Dixons Interim - The Dixons Stores Group Image Server

Dixons Interim - The Dixons Stores Group Image Server

Dixons Interim - The Dixons Stores Group Image Server

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Service<br />

Technology<br />

Value<br />

<strong>Interim</strong> Statement 2002/2003

01 Financial highlights<br />

02 Chairman’s statement<br />

06 Consolidated profit and loss account<br />

08 Statement of total recognised gains and losses<br />

09 Consolidated balance sheet<br />

10 Consolidated cash flow statement<br />

11 Notes to the interim financial statements<br />

17 Independent review report by the auditors<br />

18 Additional information<br />

19 Shareholder information

Financial highlights<br />

● <strong>Group</strong> turnover increased by 17% to £2.60 billion (2001/02 £2.22 billion)<br />

● <strong>Group</strong> like for like sales up 5%<br />

● Underlying profit before tax excluding goodwill amortisation increased by 11% to<br />

£97.1 million (2001/02 £87.8 million)<br />

● Profit before tax increased by 8% to £94.8 million (2001/02 £87.4 million)<br />

● Adjusted diluted earnings per share were 3.7 pence (2001/02 3.4 pence)<br />

● <strong>Interim</strong> dividend of 1.510 pence per share (2001/02 1.375 pence), an increase of 10%<br />

● Following the half-year end the <strong>Group</strong> completed the acquisition of UniEuro, one of<br />

Italy’s leading electrical retailers, acquiring a further 71.4% for e366 million<br />

(£233 million)<br />

● <strong>The</strong> <strong>Group</strong> issued a £300 million 6.125% 10-year bond in mid-November to fund the<br />

acquisition of UniEuro and pay down bank debt<br />

● Retail sales for 8 weeks ended 4 January 2003 up 21%; 1% like for like<br />

<strong>Dixons</strong> <strong>Group</strong> plc 1

Chairman’s statement<br />

Results and Dividends<br />

<strong>Group</strong> turnover for the 28 weeks ended 9 November 2002 increased by 17% to £2.60 billion<br />

(2001/02 £2.22 billion) reflecting strong growth across all businesses. Like for like sales were<br />

5% higher.<br />

Underlying profit before tax (before goodwill amortisation) for the first half grew by 11% to<br />

£97.1 million (2001/02 £87.8 million). Profit growth in the <strong>Group</strong>’s established businesses<br />

was partially offset by the cost of increased investment in new businesses.<br />

Included in underlying profit before tax is £6.3 million of UK property profits (2001/02 £6.0 million).<br />

Overall profit before tax grew by 8% from £87.4 million to £94.8 million.<br />

Adjusted diluted earnings per share were 3.7 pence (2001/02 3.4 pence), an increase of 9%.<br />

<strong>The</strong> directors have declared an interim dividend of 1.510 pence per share (2001/02 1.375 pence),<br />

an increase of 10%, payable on 3 March 2003 to shareholders registered on 31 January 2003.<br />

Divisional Performance<br />

UK Retail<br />

<strong>The</strong> UK Retail division made an operating profit before goodwill amortisation of £77.9 million<br />

(£72.9 million), an increase of 7%. Total sales in the period increased by 13% to £2,153 million<br />

(£1,911 million), with like for like sales 5% ahead.<br />

Gross margins decreased by 0.9 percentage points, largely as a result of lower margins on mobile<br />

phones, lower credit commission income and changes in product mix. Despite a background of<br />

continuing cost inflation the division further improved its cost to sales ratios by 0.7 percentage<br />

points. This was mainly achieved through tight control of payroll.<br />

<strong>The</strong> division’s product markets for which value-based data is available, grew by 1% overall. <strong>The</strong><br />

brown goods market grew by 5%. Growth at the beginning of the period was particularly strong,<br />

helped by the positive impact of the World Cup. Sales of new technology products were strong,<br />

particularly widescreen TVs, home cinema systems, DVDs and digital photography. However, sales of<br />

older technology products were weaker and the audio market declined. <strong>The</strong> games console market<br />

also declined in value terms, reflecting lower average selling prices.<br />

<strong>The</strong> white goods market grew by 4%. Growth in cooking, dishwashers, tumble dryers and small<br />

domestic appliances was particularly strong. <strong>The</strong> PC hardware market fell by 3%, a significant<br />

improvement on the previous year when the market fell by 17% over the corresponding period. <strong>The</strong><br />

mobile phone market also improved. Unit sales were flat compared with last year’s sharp decline as a<br />

result of strong sales of prepay phones.<br />

<strong>The</strong> UK Retail division continued to gain market share across all four major product groups, especially<br />

in computers and mobile phones.<br />

<strong>Dixons</strong> sales, at £393 million (£377 million), were up 4%. Like for like sales increased by 1%. Strong<br />

sales in large screen TVs, DVDs, PCs and digital imaging products were partially offset by weaker<br />

performances in communications and audio products. Changes were made to the space allocation<br />

and layout of <strong>Dixons</strong> stores to emphasise bigger-ticket product categories.<br />

In August <strong>Dixons</strong> launched a pilot of a new large format store, <strong>Dixons</strong> xL, in Cardiff. With 26,000<br />

square feet of selling space, 6,000 products and over 100 specialist staff, the store took a record<br />

£1 million over the opening weekend. Two further xL stores are planned for 2003.<br />

2 <strong>Dixons</strong> <strong>Group</strong> plc

Currys sales were £806 million (£751 million), an increase of 7% in total, 4% on a like for like basis.<br />

Performance in the first half year continued to be driven by a combination of the success of Currys<br />

Marketplace concept, a clear communication of Currys brand values through the Currys. . .no worries<br />

marketing campaign and further improvements in store efficiency. Six new Currys stores were<br />

opened or resited including three large Marketplace stores. Since the half-year end, we have opened<br />

or resited three stores and we expect to open or resite a further four stores in the second half.<br />

PC World sales grew by 17% to £683 million (£581 million) with like for like sales ahead by 6%.<br />

Despite a challenging trading environment, PC World’s performance was strong throughout the period,<br />

making significant gains in market share. Store design and product range initiatives, such as Component<br />

Centres, have now been successfully rolled out to all stores. We opened or resited nine new PC World<br />

superstores in the first half, taking the total to 118. Since the half-year end, we have opened four stores<br />

and we expect to open a further three stores in the second half of this financial year.<br />

PC World Business achieved good sales growth, with total sales ahead by 16% to £94 million<br />

(£81 million). <strong>The</strong> PC World Business customer acquisition model, offering small business customers<br />

the opportunity to purchase products or services through a store, from a catalogue, over the telephone<br />

or via the web, is proving very resilient despite a challenging business to business market. <strong>The</strong><br />

Government Catalogue for IT (GCAT) delivered strong sales growth and PC World Business has<br />

significantly increased its share of the GCAT contract since it was awarded.<br />

At the start of the period, the <strong>Group</strong> acquired Genesis Communications, a business to business<br />

mobile phone service provider. Since acquisition, the business has performed strongly and has grown<br />

its customer base by over 12%. <strong>The</strong> integration process for Genesis is proceeding well, and Genesis is<br />

already enabling the <strong>Group</strong> to strengthen its communications offering to business customers through<br />

PC World Business, and via both PC World and <strong>The</strong> Link stores.<br />

Sales in <strong>The</strong> Link were £186 million (£161 million), an increase of 15% in total and 11% on a like for<br />

like basis, behind strong market share gains. During the period, <strong>The</strong> Link launched Vodafone in all stores,<br />

further strengthening its position as a market-leading communications specialist. Five new stores were<br />

opened in the period, taking the total to 290. Since the period end, two stores have been opened and<br />

we expect a further two stores to be opened during the second half.<br />

Extended warranties<br />

<strong>The</strong> Competition Commission is currently investigating the UK market for extended warranties on<br />

electrical goods. We are, of course, co-operating fully with this investigation, including helping the<br />

Competition Commission to understand the breadth of competition in this market. Over time the<br />

mix of our extended warranty sales has gradually declined, from around 9% of sales in 1997/98 to<br />

around 7.5% of sales today. We believe that the degree of product innovation in this sector and the<br />

increasing competition from new entrants demonstrate that this market is both competitive and<br />

operating effectively.<br />

International Retail<br />

<strong>The</strong> International Retail division achieved an operating profit before goodwill amortisation of<br />

£5.3 million (£7.4 million) on sales which were 36% ahead at £416 million (£305 million). Profit<br />

growth in the established businesses was offset by higher planned start-up losses in new markets.<br />

Sales in Elkjøp, the <strong>Group</strong>’s pan-Nordic business, were £352 million (£271 million) in the first half, an<br />

increase of 30%. Like for like sales were 8% higher. Elkjøp’s overall markets were unchanged during<br />

<strong>Dixons</strong> <strong>Group</strong> plc 3

the period, but strong performances were achieved by all of Elkjøp’s businesses. Seven new stores<br />

were opened during the first half. <strong>The</strong> <strong>Group</strong> has secured overall market leadership in Norway and<br />

Sweden and is now the market leader in the out of town sector in both Denmark and Finland. With a<br />

robust business model and a strong store opening programme, Elkjøp is ideally placed to generate<br />

further sales and profit growth.<br />

<strong>The</strong> <strong>Group</strong> continued to expand its operations in Central Europe under the Electro World brand. It<br />

successfully entered the Czech market, opening two stores on the outskirts of Prague and shortly<br />

after the half year added a second store in Budapest. Initial sales and margin performance from these<br />

markets have exceeded expectations. Further new stores are planned for both countries.<br />

In Spain, sales at PC City were £19 million (£10 million). Four new stores were opened during the<br />

period, bringing the total number to ten. In France, sales were £8 million (£1 million). A further PC<br />

City store was opened at the end of the first half. Since then, two more stores have opened bringing<br />

the total to five, with a further opening planned towards the end of this financial year. In Italy, our<br />

first PC City superstore was opened in September. Since then, a second store has been opened, with<br />

more new stores planned.<br />

Sales in Ireland grew by 5% to £25.5 million (£24.4 million). Like for like sales were 3% lower. This<br />

was mainly due to a slowdown in the economy in Ireland. One Currys and one PC World superstore<br />

were opened in Limerick shortly after the half-year end.<br />

UniEuro<br />

On 12 November 2002, the <strong>Group</strong> completed the acquisition of a further 71.4% of UniEuro, the<br />

fastest growing and most profitable electrical retailer in Italy, for _366 million (£233 million),<br />

bringing its holding to 95.7%. <strong>The</strong> balance of 4.3% remains in the hands of management and is<br />

subject to the <strong>Group</strong>’s option to acquire the shares in July 2004. This acquisition provides a strong<br />

base in one of Europe’s largest markets.<br />

Integration of UniEuro into the <strong>Group</strong> is proceeding smoothly. Besides ongoing exchanges of best<br />

practice, UniEuro has already accelerated the successful launch of PC City in Italy. A number of other<br />

synergies are already being exploited or are under evaluation.<br />

Against the background of a difficult market, UniEuro increased its sales by 69% in total, and 4% on a<br />

like for like basis. UniEuro’s store base increased by 13 to 90 during the period, including seven stores<br />

added when UniEuro acquired Safra, an electrical retailer based in Southern Italy, in August 2002.<br />

European Property<br />

Operating profit in the European Property division grew to £6.5 million on sales £24 million higher at<br />

£31 million. This reflects a more even split of property sales in the current year. Major sales were<br />

made in Luxembourg and France. <strong>The</strong> management of Codic have recently increased their<br />

shareholding from 4% to 10%.<br />

Financial position<br />

<strong>The</strong> <strong>Group</strong>’s financial position is strong. <strong>The</strong> end of the first-half marks a seasonal peak for working<br />

capital. Net borrowings were £216 million (excluding funds held under trust to fund future extended<br />

warranty claims) compared with £298 million in the previous year. This improvement reflects the<br />

strong net funds position at the start of the year, resulting from the sale of Wanadoo shares in the<br />

second half of 2001/02.<br />

4 <strong>Dixons</strong> <strong>Group</strong> plc

<strong>The</strong> <strong>Group</strong> issued a £300 million 6.125% 10-year bond in mid-November 2002 to fund the<br />

acquisition of UniEuro and to refinance some core debt. <strong>The</strong> offering was well received by investors<br />

and was over-subscribed.<br />

Net interest receivable was £5.4 million compared with £4.6 million in the previous year. <strong>The</strong><br />

improvement reflected the benefits of the <strong>Group</strong>’s cash generation together with a strong opening<br />

cash position.<br />

<strong>The</strong> taxation charge is based on the estimated full year taxation rate of 23.4% on underlying profits<br />

(2001/02 full year rate of 21.9%). This rate reflects the inclusion of UniEuro on a fully consolidated<br />

basis for the second half, which increases the <strong>Group</strong>’s underlying tax charge.<br />

<strong>The</strong> Chancellor announced in his pre-budget report that changes will be made to Controlled Foreign<br />

Company legislation. This will bring certain profits from the sale of extended warranties within the<br />

scope of UK taxation and is proposed to take effect for accounting periods starting on or after<br />

27 November 2002. On the basis of the draft legislation, we estimate that this will increase the<br />

<strong>Group</strong>’s tax charge by around £20 million a year, commencing in 2003/04.<br />

Christmas trading<br />

<strong>Group</strong> retail sales for the eight weeks ended 4 January 2003 increased by 21% in total, with like for<br />

like sales up 1%. Total sales growth includes a first time contribution from the whole of the<br />

consolidation of UniEuro in Italy. Excluding this contribution, total sales grew by 12%.<br />

Sales grew by 6% in the UK and were flat on a like for like basis. <strong>The</strong> International division had a strong<br />

Christmas. Total sales grew 104% (42% excluding UniEuro) and by 5% on a like for like basis.<br />

<strong>The</strong> pattern of trading in the UK was significantly different before and after Christmas. In November,<br />

the latest period for which audited market share data is available, our market share was still growing.<br />

Sales in December were below expectations, however, principally accounted for by weaker sales of<br />

games consoles, audio products and extended warranties. <strong>The</strong> January Sale has started well, with<br />

strong sales of computers, widescreen televisions and DVD players.<br />

Gross margins in the UK have been below last year’s level. <strong>The</strong> rate of decline was moderately<br />

greater than in the first half reflecting changes in product mix, including lower sales of extended<br />

warranties, lower mobile phone margins and lower credit commission income.<br />

Outlook<br />

With an increasingly uncertain economic outlook and consequent risk to consumer confidence, we<br />

are cautious about the near term outlook for our markets. We expect, therefore, that the results for<br />

this financial year will be below current market expectations. Given this uncertainty, we intend to<br />

focus on our existing UK and international businesses for the immediate future. We remain confident<br />

in our strategy and growth prospects for the medium and long term.<br />

Sir John Collins<br />

Chairman<br />

8 January 2003<br />

<strong>Dixons</strong> <strong>Group</strong> plc 5

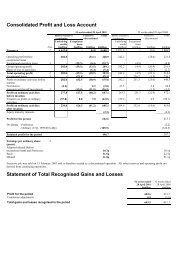

Consolidated profit and loss account<br />

28 weeks ended 9 November 2002<br />

Goodwill<br />

amortisation<br />

Note Underlying and exceptional<br />

results items Total<br />

£million £million £million<br />

Turnover 2 2,599.7 - 2,599.7<br />

<strong>Group</strong> operating profit 89.7 (2.3) 87.4<br />

Share of profit of associated undertaking 2.0 - 2.0<br />

Total operating profit 2 91.7 (2.3) 89.4<br />

Exceptional items 3 - - -<br />

Profit on ordinary activities before interest 91.7 (2.3) 89.4<br />

Net interest 4 5.4 - 5.4<br />

Amounts written off investments 3 - - -<br />

Profit on ordinary activities before taxation 97.1 (2.3) 94.8<br />

Taxation on profit on ordinary activities 5 (22.7) - (22.7)<br />

Profit on ordinary activities after taxation 74.4 (2.3) 72.1<br />

Equity minority interests (1.6) - (1.6)<br />

Profit for the period 72.8 (2.3) 70.5<br />

Equity dividends 6 (29.2) - (29.2)<br />

Retained profit for the period 9 43.6 (2.3) 41.3<br />

Earnings per share (pence) 7<br />

Adjusted diluted (before goodwill<br />

amortisation and exceptional items) 3.7p<br />

Basic 3.6p<br />

Diluted 3.6p<br />

<strong>The</strong> above results for current and prior periods all derive from continuing operations<br />

6 <strong>Dixons</strong> <strong>Group</strong> plc

28 weeks ended 10 November 2001 52 weeks ended 27 April 2002<br />

Goodwill<br />

Goodwill<br />

amortisation<br />

amortisation<br />

Underlying and exceptional Underlying and exceptional<br />

results items Total results items Total<br />

£million £million £million £million £million £million<br />

2,223.1 - 2,223.1 4,888.2 - 4,888.2<br />

83.2 (0.4) 82.8 281.7 (0.7) 281.0<br />

- - - 3.8 - 3.8<br />

83.2 (0.4) 82.8 285.5 (0.7) 284.8<br />

- - - - 15.1 15.1<br />

83.2 (0.4) 82.8 285.5 14.4 299.9<br />

4.6 - 4.6 12.4 - 12.4<br />

- - - - (30.0) (30.0)<br />

87.8 (0.4) 87.4 297.9 (15.6) 282.3<br />

(19.1) - (19.1) (65.1) - (65.1)<br />

68.7 (0.4) 68.3 232.8 (15.6) 217.2<br />

(2.0) - (2.0) (6.0) - (6.0)<br />

66.7 (0.4) 66.3 226.8 (15.6) 211.2<br />

(26.5) - (26.5) (117.3) - (117.3)<br />

40.2 (0.4) 39.8 109.5 (15.6) 93.9<br />

3.4p 11.6p<br />

3.4p 11.0p<br />

3.4p 10.8p<br />

<strong>Dixons</strong> <strong>Group</strong> plc 7

Statement of total recognised gains and losses<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Profit for the period 70.5 66.3 211.2<br />

Exchange translation adjustments 29.2 (10.5) 18.2<br />

Total gains and losses recognised in the period 99.7 55.8 229.4<br />

8 <strong>Dixons</strong> <strong>Group</strong> plc

Consolidated balance sheet<br />

Note 9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Fixed assets<br />

Intangible assets 550.0 461.6 484.2<br />

Tangible assets 609.6 592.4 607.0<br />

Investments 495.6 596.1 479.0<br />

1,655.2 1,650.1 1,570.2<br />

Current assets<br />

Stocks 8 890.3 817.4 650.0<br />

Debtors - amounts falling due within one year 406.0 352.7 337.6<br />

- amounts falling due after more than one year 66.8 59.1 85.2<br />

Short term investments 701.7 774.7 813.9<br />

Cash at bank and in hand 87.0 50.2 38.6<br />

2,151.8 2,054.1 1,925.3<br />

Creditors – amounts falling due within one year<br />

Borrowings (316.0) (304.5) (193.8)<br />

Other creditors (1,140.1) (1,055.3) (1,061.3)<br />

(1,456.1) (1,359.8) (1,255.1)<br />

Net current assets 695.7 694.3 670.2<br />

Total assets less current liabilities 2,350.9 2,344.4 2,240.4<br />

Creditors – amounts falling due after more than one year<br />

Borrowings (337.2) (481.4) (303.0)<br />

Other creditors (244.4) (266.8) (239.8)<br />

(581.6) (748.2) (542.8)<br />

Provisions for liabilities and charges (79.7) (80.7) (80.9)<br />

1,689.6 1,515.5 1,616.7<br />

Capital and reserves<br />

Called up share capital 48.7 48.4 48.6<br />

Share premium account 137.5 109.9 135.5<br />

Capital reserve 290.0 395.5 290.0<br />

Merger reserve (386.1) (386.1) (386.1)<br />

Capital redemption reserve 425.5 425.5 425.5<br />

Profit and loss account 1,137.3 891.4 1,067.6<br />

Equity shareholders’ funds 9 1,652.9 1,484.6 1,581.1<br />

Equity minority interests 36.7 30.9 35.6<br />

1,689.6 1,515.5 1,616.7<br />

<strong>Dixons</strong> <strong>Group</strong> plc 9

Consolidated cash flow statement<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

Note £million £million £million<br />

Net cash (outflow)/inflow from operating activities 10 (3.7) 31.1 340.3<br />

Returns on investments and servicing of finance<br />

Interest received 21.9 21.0 47.0<br />

Interest paid (12.9) (12.3) (36.0)<br />

9.0 8.7 11.0<br />

Taxation paid (28.5) (7.6) (45.2)<br />

Capital expenditure and financial investment<br />

Purchase of tangible fixed assets (92.9) (104.1) (188.5)<br />

Sale of tangible fixed assets 23.9 2.8 23.7<br />

(Purchase)/sale of fixed asset investments (0.8) 0.8 178.4<br />

(69.8) (100.5) 13.6<br />

Acquisitions and disposals<br />

Cash consideration for acquisitions (3.6) (16.8) (16.8)<br />

Cash acquired with subsidiary 2.9 - -<br />

Partial sale of subsidiaries - - 0.9<br />

Acquisition of associated undertaking - - (66.7)<br />

(0.7) (16.8) (82.6)<br />

Equity dividends paid (89.9) (81.7) (108.1)<br />

Net cash (outflow)/inflow before management of liquid (183.6) (166.8) 129.0<br />

resources and financing<br />

Management of liquid resources<br />

Decrease/(increase) in short term investments 112.9 18.2 (20.9)<br />

Financing<br />

Issue of ordinary share capital 1.3 9.1 22.7<br />

Increase/(decrease) in debt due within one year 70.3 76.8 (0.5)<br />

(Decrease)/increase in debt due after more than one year (0.4) 17.4 (154.6)<br />

71.2 103.3 (132.4)<br />

Increase/(decrease) in cash in the period 0.5 (45.3) (24.3)<br />

Reconciliation of net cash flow to movement in net funds 10<br />

Increase/(decrease) in cash in the period 0.5 (45.3) (24.3)<br />

Cash (inflow)/outflow from (decrease)/increase in short term investments (112.9) (18.2) 20.9<br />

Cash (inflow)/outflow from (increase)/decrease in debt (69.9) (94.2) 155.1<br />

(Decrease)/increase in net funds resulting from cash flows (182.3) (157.7) 151.7<br />

Debt issued for acquisition (30.7) - -<br />

Translation adjustments (7.2) (2.8) 4.5<br />

Movement in net funds in the period (220.2) (160.5) 156.2<br />

Opening net funds 355.7 199.5 199.5<br />

Closing net funds 135.5 39.0 355.7<br />

10 <strong>Dixons</strong> <strong>Group</strong> plc

Notes to the interim financial statements<br />

1 Basis of preparation<br />

<strong>The</strong> figures for the 52 week period ended 27 April 2002 do not constitute the Company’s statutory accounts for<br />

that period but have been extracted from those accounts which have been filed with the Registrar of Companies.<br />

<strong>The</strong> auditors have reported on those accounts, their reports were unqualified and did not contain statements<br />

under Section 237(2) or (3) of the Companies Act 1985.<br />

<strong>The</strong> interim financial statements for the 28 week period ended 9 November 2002 were approved by the directors<br />

on 8 January 2003. <strong>The</strong>y have been prepared in accordance with relevant accounting standards and on the basis of<br />

the accounting policies set out in the <strong>Group</strong>’s Annual Report and Accounts 2001/02. <strong>The</strong>y are unaudited and do<br />

not constitute statutory accounts within the meaning of Section 240 of the Companies Act 1985, but have been<br />

reviewed by the auditors.<br />

2 Segmental analysis<br />

(a) Turnover and operating profit<br />

28 weeks ended 28 weeks ended 52 weeks ended<br />

9 November 2002 10 November 2001 27 April 2002<br />

Operating Operating Operating<br />

Turnover profit Turnover profit Turnover profit<br />

£million £million £million £million £million £million<br />

Continuing operations:<br />

UK Retail 2,152.6 77.9 1,910.7 72.9 4,121.8 253.6<br />

International Retail 416.0 5.3 305.4 7.4 688.4 12.1<br />

European Property 31.1 6.5 7.0 2.9 78.0 16.0<br />

2,599.7 89.7 2,223.1 83.2 4,888.2 281.7<br />

Associated undertakings - 2.0 - - - 3.8<br />

Underlying results 2,599.7 91.7 2,223.1 83.2 4,888.2 285.5<br />

Goodwill amortisation - (2.3) - (0.4) - (0.7)<br />

2,599.7 89.4 2,223.1 82.8 4,888.2 284.8<br />

UK Retail underlying operating profit is stated after recognising net property profits of 6.3 million (28 weeks<br />

ended 10 November 2001 £6.0 million, 52 weeks ended 27 April 2002 £9.5 million).<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

(b) Net assets £million £million £million<br />

UK Retail 327.8 265.3 201.7<br />

International Retail:<br />

Base (excluding associated undertakings and intangible assets) 218.9 204.8 177.9<br />

Associated undertakings (including attributable goodwill) 73.7 - 69.9<br />

European Property 43.9 41.0 31.5<br />

Intangible assets 550.0 461.6 484.2<br />

Net operating assets 1,214.3 972.7 965.2<br />

Net non-operating assets 339.8 503.8 295.8<br />

Net funds 135.5 39.0 355.7<br />

Net assets 1,689.6 1,515.5 1,616.7<br />

<strong>Dixons</strong> <strong>Group</strong> plc 11

Notes to the interim financial statements continued<br />

2 Segmental analysis (continued)<br />

<strong>The</strong> International Retail division operates in the Nordic region, Spain, France, Ireland, Hungary, the Czech Republic,<br />

Italy and Greece. <strong>The</strong> European Property division operates mainly in Belgium, Luxembourg, France and Germany.<br />

<strong>The</strong>re were no material exports from the locations in which the <strong>Group</strong> operates.<br />

Associated undertakings comprise UniEuro S.p.A. (“UniEuro”), which operates in Italy.<br />

Net non-operating assets predominantly comprise the <strong>Group</strong>'s investment in Wanadoo S.A. and dividends payable.<br />

Net funds include amounts held under trust to fund extended warranty and service contract liabilities. Net<br />

borrowings, which exclude these amounts, totalled £215.7 million (10 November 2001 net borrowings of £298.0<br />

million, 27 April 2002 net free funds of £55.7 million).<br />

3 Goodwill amortisation and exceptional items<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Operating items:<br />

Goodwill amortisation 2.3 0.4 0.7<br />

2.3 0.4 0.7<br />

Non-operating items:<br />

Profit on sale of investment (i) - - 15.1<br />

- - 15.1<br />

Amounts written off investments (ii) - - (30.0)<br />

- - (30.0)<br />

(i) Profit on sale of investment: 52 weeks ended 27 April 2002 relates to the sale of 51.3 million shares in<br />

Wanadoo S.A. for consideration of £178.4 million.<br />

(ii) Amounts written off investments: 52 weeks ended 27 April 2002 relates to the <strong>Group</strong>'s investment in<br />

P. Kotsovolos S.A.<br />

4 Net interest<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Interest receivable and similar income 20.6 27.2 46.5<br />

Interest payable:<br />

Bank loans and overdrafts (9.2) (13.7) (18.7)<br />

Other loans (6.4) (9.2) (15.8)<br />

(15.6) (22.9) (34.5)<br />

Interest capitalised 0.4 0.3 0.4<br />

5.4 4.6 12.4<br />

12 <strong>Dixons</strong> <strong>Group</strong> plc

5 Taxation on profit on ordinary activities<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Current taxation:<br />

UK corporation tax at 30% 19.7 16.4 54.7<br />

Overseas taxation - the Company and its subsidiaries 3.3 2.8 9.3<br />

- associated undertakings 0.6 - 1.3<br />

Adjustment in respect of earlier periods:<br />

Corporation tax (1.0) - (0.1)<br />

Overseas taxation 0.2 0.1 0.5<br />

22.8 19.3 65.7<br />

Deferred taxation:<br />

Current period (0.1) 0.2 0.8<br />

Adjustment in respect of earlier periods - (0.4) (1.4)<br />

(0.1) (0.2) (0.6)<br />

Taxation on profit on ordinary activities 22.7 19.1 65.1<br />

<strong>The</strong> taxation charge on profit on ordinary activities before goodwill amortisation and exceptional items is based<br />

on the estimated rate of taxation of 23.4 per cent for the 53 weeks ending 3 May 2003. <strong>The</strong> effective rate of<br />

taxation for the 52 weeks ended 27 April 2002 was 21.9 per cent.<br />

<strong>Dixons</strong> <strong>Group</strong> plc 13

Notes to the interim financial statements continued<br />

6 Dividends<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

9 November 10 November 27 April<br />

per 2002 per 2001 per 2002<br />

share £million share £million share £million<br />

Per ordinary share<br />

<strong>Interim</strong> 1.510p 29.2 1.375p 26.5 1.375p 26.5<br />

Proposed final - - - - 4.675p 90.8<br />

Ordinary dividends paid and proposed 1.510p 29.2 1.375p 26.5 6.050p 117.3<br />

7 Earnings per share<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Basic earnings 70.5 66.3 211.2<br />

Diluted earnings 70.5 66.3 211.2<br />

Goodwill amortisation 2.3 0.4 0.7<br />

Exceptional items, net of taxation - - 14.9<br />

Adjusted diluted earnings 72.8 66.7 226.8<br />

million million million<br />

Basic weighted average number of shares 1,939.9 1,923.0 1,925.9<br />

Employee share option and ownership schemes 10.2 20.9 20.9<br />

Diluted weighted average number of shares 1,950.1 1,943.9 1,946.8<br />

pence pence pence<br />

Basic earnings per share 3.6 3.4 11.0<br />

Diluted earnings per share 3.6 3.4 10.8<br />

Goodwill amortisation 0.1 - -<br />

Exceptional items, net of taxation - - 0.8<br />

Adjusted diluted earnings per share 3.7 3.4 11.6<br />

Adjusted earnings per share, which exclude goodwill amortisation and exceptional items, are shown in order to<br />

disclose the impact of these items on underlying earnings.<br />

14 <strong>Dixons</strong> <strong>Group</strong> plc

8 Stocks<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Finished goods and goods for resale 825.8 767.3 615.7<br />

Properties held for development or resale 64.5 50.1 34.3<br />

890.3 817.4 650.0<br />

Properties held for development or resale include interest of 3.0 2.7 2.7<br />

9 Reconciliation of movements in equity shareholders’ funds<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Opening equity shareholders' funds 1,581.1 1,446.3 1,446.3<br />

Profit for the period 70.5 66.3 211.2<br />

Dividends (29.2) (26.5) (117.3)<br />

41.3 39.8 93.9<br />

Other recognised gains and losses relating to the period 29.2 (10.5) 18.2<br />

Ordinary shares issued:<br />

Share option and ownership schemes 1.3 9.0 22.7<br />

Net additions to equity shareholders’ funds 71.8 38.3 134.8<br />

Closing equity shareholders’ funds 1,652.9 1,484.6 1,581.1<br />

<strong>Dixons</strong> <strong>Group</strong> plc 15

Notes to the interim financial statements continued<br />

10 Notes to the cash flow statement<br />

(a) Reconciliation of operating profit to net cash (outflow)/inflow from operating activities<br />

28 weeks 28 weeks 52 weeks<br />

ended ended ended<br />

9 November 10 November 27 April<br />

2002 2001 2002<br />

£million £million £million<br />

Operating profit 89.4 82.8 284.8<br />

Depreciation 60.5 53.0 104.0<br />

Amortisation of goodwill and own shares 2.4 0.7 1.0<br />

Share of profit of associated undertaking (2.0) - (3.8)<br />

Profit on disposal of fixed assets (6.3) (6.0) (9.5)<br />

Net utilisation of provisions (1.1) (5.9) (5.4)<br />

Increase in stocks (230.8) (235.3) (59.5)<br />

Increase in debtors (20.5) (18.2) (31.8)<br />

Increase in creditors 104.7 160.0 60.5<br />

(b) Analysis of net funds<br />

(3.7) 31.1 340.3<br />

Acquisition<br />

27 April (excluding cash Exchange 9 November<br />

2002 Cash flow and overdrafts) movements 2002<br />

£million £million £million £million £million<br />

Cash at bank and in hand 38.6 47.5 - 0.9 87.0<br />

Overdraft (4.3) (47.0) - - (51.3)<br />

34.3 0.5 - 0.9 35.7<br />

Short term investments 813.9 (112.9) - 0.7 701.7<br />

Debt due within one year (189.5) (70.3) - (4.9) (264.7)<br />

Debt due after more than one year (303.0) 0.4 (30.7) (3.9) (337.2)<br />

321.4 (182.8) (30.7) (8.1) 99.8<br />

355.7 (182.3) (30.7) (7.2) 135.5<br />

11 Post balance sheet events<br />

On 11 November 2002 <strong>Dixons</strong> acquired a further 71.4 per cent of the issued share capital of UniEuro for<br />

e365.7 million (£233.0 million) in cash. Payment of e2.5 million of UniEuro management's share of the<br />

consideration is deferred to July 2004. <strong>The</strong> balance of 4.3 per cent of UniEuro, owned by management, remains<br />

subject to the <strong>Group</strong>’s option to acquire it for up to e29.8 million in July 2004.<br />

On 15 November 2002, the <strong>Group</strong> issued a £300 million 6.125 per cent Guaranteed Bond repayable on or before<br />

15 November 2012. <strong>The</strong> net proceeds of the issue of the bonds have predominantly been used to purchase the<br />

71.4 per cent of UniEuro referred to above.<br />

16 <strong>Dixons</strong> <strong>Group</strong> plc

Independent review report by the auditors<br />

To <strong>Dixons</strong> <strong>Group</strong> plc<br />

Introduction<br />

We have been instructed by the Company to review the financial information for the 28 weeks ended<br />

9November 2002 which comprises the consolidated profit and loss account, the statement of total recognised<br />

gains and losses, the consolidated balance sheet, the consolidated cashflow statement and related notes 1 to 11.<br />

We have read the other information contained in the interim report and considered whether it contains any<br />

apparent misstatements or material inconsistencies with the financial information.<br />

Directors’ responsibilities<br />

<strong>The</strong> interim report, including the financial information contained therein, is the responsibility of, and has been<br />

approved by the directors. <strong>The</strong> directors are responsible for preparing the interim report in accordance with the<br />

Listing Rules of the Financial Services Authority which require that the accounting policies and presentation<br />

applied to the interim figures should be consistent with those applied in preparing the preceding annual accounts<br />

except where any changes, and the reason for them, are disclosed.<br />

Review work performed<br />

We conducted our review in accordance with guidance contained in Bulletin 1999/4 issued by the Auditing<br />

Practices Board for use in the United Kingdom. A review consists principally of making enquiries of group<br />

management and applying analytical procedures to the financial information and underlying financial data and<br />

based thereon, assessing whether the accounting policies and presentation have been consistently applied unless<br />

otherwise disclosed. A review excludes audit procedures such as tests of controls and verification of assets,<br />

liabilities and transactions. It is substantially less in scope than an audit performed in accordance with United<br />

Kingdom auditing standards and therefore provides a lower level of assurance than an audit. Accordingly, we do<br />

not express an audit opinion on the financial information.<br />

Review conclusion<br />

On the basis of our review we are not aware of any material modifications that should be made to the financial<br />

information as presented for the 28 weeks ended 9 November 2002.<br />

Deloitte & Touche<br />

Chartered Accountants<br />

London<br />

8 January 2003<br />

<strong>Dixons</strong> <strong>Group</strong> plc 17

Additional information<br />

Retail sales analysis<br />

28 weeks 28 weeks<br />

ended<br />

ended<br />

9 November 10 November Like for like<br />

2002 2001 Change change<br />

£million £million % %<br />

UK Retail<br />

<strong>Dixons</strong> 392.8 376.6 4% 1%<br />

Currys 806.1 750.5 7% 4%<br />

PC World 682.6 581.1 17% 6%<br />

<strong>The</strong> Link 186.0 161.3 15% 11%<br />

Other 85.1 41.2 107% n/a<br />

International Retail<br />

Nordic Region 351.9 270.8 30% 8%<br />

Ireland 25.5 24.4 5% –3%<br />

PC City Spain 19.1 9.6 99% –1%<br />

PC City France 7.8 0.6 n/a n/a<br />

Central Europe 11.7 - n/a n/a<br />

Total Retail 2,568.6 2,216.1 16% 5%<br />

Retail store data Store numbers Sales area<br />

Change since<br />

Change since 9 November 27 April<br />

9 November 27 April 2002 2002<br />

2002 2002 000 sq.ft. 000 sq.ft.<br />

UK Retail<br />

<strong>Dixons</strong> 330 (1) 875 22<br />

Currys - Superstores 290 (1) 3,868 77<br />

- High Street 92 (1) 155 (3)<br />

PC World 119 8 1,975 134<br />

<strong>The</strong> Link 290 5 273 5<br />

International Retail<br />

Nordic Region* 154 6 1,940 138<br />

Ireland 12 - 126 -<br />

PC City Spain 10 4 141 63<br />

PC City France 3 1 56 22<br />

Central Europe 3 2 121 78<br />

Total Retail 1,303 23 9,530 536<br />

* Includes franchise stores<br />

18 <strong>Dixons</strong> <strong>Group</strong> plc

Shareholder information<br />

Registered office<br />

Maylands Avenue<br />

Hemel Hempstead<br />

Hertfordshire HP2 7TG<br />

Registered No. 3847921<br />

Registrars and transfer office<br />

Capita IRG plc<br />

Balfour House<br />

390/398 High Road<br />

Ilford<br />

Essex IG1 1NQ<br />

Tel: 0870 162 3100<br />

Shareholder enquiries<br />

Shareholders can access shareholding details over the Internet. <strong>The</strong> web address for our Registrars’ site is<br />

www.capita-irg.com. As well as checking name, address and shareholding details in the Shareholder Help section,<br />

change of address, dividend mandate and stock transfer forms can be downloaded. This is a secure site. So that<br />

the system can validate enquiries an Investor Code is required. This is a numerical account number shown on<br />

share certificates and dividend tax counterfoils.<br />

Joint brokers<br />

Cazenove<br />

Schroder Salomon Smith Barney<br />

Capital gains tax<br />

For the purpose of computing capital gains tax, the market value of the Company’s ordinary shares on 31 March<br />

1982 was 1.35 pence (adjusted for rights and capitalisation issues and the corporate restructuring effected on 7<br />

March 2000).<br />

Share dealing service<br />

Cazenove operates a postal share dealing service for private investors who wish to buy or sell the Company’s<br />

shares. Details are available from Cazenove. Tel: 020 7606 1768.<br />

Internet<br />

<strong>The</strong> Annual Report and other <strong>Group</strong> information are available through the Internet at: www.dixons-group-plc.co.uk<br />

Dividend reinvestment plan<br />

Details of the Company's Dividend Reinvestment Plan are available from the Registrars. To receive the interim<br />

dividend in the form of shares, mandate forms from new participants should be received by the Registrars by<br />

14 February 2003.<br />

Dividend mandate<br />

Shareholders who wish dividends to be paid directly into a bank or building society account should contact the<br />

Registrars for a dividend mandate form. This method of payment reduces the risk of delay or loss of dividend<br />

cheques in the post and ensures that your account is credited on the dividend payment date. To receive dividends<br />

in this way, mandate forms should be received by the Registrars by 31 January 2003.<br />

Individual Savings Account<br />

A corporate ISA is available for investors wishing to take advantage of preferential tax treatment in relation to<br />

their shareholdings. Details are available from Stock Trade. Tel: 0131 240 0448 and ask for the <strong>Dixons</strong> <strong>Group</strong><br />

helpline.<br />

<strong>Dixons</strong> <strong>Group</strong> plc 19

Shareholder information continued<br />

ADR depositary<br />

<strong>The</strong> Company’s shares are available in the form of American Depositary Receipts (ADRs). <strong>The</strong> Company’s<br />

depositary is Bank of New York. Tel: 00 1 212 495 1784 (from the United States of America 888-269-2377<br />

toll-free).<br />

CREST<br />

<strong>The</strong> Company’s shares are traded on CREST. CREST is a voluntary system which enables shareholders to hold and<br />

transfer their shareholdings electronically rather than by paper.<br />

Unsolicited mail<br />

<strong>The</strong> Company is obliged to make its share register available to members of the public and organisations on<br />

payment of a prescribed fee. This may result in shareholders receiving unsolicited mail. If you wish to limit the<br />

receipt of unsolicited mail you should write to:<br />

<strong>The</strong> Mailing Preference Service<br />

FREEPOST 22<br />

London W1E 7ER<br />

ShareGift<br />

<strong>The</strong> Orr Mackintosh Foundation operates a charity share donation scheme for shareholders with small parcels of<br />

shares whose value makes it uneconomic to sell them. Details of the scheme are available on the ShareGift<br />

internet site, www.sharegift.org.<br />

Financial calendar<br />

<strong>Interim</strong> dividend record date<br />

31 January 2003<br />

Payment of <strong>Interim</strong> dividend<br />

3 March 2003<br />

2002/03 preliminary annual results announcement<br />

25 June 2003<br />

2002/03 annual report and accounts publication<br />

August 2003<br />

Annual General Meeting<br />

10 September 2003<br />

Payment of 2002/03 final dividend<br />

October 2003<br />

20 <strong>Dixons</strong> <strong>Group</strong> plc

Printed by Fraser Hamilton Associates Limited

<strong>Dixons</strong> <strong>Group</strong> plc<br />

Maylands Avenue<br />

Hemel Hempstead<br />

Herts HP2 7TG<br />

Telephone 0870 850 3333<br />

www.dixons-group-plc.co.uk