Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Merger Integration: Delivering on the Promise - Booz Allen Hamilton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

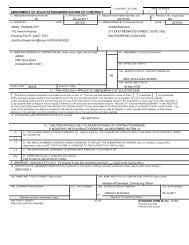

Although no <strong>on</strong>e-size-fitsall<br />

formula can apply to every<br />

company’s unique situati<strong>on</strong>, in<br />

our experience four principles are<br />

<strong>the</strong> key to success in merger integrati<strong>on</strong>.<br />

They all start with <strong>the</strong><br />

CEO — before <strong>the</strong> deal closes.<br />

1. Communicate a shared visi<strong>on</strong><br />

for value creati<strong>on</strong>.<br />

2. Seize defining moments<br />

to make explicit choices and<br />

trade-offs.<br />

3. Simultaneously execute<br />

against competing critical<br />

imperatives.<br />

4. Employ a rigorous<br />

integrati<strong>on</strong> planning process.<br />

This Viewpoint outlines<br />

<strong>Booz</strong> •<strong>Allen</strong>’s approach to achieving<br />

success in merger integrati<strong>on</strong>.<br />

A Marriage Made in<br />

Purgatory<br />

From airlines to automobiles<br />

to advertising,<br />

<strong>the</strong> urge to merge has<br />

escalated steadily over <strong>the</strong> past<br />

decade. In 2000 al<strong>on</strong>e <strong>the</strong>re were<br />

9,472 merger and acquisiti<strong>on</strong><br />

(M&A) transacti<strong>on</strong>s in <strong>the</strong><br />

United States — a new record. 1<br />

Worldwide, mergers and<br />

acquisiti<strong>on</strong>s through July 20,<br />

2000 were valued at $1.7 trilli<strong>on</strong>,<br />

an 18 percent year-over-year<br />

increase. 2<br />

Although this rush to <strong>the</strong><br />

altar may have been grounded in<br />

solid synergistic potential, all too<br />

many of <strong>the</strong>se marriages quickly<br />

faltered. <strong>Booz</strong> •<strong>Allen</strong> & Hamilt<strong>on</strong><br />

recently c<strong>on</strong>ducted a study of<br />

deals that closed in 1997 and<br />

1998 and discovered that 53 percent<br />

of <strong>the</strong> deals had failed to<br />

“One of <strong>the</strong> best decisi<strong>on</strong>s<br />

we made in <strong>the</strong> merger integrati<strong>on</strong><br />

process was to maintain our focus<br />

<strong>on</strong> customer service, even when<br />

it meant slowing down <strong>the</strong> rush<br />

to exploit synergies. If we kept our<br />

customers satisfied through <strong>the</strong><br />

integrati<strong>on</strong> process, we reas<strong>on</strong>ed,<br />

it was worth delaying <strong>the</strong> savings<br />

for a couple m<strong>on</strong>ths.”<br />

— CEO, medical products<br />

and services company<br />

deliver <strong>the</strong>ir expected results. (To<br />

assess <strong>the</strong>ir post-merger performance<br />

fairly and accurately, we<br />

intenti<strong>on</strong>ally restricted our sample<br />

to those deals that had closed<br />

two or more years ago.)<br />

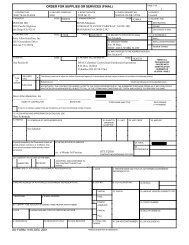

Fur<strong>the</strong>r analysis revealed<br />

that <strong>the</strong> more strategic <strong>the</strong> rati<strong>on</strong>ale<br />

for <strong>the</strong> merger, <strong>the</strong> greater<br />

<strong>the</strong> likelihood of failure (see<br />

Exhibit 1). Of those combinati<strong>on</strong>s<br />

that were simply intended<br />

to establish or exploit scale<br />

effects, 55 percent achieved <strong>the</strong>ir<br />

objectives. However, of those<br />

Exhibit 1. Extent to Which Deals Met Expectati<strong>on</strong>s Two Years After <strong>the</strong> <str<strong>on</strong>g>Merger</str<strong>on</strong>g> Close<br />

Combined: 55% Met Expectati<strong>on</strong>s<br />

Combined: 32% Met Expectati<strong>on</strong>s<br />

35<br />

Number<br />

of Deals<br />

30<br />

25<br />

20<br />

15<br />

Strategic mergers<br />

are more likely to fail<br />

10<br />

5<br />

0<br />

Achieve Scale<br />

Grow Existing Business Add Capabilities New Business Model<br />

Total Deals<br />

Met Expectati<strong>on</strong>s<br />

Increasingly Strategic Rati<strong>on</strong>ale<br />

Source: <strong>Booz</strong> • <strong>Allen</strong> & Hamilt<strong>on</strong><br />

1<br />

<str<strong>on</strong>g>Merger</str<strong>on</strong>g>stat.<br />

2<br />

Thoms<strong>on</strong> Financial Securities Data.<br />

2