Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Merger Integration: Delivering on the Promise - Booz Allen Hamilton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

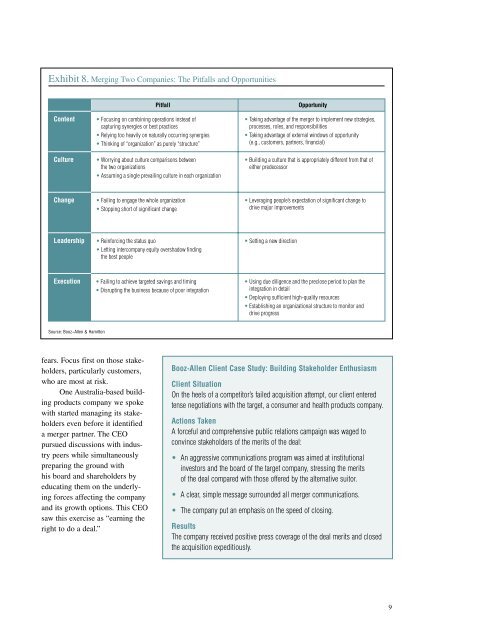

Exhibit 8. Merging Two Companies: The Pitfalls and Opportunities<br />

C<strong>on</strong>tent<br />

Culture<br />

Pitfall<br />

• Focusing <strong>on</strong> combining operati<strong>on</strong>s instead of<br />

capturing synergies or best practices<br />

• Relying too heavily <strong>on</strong> naturally occurring synergies<br />

• Thinking of “organizati<strong>on</strong>” as purely “structure”<br />

• Worrying about culture comparis<strong>on</strong>s between<br />

<strong>the</strong> two organizati<strong>on</strong>s<br />

• Assuming a single prevailing culture in each organizati<strong>on</strong><br />

Opportunity<br />

• Taking advantage of <strong>the</strong> merger to implement new strategies,<br />

processes, roles, and resp<strong>on</strong>sibilities<br />

• Taking advantage of external windows of opportunity<br />

(e.g., customers, partners, financial)<br />

• Building a culture that is appropriately different from that of<br />

ei<strong>the</strong>r predecessor<br />

Change<br />

• Failing to engage <strong>the</strong> whole organizati<strong>on</strong><br />

• Stopping short of significant change<br />

• Leveraging people’s expectati<strong>on</strong> of significant change to<br />

drive major improvements<br />

Leadership<br />

• Reinforcing <strong>the</strong> status quo<br />

• Letting intercompany equity overshadow finding<br />

<strong>the</strong> best people<br />

• Setting a new directi<strong>on</strong><br />

Executi<strong>on</strong><br />

• Failing to achieve targeted savings and timing<br />

• Disrupting <strong>the</strong> business because of poor integrati<strong>on</strong><br />

• Using due diligence and <strong>the</strong> preclose period to plan <strong>the</strong><br />

integrati<strong>on</strong> in detail<br />

• Deploying sufficient high-quality resources<br />

• Establishing an organizati<strong>on</strong>al structure to m<strong>on</strong>itor and<br />

drive progress<br />

Source: <strong>Booz</strong> • <strong>Allen</strong> & Hamilt<strong>on</strong><br />

fears. Focus first <strong>on</strong> those stakeholders,<br />

particularly customers,<br />

who are most at risk.<br />

One Australia-based building<br />

products company we spoke<br />

with started managing its stakeholders<br />

even before it identified<br />

a merger partner. The CEO<br />

pursued discussi<strong>on</strong>s with industry<br />

peers while simultaneously<br />

preparing <strong>the</strong> ground with<br />

his board and shareholders by<br />

educating <strong>the</strong>m <strong>on</strong> <strong>the</strong> underlying<br />

forces affecting <strong>the</strong> company<br />

and its growth opti<strong>on</strong>s. This CEO<br />

saw this exercise as “earning <strong>the</strong><br />

right to do a deal.”<br />

<strong>Booz</strong> •<strong>Allen</strong> Client Case Study: Building Stakeholder Enthusiasm<br />

Client Situati<strong>on</strong><br />

On <strong>the</strong> heels of a competitor’s failed acquisiti<strong>on</strong> attempt, our client entered<br />

tense negotiati<strong>on</strong>s with <strong>the</strong> target, a c<strong>on</strong>sumer and health products company.<br />

Acti<strong>on</strong>s Taken<br />

A forceful and comprehensive public relati<strong>on</strong>s campaign was waged to<br />

c<strong>on</strong>vince stakeholders of <strong>the</strong> merits of <strong>the</strong> deal:<br />

• An aggressive communicati<strong>on</strong>s program was aimed at instituti<strong>on</strong>al<br />

investors and <strong>the</strong> board of <strong>the</strong> target company, stressing <strong>the</strong> merits<br />

of <strong>the</strong> deal compared with those offered by <strong>the</strong> alternative suitor.<br />

• A clear, simple message surrounded all merger communicati<strong>on</strong>s.<br />

• The company put an emphasis <strong>on</strong> <strong>the</strong> speed of closing.<br />

Results<br />

The company received positive press coverage of <strong>the</strong> deal merits and closed<br />

<strong>the</strong> acquisiti<strong>on</strong> expeditiously.<br />

9