lead to some specific choices.<br />

For example, if <strong>the</strong> deal is a<br />

“bolt-<strong>on</strong>,” in which <strong>on</strong>e company<br />

is simply acquiring ano<strong>the</strong>r’s<br />

revenues at a marginal fixed cost,<br />

<strong>the</strong>n <strong>the</strong> integrati<strong>on</strong> approach is<br />

largely decided: absorb. But most<br />

deals of any size — our focus in<br />

this Viewpoint — involve a more<br />

complex set of competing issues.<br />

Third, you need to ask<br />

yourself how <strong>the</strong> integrati<strong>on</strong><br />

should be led. Should <strong>the</strong> CEO<br />

play a prominent role? How<br />

will you keep current businesses<br />

running smoothly while integrating<br />

new assets and realizing<br />

synergies? How aggressive do<br />

you want to be in exploiting new<br />

value? Once again, <strong>the</strong> nature<br />

of <strong>the</strong> deal and its impact <strong>on</strong><br />

industry structure will lead to<br />

certain choices. As <strong>on</strong>e CEO<br />

overseeing a mega-merger in his<br />

industry observed, “You have to<br />

be willing to bet <strong>the</strong> firm, and<br />

drive every aspect of <strong>the</strong> integrati<strong>on</strong><br />

pers<strong>on</strong>ally.”<br />

Finally, what people strategy<br />

will be required? Will you use a<br />

top-down or bottom-up decisi<strong>on</strong>making<br />

model? How will you<br />

integrate different cultures? How<br />

will you retain top performers<br />

while treating every<strong>on</strong>e with fairness<br />

and respect?<br />

Some of <strong>the</strong>se choices will<br />

be obvious given <strong>the</strong> nature of<br />

<strong>the</strong> deal. For example, in our<br />

experience clients who paid large<br />

premiums approach merger integrati<strong>on</strong><br />

very aggressively. To<br />

recover <strong>the</strong>ir investment, <strong>the</strong>y<br />

target early wins and exploit<br />

synergies immediately. A hostile<br />

6