Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Merger Integration: Delivering on the Promise - Booz Allen Hamilton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

mergers with more strategic<br />

motivati<strong>on</strong>s (e.g., move<br />

upstream or downstream in <strong>the</strong><br />

value chain, add capabilities,<br />

develop a new business model),<br />

<strong>on</strong>ly 32 percent realized <strong>the</strong>ir<br />

visi<strong>on</strong> and objectives.<br />

The widely prevalent<br />

“merger of equals” was also<br />

shown to be more failure pr<strong>on</strong>e.<br />

According to our analysis, mergers<br />

failed almost twice as often<br />

when <strong>the</strong> participants were of<br />

comparable size. Although most<br />

of <strong>the</strong> less<strong>on</strong>s in this Viewpoint<br />

are applicable to all deals, we<br />

will focus primarily <strong>on</strong> <strong>the</strong> issues<br />

attending large-scale mergers of<br />

comparably sized companies.<br />

Integrating companies is<br />

a mammoth undertaking. The<br />

tactical issues are tremendous.<br />

Indeed, when companies<br />

explained why <strong>the</strong>y had not met<br />

expectati<strong>on</strong>s, more than two<br />

thirds cited executi<strong>on</strong>-related<br />

reas<strong>on</strong>s — such as loss of key<br />

staff, poor due diligence, and<br />

delays in communicati<strong>on</strong>. Only<br />

32 percent attributed <strong>the</strong>ir failure<br />

to meet expectati<strong>on</strong>s to more<br />

strategic c<strong>on</strong>cerns such as poor<br />

fit or an overly ambitious visi<strong>on</strong>.<br />

However, whe<strong>the</strong>r tactical<br />

or strategic, problems in merger<br />

performance land <strong>on</strong> <strong>the</strong> same<br />

doorstep: <strong>the</strong>y are attributed to<br />

poor leadership. That is why so<br />

many CEOs lose <strong>the</strong>ir jobs within<br />

two years of <strong>the</strong> close of an<br />

unsuccessful large-scale merger.<br />

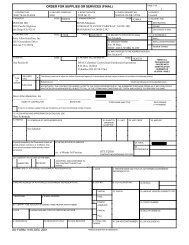

According to our research,<br />

am<strong>on</strong>g companies that did not<br />

achieve <strong>the</strong>ir targets, 42 percent<br />

Exhibit 2. Poor <str<strong>on</strong>g>Merger</str<strong>on</strong>g> Performance Leads to CEO Departures<br />

<str<strong>on</strong>g>Merger</str<strong>on</strong>g>s That Met Expectati<strong>on</strong>s<br />

Source: <strong>Booz</strong> • <strong>Allen</strong> & Hamilt<strong>on</strong><br />

saw <strong>the</strong> CEO depart within two<br />

years. That compares with a 16<br />

percent departure rate am<strong>on</strong>g <strong>the</strong><br />

CEOs of successful mergers (see<br />

Exhibit 2).<br />

As an executive presiding<br />

over a newly merged company,<br />

you are inundated with competing<br />

priorities and demands. But<br />

<strong>the</strong> most important questi<strong>on</strong>s<br />

before you are <strong>the</strong>se:<br />

• How do you deliver <strong>on</strong> <strong>the</strong><br />

value you promised shareholders<br />

and investors while simultaneously<br />

“keeping <strong>the</strong> wheels <strong>on</strong><br />

<strong>the</strong> business”?<br />

• In <strong>the</strong> wake of a merger, how<br />

do you successfully integrate<br />

operati<strong>on</strong>s while maintaining<br />

your focus <strong>on</strong> customers?<br />

84% CEO Remained 58%<br />

After Two Years<br />

It’s important to start <strong>the</strong><br />

merger integrati<strong>on</strong> process as so<strong>on</strong><br />

as possible. To be successful, you<br />

must sow <strong>the</strong> seeds of integrati<strong>on</strong><br />

<str<strong>on</strong>g>Merger</str<strong>on</strong>g>s That Did Not<br />

Meet Expectati<strong>on</strong>s<br />

16% CEO Departed<br />

42%<br />

within Two Years<br />

well before <strong>the</strong> deal closes. That<br />

means making <strong>the</strong> following<br />

decisi<strong>on</strong>s early:<br />

• How will we create value?<br />

• How will we approach and<br />

structure <strong>the</strong> merger?<br />

• How will we lead and manage<br />

<strong>the</strong> integrati<strong>on</strong>?<br />

• What is our people strategy<br />

for <strong>the</strong> transiti<strong>on</strong> to <strong>the</strong> merged<br />

organizati<strong>on</strong>?<br />

The unique characteristics<br />

of <strong>the</strong> deal will dictate <strong>the</strong> particular<br />

choices you make in each<br />

area; <strong>the</strong>re is no <strong>on</strong>e-size-fits-all<br />

recipe for successful merger<br />

integrati<strong>on</strong>. Comprehensive due<br />

diligence will inform <strong>the</strong>se early<br />

decisi<strong>on</strong>s, which will <strong>the</strong>n become<br />

<strong>the</strong> foundati<strong>on</strong> of a rigorous integrati<strong>on</strong><br />

planning process. The<br />

result: both organizati<strong>on</strong>s will be<br />

ready to integrate immediately<br />

after <strong>the</strong> merger’s close.<br />

3